TOGETHER WITH

Today's edition is sponsored by iFunds. With iFunds, you get instant funding up to $500,000, no profit targets, no evaluations, and payouts on demand. Trade forex, crypto, stocks, and indices — all from a sleek, user-friendly platform built for speed and simplicity.

Hey traders, Ezekiel here with your latest market update. Let’s break down what’s driving the action and keep you ahead of the curve.

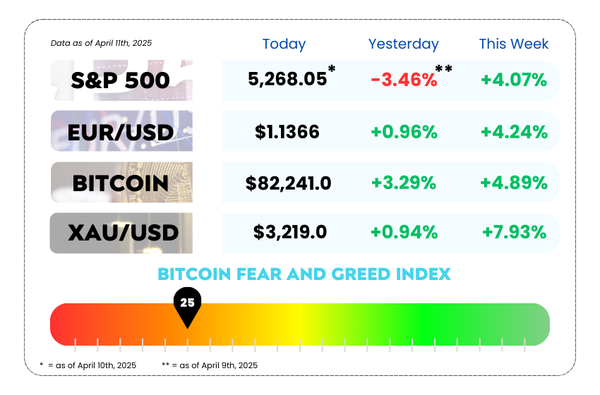

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- China raises tariffs to 125% in escalating response to U.S. trade measures

- Dollar weakens sharply as gold hits record amid escalating US-Chine trade war

- Master the Cup and Handle pattern, and learn a pro-level strategy for serious traders with our video

🔥 China Fires Back: Tariffs Jump to 125% 🔥

Trade war? More like trade WWE.

In a classic “you raise, we raise higher” move, China just slapped back at the U.S. with a tariff hike to 125%, up from 84%. That’s right, President Trump played his card, and Beijing answered with a power move of its own. 🚀

These countermeasures take effect Saturday, and yep, they’re adding jet fuel to the already-chaotic US–China trade war. The ripple effect? 📉 U.S. stocks are wobbling like a Jenga tower in an earthquake.

Now, here's where things get spicy:

- Trump announced a 90-day pause on Liberation Day tariffs.

- The EU followed suit, putting their retaliatory moves on ice. 🧊

- But despite all that, the White House says the real tariff rate on Chinese goods is sitting at 145% — not 125% like the Big Guy first said. (Someone’s calculator needs charging.)

Beijing is throwing signals that this might be the last escalation, even if Washington keeps poking the bear. 🐻 But we’ve all seen this movie before… and it usually comes with a sequel.

🎤 Meanwhile, in Washington…

Trump and his crew are doing their best “everything’s fine!” impression.

Treasury Secretary Scott Bessent told the press he's confident this “pause” will lead to “great certainty” and sweet new trade deals.

Sure, Scott. Just pass us that crystal ball next time. 🔮

🌎 A Quick Word on USMCA:

For our cross-border trading friends — if you're dealing with US-Mexico-Canada (USMCA) goods:

- ✅ Compliant goods = 0% tariff

- ❌ Non-compliant = 25%

- ⚡️ Energy & potash? Just 10%

Because who doesn’t love a little fine print with their economic drama?

🤔 Asia Forex Mentor Insights

This tariff tit-for-tat is more than just political theater, it directly impacts market volatility, investor confidence, and currency movement. Watch how the Yuan, USD, and safe-haven currencies like the JPY and CHF react over the weekend.

Also, keep an eye on risk-on vs risk-off flows. When trade tensions flare, investors tend to run for cover, and forex markets love a good panic. 😅💱

Stay frosty, traders. This ain’t over yet. 🥶

🚀 Instant Capital. Zero Evaluations. Real Profits. 🚀

Trade instantly. Profit freely. No strings attached.

iFunds is changing the game with instant funding up to $500,000, no profit targets, no evaluations, and payouts on demand.

Trade forex, crypto, stocks, and indices all from one sleek, beginner-friendly platform.

💸 Zero evaluation

📉 Low commissions & swap fees

⚡ Quick sign-up. Instant access.

The dollar just tripped on its own ego, and gold is out here breaking new records like it’s in Olympic mode 🏅.

As the US–China trade war goes full boss battle mode, global markets are reacting in a big way:

- The dollar index fell 1%, hitting a 6-month low 📉

- Gold flew past $3,200/oz, smashing records 🪙

- The euro flexed hard, rising 1.4% to $1.13 💪

- And yes, even Bitcoin joined the party, jumping 4% 🚀

- The message from the markets? “We don’t trust the dollar right now.”

🧨 Trade War Gets Personal

China came in HOT 🔥, raising tariffs on all U.S. goods to 125% — and not pulling punches.They even dropped this mic line:

“The U.S. isn’t worth matching anymore.”

Translation? Game on.

Beijing says they’ll “fight to the end” if the U.S. keeps pushing. Meanwhile, the White House is still acting like it’s got the upper hand — but investors clearly aren’t buying it.

🧠 “Sell America” Becomes the Mood

According to ING strategists, we’re officially in a “dollar confidence crisis.” That’s Wall Street code for:

👉 People are dumping the dollar and looking for safe havens.

Treasuries held steady, and the S&P 500 is cautiously inching upward while everyone waits to see what the banks say in Q1 earnings.

🧃 Investors Are Getting Defensive

Bank of America’s Michael Hartnett put it bluntly:

“US exceptionalism is turning into US repudiation.”

He’s telling investors to:

- Sell any stock rallies

- Stay long on 2-year Treasuries

- And hold tight until the Fed steps in

Basically: stay defensive, watch your risk, and don’t go FOMO-buying into any green candles just yet. 📉

Asia Forex Mentor Insights

This isn’t just another news headline, this is a macro-level shift. The dollar's role as the world's reserve currency is showing cracks, and that has ripple effects on forex trading, cross-border capital flows, and risk appetite globally.

👉 Gold soaring = flight to safety

👉 Euro strength = dollar weakness priced in

👉 Yuan volatility ahead = opportunity for sharp FX plays

If you’re trading forex right now, risk management is king. Expect higher volatility, and don’t be surprised if safe-haven currencies (JPY, CHF) start making moves too.

And remember: the trend is your friend… until it’s not. 🧠📊

MEMES OF THE DAY

When you enter a trade and it instantly goes the other way 😩

It’s always the broker’s fault, right? 💀