TOGETHER WITH

Today’s edition is brought to you by Markets4you, your trusted partner in smarter, more powerful trading. With tight spreads, fast withdrawals, and a bonus program that lets you double your initial deposit, Markets4you gives you the edge you need to trade with confidence.

Ready to take your trading to the next level? Click here to claim your bonus now. 💸

Hey traders, Ezekiel here with your quick market update. Let’s dive into what’s shaking up the markets, why it matters, and how you can stay one step ahead:

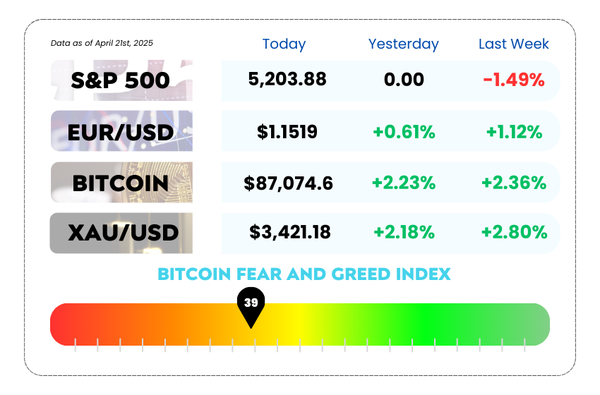

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Gold hits $3,400, dollar in the dirt, markets in panic mode

- U.S. growth risks mount as tariffs return and immigration tightens

- From doji to breakouts: 22 essential trading setups explained fast

🚀 Double Your Deposit with Markets4you! 🚀

Fuel your trading with Markets4you’s Deposit Bonus Program — choose your bonus level when you deposit and instantly double your funds with trading credit. More capital means more trading power. 💰📈

Why Markets4you?

✔️ Tight spreads & high leverage

✔️ 150+ tradeable instruments

✔️ Instant deposits & withdrawals

✔️ Segregated client funds

WEEKLY MARKET MAYHEM

For this week's market mayhem, here’s what we got for you today:

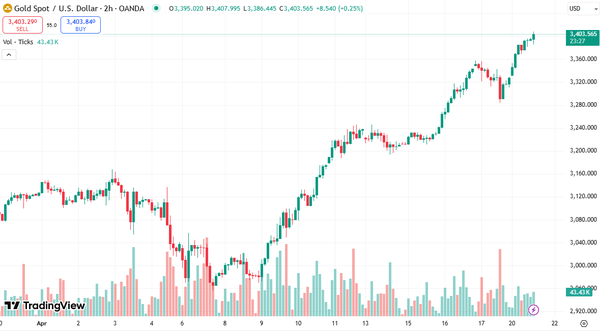

💥 Gold Just Set a New Record – and It's Flexing Hard 💥

Gold just hit $3,400 an ounce. Yup, it's not just shining — it’s flexing on the markets while the dollar takes a nap. 🛌📉

Here’s what’s fueling the gold rush:

- The US dollar just hit its weakest level since late 2023

- Political noise is getting louder, with the Fed caught in the crossfire

- And the trade war tensions are simmering like leftover dumplings 🍜🔥

All of that? It's a perfect storm pushing investors to ditch risk and pile into safe havens,and gold is leading the charge like it’s got cheat codes.

The drama around the Fed hasn’t helped. With pressure mounting for lower interest rates and talk of leadership shake-ups, markets are on edge. When monetary policy starts looking more political than predictable, confidence in the dollar takes a hit, and gold picks up the slack.

XAU/USD Daily Chart as of April 21st, 2025 (Source: TradingView)

Meanwhile, global demand for the shiny stuff isn’t slowing down:

- Central banks are adding to their gold reserves

- Gold-backed ETFs have been on a 12-week buying streak

- Big banks are getting real bullish — some are even calling for $4,000 gold by next year 🤯

As for the trade front? China’s not thrilled about countries warming up to the US. That’s adding even more tension, and markets are feeling the heat. Oh, and global growth fears? Still here — with fresh data on the way that could turn up the anxiety even more.

Right now:

- Gold: 🚀 $3,400.38/oz (up 2.2%)

- Silver: +1%

- Platinum: Gaining

- Palladium: Sitting this one out

🤔 Asia Forex Mentor Insights

When safe havens outperform, it's a clear sign the market’s wearing its nervous pants.

Gold’s rally isn’t random, but a reaction to macro noise, central bank chaos, and dollar doubt. For traders, this is a reminder: stay agile, stay informed, and always understand the why behind the what.

We're not saying sell your house for gold bars… but maybe don’t sleep on the signals either. 😏

📰 Asia Forex Mentor and Markets4you Announce Free Live Webinar on Naked Price Action Trading 📰

In a move to help traders cut through the noise and gain clarity in their technical analysis, Asia Forex Mentor has announced a free live webinar in partnership with Markets4you — focusing on the powerful concept of Naked Price Action Chart Reading.

Led by Ezekiel Chew, founder of Asia Forex Mentor and one of the most in-demand trading mentors globally, the session aims to simplify the trading process by teaching participants how to interpret price movement directly from the charts, without relying on indicators.

📅 Date: April 29, 2025

🕖 Time: 7:00 PM (GMT +8)

📍 Location: Online via Zoom

💥 Admission: Absolutely FREE

🔍 What you’ll learn:

- The core principles of naked price action trading

- How to spot high-probability setups without relying on lagging indicators

- The ability to read market psychology straight from price movement

- Actionable techniques to anticipate market direction with more confidence

Spots are limited — don’t wait.

🔥 Tariffs Up, Immigration Down — The U.S. Might Be Shooting Its Own Economy in the Foot 🔥

The U.S. economy might be headed for a one-two punch: Trump’s tariff revival AND a crackdown on immigration. Spoiler: Neither of those is helping growth — and together, they could turn into a recipe for stagflation soup. 🥴🍲

Let’s unpack the chaos:

Trump’s policies are back in full swing — tariffs on deck, and now an aggressive push to clamp down on immigration. Raids are up, legal immigration is being squeezed, and millions of undocumented workers are being told to pack their bags.

The timing? Not great. The U.S. labor market has been running hot because of immigration. Since 2020, around 5.5 million immigrants (legal and undocumented) joined the workforce, helping businesses hire, boosting productivity, and keeping wage inflation in check. 🚀💼

Now, with fewer workers coming in and more potentially forced out, the labor pool’s shrinking. That could mean:

- Slower job creation

- Higher inflation

- Worse supply chain headaches

- And higher wages… for fewer people

NVIDIA Corporation Stock Daily Chart as of April 16th, 2025 (Source: TradingView)

Trump’s tariffs aren’t helping either. Slapping more duties on imports might protect some industries short term — but they also push prices up across the board. Imagine inflation doing pushups while job growth naps in the corner. 🏋️💤

At the same time, businesses are sweating:

- Construction, agriculture, food service, and childcare are already struggling to fill roles

- With fewer immigrant workers, costs rise, and prices follow

- Even local grocery delivery companies are bracing for price hikes as farm labor thins out

Add it all up, and the economic engine that roared back after the pandemic might start sputtering, just as recession fears are making a comeback tour.

And if you’re thinking this is just a short-term squeeze? Think again. As the U.S. population ages, immigration is one of the only engines left for long-term growth. Without it, the population could actually start shrinking in the next decade. That’s not just a demographic stat, that’s an economic red flag. 🚩

🤔 Asia Forex Mentor Insights

This is one of those moments where policy meets macro reality — and reality might not flinch.

Immigration has been a quiet MVP in the post-COVID recovery, supporting job growth, keeping inflation somewhat in check, and helping the U.S. stay competitive. Strip that away and add tariffs? You're removing supply and adding cost — a dangerous combo for any economy.

For traders, this is a signal to watch inflation data like a hawk and prepare for policy-driven volatility. The labor market might look healthy now, but the trendlines are shifting fast, and FX markets won’t ignore it.

Stay nimble. Stay informed. And maybe don’t bet against gold or inflation hedges just yet. 🧠📊

MEMES OF THE DAY

Because patience is a virtue… but FOMO is stronger. 😅

When the chart says one thing but your inner economist starts monologuing… 🤯