TOGETHER WITH

Today’s edition is brought to you by Funded Trader Markets — the go-to platform for traders ready to take their game to the next level.

Trade live with real capital, skip the endless demo grind, and enjoy top-tier support while keeping up to 80% of your profits — with zero hidden fees.

Hey traders, Ezekiel here — let’s break down today’s market action and see how it could shape your next big trading move.

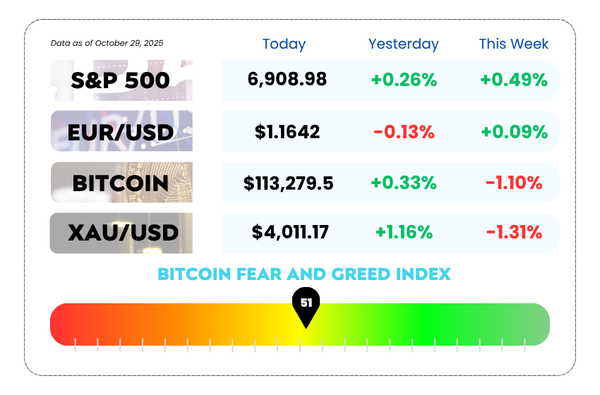

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Inflation cools to 3%, but stays stubbornly above target

- EUR/USD steadies around 1.1645 ahead of Fed decision

- Master institutional Order Block trading and trade like the pros with our video

Go Live, Trade Big — Get Funded Instantly with FTM! 🚀

Forget demo accounts — it’s time to trade with real capital and keep up to 100% of your profits. With Funded Trader Markets (FTM), you can skip the slow grind and jump straight into live trading with funding that’s fast, flexible, and built for serious traders.

FTM gives you the freedom to trade your way — no gimmicks, no handcuffs, just pure opportunity.

💡 Why Traders Choose FTM:

- Flexible Funding Options: From 1-Step Nitro to Instant Funding, pick a plan that fits your style.

- Low-Cost Entry: Challenges start at only $39 — perfect for every trader level.

- Massive Profit Splits: Keep up to 100% of what you earn.

- Freedom to Trade: No required trading days, and news trading is allowed.

- Instant Access: Skip evaluations and start trading live immediately.

- Fast Payouts: Get your profits within hours, not weeks. ⚡

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

The Fed’s Flying Blind… But Still Cutting Rates 😬

The Federal Reserve just wrapped up its latest policy meeting, and here’s the kicker — they’re making major decisions without official data. Yup, the government shutdown means no jobs report, no clear read on the economy, and basically no flashlight in a dark room.

Still, the Fed is expected to trim interest rates by another 0.25%, marking their second cut this year. It’s like driving with your eyes closed, but hey — at least they’ve got seatbelts on.

So what’s happening?

Private data sources (like ADP and Revelio Labs) are waving red flags — job growth is slowing hard. ADP says private payrolls dropped 32,000 in September, and across industries like construction, retail, and manufacturing, job losses are piling up. The only bright spot? Healthcare added 249,000 jobs — apparently, people still need doctors even when the economy catches a cold.

Meanwhile, inflation cooled slightly, rising 3% year over year on a core basis (that’s the Fed’s preferred number). But let’s not celebrate too soon — it’s still above their 2% target, and some insiders think inflation could stay sticky as tariffs and rising retail prices creep in.

One economist put it simply: “It’s not the 1970s, but it kinda feels like stagflation.” Translation — slow growth, high prices, and a Fed that can’t seem to win.

💥 The Big Dilemma:

Cut too much, and inflation could get worse. Cut too little, and the economy might cool faster than your morning coffee.

Even so, Wall Street is betting big that another rate cut is coming not just now, but again in December. Some Fed members agree — others say “let’s wait for the data we don’t have.” 🤷♂️

Adding more spice, loan delinquencies (especially on subprime auto loans) are starting to creep up. A few regional banks even took losses on bad commercial loans. It’s not a full-blown crisis, but it’s giving off early warning vibes that the economy’s hitting the brakes.

The Fed’s trying to “lean toward risk management” — meaning, they’d rather cut first and ask questions later. Problem is, without real data, those questions might stay unanswered for a while.

🤔 Asia Forex Mentor Insights

The Fed’s next move has traders watching like hawks 🦅. A rate cut means the dollar could soften, potentially giving pairs like EUR/USD and GBP/USD a short-term lift. But if inflation remains stubborn, we could see a quick reversal as markets price in future tightening.

Bottom line: volatility is the name of the game, and positioning wisely ahead of December’s meeting could make or break your trades. Stay nimble, stay smart — and maybe keep your own flashlight handy 🔦.

The AFM Broker Awards 2025 — 30 Days Left to Nominate! ⏰

Time’s ticking, traders! The AFM Broker Awards 2025 are live — but you’ve got just 30 days left to nominate the brokers that truly stand out.

This isn’t about flashy ads or big promises. It’s about recognizing the brokers who actually deliver — the ones who provide real transparency, lightning-fast execution, and support that shows up when it matters most. 💪

Because let’s be real — not every broker walks the talk. Some just market hard, while others earn your trust through consistent performance and trader-first service. And those are the ones we want to celebrate.

💬 Got a broker who’s gone above and beyond?

💼 One that’s reliable, transparent, and always has your back?

Then it’s your time to act. 👉 Nominate them now and help us shine a light on the brokers shaping a better trading world. 🌍

⏳ Nominations close in just 30 days, and once the window shuts, that’s it. Don’t miss your chance to give your favorite broker the recognition they’ve earned.

EUR/USD Holds Steady As Markets Wait on the Fed 🕰️

The EUR/USD pair is catching its breath before the big show — the Federal Reserve’s rate decision later today. It’s trading around 1.1645, after bouncing from session lows near 1.1618. Basically, traders are just waiting for Powell to say something interesting.

The US Dollar’s been pacing in circles all week, with investors too nervous to make big moves ahead of the Fed announcement. The market’s pricing in a 25 basis-point rate cut, but what everyone really wants is a clue — will there be another cut in December, or will the Fed finally chill?

Over in the political theater, President Trump has been busy making headlines of his own. He’s currently touring Asia, sealing a rare earth trade deal with Japan, and heading to South Korea for a sit-down with China’s President Xi Jinping. The goal: set up a framework to extend the trade truce between the two economic heavyweights.

Meanwhile, in Europe, the Eurozone’s data isn’t exactly flexing. Spain’s Q3 GDP slowed to 0.6% growth, missing forecasts, while retail sales slipped from 4.5% to 4.2%. It’s not a crisis — but it’s not helping the Euro’s case either.

EUR/USD Daily Chart as of October 29th, 2025 (Source: TradingView)

MEMES OF THE DAY🤣