TOGETHER WITH

Today’s edition is sponsored by Funded Trader Markets, the platform designed for traders who are ready to scale up.

Skip the demo grind and start trading live with real capital, access top-tier support, and keep 80% of your profits, all with no hidden fees.

Hey traders, Ezekiel here! Let’s dive into today’s market movements and uncover what’s driving the charts so you can stay one step ahead:

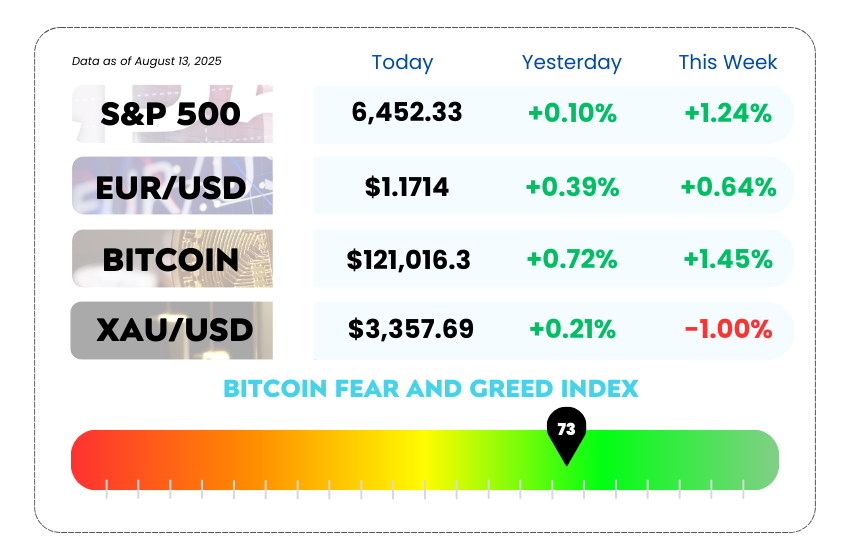

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Dollar weakens, Fed rate cut expectations rise, and Ethereum surges

- Oil markets face record supply glut in 2026, IEA warns

- Learn the secret to trading smarter by mastering support and resistance levels with our video

Skip the Demo, Start Trading Live with Funded Trader Markets 📈

Looking to trade with real capital and keep 100% of your profits? Funded Trader Markets (FTM) offers a straightforward path to funding with minimal hurdles.

🚀 Why Traders Choose Funded Trader Markets

- Multiple Funding Options: Choose from 1-Step Nitro, Nitro Pro, Nitro X, 2-Step Speed, 2-Step Standard, and Instant Funding plans

- Affordable Entry Fees: Start with challenges as low as $39, making it accessible for traders at all levels

- High Profit Splits: Earn up to 100% profit share, depending on the funding plan

- Flexible Trading Rules: No strict trading day requirements and news trading is allowed.

- Instant Funding Available: For experienced traders, skip the evaluation process and start trading live immediately

- Fast Payouts: Enjoy on-demand payouts, often processed within hours.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Dollar Falters, Fed Cuts on the Horizon & Crypto Makes Waves 🌊

The U.S. dollar just dipped to a two-week low, and it's sparking some serious discussions on Wall Street.

Investors are now practically betting their dollars that the Federal Reserve will make a rate cut at its September meeting after a tame reading of July’s inflation data. With a near 98% probability now priced in for a 0.25% rate cut, traders are recalibrating their expectations.

What Caused This Drop?

First, the U.S. inflation report came in milder than expected, showing a modest increase in consumer prices. This has fueled expectations that the Fed will need to adjust its current policy, as inflation seems to be slowing down, and the job market isn't exactly thriving either.

Add to that Trump’s ongoing battle with the Fed, and we’ve got a situation where market uncertainty is high, but the currency is weaker. As tensions rise, investors are leaning towards the expectation of a rate cut.

The Dollar Index fell to 97.76, its lowest level since July 28, extending its 0.5% slide from Tuesday. Meanwhile, the euro and pound took full advantage, both rising to multi-week highs against the dollar. The euro reached $1.1709, while the pound pushed up to $1.3562.

US Dollar Index Daily Chart as of August 13th, 2025 (Source: TradingView)

Overseas, the Australian dollar rallied by 0.35%, closing at $0.6552, and the New Zealand dollar was up 0.5%, making gains at $0.5986. The Reserve Bank of Australia also made waves by announcing a rate cut and signaled more easing might be needed to keep inflation in check and support economic recovery.

💼 Meanwhile, Bitcoin’s rally hit a pause, coming in at $119,809, but Ethereum quietly stole the spotlight. ETH surged to a near four-year high of $4,679 — showing signs of strength that many didn’t expect, especially after BTC’s run.

Ethereum’s quiet breakout is becoming more noticeable as it even overtook BTC in trading volume on platforms like OKX. Investors are buying into ETH as it sees real-world adoption and increased confidence from the broader market.

What’s Driving These Moves?

In crypto, Ethereum’s bullish momentum is becoming more prominent, and some analysts suggest it might be overtaking Bitcoin in terms of market dominance.

Ethereum’s strong use cases in decentralized finance (DeFi), NFTs, and blockchain technology are pushing investors to place more faith in ETH, even over the pioneer of crypto, Bitcoin.

But it’s not just about crypto. The dollar’s decline also means that commodities like gold and high-yielding currencies like the Australian and New Zealand dollars are seeing support.

So, while Bitcoin has paused its rally, Ethereum’s quiet breakout is worth noting — many traders are betting on a future where ETH could lead the charge, especially as more institutional investors dive in.

The next few weeks are crucial. Investors are now eyeing August 1, the deadline for the U.S. to impose tariffs on countries without trade agreements, and Jerome Powell’s speech at Jackson Hole in late August. These could make or break the next market move.

🤔 Asia Forex Mentor Insights

The outlook is clouded with a weaker dollar, stronger commodities, and bullish sentiment in crypto. The market’s watchful eye is on the Fed, and traders are hoping that a September rate cut will continue to provide a tailwind for these markets.

The upcoming inflation data and Powell’s remarks will be crucial for understanding just how the Fed plans to handle the balance of inflation, growth, and labor market recovery.

Meanwhile, Ethereum’s growth in the real world is showing more than just speculative moves, positioning it for potential outperformance if this trend continues.

IEA Warns of Record Oil Surplus by 2026 as Supply Outpaces Demand 🛢️

Oil prices have been in retreat this year, and according to the latest report from the International Energy Agency (IEA), the future of the market looks even more bloated, with a potential record surplus in 2026.

Global oil demand is slowing, while supply is growing rapidly, setting the stage for a supply glut that could overshadow even the pandemic-era 2020 crisis.

The IEA forecasts that oil inventories will accumulate at a rate of 2.96 million barrels per day next year, a pace far exceeding what was seen during the pandemic's deepest lows.

In other words, while 2020’s stockpiles were due to reduced demand, 2026’s glut could be the result of oversupply outpacing even the most optimistic demand expectations.

Meanwhile, crude prices have already dropped by 12% this year, hovering near $66 a barrel. This price decline is a double-edged sword: It’s a relief for consumers after years of rising fuel costs, but it spells trouble for oil producers and countries whose economies rely on high oil prices.

The price drop may also provide a temporary win for US President Trump, who has been pressuring for lower fuel costs to benefit consumers, but it adds uncertainty to the market.

CFDs on WTI Crude Oil 5-Day Chart as of August 13th, 2025 (Source: Trading View)

OPEC+ is struggling to manage the balance, as rising production from both the cartel and non-OPEC countries, like the US and Brazil, continues to chip away at the group’s market share.

Even Saudi Arabia, which has spearheaded OPEC+’s production cuts and slow-ups, is facing a challenge in controlling the market, especially with global oil consumption growing at a sluggish pace of just 680,000 barrels per day this year, the weakest growth rate since 2019.

Despite a somewhat strong summer demand for driving fuels, the IEA says oil inventories are already approaching 46-month highs, signaling a growing concern that the market is nearing oversupply.

In the long term, the shift toward electric vehicles and alternative energy sources could limit global oil demand, signaling a potential stall in growth by the end of this decade.

With a sluggish demand forecast for key oil markets like China, India, and Brazil, and the increase in supply from non-OPEC+ producers, the IEA predicts that OPEC+ will continue to face stiff competition.

As the market braces for 2026, one thing is clear: something’s gotta give. With global demand slowing and supply ramping up, it’s only a matter of time before the balance tips.

Will OPEC+ continue to ramp up production to secure market share, or will they pull back to avoid flooding the market? Time will tell, but in the meantime, expect a bumpy ride ahead for oil prices and producers alike.

🤔 Asia Forex Mentor Insights

With the potential for such a massive oversupply coming into play, traders should keep a close eye on any signals of volatility in oil futures.

The long-term outlook is clouded by the continued fight for market share and shifting demand, but those with the right timing can still make profitable moves.

Watch for opportunities in currency pairs tied to oil producers, as shifts in oil prices could trigger bigger market movements! 🌍📊

MEMES OF THE DAY

Don't let FOMO drive your trades 🧠

That moment when the news drown your analysis 💀