TOGETHER WITH

Today's edition is sponsored by Markets4you. Grab their 100% Deposit Bonus and watch your trading capital double instantly — the smartest way to trade bigger without spending extra.

Unlock smarter trading power today with Markets4you.

Hey traders, it’s Ezekiel dropping the latest market insights to keep you one step ahead. Let’s dive in!

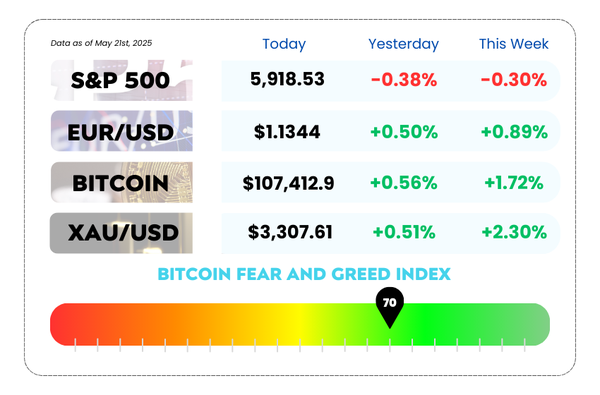

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Level up your trading with our free webinar on risk and position sizing

- Dollar drops to 1-month low as G7 talks heat up

- Yields pop above 5% and Wall Street starts sweating fiscal reality

- Master the Cup and Handle to catch winning breakouts with our YouTube video!

💥 Boost Your Trading Power with Markets4you’s 100% Deposit Bonus! 💥

Want to kickstart your trading with twice the capital? Markets4you makes it easy to double your money instantly and amplify your market moves!

How it works:

- Deposit any amount you like

- Pick your bonus level

- Get a 100% matching bonus credited immediately — no waiting, no fuss

- The bigger your deposit, the bigger your bonus

Whether you’re a newbie or a seasoned trader, this bonus means more trades, more opportunities, and a bigger profit potential! 🚀

Why settle for less when you can trade with double the firepower?

Ready to maximize your edge? Join Markets4you today and turn your deposit into double the trading muscle! 💪📈

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

🚨 Don’t Miss Out! Live Webinar on Risk Management & Position Sizing with Ezekiel Chew 🚨

Join Octa and Asia Forex Mentor on May 22, 2025, at 7:00 PM (GMT+8) for an exclusive session with top trading mentor Ezekiel Chew.

Want to discover what separates the pros from the rest? In this must-attend event, you’ll learn:

✅ Why a strategy alone won’t guarantee success

✅ The key factors that truly improve your trading odds

✅ The mindset shifts that elite traders swear by

✅ How to join the top 10% of consistently winning traders

🗓️ When: May 22, 2025

⏰ Time: 7:00 PM (GMT+8)

💰 Cost: Totally FREE

🎁 Plus, live participants get access to exclusive bonus rewards!

📌 Hurry and save your seat, spots are limited and this event is packed with value!

📉 The Dollar’s Losing Streak: What’s Really Going On? 📉

The US dollar just hit a one-month low, and traders are watching the G7 meeting like it’s the finale of a reality show.

But this isn’t just your regular currency dip, it’s starting to feel like the market’s confidence in the US economy is getting… shaky 🫨

Here’s what’s cookin':

- The US Dollar Index is sitting at 99.633, its weakest level in a month.

- Options traders are turning bearish, and not just a little — one-month sentiment is the worst it's been in five years. Yikes.

- Behind the scenes? Talks between South Korea and the US on FX policy are “ongoing,” and Japan wants in too. Everyone’s getting a seat at the currency table.

US Dollar Index Daily Chart as of May 21st, 2025 (Source: TradingView)

🧨 Dollar’s Down… but Not Out?

Markets are sniffing out stagflation risks — slow growth + high inflation = bad vibes.

At the same time, concerns over the US budget deficit are mounting. With lawmakers haggling over a new tax-cut plan, projected revenue losses are in the trillions (yep, with a “T”). Meanwhile, Moody’s just downgraded US debt, and that didn’t exactly boost investor confidence.

Put it all together, and you’ve got a recipe for a weaker dollar, even if Washington isn’t explicitly pushing for one.

💣 Geopolitical Drama Adds to the Mix

New US intelligence suggests Israel might be prepping a strike on Iran’s nuclear facilities, and that news gave haven currencies like the yen and Swiss franc a boost. The dollar? Still sliding against all its G10 peers.

📉 It’s Not Just a Currency Story but a Confidence Story

Morgan Stanley’s analysts think US stocks and bonds are still a buy 📈, but they also expect the dollar to stay on the back foot. Why? Because the US’s economic edge over other countries is fading, and the yield gap is narrowing too.

Translation: other countries are catching up, and investors are rethinking just how overweight they want to be on the US.

🤔 Asia Forex Mentor Insights

This isn’t just short-term noise. The greenback’s decline signals a deeper shift, markets are starting to lose faith in US policy stability. With G7 meetings in focus and FX chatter heating up in Asia, don’t be surprised if this turns into a bigger trend.

The smart move? Stay nimble, watch the sentiment, and don’t underestimate the power of global macro currents 🌊📊

💀 Bonds Are Spooked, and It’s Not About Inflation This Time 💀

Something weird is happening in the bond market… and no, it’s not just the usual inflation ghost 👻

This time, it’s America’s fiscal mess that’s rattling investors.

The 30-year Treasury yield jumped above 5%, a key psychological level, not once, but twice this week, setting off alarm bells across Wall Street.

And when bond yields go up, prices go down… which means people are selling bonds instead of treating them like the safe haven they usually are in times of stress. That’s not normal.

Welcome to the “Sell America” narrative. Yeah, it’s a thing now.

📉 From Trade Wins to Budget Bombs

Just a few weeks ago, markets were high-fiving over progress on tariffs and trade deals. Fast forward to now, and all that positivity is getting wiped out by a new storyline: “Uh oh, the US might be broke.”

Here’s why:

- The US just took another credibility hit after Moody’s downgraded its credit outlook.

- Trump’s new tax plan could add $4 trillion to the national debt.

- Lawmakers are playing budget Jenga while trying to pass it before Memorial Day. 🧱💥

So instead of celebrating trade momentum, investors are now bracing for rising borrowing costs, shrinking fiscal room, and less appetite for US debt — especially from overseas players.

💸 The Yield Curve’s Screaming “Fiscal Stress”

In normal times, a steepening yield curve suggests strong growth ahead. But not this time. The curve’s getting steeper because long-term yields are spiking while short-term ones are chilling. Translation: investors want more money upfront to deal with what they see as a risky, messy fiscal future.

Even more worrying? A rise in something called the “term premium”, basically the market saying, “We need to be paid more to lend you money for the long haul.”

It’s not exactly a vote of confidence in America’s economic management.

🚪Is the World Looking for the Exit?

All this uncertainty has global investors side-eyeing the US like 👀. For decades, Treasury bonds were the king of safety, the place you go when everything else feels risky.

But now, between the downgrade, policy chaos, and ballooning debt, some foreign investors are wondering if it's time to diversify away from Treasuries. There's no perfect substitute… but there is rising hesitation.

🤔 Asia Forex Mentor Insights

This week’s bond market volatility is a shift in sentiment, and maybe a preview of what happens when confidence in the US’s fiscal outlook starts to crack. The focus is moving from inflation to long-term debt sustainability, and that’s a whole different beast.

For traders, this means paying close attention to yield curve moves, term premium trends, and global capital flows. If the “Sell America” mood sticks, it could drive shifts in FX dynamics, risk appetite, and even equity markets across Asia and beyond.

Stay sharp, stay flexible, the old market narratives are breaking down, and new ones are just getting started ⚔️📈

MEMES OF THE DAY

Because sometimes, all you can do is pray together and trust the moon 🚀🌕

When you remind yourself to stay calm… but the market has other plans 😅