TOGETHER WITH

Today’s edition is brought to you by Markets4you. With their 100% Deposit Bonus, you instantly double your trading capital, giving your strategy more breathing room without adding to your expense.

👉 Kickstart your trades with twice the capital at Markets4You.

What’s up, traders? Ezekiel here with your quick-hit market breakdown to help you stay sharp and ahead. Let’s get into it!

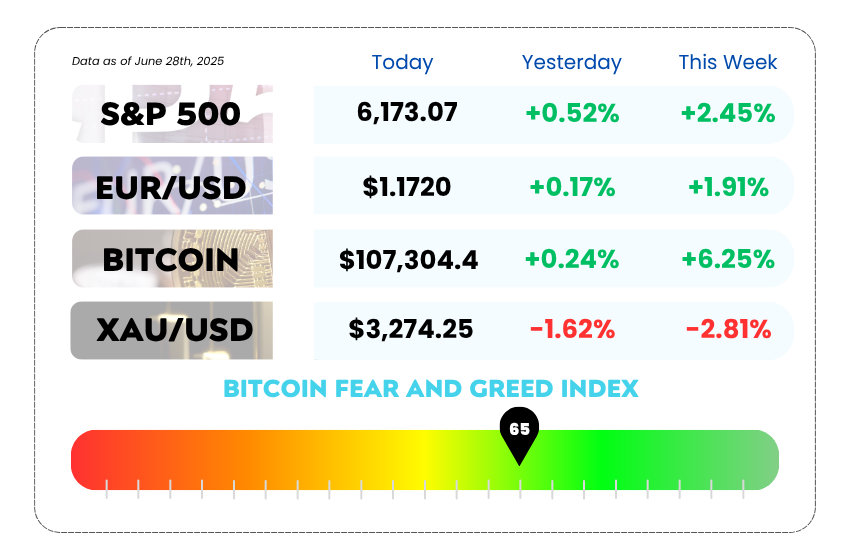

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Markets climb higher but traders brace for a Trump-induced whiplash

- South Korea races to strike a trade deal before U.S. tariff deadline

- Learn to avoid fake breakouts and trade smart zones with our YouTube video

Trade. Review. Get Rewarded. 💬

Markets4You just made sharing your trading experience worth real cash. Their new “Review & Reward” Promotion is your chance to turn honest feedback into bonus money. Yep, your review = real rewards. 💸

It’s simple:

✅ Trade at least once on your verified account

✅ Share your genuine review

✅ Submit a screenshot to support@markets4you.com

✅ Get rewarded—easy as that

Don’t wait because this promo just launched last June 20 and won’t be around forever.

👉 Haven’t registered yet?

Hit the button below and create your Markets4You account today to start earning from your experience.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Markets Are Rallying… but Traders Still Don’t Trust the Vibes 📉

US markets are partying like it’s 2021 again, with the S&P 500 and Nasdaq pushing into record territory. But if you think traders are popping champagne… think again.

🧠 Despite the green candles, nobody’s feeling safe. Why? Two words: Trump's policy roulette.

The market might look calm on the surface, but under the hood? It's pure anxiety. The April tariff bombshell is still fresh, and investors haven’t forgotten how fast things flipped from all-time highs to near-bear market territory. Even now, just one rogue post from Trump can throw the entire setup off.

⚠️ “Snapchat Presidency” = Market Whiplash

Wall Street’s now living in what one strategist called a “Snapchat presidency” — policies that vanish as quickly as they appear. One minute it’s no deal with Iran, next minute it’s ceasefire and back to the bull run. Tariffs? Off, then on. Rate pressure? Cooling, then heating.

That kind of inconsistency is killing confidence. Even with volatility (VIX) falling from 52.3 to 16.3, options traders aren’t buying into the hype. Institutions are holding back on bullish calls, spreads are wide, and liquidity remains thin, worse than what traders saw even in late 2024.

Volatility S&P 500 Index Daily Chart as of June 28th, 2025 (Source: TradingView)

🤷♂️ A Rally Without Trust

The weird part? This market bounce has almost no momentum behind it. Options activity is lukewarm, bid/ask spreads are still unusually high, and market depth is practically skeletal, the lowest in over 20 years, according to some desks.

That’s because the rally is not conviction-driven. It’s relief-driven. A quick bounce off geopolitical panic, not sustained by strong fundamentals. It’s the “I guess we’re not going to war this week” kind of buying, and that’s fragile.

🤔 Asia Forex Mentor Insights

Here’s the technical kicker: Price is running on shallow liquidity, so fakeouts and whipsaws are more likely than clean breakouts. Look at S&P and Nasdaq — yes, they’re in price discovery, but with low conviction, which means:

- Volume divergence is your best friend here. Track volume spikes that don’t move price, it’s a red flag.

- Expect range compression followed by violent expansion once Trump tweets again or macro data flips.

- Volatility clusters are forming, watch VIX sub-20 levels carefully. They may lull traders into a false sense of security before volatility resurfaces fast.

Smart traders aren’t going all-in on this pump. They’re scaling in, hedging wide, and keeping one eye on the news feed.

📊 Remember: A market can rally without confidence… but it rarely holds without it. Trade accordingly.

South Korea's Trading Chess Game with Team Trump 🇰🇷

The deadline is ticking, tariffs are looming, and South Korea just pulled out its diplomatic playbook.

South Korea’s new trade minister Yeo Han-koo just wrapped a Washington trip where he met with top U.S. officials, and the mission was clear: don’t let the July 9 tariff bomb detonate. He’s trying to strike a deal that saves Korea from getting hit with a 25% tariff on exports like cars, chips, and batteries.

🔄 But here’s the twist: this isn’t just about dodging a tax hike. Korea wants to reset the trade relationship. Yeo pitched a “mutually beneficial” framework — not just a short-term fix, but a longer-term partnership. Think less “patch-up”, more “let’s stop breaking things and start building something.”

Why it matters? Because South Korea isn’t just some side player. It’s a manufacturing powerhouse, a key part of global supply chains for semiconductors and EVs. A 25% tariff here could ripple across the entire tech sector and hit both economies hard.

But Seoul’s got more than just tariffs on the radar. They’re also sweating over Washington’s tighter controls on exporting tech to China — something that’s already got Korean chipmakers feeling the squeeze.

📉 South Korea’s economy is already slowing, with GDP forecasts just cut to 0.8% growth for 2025. Another hit from tariffs would feel like kicking someone while they’re already down.

Meanwhile, U.S. Commerce Secretary Howard Lutnick teased that more deals are coming, with up to 10 countries in the mix. He also hinted that Trump might delay the July 9 deadline, giving negotiators more time to breathe. But Seoul? Still holding its breath.

🤔 Asia Forex Mentor Insights

This is a pressure test for global risk sentiment.

If talks fall apart and tariffs snap back into place, expect USD/KRW to spike and risk-off flows into JPY and gold. Keep a close watch on semis and EV sector-related pairs.

Traders should also look out for a volatility bump around the July 9 deadline, especially if there's no extension news by early next week.

In short: watch how diplomacy plays out because this has the potential to move markets far beyond Seoul and Washington.

MEMES OF THE DAY

Just waiting for the “real breakout” since 2021 💎

Blaming the chart won’t fix your FOMO entries 😅