TOGETHER WITH

Today’s edition is sponsored by FP Markets, your gateway to the world of forex trading. Trade over 70 currency pairs with razor-sharp spreads, lightning-fast execution, and pro-level platforms like MT4, MT5, and TradingView.

👉 Ready to level up your trading? Start trading with FP Markets today.

Hey traders, Ezekiel here with your quick market breakdown. Here’s what’s moving, why it matters, and how to stay one step ahead:

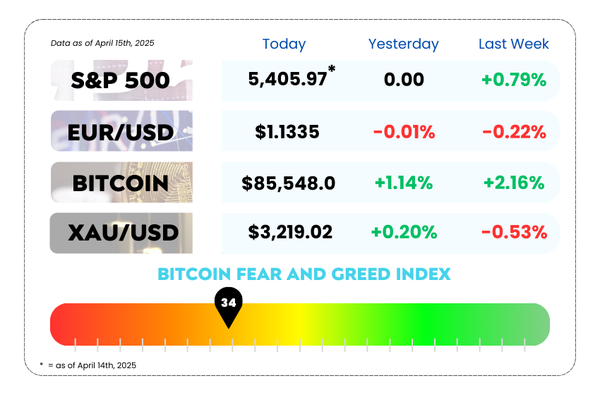

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Gold shines brighter as US starts beef with Semis and Pharma

- Auto stocks zoom after Trump teases tariff reprieve

- Master the perfect pullback entry and stop getting stopped out with our video

🟡 Gold’s Out Here Flexin’ Again 🟡

Gold is making moves — and it’s not just doing yoga, it’s edging closer to its all-time high 🧘♂️💰.

As the U.S. ramps up its trade beefs with a side of semiconductors and pharma probes 🍔💊, traders are piling into the one thing that never tweets or defaults: gold.

Right now, it’s hovering around $3,223/oz, just a casual $20 away from Monday’s record high. That’s like ordering the Big Mac and asking for just one more fry to hit the perfect meal 🍟

What’s going on?

The U.S. Commerce Department is poking around semiconductor and pharmaceutical imports, citing “national security”. 👀

That’s code for: “We might slap more tariffs on stuff.”

Meanwhile, markets are shaky, trust in U.S. assets is wobbling, and traders are hugging gold like it’s a security blanket 🧸

XAU/USD Daily Chart as of April 15th, 2025 (Source: TradingView)

Gold’s up 20% this year. Why?

Because:

- Trade war = bad vibes for global growth 🌍📉

- Uncertainty = gold’s time to shine ✨

- Fed might cut rates = gold wins again (no interest = lower opportunity cost for holding bullion)

Big money still loves gold. Goldman Sachs is betting on a moonshot to $4,000/oz by mid-2026 🚀.

Plus, China — the heavyweight champ of gold demand — is loading up:

- Yuan’s taking Ls 📉

- ETFs in China are soaking up gold

- People are ditching dollars and hedging with metal 🪙

🤔 Asia Forex Mentor Insights

Gold is doing what gold does best — being the life raft when markets feel like the Titanic. As global uncertainty grows, especially with trade tensions flaring, gold becomes more than just a safe haven… it becomes a strategy.

💡 Watch for the Fed — any whiff of a rate cut and gold could punch through its previous highs like it’s going Super Saiyan 🥇⚡

🔥 Why Trade Currencies with FP Markets? 🔥

Looking to elevate your currency trading game?

FP Markets offers a comprehensive forex trading experience with tight spreads starting from 0.0 pips, ultra-fast execution, and access to over 70 currency pairs.

FP Markets delivers a powerful forex trading experience tailored for both beginners and pros. Here's what makes them stand out:

✅ Ultra-tight spreads starting from 0.0 pips

✅ Over 70 currency pairs — majors, minors, and exotics

✅ Lightning-fast execution with low latency

✅ Platforms you know and love: MT4, MT5, cTrader & TradingView

✅ High leverage up to 500:1 (for pro-level flexibility)

💥 Wall Street’s Mood: Auto Tariffs on Pause = Slight Vibes Up 💥

The stock market pulled a little “we’re fine, everything’s fine” move Tuesday morning as U.S. futures inched higher. The reason? Trump might be taking his foot off the auto tariff pedal — for now. 😬

- Dow futures? Barely up.

- S&P? Gained 0.1%.

- Nasdaq? Feeling cute with a 0.2% boost.

It's not a fireworks show, but hey, after last week’s whiplash, even a calm breeze feels like a win 🎈

What’s behind the market’s mini glow-up?

S&P 500 Daily Chart as of April 14th, 2025 (Source: TradingView)

On Monday, Trump hinted he might delay tariffs on some electronics — and possibly let car companies off the hook. That sent auto stocks popping like champagne 🍾

But don’t pop too many bottles yet…

Because in classic 4D chess fashion, the administration also moved forward with plans to slap tariffs on semiconductors and pharma imports. So yeah, things are still about as clear as a foggy windshield 😵💫

What else is on traders' radar today?

👉 Earnings season kickoff.

Big names reporting before the bell:

- Bank of America 🏦

- Citi 💳

- Johnson & Johnson 💊

- PNC 📊

Meanwhile, Boeing dropped nearly 4% premarket, thanks to news that China told its airlines to pause new Boeing jet deliveries. Oof. That’s not the turbulence investors were hoping for ✈️📉

So while traders are clinging to the hope that Trump maybe kinda sorta eases up on tariffs, they’re also bracing for corporate earnings to tell the real story.

🤔 Asia Forex Mentor Insights

Markets are cautiously optimistic, but the keyword is cautiously. When one hand gives (auto relief), the other hand slaps (pharma + chip tariffs). Traders are watching earnings not just for results, but for guidance. If companies start saying “yo, these tariffs are messing with our margins,” expect more chop ahead. 🪓

Stay nimble, stay sharp — this market ain’t cruising on autopilot.

MEMES OF THE DAY🤣

Fibonacci said “not today.” 😤

Instant karma, but make it candlesticks. ☠️📉