TOGETHER WITH

Today’s edition is brought to you by iFunds, the no-BS prop trading platform giving you instant capital and zero excuses.

Trade forex, crypto, stocks, and indices all in one sleek setup, minus the annoying evals and drawn-out approvals.

👉 Get up to $500K in real capital and start trading today.

Hello traders, Ezekiel here with your latest market insights. Let’s unpack the key drivers shaping the market right now.

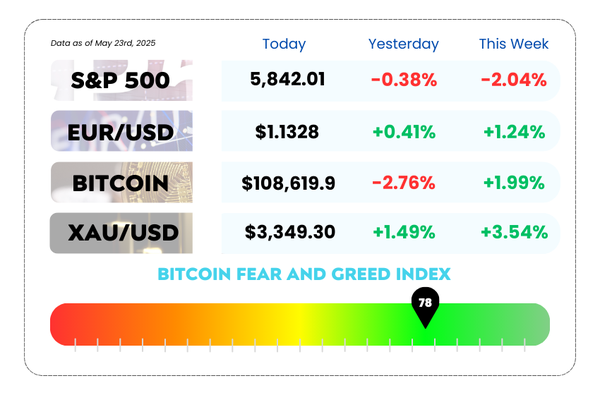

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Global trade in limbo as Trump pushes high-stakes tariff game

- Investors shrug off new tariff talk from Trump

- Discover pro-level RSI techniques for smarter trade entries and exits with our YouTube video

Skip the Challenges, Start Earning Today with iFunds 💸

iFunds is flipping prop trading on its head, giving you instant access to real capital and letting you keep the profits from day one.

This isn’t your average funding platform. It’s built for traders who want action, not red tape.

🚀 Why Traders Are Switching to iFunds:

🚫 No evaluations, no profit targets, no daily drawdowns

💸 Up to $500,000 in trading capital immediately

📉 Ultra-low commissions and swap fees

⚡ Lightning-fast sign-up and platform access

💼 Withdraw profits on your terms, anytime

Whether you're scalping, swing trading, or running EAs, iFunds gives you the freedom to trade your edge with zero nonsense.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

The US is Playing Deal or No Deal With the World 💼

Trade talks are heating up faster than instant noodles in Asia 🍜🔥

The US has basically turned global diplomacy into Deal or No Deal, and everyone’s lining up to open their case, hoping it doesn’t contain a 30% tariff.

Trump’s plan? If you’re nice, you get a handshake 🤝. If not, you get a tariff 💸.

There’s no clear roadmap. Just a July 9 deadline, a bunch of stressed-out trade reps, and a game show host-style “Here’s your rate” if you don’t play ball.

Countries are scrambling to secure economic lifelines before time runs out. From Asia to Europe, it's a frenzy of last-minute visits, temporary suspensions, and secret “technical discussions.”

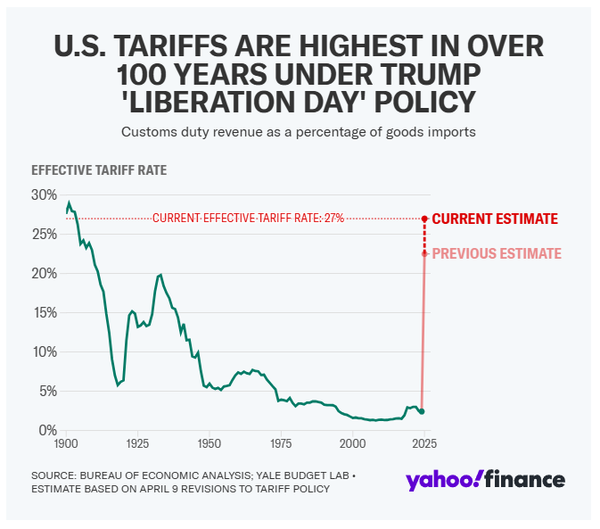

US Tariff Rate from 1900 to 2025 (Infographic from Yahoo Finance)

Let’s unpack who’s sweating the most, who’s stalling, and who’s dodging bullets like Keanu in The Matrix 🎯🕶️:

🌏 Who’s in the Game, and How They’re Playing It

📉 China – Took the bait. Trump eased the mega-tariffs (145% → 34%) for 90 days. In return, China dropped its tariffs to 10%. Both sides are “talking,” but let’s be real: it’s more like eyeing each other at a poker table.

🤝 UK – Got a “deal,” kind of. Trump called it a full package 📦, but the UK still faces 10% tariffs and 25% on auto/steel. They bought time, not peace.

📲 EU – In the group chat, but not replying. The EU can’t get its act together. Washington sent them a “wish list,” and Brussels is like, “uhh, we’ll circle back.” Spoiler: they won’t in time.

🇮🇳 India – Planning in phases like a Netflix mini-series. Phase 1: quick wins (market access, farm goods). Phase 2: the big stuff. Phase 3: a final season with potential plot twists from Congress.

🇯🇵 Japan – Calm but cautious. They want auto tariff relief and are dragging their feet to avoid bad deals. Expect movement in June but not much excitement.

🇰🇷 South Korea – Still doing homework. Second round of “technical discussions” underway. If trade negotiations had a school group project, South Korea is the one building the PowerPoint.

🇻🇳 Vietnam – Surprisingly solid. Two rounds of talks done. They’re closer to consensus than most — maybe because they’re not trying to solve 50 issues at once.

🇹🇭 Thailand – Coming in hot. Trying to shrink its trade gap with the US by $15B/year. Tightening rules, prepping talks, and playing the long game.

🇨🇦 Canada – Basically ghosted the tariff threat. USMCA saved their bacon. But they’re not fully safe — sectoral tariffs still loom large.

🇲🇽 Mexico – Mostly covered. Auto parts are the sticking point, but Mexico is trying to bundle in cooperation on other issues to sweeten the deal.

🤔 Asia Forex Mentor Insights

Trade wars = market turbulence. This is a direct hit to inflation, supply chains, and investor sentiment. Central banks are watching closely, and traders should too. A single stalled deal could trigger major shifts in currency flows and equity markets.

🧠 Your Move: Track the July 9 deadline, but don’t sleep on the quiet moves happening between now and then.

The big swings won’t come from the headlines — they’ll come from what’s signed (or not) behind closed doors.

Trump Yells Tariff Again… and Wall Street Shrugs 💤

Markets used to panic when Trump tweeted “TARIFFS” in all caps. Now? The stock market’s treating it like an old ringtone no one wants to answer. 📵📉

For weeks, it felt like every hint of a trade war was a jump scare for investors, one tweet and BOOM 💥 stocks roller-coastered. But lately? Nothing. Nada. Just… a calm scroll through the headlines like it’s business as usual.

What changed? Traders believe Trump’s gone soft on tariffs. The April selloff slapped the market hard enough to make everyone, including Trump, realize that bulldozing global trade might bulldoze the economy too. Since then, markets have quietly decided that any future tariffs will likely be watered-down versions of the original shock-and-awe plan.

The stock market isn’t calling Trump’s bluff… it’s just ignoring the game altogether.

🎢 From Panic to Chill Mode

Let’s rewind to April, the S&P 500 was flipping like a gymnast. Daily swings were the wildest since 2008. Then May showed up like, “Let’s take it easy,” and suddenly things mellowed out.

Even new trade updates barely moved the needle:

- Trump said he’ll slap tariffs on more countries? Market yawned.

- EU offered a new proposal? Barely a shrug.

- UK deal reached? Cool, but not worth a spike.

Behind the scenes, a lot of this calm is because volatility tied to tariff news has dropped like a rock. Earlier this year, 80% of the S&P’s movement was driven by trade drama. Now? Just a third.

And while that number’s still significant, it’s back to “normal panic,” not “full-on crisis” mode.

🧨 Still Room for Surprises

Now don’t get too comfy, markets haven’t turned into zen monks just yet. There’s still plenty of macro chaos that could ruin the vibes:

- US budget deficit is blowing up like it’s on TikTok.

- Moody’s downgrade knocked America off its AAA pedestal.

- Bond auctions are flopping like bad crypto launches.

Any one of these could spark a “Wait, what just happened?!” moment for traders. But right now, with earnings doing okay and economic data slightly less gloomy than predicted, markets are choosing vibes over volatility. 🎧📊

🤔 Asia Forex Mentor Insights

Big picture: The market has entered what we call the “show me” phase. Investors aren’t reacting to tough talk, they’re waiting for real policy impact before flinching.

That’s bullish for now, but it also means macro shocks, like a debt crisis, war escalation, or a bond market tantrum, could still flip the table.

So keep an eye on headlines, but trade the fundamentals. The noise is fading, but the risk isn’t gone.

MEMES OF THE DAY

Trust issues started with chart patterns like this 😤

Letting go is free, but apparently drawing 25 feels better 🃏