TOGETHER WITH

Today’s edition is powered by FP Markets, the platform made for traders who don’t mess around. With ultra-tight spreads from 0.0 pips, blazing-fast execution, and deep liquidity on MT4, MT5, and cTrader, it’s built for serious performance.

💸 Step up your trading game with FP Markets.

Hey traders, Ezekiel here. Time to unpack what’s moving the markets and how you can stay ahead of the curve.

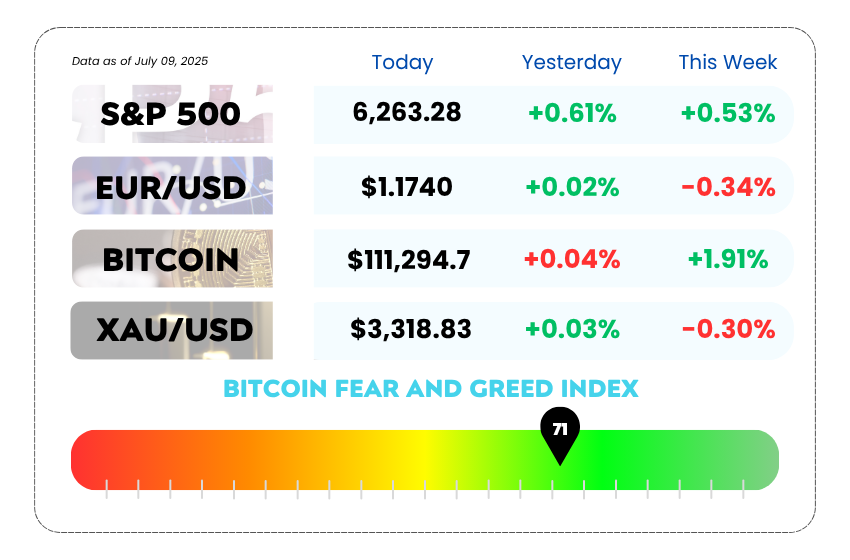

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Nvidia breaks $4T while Trump drops tariff bombs and the Fed stays chill

- EUR/USD dips near weekly lows ahead of critical Fed update

- Discover the secrets to better timing and cleaner setups with our YouTube video

Stop Trading Like It’s 2010 — Upgrade to Precision with FP Markets 🎯

Still stuck with clunky spreads and slow fills? It’s 2025, time your trades like a pro.

FP Markets delivers razor-sharp spreads from 0.0 pips, ultra-fast execution, and deep liquidity built to support serious trading, not sabotage it.

Whether you’re on MT4, MT5, or the sleek new cTrader, the edge is real.

What traders are unlocking:

✅ Pure pricing with no hidden markups

✅ Blazing execution to match market speed

✅ Institutional-grade infrastructure without the suit

👉 Ready to trade with precision? Switch to FP Markets now

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Nvidia Hits $4T, Trump Swings Tariffs, Fed Says “Not Yet” 🧠

Wall Street just crowned a new king — and it’s powered by GPUs. Nvidia briefly hit a $4 trillion market cap, making it the most valuable company in history. Traders cheered, and the entire market rode the AI high.

📈 The Nasdaq hit a fresh record, the S&P 500 ticked up, and even the Dow found some love. It’s the kind of rally that says, “AI > everything else.”

But the celebration didn’t last long…

NVIDIA Corporation (NASDAQ) Daily Chart as of July 9th, 2025 (Source: TradingView)

🚨 Enter: Trump With the Tariff Flamethrower

Just as stocks found their groove, Trump reignited global trade tensions. On Wednesday, he rolled out a second wave of letters notifying countries like the Philippines, Libya, Algeria, and Iraq of incoming tariffs, 20% to 30%, with a hard Aug. 1 deadline. Deals not signed by then? No mercy.

Oh, and he’s not done. The man’s eyeing 50% tariffs on copper and even floated 200% duties on pharmaceuticals. That sent copper prices sliding after a record Tuesday surge.

🏦 Meanwhile, the Fed Is Playing It Cool

We also got a peek inside the Fed’s brain (a.k.a. the FOMC minutes). Turns out, only a couple of officials want a rate cut in July. Most are sticking to the “wait-and-see” script, even as the market keeps pricing in two cuts this year.

So far, inflation’s cooling, but not fast enough to flip the Fed into “cut now” mode.

🤔 Asia Forex Mentor Insights

Nvidia’s dominance shows one thing clearly: the AI trade is still king. But while equities soar, Trump’s tariff blitz is a rising threat to global risk sentiment. If copper and pharma get hit next, expect volatility to pick up in commodity-linked currencies and EM pairs.

For traders, the setup is tricky, rate cut odds are fading, but tariff risk is heating up. Expect short-term USD strength, especially if Fed holds ground and tariff chaos sparks demand for safe haven plays like the dollar or yen.

Keep your eyes on pairs like USD/JPY, AUD/USD, and EM currencies facing direct US trade heat. The summer rally might be real, but headline risk is back on the board, and smart money is already hedging.

EUR/USD Slips as Tariffs Fly and Traders Brace for Fed Moves 🚨

The Euro ain't vibing this week. 😬

The EUR/USD pair is drifting lower, tapping on weekly lows as traders squint at the screens waiting for the FOMC minutes and digest the latest heat from the White House.

Trump just went full Thanos on trade again — hitting copper with a 50% tariff and threatening pharma firms with a 200% levy unless they relocate to the US within 12 months. Andthat’s on top of the 25% tariffs slapped on Japan and Korea earlier this week. 👀

While the market isn’t in full panic mode, the message is loud: Global trade is in the crosshairs again, and nobody’s safe — not even the Eurozone. EU officials are still hoping they can dodge the 10% base levy Trump teased, but a tariff letter is reportedly already en route to Brussels.

📉 That’s not a bullish recipe for the Euro.

The EUR/USD tried to recover, even poked its head near 1.1730, but got swatted back down like a weak intraday breakout. Now it’s hovering just above 1.1680 — dangerously close to Tuesday’s low.

NVIDIA Corporation (NASDAQ) Daily Chart as of June 14th, 2025 (Source: TradingView)

🤔 Asia Forex Mentor Insights

Technically, this isn’t just noise — the chart’s been giving warnings.

EUR/USD is stuck below a descending trendline from the July 1 highs — that 1.1770 zone is acting like a steel ceiling. Price action is trapped in a broadening wedge pattern, often seen when markets are nervous and choppy near tops.

The RSI on the 4H is chilling below 50, confirming there’s no bullish momentum behind any attempted rallies. But here’s the catch: 1.1680 is a serious support level, aligning with both the July 7/8 lows and the 38.2% Fib retracement from the June rally.

➡️ If we get a break below 1.1680 with strong volume, expect a quick slide toward 1.1620 or even 1.1580. But if the Fed minutes surprise dovish or tariffs soften, bulls might get a shot at reclaiming 1.1730, and maybe even that cursed trendline.

This pair’s next move? It’s a battle between geopolitics and technicals. Stay sharp.

MEMES OF THE DAY

Support? Resistance? Cheems just sees discounts 😅

When “just this once” becomes your default strategy 😬