TOGETHER WITH

Today’s edition is brought to you by WEEX. From spot to futures, OTC, and copy trading, everything you need is under one roof.

With over 1,700+ trading pairs, up to 400× leverage on futures, and support across 130+ countries, WEEX gives you the flexibility to trade your way — whether you’re just getting started or managing size like a pro.

Hey traders, Ezekiel here — let’s dive into today’s market moves and uncover what they could mean for your next trading decision.

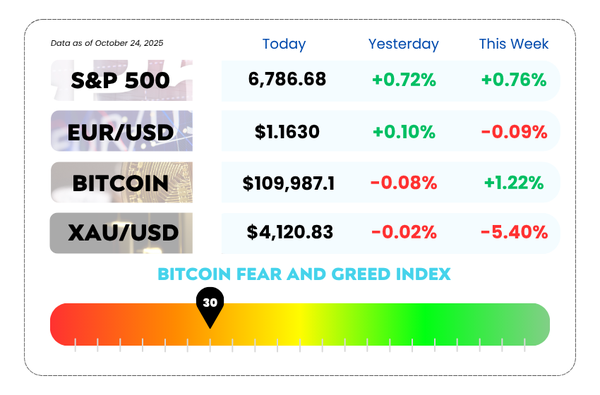

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Institutional investors cut stock exposure, leaving room for further S&P 500 gains

- EUR/USD holds near weekly lows as traders await key U.S. inflation data

- Master a simple, proven trading strategy for clearer, confident trades with our YouTube video.

WEEX: Powering the Next Generation of Pro Traders 💥

Last week, we spotlighted WEEX, the exchange built for serious traders — and the buzz hasn’t slowed down.

This week, we’re diving deeper into why WEEX is becoming a go-to home base for high-performance trading.

⚙️ Built Different: Real Tools, Real Edge

WEEX isn’t chasing hype — it’s building infrastructure that matters.

From ultra-fast execution speeds to pro-level copy trading, the platform is designed for traders who want efficiency, control, and clarity.

💹 Lightning-Fast Execution: WEEX’s matching engine handles massive order flow with minimal slippage — because every millisecond counts.

📊 Advanced Risk Controls: Smart liquidation and margin systems that protect your capital during volatile moves.

🔍 Transparent Pricing: No hidden spreads, no games — just deep liquidity and clear order books backed by real volume.

🧠 Follow the Pros, Trade Smarter

With over 5,000+ verified Pro Traders, WEEX lets you mirror real strategies that have already proven themselves in the market.

No guesswork. No noise. Just solid, data-backed trading behavior you can follow and learn from.

And the best part? You stay in full control, copy trades automatically or manage positions manually with a few clicks.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

The S&P 500’s Rally Might Have More Gas in the Tank 🥛

It looks like the S&P 500 isn’t done flexing just yet 💪

While retail traders are still popping champagne, the big money — hedge funds, quants, and discretionary whales — are sitting on the sidelines, holding more cash than usual.

But here’s the twist: that cash mountain could end up being the fuel that powers the next leg of the rally. 🚀

💼 What’s Going On

Computer-driven funds and old-school portfolio managers have slashed their stock exposure — the biggest cut since April, when trade war drama had markets sweating bullets.

- Hedge funds have pulled their risk levels down near the lowest range of the past three years.

- Systematic funds (aka the algos) hit pause after a volatility spike earlier this month sent them into mechanical deleveraging mode.

- Even the fast-money crowd offloaded stocks as the S&P gained 1% last week — their fastest sell-off since spring.

In other words, the pros are cautious, even while markets keep climbing.

📉 Why the Caution?

A few storm clouds are hanging over Wall Street’s head:

- The U.S. government shutdown saga keeps dragging on 🇺🇸

- Trade tensions with China are simmering again 🐉

- And everyone’s wondering if the AI hype train has overshot the station 🤖

At Deutsche Bank, equity positioning just dropped from moderately overweight to neutral — the sharpest weekly decline since April. Discretionary funds went from neutral to underweight, showing just how skeptical the big guys are right now.

S&P 500 Daily Chart as of October 24th, 2025 (Source: TradingView)

📈 But Earnings Are… Actually Pretty Good?

Here’s the kicker: corporate America is still printing money. 💵

- S&P 500 companies are posting 8.5% profit growth in Q3.

- About 85% of them beat expectations — the best hit rate since 2021.

- Retail traders? They’re loving it. Call option buying hit record highs, and they now make up 16% of all stock trades, the most since 2018.

So while the pros are clutching their pearls, the retail crowd’s out here saying, “Buy the dip? We never stopped.” 😎

🔮 The Set-Up

If the Fed delivers another rate cut, and earnings keep surprising to the upside, the sidelined institutions might have no choice but to jump back in.

That would mean… 🏁

More fuel, more momentum, and possibly one last sprint into year-end.

The market’s spooky October volatility might have scared a few traders, but if trends hold, there could be more treats than tricks left in this rally. 🍬📈

🤔 Asia Forex Mentor Insights

Big money’s fear is often small money’s opportunity.

With positioning this light and fundamentals still holding up, the next surge could come from those institutional buyers rushing back in.

Stay nimble, manage risk, and remember, even in a cautious market, there’s always an edge for the disciplined trader. ⚡

🏆 The AFM Broker Awards 2025 Are Live! 🏆

🚀 Big news, traders — The AFM Broker Awards 2025 have just launched!

This is your chance to shine a light on the brokers who actually deliver — those who go beyond the marketing talk and provide true transparency, lightning-fast execution, and real trader support when it counts.

Let’s be honest: not all brokers are created equal. Some make big promises, others truly earn your trust. 💪 The AFM Broker Awards exist to recognize the ones that raise the bar — the brokers that empower traders to succeed, not just trade.

And here’s where you come in.

💬 Have a broker that’s gone above and beyond for you?

💼 One that stands out for consistency, reliability, or unbeatable service?

👉 Nominate them now for the AFM Broker Awards 2025 and help us spotlight the best in the trading world.

CFDs on WTI Crude Oil 5-Day Chart as of August 13th, 2025 (Source: Trading View)

Your nomination will also help other traders discover brokers who actually put clients first. Together, we can help shape a better, fairer trading industry. 🌍

📅 Nominations are now open for a limited time. Don’t miss the chance to give your favorite broker the recognition they deserve.

►►► NOMINATE YOUR BROKER HERE NOW ◄◄◄

EUR/USD Stuck in Neutral as Traders Wait for U.S. Inflation Numbers 💶

The euro-dollar pair is doing that awkward thing again — just kind of hovering. 😅

Despite upbeat data out of Germany and the Eurozone, EUR/USD is hanging near weekly lows around 1.1615, showing no conviction ahead of today’s big U.S. data dump. Everyone’s got their eyes on CPI and PMI releases later in the day — the real catalysts that could finally shake this range-bound pair loose.

🇪🇺 Europe’s Data Looked Good… But Not Good Enough

Friday’s PMI numbers showed some life in the Eurozone — manufacturing expanded unexpectedly, and services hit their strongest pace in a year.

On paper, that’s great news for the region. It even adds a bit of support for the ECB’s hawkish stance, hinting that the central bank might not be rushing into more easing.

But the euro isn’t exactly celebrating. Instead, traders are giving it the cold shoulder this week.

🇺🇸 Trade Tensions Steal the Spotlight Again

Market sentiment took a hit after President Trump stirred the pot (again). First, he floated new software export restrictions aimed at China. Then, he threw shade at Canada, saying trade talks were “terminated.”

All that drama? Yeah, it’s keeping the dollar firm and the euro pinned down.

EUR/USD Daily Chart as of October 24th, 2025 (Source: TradingView)

📉 Technical Picture: Bears Still Have the Wheel

EUR/USD remains trapped in a descending channel, with every rally meeting sellers around 1.1620.

The 1.1580 zone is acting as key support for now, but if bears break through, we could see a slide toward 1.1545, and maybe even 1.1500 if momentum builds.

On the flip side, bulls need a clear break above 1.1620 to aim for the next checkpoints at 1.1650 and 1.1728 — though that looks like a tall order unless U.S. data disappoints.

🤔 Asia Forex Mentor Insights

The euro’s holding pattern reflects a classic case of “wait-and-see” before major U.S. data. If CPI comes in hot, the dollar could strengthen further, pushing EUR/USD toward key supports. But a softer print? That might finally give euro bulls a reason to wake up.

Either way, traders should keep risk tight and stay ready for volatility spikes — because once that CPI hits, this sleepy pair could start moving fast. ⚡

MEMES OF THE DAY🤣

The duality of a trader be like…

Me when I pray for my trade wins 💬