TOGETHER WITH

Today’s edition is brought to you by iFunds, the prop firm that skips the hoops and hands you real capital on day one. No endless tests, just pure trading potential at your fingertips.

👉 Start trading instantly with funding up to $500K.

Hey traders, Ezekiel here. Time to break down today’s market moves and what they mean for your trades.

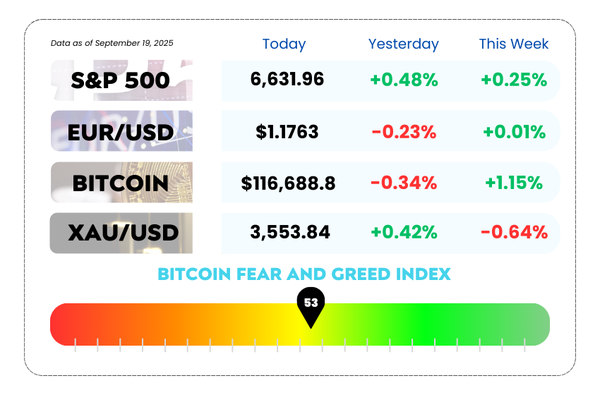

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Brokerages see no further BoE rate cuts in 2025 after September pause

- Powell’s rate cut sparks optimism, but strategists warn of near-term volatility

- Master 3 powerful scalping setups that turn precision into consistent trading wins with our YouTube video

Trade Your Strategy, Your Rules, With Instant Funding

💡 Still stuck on demo accounts and endless evaluations? It’s time to break free.

iFunds puts you straight into the markets with real capital from Day 1. No hoops, no gimmicks, just funding that grows with your skills.

Here’s what you get with iFunds:

- Instant live funding – Start with $2,500, no waiting

- Scale up to $500K+ in just 4 simple steps

- No daily drawdown limits – trade without handcuffs

- Total freedom – your strategy, your rules (yes, bots + news trading allowed)

- Lightning-fast payouts – get paid in 24 hours

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

The BoE Just Ghosted Rate Cuts in 2025 🇬🇧

The Bank of England kept rates on hold this week, and here’s the kicker — major brokerages now think that could be the last rate cut you’ll see for the entire year of 2025. Yep, 2025 might be one long waiting game.

So what’s really going on?

📊 Sticky inflation: UK inflation in August came in at 3.8%, the highest among major advanced economies. Not exactly the number that gives central bankers the confidence to whip out the scissors and slash rates.

🛑 Data still muddy: Growth is slowing, the jobs picture is fuzzy, and nobody’s convinced the UK economy can handle a big shift in policy.

🎯 Market expectations: Futures markets are only pricing in 7.5 basis points of easing by year-end, which is trader-speak for “don’t hold your breath.” That’s basically a 30% chance of one more cut in 2025.

💼 What the big banks say:

- Goldman Sachs & JPMorgan think the next real easing cycle won’t kick off until Feb 2026, with slow, steady cuts every quarter.

- Barclays is still clinging to hope for a November 2025 cut, betting upcoming data turns soft enough to force the BoE’s hand.

- BNP Paribas says December is more likely, giving policymakers a little buffer against uncertainty.

- Peel Hunt? They’re waving the “no more cuts in 2025” flag loud and clear.

Meanwhile, Governor Andrew Bailey is basically saying: “we’re not out of the woods yet, and when we do cut, it’s gonna be careful and sloooow.”

👉 Translation: The BoE isn’t slamming the door shut on cuts, but the message is clear, patience, grasshopper.

🤔 Asia Forex Mentor Insights

If you’re trading FX, this sets up a unique backdrop. A “higher-for-longer” Bank of England means the pound could stay resilient against currencies where central banks are moving into easing cycles more aggressively.

But here’s the kicker, if UK growth suddenly stumbles or inflation dives, the market could reprice fast. That’s when GBP volatility spikes and opportunity opens up.

So for now? The BoE is playing the world’s longest waiting game, and traders are left watching every inflation print like it’s the season finale of their favorite show. 🍿

Fed Fuels the Bull, but Traders Might Need Seatbelts 📈

The stock market has been partying at record highs, and Jerome Powell just brought more champagne. The Fed cut rates by a quarter point, with two more cuts likely by year-end. Powell called it a “risk-management” move — aka a safety net for a cooling labor market.

On Wall Street, that’s basically the green light for another leg up. Why? History says when the Fed cuts outside of recessions, stocks usually climb. Going back to the 1980s, the S&P has gained in 9 out of 10 cases when cuts landed near all-time highs.

No wonder strategists from Wells Fargo to Deutsche Bank are cranking up their targets. Add in resilient earnings and the AI investment cycle, and the bull still looks strong. 🐂🚀

But here’s where it gets tricky.

- Some say the near-term setup looks stretched. The S&P is already at Citi’s year-end target, and breadth has been weakening (translation: fewer stocks are carrying the rally).

- Tech, especially the Nasdaq 100, is flashing signs of “exhaustion.” Think of it as a sprinter that needs to catch its breath before running again.

- Strategists are calling for volatility spikes ahead of Q3 earnings season, with traders ready to pounce on any cracks in the AI narrative.

Nasdaq 100 Daily Chart as of September 19th, 2025 (Source: TradingView)

Longer term, the “jobless expansion” theme is taking shape. Weaker hiring cools wage growth, which actually helps corporate margins, while lower rates boost valuations. That’s the cocktail Wall Street is betting on. 🍸

The real wildcard? The Fed’s next moves. The dot plot suggests more cuts in 2025, but Powell reminded everyone that it’s still data-dependent. Inflation’s above target, the labor market is softening, and as Powell put it, there are no risk-free paths.

👉 Translation: Bulls are still in control, but traders should expect some turbulence on the ride higher.

🤔 Asia Forex Mentor Insights

For traders, this is all about the dollar’s reaction. A more dovish Fed adds downward pressure on USD, especially against higher-yielding currencies, but near-term volatility could spark swings in safe-haven plays like JPY and CHF.

If equity markets wobble in the short term, risk-off flows may temporarily support USD, but the medium-term trend looks tilted toward softness as easing unfolds.

MEMES OF THE DAY🤣

Sleep is temporary, scalps are forever 🕑

Because nothing patches losses like blind faith in the bull 🐂