TOGETHER WITH

Today’s edition is brought to you by XM, a global leader in online trading and trusted by millions of traders worldwide. With 15 years of market excellence, XM offers access to Forex, stocks, commodities, indices, and more, all on award-winning platforms built for speed, precision, and reliability.

💥 Celebrate XM’s 15-year anniversary and claim their biggest deposit bonus yet which is up to $35,000!

Hey traders, Ezekiel here — let’s break down today’s market action and see what it means for your next trading move.

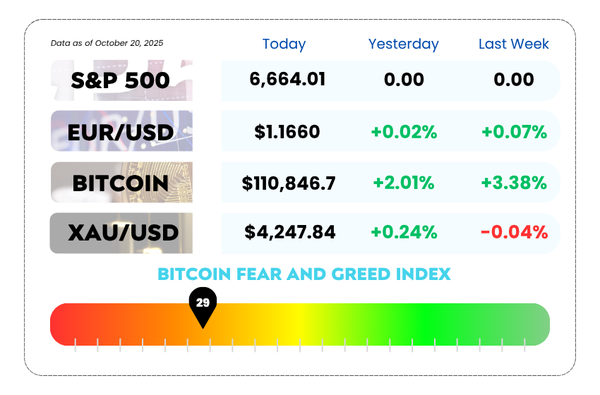

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Euro stays afloat while the dollar lifts weights and France gets a downgrade

- Death by a thousand chips? Nvidia’s rivals are rising from within

- Discover 3 proven support and resistance strategies that actually work, with our video

XM Turns 15 — And Traders Get the Biggest Bonus Yet! 🎂

Our friends at XM are celebrating a massive milestone — 15 years of empowering traders around the world. 🥳

To mark the occasion, they’re rolling out their biggest deposit bonus ever — giving traders the chance to claim up to $35,000 in bonuses. 💰

This limited-time offer isn’t just a thank-you to their global community, it’s a celebration of XM’s journey as a trusted leader in online trading — known for innovation, reliability, and next-level client support.

If you’ve been looking to scale your trading with one of the industry’s most established brokers, this could be your moment. 🚀

👉 Celebrate with XM and claim your bonus today — because 15 years in the game deserves a reward this big.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

EUR/USD Keeps Its Cool While Traders Wait for the Next Move 💶

The EUR/USD pair is showing some serious chill vibes lately — hanging out comfortably above 1.1650, like it’s got no plans to leave the party just yet. 🎉

Despite a tug-of-war between bulls and bears, the pair is holding between its 50-day and 100-day Simple Moving Averages, with the RSI hovering near 50 — basically, the market’s version of saying, “meh, I’m neutral.”

But under that calm surface, there’s a quiet buildup. If EUR/USD keeps bouncing off 1.1650 (its 100-day SMA buddy), technical buyers might step back in. In that case, 1.1700 could be the next hurdle before the market eyes 1.1765 and 1.1820.

Still, if the pair slips below 1.1650 and flips that level into resistance, traders could start eyeing 1.1580 and 1.1550 as safety nets.

EUR/USD Daily Chart as of October 20th, 2025 (Source: TradingView)

🇺🇸 Meanwhile in Dollar Land…

The U.S. Dollar flexed its muscles on Friday 💪, thanks to a stronger tone in the market and a surprisingly mellow approach from President Trump on trade with China.

Instead of dropping tariff bombs, Trump hinted that a 100% tariff “wouldn’t be sustainable” and sounded confident about finding some middle ground with Beijing. Over the weekend, he even said he wants China to buy soybeans “like the good ol’ days.” 🌱

So yeah, the trade vibes might be warming up — and that’s keeping the USD resilient.

🇫🇷 On the Euro Side…

France just got a financial downgrade from S&P Global Ratings, slipping from AA- to A+. The reason? Budget worries are still hanging over Paris like a raincloud ☁️, even with a new 2025 draft budget in hand.

This doesn’t help the Euro’s mood much, especially when global investors are already cautious about Europe’s fiscal outlook.

💹 What’s Next

With no major data on deck today, traders are watching risk sentiment for clues. Early signs? U.S. stock futures are up around 0.3%–0.5%, suggesting that optimism could keep the USD from going wild.

If the U.S.–China relationship continues to thaw, the Dollar might stay firm. But if markets start chasing risk, the Euro could sneak in a short-term rebound.

🤔 Asia Forex Mentor Insights

EUR/USD is sitting at a critical technical zone. A bounce above 1.1650 could open the door to a bullish leg toward 1.1700 and beyond, while a break below might accelerate a slide back to 1.1580. Traders should stay nimble — the next big move could come from shifts in global risk appetite, not just technical.

Nvidia’s Big Tech Frenemies Are Coming for Its Chips 🧠

Nvidia has been the AI world’s golden goose — but now, some of its biggest customers might also become its biggest competition.

The company that built the GPUs powering ChatGPT, Gemini, and almost every AI lab out there is suddenly finding itself surrounded by “friends” who are quietly saying, “thanks for the blueprint, we’ll take it from here.” 😅

💾 The Great Silicon Shift

Big Tech’s newest obsession? Building their own AI chips.

- OpenAI just teamed up with Broadcom to design custom processors, cutting out middlemen (and maybe Nvidia’s profits too).

- Meta is buying chip startup Rivos, doubling down on internal chip production.

- Amazon is already deep in “Project Rainier,” stuffing its data centers with Trainium2 chips built for AI workloads.

And let’s not forget Google, the OG of custom AI chips. Its TPUs (tensor processing units) have been around for years — and they’re getting better fast.

What used to be a one-horse race is turning into a full-on chip marathon, and Nvidia’s starting to feel the footsteps closing in. 🏃♂️💨

💸 Why Everyone Wants Their Own Chip

It’s simple: Nvidia’s chips are amazing… but they’re also expensive.

Cloud giants like Amazon, Microsoft, and Google have been renting Nvidia’s GPUs for their AI customers, but the costs are eating into their profits.

So instead of paying premium rent forever, they’re building their own homes. These in-house chips are:

- Cheaper to run,

- Better optimized for their software,

- And good enough to challenge Nvidia’s dominance.

Analysts say custom chips could make up 45% of the AI chip market by 2028, up from 37% this year. That’s a big bite out of Nvidia’s lunch 🍔.

NVIDIA Corporation (NASDAQ) Daily Chart as of October 20th, 2025 (Source: TradingView)

🤖 Google’s Quiet Power Play

Google might be the most dangerous of them all. Its TPU lineup — from Trillium to Ironwood — has become a serious rival to Nvidia’s GPUs.

Rumors say Google has already started selling its TPUs to other cloud players, moving from “internal tool” to “external product.”

One analyst valued Google’s TPU + DeepMind business near $900 billion — yeah, that’s billion with a B.

If Google keeps pushing like this, Nvidia won’t just be competing with its customers — it’ll be competing with entire ecosystems.

🏗️ Nvidia’s Counterattack

CEO Jensen Huang isn’t sweating — at least not publicly.

He says Nvidia isn’t just a chipmaker, it’s a full-stack AI infrastructure company. From GPUs to CPUs to networking gear, Nvidia sells the entire system, not just one piece of silicon.

And to be fair, the market is massive.

Nvidia has poured $47 billion into AI startups since 2020, expanding the pie for everyone. Even if Big Tech takes a slice, Nvidia’s share could still grow — just slower.

Some analysts even argue that the market is too big for anyone to “kill” Nvidia.

In their words: “There’s enough AI pie for everyone.” 🥧

⚔️ The Road Ahead

This isn’t a story of instant downfall — it’s more like “death by a thousand chips.”

Each Big Tech firm takes a little bite out of Nvidia’s margins. Over time, those cuts add up.

But Nvidia still holds the software edge — AI developers love its ecosystem, not just its hardware. And that loyalty might buy it more time than critics think.

🤔 Asia Forex Mentor Insights

The rise of custom AI chips signals a long-term power shift in tech. Nvidia’s dominance is safe for now, but profit margins could compress as its clients turn into competitors.

For traders, this dynamic could mean short-term volatility but long-term opportunity — the AI infrastructure race is expanding fast, and the winners may not be just those making chips, but those building ecosystems around them.

MEMES OF THE DAY🤣

Patience pays in Forex 📊

One second you’re winning, next second… not so much. 😬