TOGETHER WITH

Today’s edition is brought to you by iFunds, the prop firm that cuts out the nonsense and gives you real capital right from the start. No lengthy evaluations, but just straight-up trading potential in your hands.

👉 Get funded immediately, with up to $500K.

What’s up, traders? Ezekiel here. Let’s dive into today’s market shifts and how they could impact your next move.

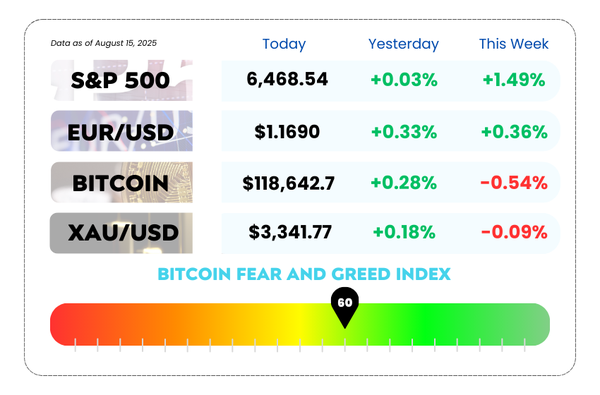

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Bitcoin drops 2% after inflation report misses expectations

- What you should do as a trader on the Alaska talks between Trump and Putin

- Learn how to avoid fake CHOCH signals and trade with precision, with our YouTube video

Skip the Boring Stuff. Start Trading Real Money. 💰

Tired of demo accounts, endless evaluations, and slow progress? iFunds flips the script and gets you in the game faster, with real capital right from the start.

No more wasting time, get $2,500 to trade live, and grow up to $500K+. Simple steps, no gimmicks.

What iFunds offer:

🔥 Instant live funding – start with $2,500, no waiting

🔥 Scale up easily – hit $500K+ with just four steps

🔥 No daily drawdown limits – trade freely

🔥 Your strategy, your rules – no restrictions on bots, news trading, or more

🔥 Fast payouts – cash in 24 hours flat

It’s time to stop playing small. Take control, trade with real money, and unlock the potential for serious growth.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Bitcoin’s Wild Ride: From Euphoria to “Ouch” in 48 Hours 🎢💥

Bitcoin’s week started like a victory parade — record highs above $123K, bullish whispers of big Fed rate cuts, corporate wallets stuffing themselves with BTC, and a pro-crypto push from the White House. But by Friday? The confetti hit the floor.

A hotter-than-expected inflation report crashed the party, dousing hopes for aggressive September cuts. Then came Treasury Secretary Scott Bessent’s reality check: the US isn’t buying Bitcoin for its reserves, at least not beyond what’s already been seized. Traders got the message and started hitting the sell button.

The Fast Flip: Macro Punch Meets Market Hype

This was the perfect storm for a pullback. Bitcoin had surged 25% YTD and a jaw-dropping 57% since April’s lows, fueled by ETF inflows, corporate treasury strategies, and a Trump administration eager to push digital assets into the mainstream.

But after the inflation shock, the rally’s “can’t lose” energy quickly morphed into profit-taking mode.

Ethereum also caught the downdraft, sliding over 2% after nearly touching its own all-time highs. The drop came despite Wall Street’s growing love for ETH as a tech infrastructure play for DeFi, stablecoins, and tokenized finance.

BTC/USD 5-Day Chart as of August 15th, 2025 (Source: TradingView)

What’s Still in Play for the Bulls 🐂

Despite the dip, the big drivers haven’t disappeared:

- Corporate demand is still strong, with more firms following the “balance sheet BTC” playbook.

- ETF inflows remain steady, signaling continued institutional appetite.

- Policy winds are still favorable, with moves to open 401(k)s to crypto potentially unlocking new waves of retail investment.

If anything, the current cool-off could be setting up for a more sustainable climb later, once macro conditions stop stepping on the gas and brake at the same time.

🤔 Asia Forex Mentor Insights

This move is a textbook momentum vs. macro clash.

Technically, Bitcoin was stretched after its parabolic run, making the inflation print a perfect excuse for sellers to lock in gains.

The $120K support now becomes the key line in the sand — hold it, and bulls might regroup quickly; break it, and we could see a deeper flush before the next leg up. Ethereum traders should watch $3.9K as the near-term pivot.

How Traders Are Positioning for the Big Alaska Summit 🛢️

Traders are preparing for an event with major market implications: this Friday's pivotal meeting between Donald Trump and Vladimir Putin. The outcome could reshape global economic landscapes, with investors already adjusting their strategies based on the potential geopolitical shifts.

From oil prices to currency swings, the market is watching closely for any signs of a ceasefire in Ukraine or changes in sanctions.

The Shift Towards Reconstruction and Recovery 🔨📈

As anticipation builds, traders are betting on assets linked to Ukraine’s recovery and European stability. Ukrainian bonds have rallied, fueled by hopes of peace talks advancing, and stocks related to the country’s reconstruction are attracting investor attention. European banks that still have ties to Russia are also seeing gains, showing how deeply interwoven geopolitical events are with market performance.

But that’s not all. Central and Eastern European stocks are outperforming, reflecting investor optimism that the Ukraine war might finally be heading toward resolution. Countries like Poland, Hungary, and Czech Republic have outperformed their global peers as traders bank on a future where the region can grow without the shadow of war looming over it.

Defense Stocks Cooling Down, but They Might Heat Up Again 🛡️🔥

A sector that has seen major gains this year is defense stocks, which shot up over 70% as Europe, led by Germany, increased military spending. However, with the Alaska summit around the corner, defense stocks are cooling off, with some dropping 6% since July.

Could a ceasefire suddenly spark another rally in this sector? Traders are split, but it’s clear that any sign of a peaceful outcome could lead to even higher defense spending, especially if Russia’s aggression continues.

The Impact on Currencies, Watch the Euro and the Dollar 💵💶

The Euro has been gaining attention ahead of the summit, with some strategists predicting it could surge to $1.20–$1.25 if signs of a peaceful resolution come to light.

Conversely, the U.S. Dollar could slip in response to these developments, potentially leading to a favorable exchange rate for European currencies. This is a critical moment for forex traders, as the geopolitical landscape could heavily influence currency markets for the foreseeable future.

Commodities: The Wildcard 🛢️💥

Oil has been particularly sensitive to this geopolitical tension. With crude prices hovering near a two-month low, Brent crude could face further pressure if the talks open the door to peace.

Analysts suggest that if a ceasefire comes into play, oil prices could tumble further, dipping into the low $60s, a scenario that traders are preparing for.

On the other hand, gold has benefitted from geopolitical uncertainty, and any positive outcome from the summit could ease its safe-haven demand. Copper, another industrial metal, will likely feel the pressure as the market weighs the possibility of Russia rejoining global trade.

🤔 Asia Forex Mentor Insights

Traders are already positioning themselves for potential market volatility. If a positive outcome emerges from the Alaska talks, expect the U.S. Dollar to weaken, euro to surge, and commodity prices to adjust accordingly.

The global supply chain could also shift as sanctions and trade relations come into focus once again.

While the Alaska summit could bring temporary uncertainty, savvy traders are watching for signs of change that could significantly impact market positioning. Market movements over the next week could set the tone for the rest of the year.

Geopolitical events like these provide critical opportunities for traders to adjust strategies. As markets react, understanding the underlying dynamics between currency movements, commodity prices, and global trade is essential to staying ahead of the game.

MEMES OF THE DAY🤣

Don’t chase tweets, wait for the numbers. 🧑💻

Do your homework before investing 🧠