TOGETHER WITH

Today's edition is sponsored by Markets4you. With Markets4you’s 100% Deposit Bonus, your capital gets a serious upgrade, instantly. It’s the perfect way to trade bigger, without stretching your wallet.

Tap into the power of smart capital with Markets4you.

Hey traders, Ezekiel here to break down the latest market moves so you can stay ahead of the game. Let’s jump in.

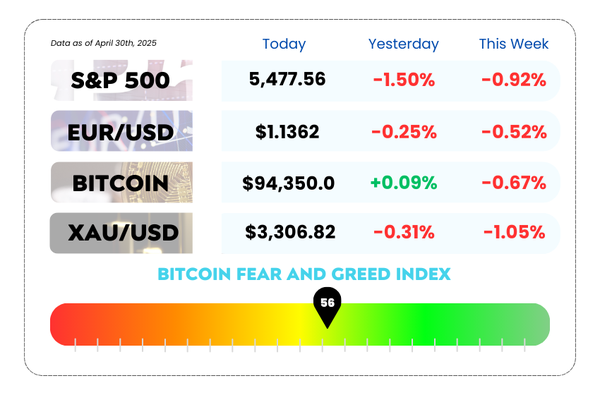

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Trump's tariff talk heats up as China quietly plans its next move

- Gold takes a breather as trade war fears chill out (for now)

- Turn confusing charts into clear signals using MACD with our video

💰 Double Your Power with Markets4you’s 100% Deposit Bonus! 🚀

Looking to boost your trading firepower from day one? Markets4you has your back with an unbeatable offer: get a 100% deposit bonus and instantly double your trading capital!

Here’s how it works:

When you fund your trading account, just choose your preferred bonus level, and Markets4you will instantly match your deposit with a trading credit, no waiting, no hassle. The more you deposit, the more bonus you unlock. Simple as that.

Whether you're scaling up your strategy or just starting out, this is your chance to maximize opportunity with minimal risk.

More capital = more trades = more potential profit. 📈💼

Don’t just trade. Trade with twice the strength.

Join Markets4you today and turn your deposit into double the potential.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

🚨 Big Week for Wall Street: Data Drops & Big Tech Drama Ahead 🚨

US stock futures are basically just chillin’ midweek 😴 as traders gear up for a double-shot of economic data and earnings from Big Tech heavyweights. Think of it like standing at the edge of a rollercoaster, we’re not moving yet, but everyone’s strapped in and staring at the drop. 🎢

Here’s what’s brewing:

- S&P 500 futures slipped 0.1%

- Nasdaq 100 futures took a slightly bigger hit, down 0.3% (👎 thanks, Super Micro)

- Dow futures squeaked out a 0.1% gain — not much, but enough to stretch its 2025 win streak

Why the wait? Everyone’s bracing for a wave of economic data and earnings that could either confirm fears… or calm them. Either way, we’re about to find out if April was just a hiccup or a warning shot. 🔍

🧨 Trade Tensions = Market Mayhem?

April was a wild ride. Thanks to Trump’s fresh round of tariff hikes, stocks have been zigzagging like a meme coin chart. The Dow's looking at a 2.5% monthly drop, while the S&P and Nasdaq fared slightly better, but no one’s exactly celebrating.

And now comes the GDP update later today, aka our first look at how the economy held up as the tariff hammer dropped. Forecast? A sad little 0.1% growth. That’s the weakest quarter since 2022. 🫠

Also dropping: the core PCE inflation reading, the Fed’s favorite yardstick. It’ll show how prices were behaving before tariffs really got spicy.

S&P 500 Daily Chart as of April 30th, 2025 (Source: TradingView)

🧠 Big Tech’s Earnings = All Eyes on AI

Microsoft (MSFT) and Meta (META) are both set to report earnings after the bell. Investors want to see two things:

- AI returns — is all that hype finally turning into profit?

- Tariff exposure — especially for Meta, as questions grow around ad revenue and international ops

Super Micro (SMCI) already dropped the mood earlier this week, guiding lower due to soft AI server demand. That hit Nasdaq futures right where it hurts.

🧧 Trump vs China: Round 2?

Trump says China will “eat the cost” of his 145% tariffs, claiming US consumers won’t feel the pain. Beijing’s playing it cooler — reportedly drafting a list of US goods to exempt from its 125% tariffs. So yeah… sounds like backdoor negotiations are bubbling. The question is: who moves first? 🇺🇸🤝🇨🇳

Markets seem cautiously optimistic that this tariff battle may soften soon — if only because no one wants to pay $3,000 for a MacBook. 💻💸

🤔 Asia Forex Mentor Insights

For traders in Asia and beyond, this is a prime example of how macro data + geopolitical noise = serious volatility. Keep an eye on US GDP and core PCE, they’ll guide the next dollar moves.

Meanwhile, Big Tech’s earnings could set the tone for risk sentiment heading into May. Stay nimble, keep those stop losses tight, and remember: when the market hesitates, opportunity often knocks. 🚪📈

🥇 Gold Takes a Breather as Trade Tensions Chill 🥇

Gold's hot streak just hit the pause button. After a massive rally that had it flirting with $3,500, the yellow metal cooled off for a second straight day — trading around $3,305/oz early Wednesday. Why? Because markets are starting to feel a little less scared. 😌📉

President Trump pulled a rare move and eased some auto tariffs, signing off on two executive orders to cut levies on imported car parts and block tariff stacking on foreign-made vehicles. The result? A small retreat in haven demand, and gold taking a step back as risk appetite tiptoes back in.

🔧 Bad Data, Shrugged Off

Normally, weak US data would’ve lit a fire under gold. But not this time.

- Consumer confidence fell to a 5-year low in April

- Job openings hit their lowest point since September

Still, investors seem more focused on trade optimism than the macro blues. Trump said China, India, and France are all looking to strike deals with the US. (Though, as usual, Beijing’s like: “Talks? What talks?” 🐉🤷)

He also took a jab at the Fed’s Powell and called recent inflation numbers “fake news.” Classic Trump energy, now 100 days into his latest term.

XAU/USD Daily Chart as of April 30th, 2025 (Source: TradingView)

💰 Gold Still on Fire Long-Term

Even with the pullback, gold is up over 25% this year — and last week it briefly broke through $3,500 on pure global jitters. Momentum’s been driven by:

- Massive inflows into gold ETFs 📈

- Central bank buying (China’s been loading up)

- Speculators in Asia jumping in on the rally

So yeah, don’t count gold out. It's just taking a water break while the world figures out if this trade truce is real or just another teaser trailer.

🤔 Asia Forex Mentor Insights

Gold’s minor dip is a classic risk-on move, but the macro story isn’t over. Traders in Asia should watch for China’s next move on trade talks, and whether US inflation and Fed drama ignite fresh uncertainty.

Also, any pullback in gold could be a setup, not a setback. Stay sharp, manage your entries, and keep one eye on the dollar index. 🧠⚡

MEMES OF THE DAY🤣

I blinked once and got stopped out twice 😵💥

I felt that in my trading soul 🧘