After months of record highs and unshakable optimism, Bitcoin’s momentum has finally met resistance. The cryptocurrency tumbled more than 7% in a single trading session, sliding toward the $100,000 zone. But the real story isn’t the price, it’s the mood.

Across global markets, investors are growing uneasy. A surge in risk aversion is draining enthusiasm for speculative assets, and Bitcoin is feeling the heat. With confidence slipping and safer options drawing capital, the world’s largest cryptocurrency is now fighting gravity rather than rewriting history.

From Euphoria to Exhaustion

It’s not panic, but the energy that powered Bitcoin’s rise has cooled. Central banks are holding the line on high interest rates, signaling that easy money isn’t coming back anytime soon. The Federal Reserve’s cautious stance has effectively told traders: buckle up, volatility isn’t your friend right now.

As borrowing costs stay elevated, risk appetite has shrunk. The 10-year Treasury yield remains near 4%, while the U.S. Dollar Index (DXY) has pushed past 100, flashing “defensive mode” across markets. Those signals don’t just affect bonds, they ripple straight into crypto, draining liquidity from high-risk assets.

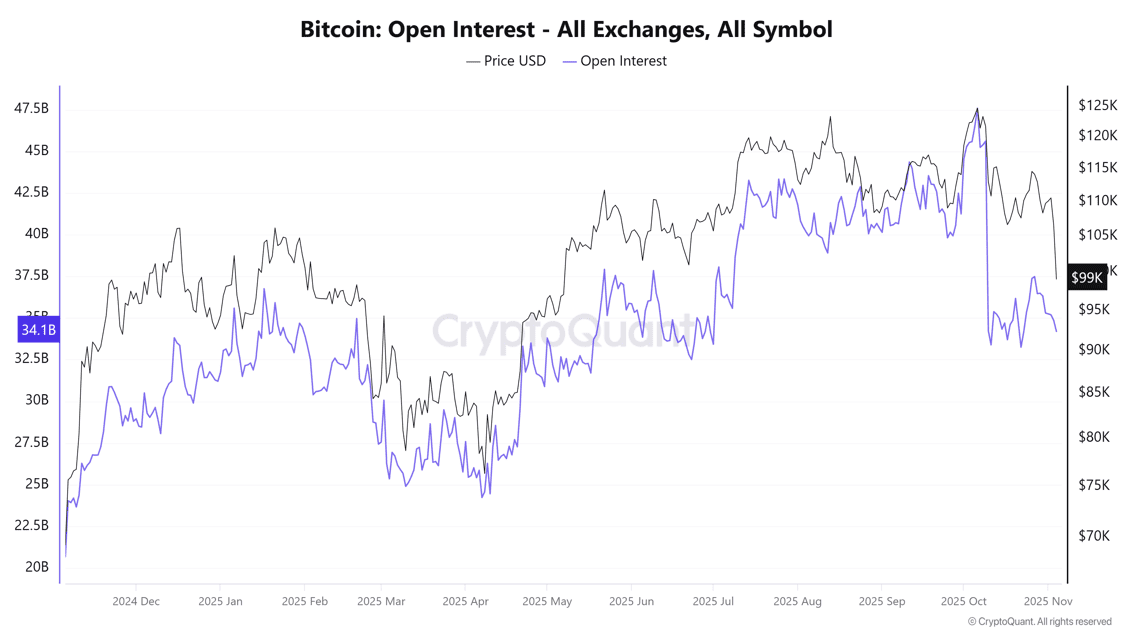

This shift shows up clearly in the Bitcoin Open Interest data. The total number of open positions has plunged toward $34 billion, one of the steepest declines of 2025. Longs are closing, traders are de-risking, and the message is clear: macroeconomic confidence is taking a break.

Source: Cryptoquant

Also Read: 9 SHOCKING Credit Score Myths You Probably Still Believe (and It's Costing You Thousands!)

Fear Tightens Its Grip

It’s not just Bitcoin feeling the chill. The broader crypto market is also flashing warning lights. The Crypto Fear & Greed Index has fallen to 27, deep in the fear zone and inching toward “extreme fear.” That kind of reading doesn’t kill rallies outright, but it makes new ones harder to start.

As capital keeps leaving and sentiment sinks, selling pressure could dominate through the end of the year. Traders are no longer asking, “How high can it go?” They’re asking, “Where does it stop falling?”

The Technical Reality Check

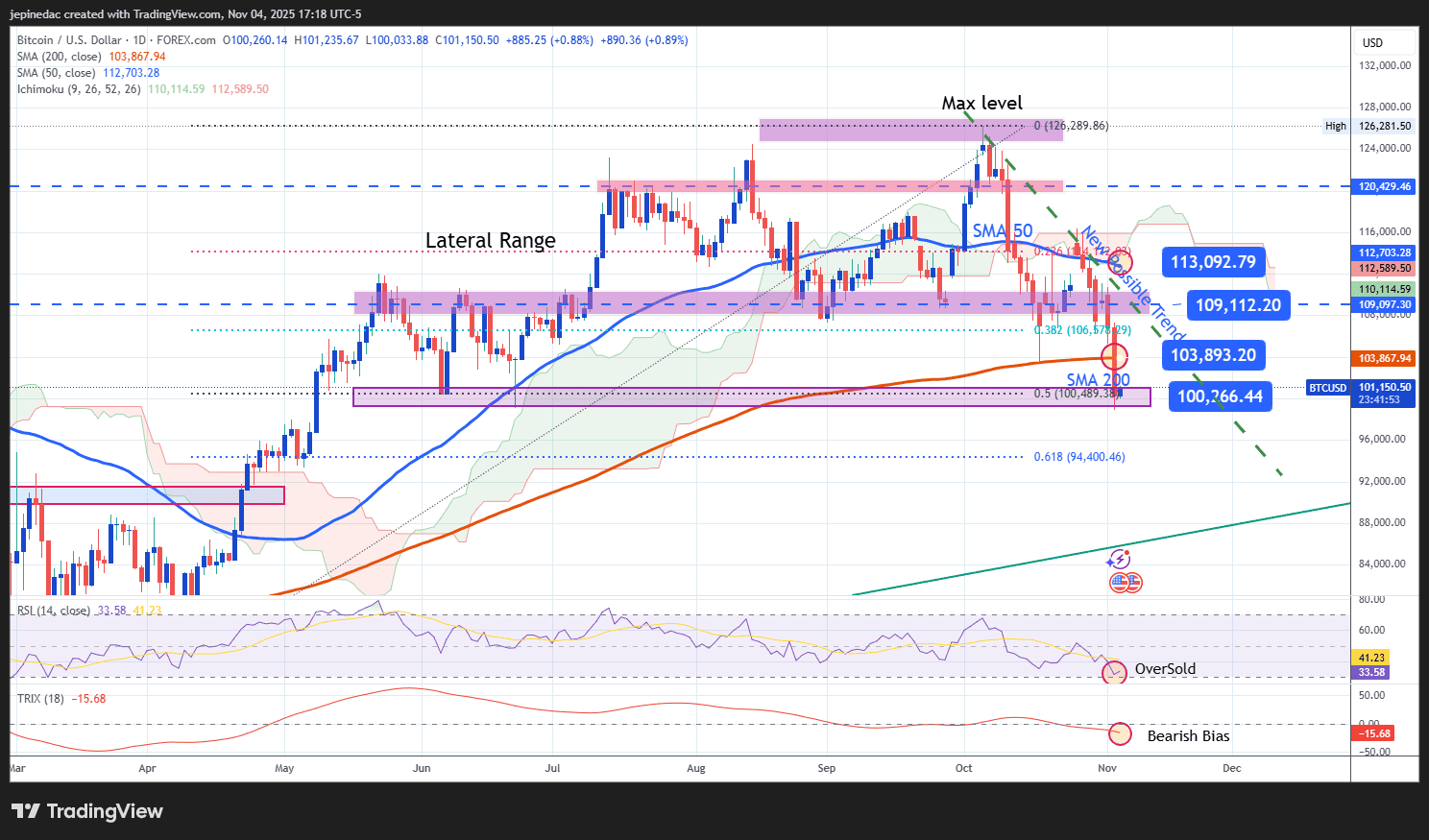

Since early October, Bitcoin has drawn a clear pattern of lower lows, carving out a short-term downtrend. The price recently broke below its 200-period simple moving average, confirming that sellers still control the pace.

The RSI has hovered below 50 for weeks, showing that momentum remains negative. It’s inching closer to 30, the oversold threshold that often sparks short-term rebounds, but nothing yet suggests a full recovery. Meanwhile, the TRIX indicator continues to slope downward beneath the zero line, reinforcing the bearish bias through the medium term.

Also Read: This is Why the Real Move Begins After Bitcoin Clears 120K

The Bigger Picture

If Bitcoin can’t hold the line at $100,000, the slide could steepen. The $103,000 zone, aligned with the 200 SMA, offers temporary relief, but the more meaningful resistance sits near $109,000. That’s the level bulls must reclaim to break the downtrend narrative.

Bitcoin’s latest fall isn’t just about charts or indicators, it’s about trust. Markets are signaling that confidence, not price, drives the next move. As rate expectations tighten and investors seek shelter, risk assets like BTC are caught in the crossfire.

For traders, this is the time to focus on structure and sentiment rather than headlines. Watch for whether $100,000 holds or breaks, and keep an eye on macro triggers such as Treasury yields and the dollar’s strength.

Bitcoin’s short-term bias may be bearish, but volatility works both ways. When fear peaks, sharp reversals often follow, and those who stay patient and disciplined are the ones ready when it turns.

Source: StoneX, Tradingview