Ever wondered why some stocks rise fast while others barely move? That’s where momentum trading comes in. This trading strategy helps traders spot price trends driven by market sentiment and market volatility. Unlike value investing, which waits for cheap prices, momentum traders act when they sense upward momentum and strong market trends. Using technical indicators like moving averages and the relative strength index , they identify buy and sell signals before sudden reversals occur. This momentum strategy focuses on price movements that reflect emotional investor sentiment and increasing volume.

Momentum trading strategies rely on technical analysis tools to track how an asset’s price reacts to changing market conditions. Skilled traders watch for momentum stocks showing strong price momentum and use risk management to protect against adverse market movements. The goal is simple: buy high and sell higher while the trend stays strong. Momentum investing can bring higher returns, but it’s inherently risky. Successful traders understand the risks involved, maintain clear exit points, and adapt fast to changing market conditions. Done right, this trading style lets momentum traders turn price movements into profit in even the most volatile markets.What Is Momentum Trading?

Momentum trading is a trading strategy where traders buy stocks showing strong movement in one direction. Instead of waiting for a low entry, momentum traders focus on price acceleration caused by market sentiment and changing market conditions. The idea is simple, when demand pushes a stock’s price higher, it often keeps rising for a while. That’s where momentum investing begins. To identify these movements, traders rely on technical indicators like moving averages and the stochastic oscillator . These tools help confirm if the momentum is building or losing strength. A good momentum strategy involves studying price charts, spotting strong trends, and acting before most traders notice. Successful traders combine timing, patience, and adaptability to turn short-term movements into profit. While momentum trading strategies can be powerful, they also demand discipline, because when momentum fades, quick selling is key to protect gains.Can Momentum Trading be Profitable?

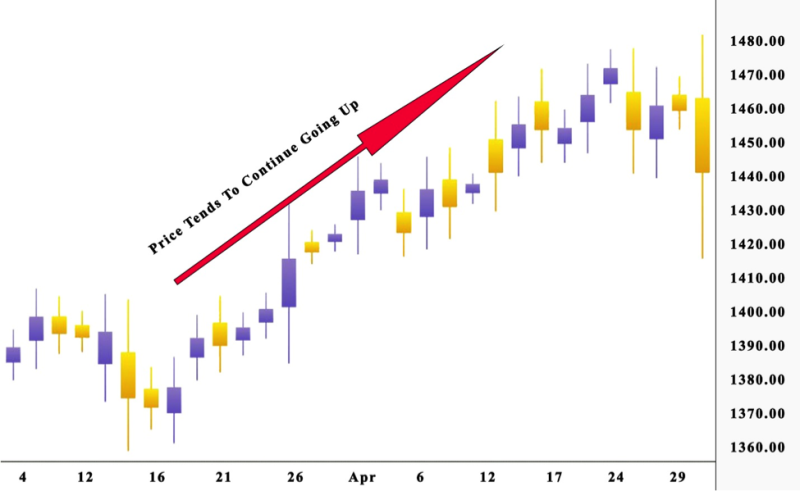

Yes, momentum trading can be profitable when done with patience and proper timing. It’s common for stocks to rise for several days after strong earnings or breaking news. Sometimes, even a short squeeze can push an asset’s price up for a few days. Traders believe that these trends often build on themselves, fueled by market confidence and emotional buying. When the prediction holds true, the result is clear, profit.

Most brokers and momentum traders scan for positive earnings reports as early signals to enter the trend. They use moving averages, volume analysis, and the stochastic oscillator to confirm whether the momentum is gaining strength. It’s best to start buying early in the trend, while the price is still low, then aim to sell at a higher price before the selling pressure returns. The objective is simple, capture short-term movement while managing risks from volatility and changing market conditions. Many online courses now teach this trading strategy, helping traders ride the wave confidently for higher returns.

Momentum Traders’ Indicators

Momentum trading works best in volatile markets where traders react quickly to price movement. To spot developing momentum, professionals rely on a few essential indicators that reveal when a trading strategy is gaining strength or losing steam. These factors help momentum traders read the market and act before unexpected reversals occur.- Volume

- Volume measures how many stocks are traded during a specified period. In momentum trading, it signals the strength behind a price move.

- High volume means more active buyers and sellers, allowing traders to enter or exit positions easily.

- When volume spikes, it often confirms that real momentum is forming, supported by strong interest in the market.

- Volatility

- Volatility is a momentum trader’s heartbeat. It tracks how much a stock’s price changes over time.

- High volatility means wider price swings, giving momentum trading strategies more room for profit.

- A low-volatility environment can weaken momentum, while extreme movements can signal downward momentum or trend exhaustion.

- Strong risk management is vital to protect trades from rapid market shifts and potential losses.

- Time Frame

- Every momentum strategy depends on timing. Most setups in momentum trading happen over short windows, but they can extend when trends stay strong.

- Traders may use technical analysis tools to decide how long to hold a position based on price strength.

- Some traders apply this trading strategy for short-term day trades, while others stretch it over longer cycles when momentum remains steady in stock markets.

Momentum Trading Strategies

- Follow Breakouts Early In momentum investing, timing is everything. When stocks break above resistance, it signals strong momentum and confidence in the market. Traders use this momentum strategy to enter early while price trends are forming. Proper risk management is key, set clear exits before momentum slows.

- Ride Earnings Surprises Positive earnings often spark sudden momentum as investors rush to buy. These events can push stocks higher within hours. In this market setup, traders rely on buy and sell signals from charts to catch short bursts of movement. Quick reactions and smart risk management protect profits during volatile moves.

- Trade with the Trend Every strong momentum strategy focuses on direction. When the market moves steadily upward, traders follow the flow instead of guessing reversals. Watching moving averages helps confirm solid momentum and sustained price trends. This disciplined approach keeps trades aligned with the market’s energy.

- Watch for High Volume Confirmation True momentum needs participation. When stocks trade at unusually high volume, it confirms real interest in the market. This helps traders filter out weak moves. In momentum investing, volume supports confidence, showing that the move isn’t just noise but genuine momentum building.

- React to News and Catalysts Breaking news creates powerful momentum waves. A new product launch, acquisition, or policy change can shift market behavior instantly. Momentum traders use these triggers as part of their momentum strategy to act fast. When handled carefully, this method turns short-term market emotion into long-term profit through consistent momentum investing.

Risks Involved in Momentum Trading

- Trend Reversals Can Happen Anytime In momentum trading, traders rely on a trend continuing, but price direction can shift without warning. A sudden reversal can turn profit into loss in seconds, especially during volatile sessions.

- Timing the Exit Is Difficult Knowing when to sell is one of the biggest risks involved in this strategy. The perfect trade means selling near the peak, but spotting that moment is rarely easy. Even small delays can erase gains.

- Emotional Decisions Can Ruin Trades Rapid price changes trigger emotional reactions. Traders who chase moves or panic during dips often lose focus. Successful momentum investing requires discipline and a clear plan to avoid emotional mistakes.

- Late Entries Reduce Profit Potential Joining a trend too late means buying when the move is nearly over. When momentum fades, prices fall quickly, leaving little chance to recover losses. Timing is everything in momentum trading.

- Sharp Downturns Affect Both Sides Momentum works in both directions. When strong selling begins, panic spreads fast, and stocks can collapse in value. This creates a chain reaction where desperate traders rush to exit, amplifying losses across the market.

Momentum Strategy in Day Trading

A momentum strategy is the foundation of successful day trading. Every day, some stocks move sharply, and the goal is to spot them early. Momentum traders rely on technical indicators to identify which assets are beginning strong moves and how long those moves might last. The focus is always on price action, because sideways stocks rarely offer good trading opportunities. Most traders use stock scanners to find momentum setups forming in real time. They search for stocks with unusual volume, clear market direction, and strong chart patterns. A good candidate for momentum trading often shows a price above the moving averages and breaks past resistance levels. Catalysts such as earnings reports, company updates, or breaking news can also spark fresh momentum. However, not every move needs news, some stocks rise purely from technical breakouts. The key is learning to recognize early momentum and act before the crowd does, turning quick price surges into reliable trading opportunities.The Best Time of Day to Trade

In momentum investing, timing can make or break a trade. The best opportunities often appear early in the day when price movements are strongest. Many strategies focus on the market’s opening hour, usually between 9:30 a.m. and 11:30 a.m. During this time, traders react to overnight news, creating sharp trend movements that can lead to quick profit. However, smart investing doesn’t stop after the morning rush. The price of a stock that looked quiet earlier can suddenly rise later when new information hits. That’s why patient traders keep watching the trend throughout the day. The first pullback, often forming a bull flag, can signal a second wave of strength. The key is to buy high only when momentum is clear and plan selling when the trend slows. In momentum investing, discipline and timing work hand in hand, turning short bursts of activity into steady profit through well-practiced strategies.

Momentum Day Trading Chart Patterns

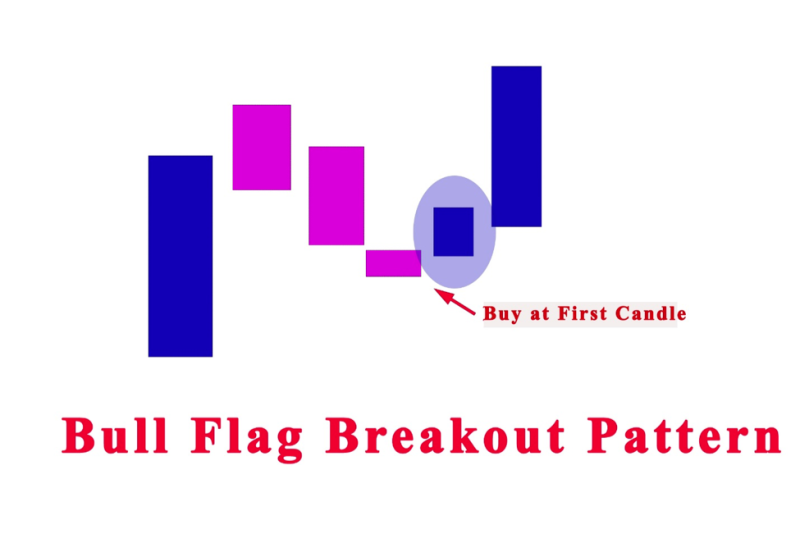

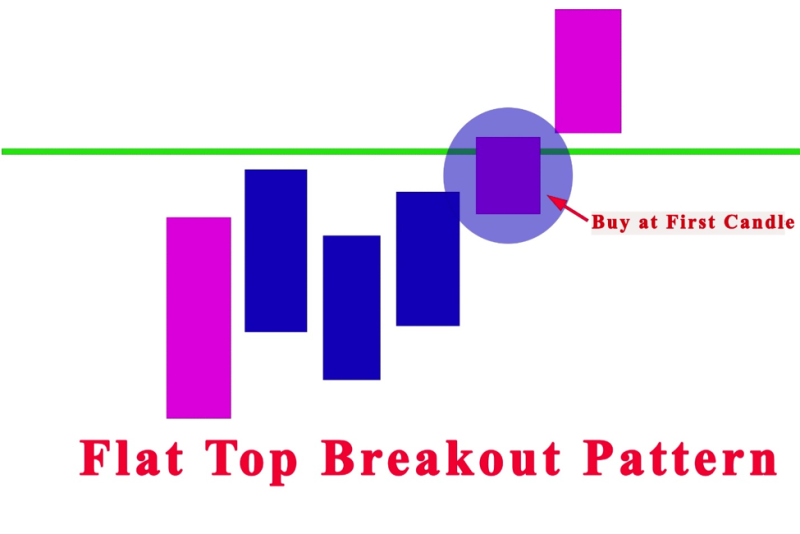

In momentum trading, chart patterns help traders see where the price might move next. These patterns act like visual clues showing how momentum is building. Day traders study charts daily because reading them well separates average traders from skilled ones. A strong momentum strategy often begins with spotting a breakout or a clean continuation pattern.

One of the most common setups in momentum trading is the bull flag pattern. It appears when a stock’s price rises sharply, then pauses briefly before climbing again. This short pause shows healthy consolidation and gives traders a low-risk entry point. When the volume spikes and the asset’s price breaks above the flag, it signals fresh momentum. Another classic pattern is the flat-top breakout. Here, the price tests the same resistance level repeatedly until buyers finally push through. When that happens, momentum surges, and stocks often rise quickly. Traders who manage their risk tolerance carefully can capture strong moves while protecting capital. Patterns like these help identify sustained trends and guide decisions that turn simple setups into steady momentum opportunities. Also read: A Complete Guide To Your Trading Plan

Also read: A Complete Guide To Your Trading Plan