Contents

- What are Trailing Stops?

- Why do Traders Use Trailing Stops?

- Mechanics of Limiting Trading Losses

- Types of Trailing Stop Orders

- Benefits of Market Orders

- Day Traders Trading Strategies

- Stop-Loss Order Risk

What are Trailing Stops?

A trailing stop limit is a moving stop limit that reduces the chances a trader will lose money if the market moves against the trader. They are commonly used by day traders who need to quickly move into and out of market positions with limited losses. Moreover, they can do this while getting the the limit price they want or a better one,

If the trader predicts that the asset price will rise, then as the asset's market price in the investor's favor, the trailing stop rises with it. If the stock falls or there is a price pullback, a trailing stop limit order may be issued for the purchase of the asset at the trailing stop limit price, the trigger price.

On the other hand, if a trader predicts that the stock price will fall, and, instead, the market price rises, when the price hits the trailing stop, a trailing stop limit order will be executed to sell the asset.

In both examples the traders limit losses, capital and profit, by using a trailing stop limit order.

Why do Traders Use Trailing Stops?

Using a trailing stop limit order is a trading strategy. Traders set trailing stop limits so that they can limit their potential losses or reduced profits yet not limit their potential profits. Trailing stops protect gains by triggering orders when the current market price hits the trigger price.

Mechanics of Limiting Trading Losses

Stop Loss Orders

Stop loss orders have stop loss prices. The stop loss limit is how much the asset's price can increase or decrease before a purchase order is executed at the trigger price, the execution price. The order is executed via a stop loss order that has a price that changes as the asset's market price changes. This is better than a stop price because it permits the trader to maximize possible gain before exiting the market position.

Stop prices do not move with the market. They are static. When the market hits the stop price, an order to purchase/sell the asset will be executed even if the trader could have made more money by waiting before executing the order.

Limit Offset

Limit offsets are used with limit orders and stop limit orders. They let traders decide how aggressive or passive you want to be when your pre-set limit order price is the same as the current price.

A limit offset is the ‘room' given for there to be price movement after a price move in favor of the trader. For example, if the limit offset is “0”, the execution and market price are the same price. In short, the trader will only buy/sell when the current market price is the same as the stop price.

Conservative traders may keep their limit offset small because they do not want to risk their market gains by being too greedy. However, more seasoned or less conservative traders may have bigger limit offsets because they don't want to reduce their potential gains by entering or exiting the market too soon or too late.

Positive Limit Offsets

A positive price limit offset indicates that the trader wants the market to reach the price set by the trader. In the case of a purchase, the trader wants the current price to fall by a few points to make the cost of acquiring the asset lower.

Whereas, if the trader is planning to sell the security, the trader is willing to wait for the market price to rise before selling the security. Essentially, traders who use positive limit offsets are willing to lose some money and potential profit in order to get the price they want for their securities.

Negative Limit Offsets

Negative limit offsets are used by traders who are willing to pay more to purchase an asset or accept less money for it when they sell it. Their eagerness to sell or buy the asset motivates them to enter into a less lucrative market trade than if they waited for a better price. Traders may do this because the market trend is not very strong, coming to an end, or unclear.

They could also do this to exit a trade quickly in order to put their capital in a more lucrative investment. In the alternative, they may be desperate to enter a position because the market trend is strong and they expect huge market gains when they exit the position.

Types of Trailing Stop Orders

All of these stop orders limit day traders' losses but protect their gains and enable them to realize the highest profits possible before entering or exiting a market position.

Stop-Loss Price

A price that is a specific percentage of the asset's current market price or that is set dollar amount above or below the asset's current market price. Brokers are instructed to sell or buy an asset when its market price hits the trader's stop-loss price.

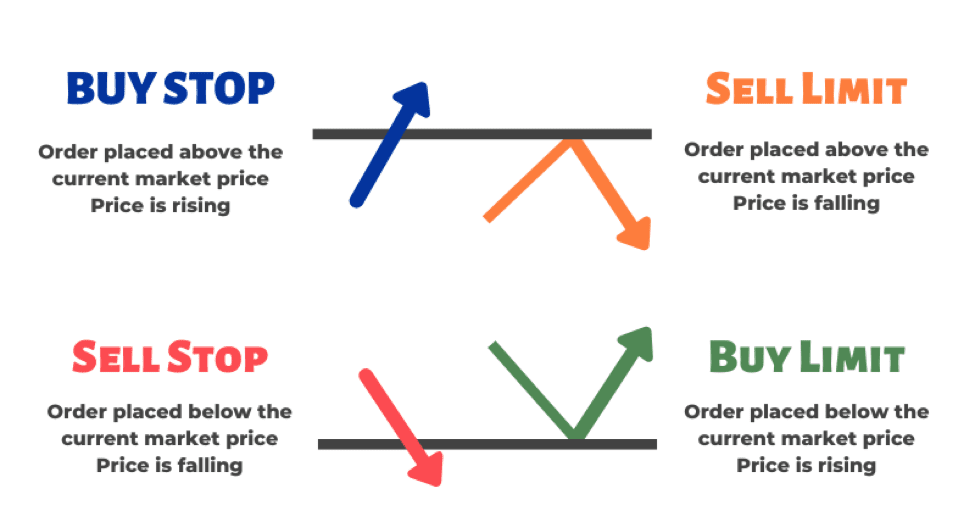

Stop Loss Order

Stop loss orders limit trader's losses. The broker may have an order to buy a security up to a set stop price, also referred to as a buy-stop. In the alternative, the broker may have an order to sell the security until its price declines to a specific price point, and then the broker must stop selling the security, also referred to as a sell-stop.

Trailing Stop Loss Order

The trader sets the stop-loss price to a specified percentage of the security's market when the order was created.

Trailing Stop Limit Orders

A trailing stop limit order, also referred to as a trailing stop, has a stop-loss price and the broker is instructed to execute the order when the specified order limit can be processed at the stop-loss price.

Benefits of Market Orders

Trailing stop loss and trailing stop limit orders may not always be the best trading strategy. If the market price is volatile or there is a strong trend reversal against the trader, the trader may want to make the purchase/sell immediately.

Advantages

The benefits of making a swift trade is that the trader gets the most recent price and therefore can reduce future losses, real or anticipated. In addition, a market order is executed faster than all other types of orders sent to brokers.

In essence, there is an order hierarchy that brokers follow when executing orders. Fortunately for stressed traders who are desperate to enter or exit a position, a market is always the first to be processed by the broker and executed the fastest.

Drawbacks

The drawbacks of using a market order is that you may pay slippage, bid-ask spread fees, and broker commission fees.

Slippage is the difference between the asset price and the price paid when the market order is executed by the broker. Depending how quickly the market price is changing, the slippage may be insignificant or quite costly.

Another fee that the trader may have to pay is determined by the broker's bid-ask spread. If brokers set the bid-ask spread in their favor the price of the market order execution will be even higher.

Finally, the trader must pay the broker's commission fee for executing the market order. Brokers' fees can vary for a number of reasons. Ultimately, the trader may not know the broker's fee for processing the market order before sending the market order to the broker.

Day Traders Trading Strategies

Day traders often use stop-losses, trailing stop losses, trailing stop loss limit orders, and other limit loss trading orders to protect their gains and trigger execution of their orders when the market price is attractive to them. These pre-set orders free them from spending large amount of time monitoring market data and trying to execute their orders before the market price changes.

These types of orders are cheaper to execute than market orders and give the traders the freedom to pursue other economic activities while their brokers are handling the orders they have already decided on.

Also Read: Day Trading for Dummies

Stop-Loss Order Risk

Stop-loss orders are less effective when an asset's market price suddenly skyrockets or plunges. In those circumstances, the market price may change so quickly that the stop-price is not triggered. Unfortunately for the trader, by the time the order is processed it will be executed at a less desirable price than stipulated by the trader.