As someone who spends each day watching bond markets and tracking Federal Reserve moves, I can tell you that the question on every homeowner’s mind, “is now a good time to refinance your mortgage?” isn’t as simple as looking at the headline rate. In 2025, refinance mortgage rates have stabilized in the mid-6% range, and while that’s far from the ultra-low levels of 2021, it’s still historically competitive. But the decision to refinance isn’t just about the current number. It’s about timing the market, knowing your break-even point, and understanding what the next 12 months could look like for interest rates.

Here are the 10 reasons, based on market trends and economic analysis, that will help you determine whether refinancing in 2026 is the right move.

1. Current Refinance Rates Are Lower Than Last Year’s Peak

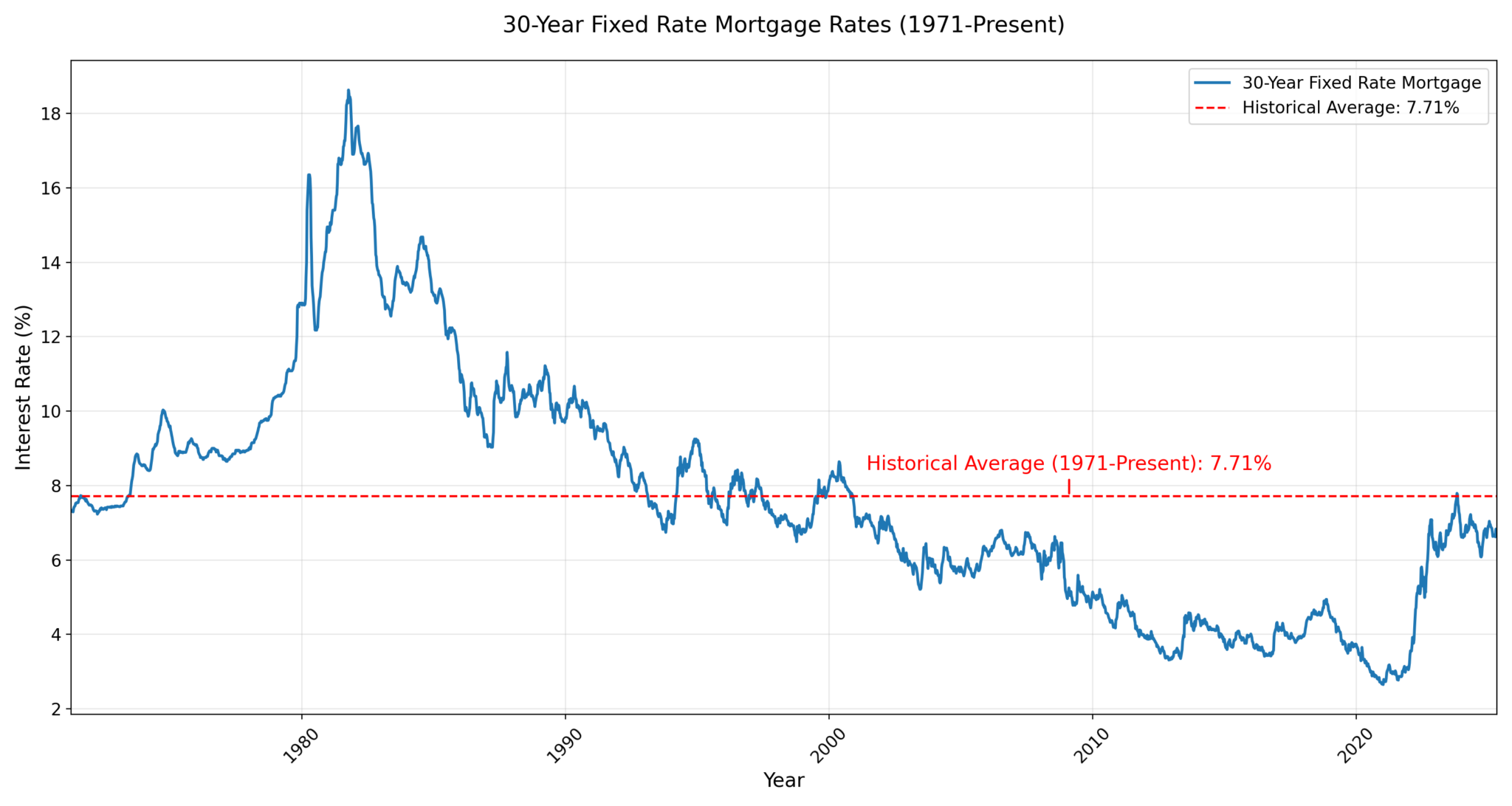

According to Bankrate and NerdWallet, the average 30-year fixed refinance rate in August 2025 is hovering between 6.56% and 6.88%, down from over 7.5% in late 2023. While these rates aren't historic lows, they’re lower than what many homeowners locked in during the last wave of inflation-driven hikes.

If you locked in a mortgage during the rate spikes of 2022–2023, this is likely your first real opportunity to refinance at a lower rate.

2. Even a 0.5% Rate Drop Can Save You Thousands

Gone are the days when you needed a 2% rate drop to justify a refinance. With today’s loan balances and amortization structures, a 0.5% drop can yield real savings.

For example, refinancing a $350,000 loan from 7.25% to 6.75% could save over $100 per month, or more than $1,200 per year. That adds up, especially if you plan to stay in your home for the next 5–10 years.

3. Mortgage Rates Are Expected to Stay in the 6% Range Through 2025

If you're holding out for 5% or lower refinance rates to return, you might be waiting a long time. The latest housing outlook from Fannie Mae expects 30-year fixed rates to hover around 6.4% by the end of 2025 and only dip slightly to 6.1% in 2025.

In other words, this may be as good as it gets for a while.

4. You Can Lock In a Shorter Term to Save More

If your goal isn’t just lowering your monthly payment, but building wealth, refinancing into a shorter loan term (like 15 or 20 years) can help you save tens of thousands in interest.

Many lenders offer 15-year refinance rates in the mid-5% range, which may come with slightly higher monthly payments but much lower total borrowing costs.

5. Refinancing Can Help You Eliminate PMI

Private Mortgage Insurance (PMI) typically costs 0.5% to 1.5% of your loan annually, which adds up quickly. If your home’s value has increased and your loan-to-value ratio is below 80%, you might be eligible to remove PMI through a refinance.

This move alone could save you $100–$200 per month, even if your rate doesn’t drop significantly.

6. You Can Use a Refinance to Tap Home Equity (Carefully)

A cash-out refinance lets you replace your current mortgage with a larger loan and take the difference as cash, ideal for debt consolidation, home improvements, or large expenses.

However, only consider this if you're refinancing from a high existing rate. Otherwise, you may be better off with a home equity line of credit (HELOC), which preserves your current low-rate mortgage.

7. Political and Economic Risks Could Push Rates Higher

Bond markets are incredibly sensitive to risk, and right now, there’s plenty of it. Between Trump’s tariff policies, a growing federal deficit, and global political unrest, there’s as much reason for rates to climb back toward 7% as there is for them to fall. Inflation, while cooling, remains a wildcard. My advice? Don’t wait for the perfect rate environment, because in markets, “perfect” rarely arrives.

8. Closing Costs and Break-Even Math Still Matter

Even with favorable rates, refinancing is only worth it if the math checks out. Closing costs typically range from 2% to 5% of your loan amount, meaning a $300,000 loan could carry $6,000–$9,000 in upfront costs. As a financial professional, I always stress the break-even point: divide your total closing costs by your projected monthly savings. If you save $200 per month and your closing costs are $6,000, your break-even is 30 months. If you’ll move before then, refinancing doesn’t make sense.

9. The Window for Opportunity May Be Narrow

Markets move fast. One bad inflation report, a surge in energy prices, or a weak Treasury auction can push yields higher, which directly impacts refinance mortgage rates. While rates have hovered in the mid-6% range for much of 2025, it wouldn’t take much for them to spike toward 7% again. Locking in a refinance now, while the window is open, can protect you against that risk.

10. Strategic Timing Beats Waiting for the Bottom

As a trader, I know you’ll never time the absolute bottom of any market—whether it’s stocks, bonds, or mortgage rates. Too many homeowners miss savings because they’re waiting for rates to fall “just a little more.” If your current mortgage rate is above 7%, and you plan to stay in your home for at least 3 to 5 years, the smart play is to refinance now, lock in a stable rate, and start saving immediately rather than trying to predict an uncertain future.

Also Read: 9 SHOCKING Credit Score Myths You Probably Still Believe (and It’s Costing You Thousands!)

Is 2026 the Right Year to Refinance?

From where I sit, watching the interplay between Treasury markets and mortgage-backed securities every day, 2026 offers a reasonable, though not perfect, refinance window. Rates are stable but not expected to fall significantly, and the risk of upward pressure is real. If your current rate is over 7%, refinancing now could save you thousands of dollars over the next decade. If you’re already sitting on a sub-6% rate, I’d hold tight and explore alternatives like HELOCs.

The key is to run the numbers. Check your credit score, request at least two quotes from lenders, and calculate your break-even point. The decision to refinance is as much about personal financial planning as it is about interest rates. From a market perspective, waiting for the perfect time could mean missing the opportunity altogether.