Have you ever followed your strategy to the letter, only to watch the market go completely against you?

You bought expecting a bounce… and the market collapsed.

You sold into a breakdown… and price rocketed up.

Frustrating, isn’t it?

Well, here’s the truth no one tells you:

Most traders don’t lose because their strategy sucks, they lose because they’re trading in the wrong direction.

You’re not broken. Your indicators aren’t useless.

You’re just entering at the worst possible time because you’ve been tricked by fake moves.

In this guide, I’ll show you how to flip the script, using a concept called the Change of Character (ChoCh) and three powerful confirmations that’ll help you avoid traps, spot real trend reversals, and boost your win rate, all without changing your strategy.

Let’s dive in.

Part 1: What Is a Change of Character (ChoCh) — And Why Does It Matter?

A Change of Character is the first structural clue that the market trend might be about to reverse.

Let’s say the market is in an uptrend, making higher highs and higher lows. A ChoCh occurs when price breaks and closes below a major higher low, usually within a demand zone, with clear bearish intent.

This signals that:

-

Buyers are losing control.

-

The uptrend may be exhausted.

-

A bearish shift could be underway.

But here’s the kicker… Not every break of structure means the trend has changed.

The market loves to play games. It will sweep stop losses, create fake-outs, and pull you in before reversing hard.

So your job isn’t just to see a structural break…

It’s to validate it.

That’s why we don’t rely on ChoCh alone. We combine it with 3 key confirmations, so you’re not blindly guessing, but making informed entries based on real market sentiment.

Part 2: The Anatomy of a Valid ChoCh (Step-by-Step Breakdown)

Here’s how a true Change of Character plays out:

-

The market is in an uptrend, forming higher highs and higher lows.

-

A break in structure occurs, price closes below the most recent significant low with candle body confirmation, ideally inside a demand zone.

-

This signals a shift from bullish to bearish momentum.

-

If price continues lower, breaking a second key higher low (another demand zone), that’s your second confirmation of a deeper trend change.

-

Eventually, a supply zone forms at the top, this becomes your new area of interest for sell entries on a retest.

This is not just a one-candle trick. It’s a complete narrative that tells you the story of control shifting from buyers to sellers (or vice versa in a downtrend).

But again, these breaks can be deceptive.

So let’s move on to the 3 keys that filter real ChoChs from fake ones.

Part 3: The 3 Keys to Validating a Real Change of Character

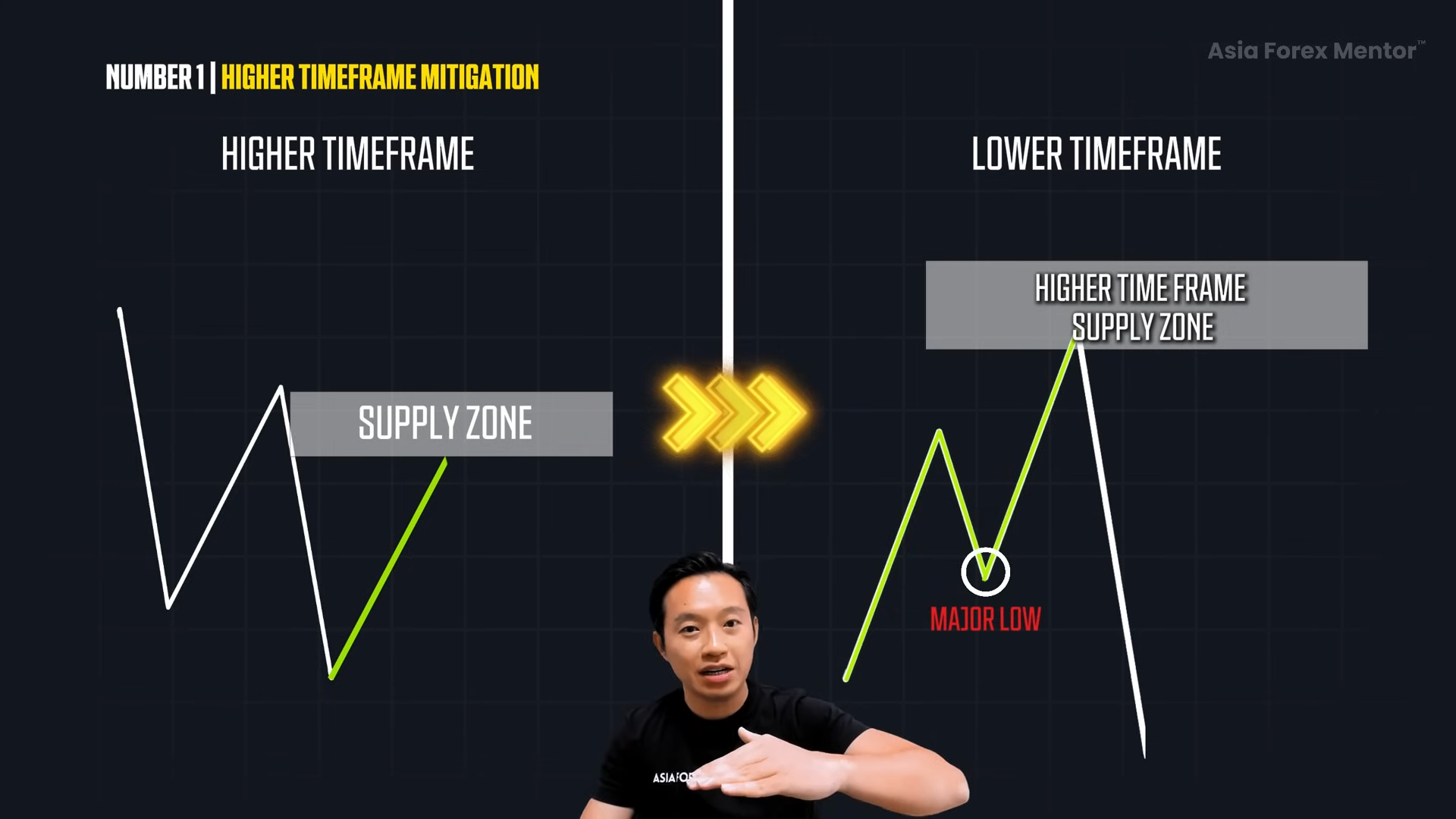

✅ Key #1: Higher Time Frame Mitigation

This is where most traders get it wrong.

They see a structural break on the 1H or 4H chart and think,

“Yes! The trend has changed! Let’s go long!”

But they forget to ask the most important question:

“Has price reacted from a higher time frame supply/demand zone?”

Here’s the rule:

A ChoCh is only valid if price first reacts from a fresh, unmitigated supply/demand zone on the higher time frame.

If the move didn’t begin from that level, the break you’re seeing could be just a pullback — not a reversal.

Let’s say price is in a downtrend on the daily. It pulls back and breaks above a minor supply zone on the 4H. That might look like a bullish ChoCh…

But if it didn’t come from a fresh daily demand zone, it's just a retracement, and the downtrend will likely continue.

📌 Avoid This Trap: Don’t confuse retracements for reversals. Wait for price to tap into a real higher time frame zone before trusting a ChoCh.

This step alone will filter out 70% of your bad trades.

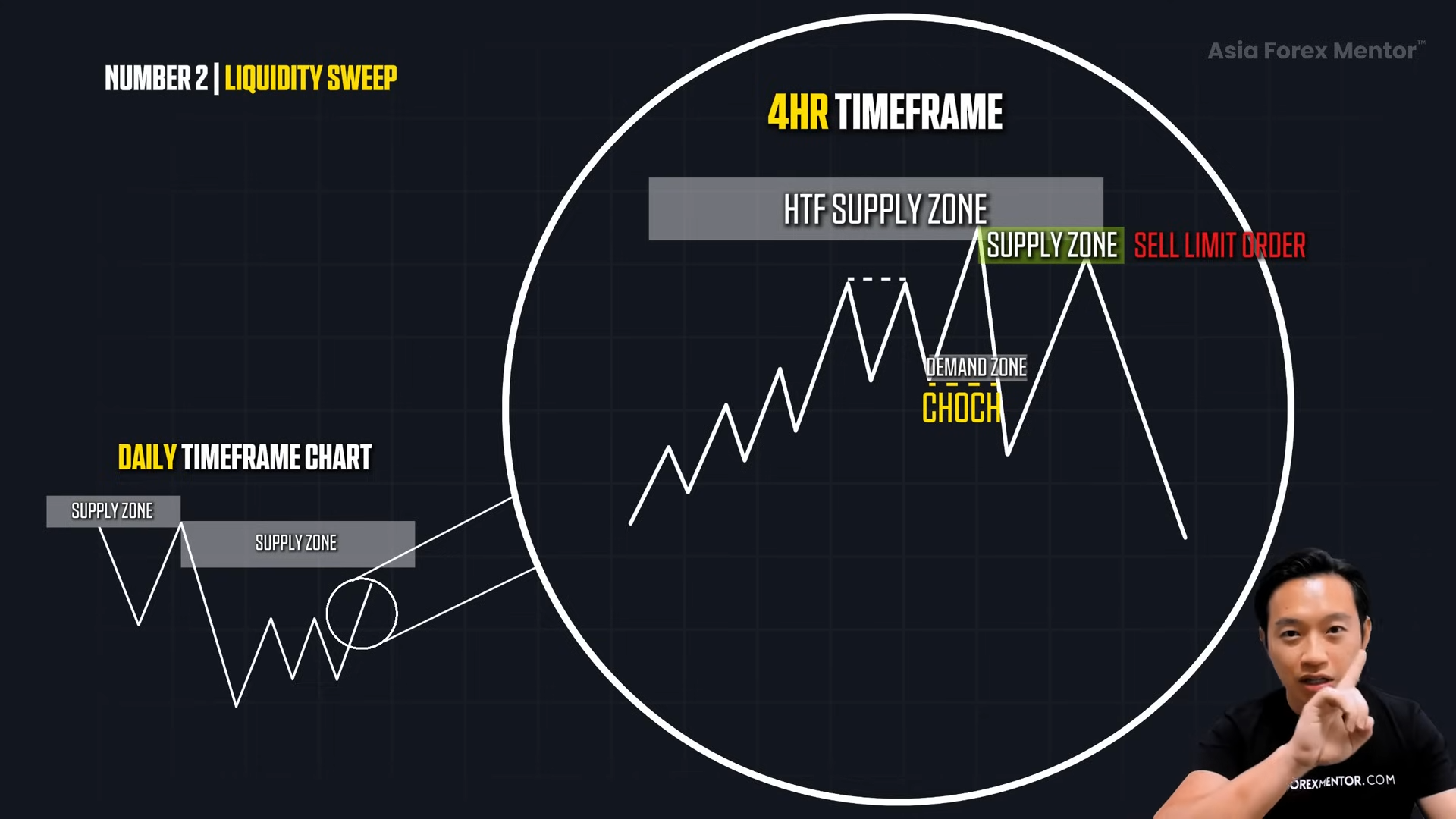

✅ Key #2: Liquidity Sweep Confirmation

You’ve probably seen this setup:

-

Price forms equal highs or equal lows (double tops or bottoms).

-

Everyone piles in, placing stop losses just above/below those levels.

-

Then the market sweeps the liquidity, taking out stops, before reversing.

This is called a liquidity grab or stop hunt, and it’s one of the most effective tools smart money uses to manipulate retail traders.

In the context of ChoCh, a valid reversal is more likely to occur after a liquidity sweep.

Let’s walk through it:

-

Price is in a bearish trend on the daily.

-

On the 4H chart, it’s climbing toward the daily supply zone.

-

Right before reaching the zone, it forms equal highs, building liquidity.

-

Price spikes just above those highs (sweeping liquidity), taps into the daily supply zone, then reverses.

-

That reversal breaks structure → confirms the ChoCh.

Now you have context + structure + manipulation which is a powerful confluence.

🧠 Pro Tip: Liquidity zones often lie right near major supply/demand areas. Wait for the sweep and the reaction, that’s your edge.

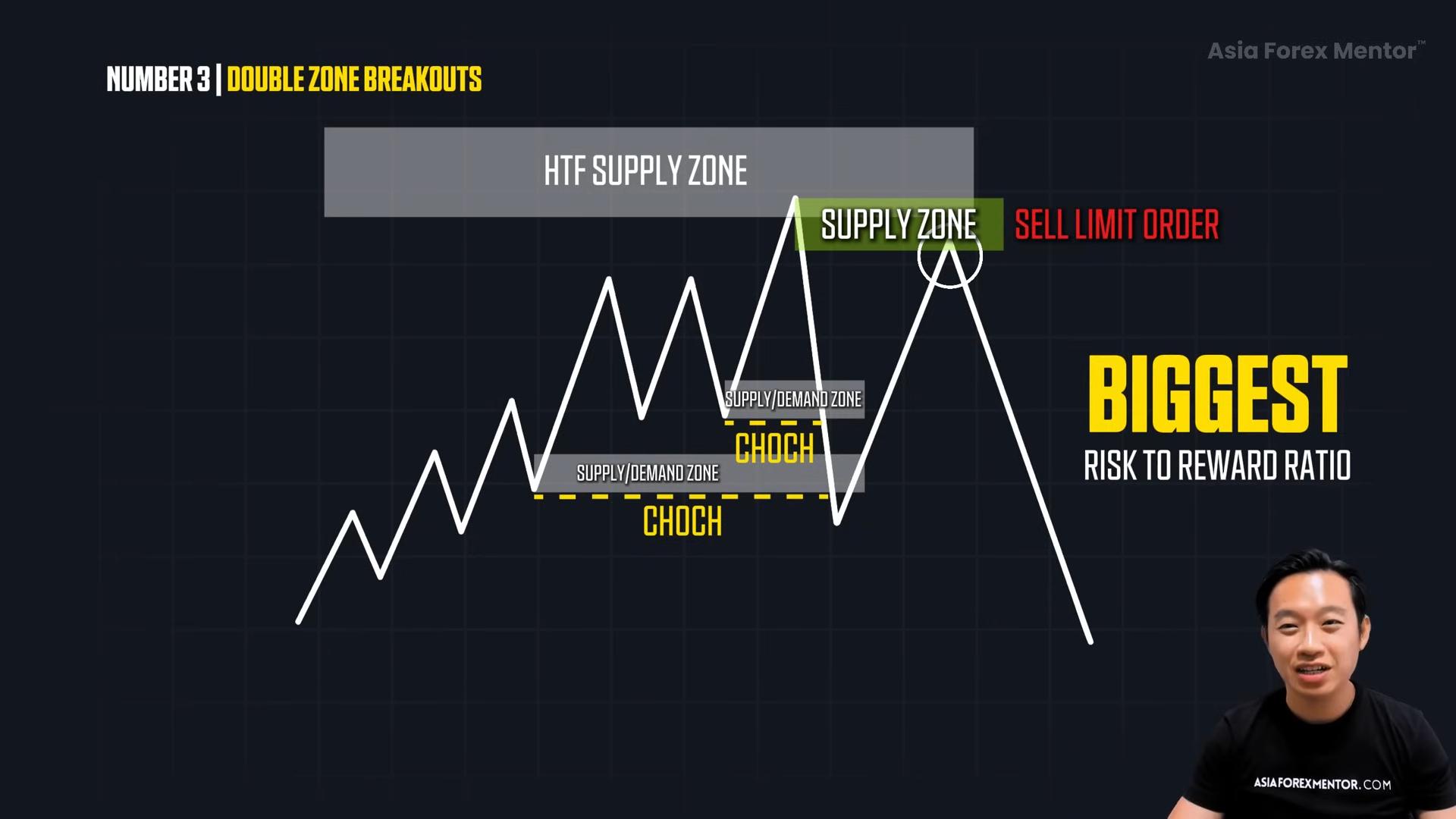

✅ Key #3: Double Zone Breakout

This is your final green light.

A real trend reversal often includes two consecutive zone breaks, not just one.

Think of it this way:

-

A single break could be noise or a fake-out.

-

A double break shows strength, intent, and momentum.

Here’s how it works:

-

Price breaks below the first major higher low (demand zone) → potential ChoCh.

-

Price continues lower and breaks the second major demand zone → double zone breakout.

-

A new supply zone forms at the top.

-

You can now wait for price to retest that supply zone and enter a short with confidence.

This double-break confirmation gives you:

-

A stronger signal that the trend has shifted.

-

A clearer entry zone (new supply).

-

An improved risk-to-reward because you’re not guessing.

Part 4: Putting It All Together — Your Reversal Blueprint

Let’s tie all this up into a repeatable process.

When you suspect a trend reversal is coming:

🔍 Step 1: Start with the Higher Time Frame

-

Identify fresh, unmitigated supply or demand zones.

-

Avoid areas that have already been tapped multiple times.

🔎 Step 2: Drop to the Lower Time Frame

-

Look for liquidity sweeps (equal highs/lows near HTF zones).

-

Wait for strong price reaction after the sweep.

📉 Step 3: Look for Structure Breaks

-

Watch for a clean ChoCh, a break of major structure with a candle body close.

-

Look for a second break for the double zone confirmation.

🎯 Step 4: Plan Your Entry

-

Use the newly formed supply/demand zone at the extreme for your entry.

-

Place a limit order with stop loss above/below the structure.

-

Target the next key level or trail using structure.

By combining HTF zones + liquidity sweep + double zone breakout, you’re stacking the odds in your favor — and staying away from the traps that catch most traders.

Part 5: Bonus — Retracement or Reversal? Here's How to Tell

Here’s a quick mental framework to distinguish the two:

| Scenario | Retracement | Reversal |

|---|---|---|

| HTF zone touched? | ❌ No | ✅ Yes |

| Liquidity swept? | ❌ No | ✅ Yes |

| Structure broken once? | ✅ Maybe | ✅ Yes |

| Structure broken twice? | ❌ No | ✅ Confirmed |

| Entry zone formed at extreme? | ❌ No | ✅ Yes |

Retracements happen within the trend and often lure traders into trading the wrong direction.

Reversals are trend shifts, and when you can read them correctly, your win rate improves, your trades move faster, and your risk-reward skyrockets.

Final Thoughts: Stop Guessing, Start Reading the Market

The Change of Character is one of the most powerful tools for any trader.

But alone, it's not enough. You need to validate it with higher time frame zones, liquidity sweep traps, and double zone breakouts.

When you do that, you stop getting faked out.

You stop trading against the trend.

You stop bleeding money on “almost good” trades.

And instead, you start trading with clarity, with context, and with confidence.

So here's your challenge:

Next time you see a breakout, don’t jump in.

Ask: “Is this move valid?”

Check the HTF zone. Look for liquidity. Confirm the double break.

Do this consistently, and watch your trading improve dramatically.

Now here's the thing…

If you’re a visual learner (or want to see real chart examples), I highly recommend watching the full video below.

Ready to go deeper?

Grab our free 5-part trading masterclass where we break down real examples, step-by-step, using this exact method.

Because once you stop trading in the wrong direction… everything changes.