Cryptocurrency adoption in Myanmar has been growing, driven by increasing interest in digital assets and evolving financial technologies. This surge highlights the importance of secure and reliable brokers for navigating the complexities of crypto trading and ensuring investor safety.

Choosing the best crypto brokers in Myanmar requires careful consideration of several factors, such as low trading fees, robust customer support, and access to global markets. Traders, whether retail traders, experienced traders, or algorithmic traders, benefit from brokers offering features like negative balance protection, crypto CFDs, and dedicated crypto wallets. This guide explores the top brokers meeting these criteria to support diverse trading styles and goals.

Key Features to Look for in a Crypto Broker

When selecting the best crypto brokers in Myanmar, prioritize security measures like encryption and cold storage to protect crypto assets. Transparent trading fees and low trading costs are critical for minimizing expenses, especially for retail traders and experienced traders. A user-friendly trading platform with features such as demo accounts and tools for technical analysis can significantly enhance your trading experience.

Consider brokers regulated by securities and exchange commissions in multiple jurisdictions to ensure compliance with local laws like forex trading legal standards. For crypto trading, look for options supporting crypto CFDs, underlying crypto assets, and margin trading. Features like negative balance protection, deep liquidity, and social trading cater to both retail investors and professional traders aiming for high volume trading or algorithmic strategies. Reliable customer support, low withdrawal fees, and access to global markets further distinguish a trusted broker.

The 5 Best Crypto Brokers in Myanmar in 2025

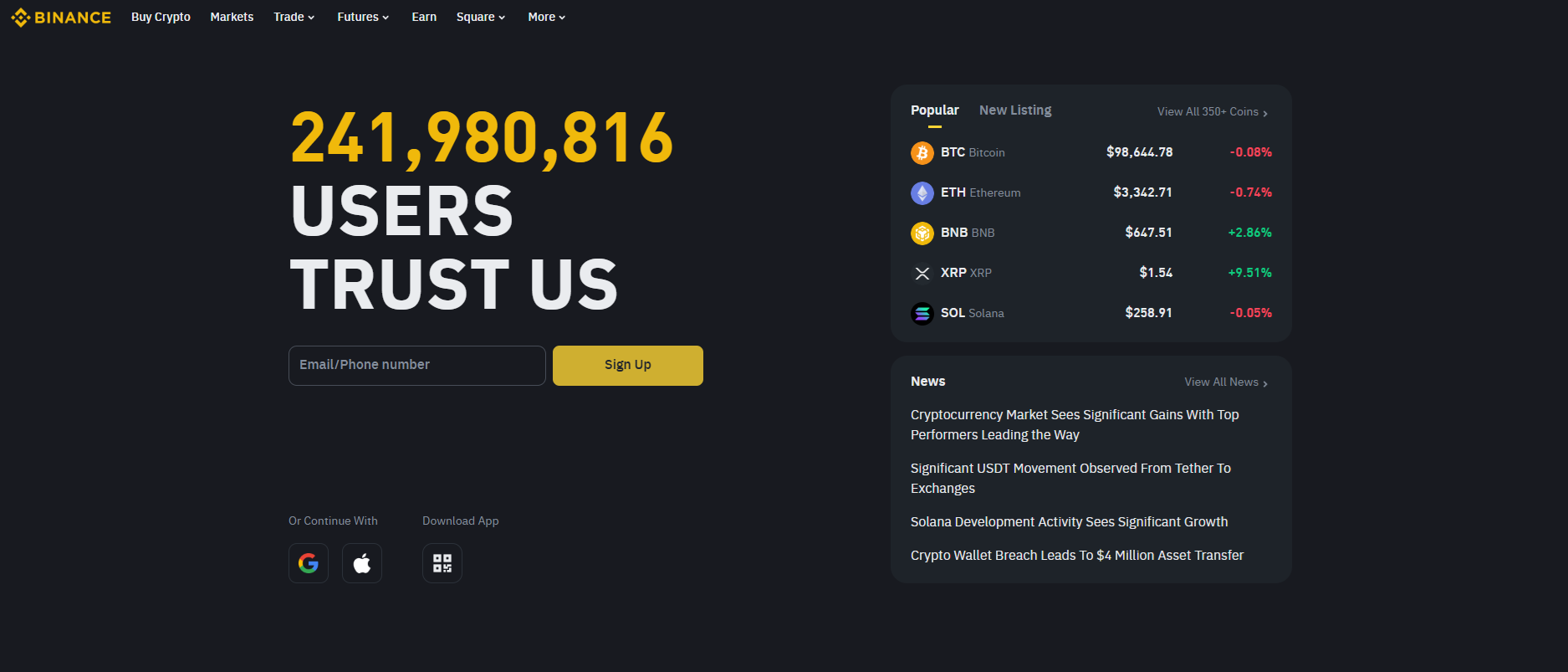

#1. Binance

What is Binance?

Binance is a leading cryptocurrency exchange offering a wide range of digital assets for trading. It provides advanced trading tools and supports spot, futures, and margin trading. Known for its high liquidity, Binance also offers additional features like staking, lending, and its native token, BNB.

Advantages and Disadvantages of Binance

Binance Commissions and Fees

Binance charges competitive fees, with trading fees starting as low as 0.1%. Users can reduce costs by paying with BNB tokens or meeting certain trading volume thresholds. Deposit fees are typically free, but withdrawal fees vary based on the cryptocurrency. This structure ensures affordability for both beginners and experienced traders.

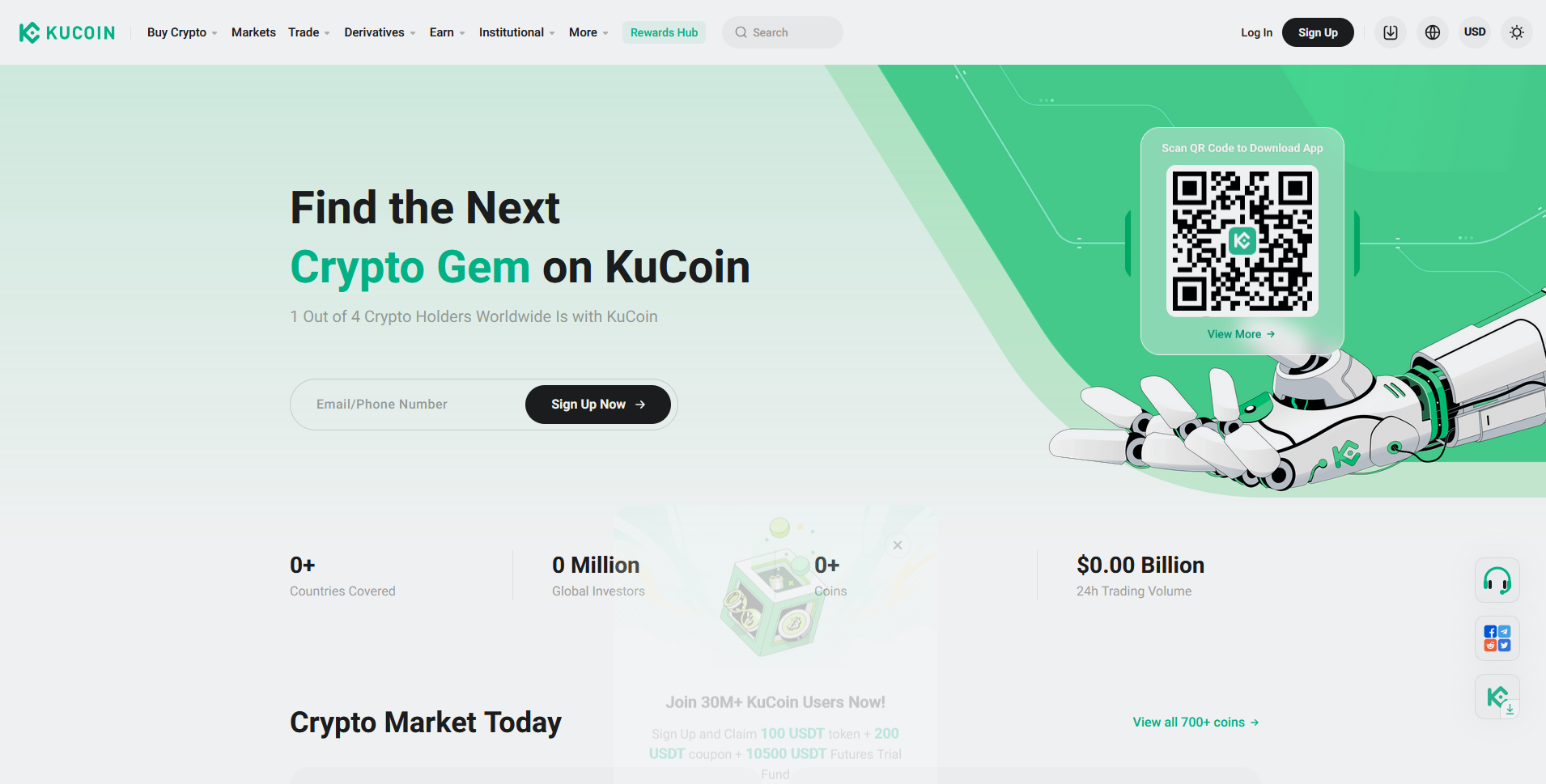

#2. KuCoin

What is KuCoin?

KuCoin is a global cryptocurrency exchange offering trading, staking, and lending services for a wide range of digital assets. Known as the “People’s Exchange,” it supports a user-friendly interface and advanced trading tools. KuCoin also boasts strong security measures and an active global community. Its diverse features make it suitable for both beginners and experienced traders.

Advantages and Disadvantages of KuCoin

KuCoin Commissions and Fees

KuCoin offers competitive trading fees starting at 0.1% per transaction, with further discounts available for using its native token, KCS. Withdrawal fees are dynamic and vary by asset, ensuring flexibility for users. While deposit fees are generally free, network fees apply to blockchain transactions. These low-cost options make it an attractive choice for cost-conscious traders.

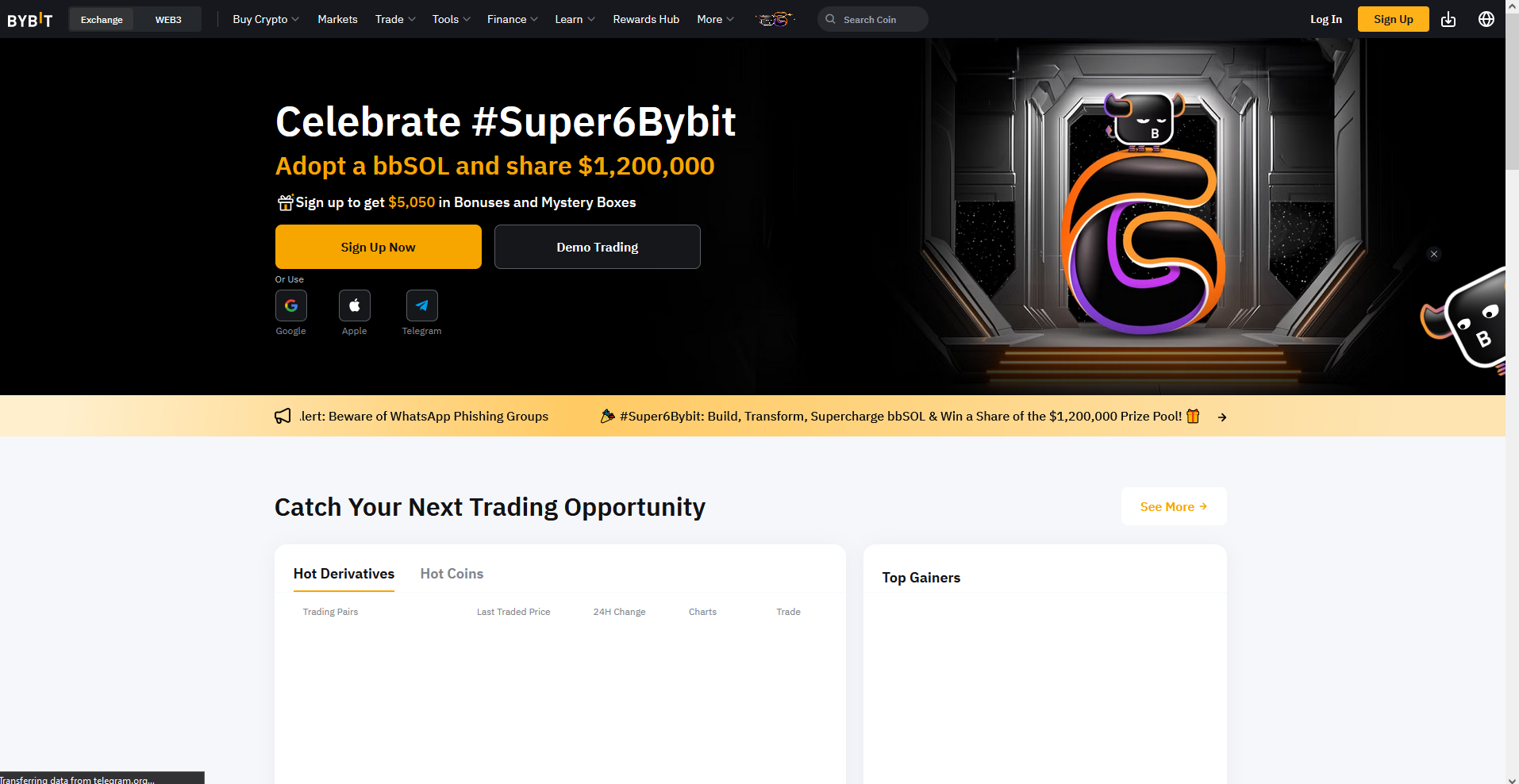

#3. ByBit

What is ByBit?

ByBit is a cryptocurrency exchange known for its focus on derivatives trading. It provides a user-friendly platform with advanced trading tools tailored for experienced traders. ByBit supports perpetual contracts and offers high leverage options, making it popular among crypto enthusiasts. The platform also emphasizes security with robust measures to protect user funds.

Advantages and Disadvantages of ByBit

ByBit Commissions and Fees

ByBit operates with a maker-taker fee structure, encouraging liquidity on the platform. Makers typically enjoy a slight rebate, while takers are charged a standard fee. Additionally, ByBit imposes funding rates for perpetual contracts, which vary depending on market conditions. The transparent fee structure appeals to professional traders seeking clarity.

#4. Crypto.com

What is Crypto.com?

Crypto.com is a comprehensive cryptocurrency platform offering a variety of services, including trading, staking, and a popular crypto wallet. Known for its user-friendly interface, it supports over 250 cryptocurrencies and features a range of rewards through its Visa debit card. The platform also provides competitive earning opportunities via staking and cashback incentives for users.

Advantages and Disadvantages of Crypto.com

Crypto.com Commissions and Fees

Crypto.com applies a tiered fee structure for trading, starting at 0.4% for both maker and taker trades, with potential discounts based on trading volume and CRO staking. Deposit fees are generally free, but withdrawal costs vary depending on the currency. Its Visa card offers rewards but may require staking CRO, which introduces additional considerations. Users should review transaction-specific charges to optimize their experience.

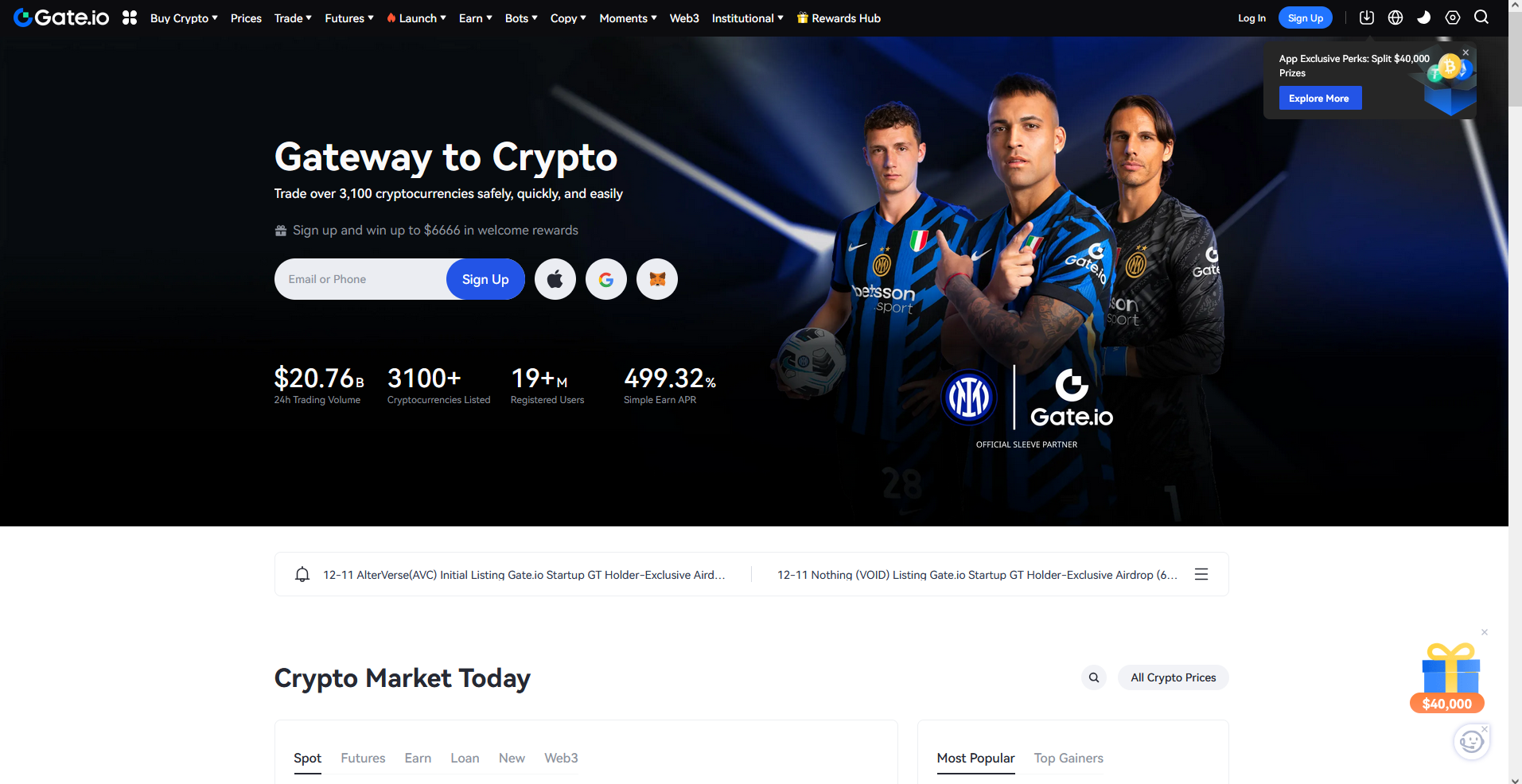

#5. Gate.io

What is Gate.io?

Gate.io is a cryptocurrency exchange platform known for offering a wide range of digital assets and advanced trading features. It provides users with access to spot trading, margin trading, and futures, making it suitable for both beginners and experienced traders. Gate.io prioritizes security with robust measures such as cold wallet storage and multi-signature verification.

Advantages and Disadvantages of Gate.io

Gate.io Commissions and Fees

Gate.io offers competitive trading fees starting at 0.2% for spot trades, with discounts available for higher trading volumes or holding their native token, GT. Withdrawal fees vary by asset, while deposit fees are typically free. Gate.io's fee structure is considered user-friendly, but high-volume traders benefit the most from its tiered discounts.

Why These Brokers Stand Out

The best crypto brokers in Myanmar distinguish themselves by offering robust trading platforms and ensuring compliance with the country's Securities and Exchange Commission regulations. They cater to retail traders, professional traders, and crypto investors, providing features such as negative balance protection, free demo accounts, and deep liquidity for seamless trading of crypto assets and forex trading. Trusted brokers in Myanmar also offer low trading fees, strong customer support, and advanced trading tools, ensuring an optimized trading experience.

Additionally, these brokers prioritize safety and compliance by operating under multiple jurisdictions and adhering to international standards. Features like dedicated crypto wallets, copy trading, and access to crypto cfds and underlying crypto assets make them suitable for active traders and experienced traders alike. Their support for margin trading, social trading, and algorithmic traders ensures flexibility for varied trading styles while maintaining risk management measures to protect retail investor accounts.

Also Read: The 5 Best Binary Brokers in Myanmar in 2025: Simplified Trading

Conclusion

In conclusion, selecting secure and reliable brokers is critical for a successful trading experience, whether you're exploring forex trading or venturing into crypto assets. The best crypto brokers in Myanmar and top forex brokers prioritize safety, transparent trading fees, and robust customer support, making them essential for professional traders and retail traders alike.

To optimize your trading experience, consider platforms that offer free demo accounts, negative balance protection, and access to crypto markets with low trading costs. Evaluate factors such as margin trading, access to underlying crypto assets, and deep liquidity to ensure compatibility with your trading styles. Research thoroughly and choose a trusted broker operating in multiple jurisdictions to safeguard your investments in global markets.

FAQs

What is the best crypto broker for beginners in Myanmar?

Binance and KuCoin are excellent for beginners due to their user-friendly interfaces and extensive educational resources.

Are crypto brokers in Myanmar regulated?

While Myanmar’s crypto regulations are evolving, these brokers adhere to global compliance and security standards to ensure user safety.

Can I trade crypto on my phone in Myanmar?

Yes, all brokers listed, including Binance and OKX, offer mobile apps for convenient trading on the go.