Cryptocurrency trading is rapidly gaining traction among Thai traders, with the crypto market evolving into a pivotal aspect of the financial markets. The growing interest in digital assets and cryptocurrency exchanges underscores the need for reliable crypto trading platforms. In Thailand, traders are exploring trading strategies across diverse trading instruments, such as CFD trading, futures trading, and currency trading, to capitalize on the booming market.

Choosing the right crypto exchange in 2024 is crucial for a smooth trading experience. Factors such as low trading fees, robust security measures, and user-friendly interfaces are essential for both experienced traders and beginners. The ranking criteria for the best crypto brokers in Thailand focus on aspects like regulatory compliance with the Securities and Exchange Commission, customer support, trading processes, and access to advanced trading tools. These ensure seamless trading of crypto assets while protecting client funds and offering diverse trading options for various trading styles.

Overview of the Crypto Trading Landscape in Thailand

Cryptocurrency trading in Thailand has witnessed significant growth, with a rising number of Thai traders exploring crypto trading platforms to engage in digital assets. The demand for diverse trading options like crypto CFDs, currency pairs, and futures trading continues to increase among experienced traders and retail investor accounts. Crypto traders are drawn to advanced trading tools, low trading fees, and seamless trading experiences offered by some of the best crypto exchanges in Thailand. Thai exchanges have also started incorporating robust security measures and strong customer support to enhance trust among users.

The Securities and Exchange Commission (SEC) in Thailand plays a crucial role in setting a strong regulatory framework for crypto brokers and cryptocurrency exchanges. These regulations emphasize regulatory compliance, client funds safety, and clear fee structures, ensuring a smooth crypto trading experience. Brokers catering to active traders often provide extensive educational resources, technical analysis, and market research for developing effective trading strategies. Popular trading platforms also support multiple deposit methods like bank transfers and payment methods for selling bitcoin or executing crypto transactions securely. As the crypto market evolves, Thailand remains a promising hub for crypto assets and financial markets, balancing innovation with stringent oversight.

The 5 Best Crypto Brokers in Thailand in 2024

#1. Bybit

What is Bybit?

Bybit is a cryptocurrency derivatives exchange offering a user-friendly platform for trading futures and perpetual contracts. It supports a wide range of digital assets with advanced tools and a competitive fee structure. Known for its reliability and high-speed execution, Bybit caters to both beginners and experienced traders in the crypto market.

Advantages and Disadvantages of Bybit

Bybit Commissions and Fees

Bybit charges competitive trading fees, including a maker fee of 0.025% and a taker fee of 0.075%. It offers discounts on fees for large-volume traders and zero fees on deposits. Withdrawal fees are fixed depending on the cryptocurrency being transferred. This fee structure ensures affordability for both casual and professional traders.

#2. Binance

What is Binance?

Binance is a leading cryptocurrency exchange platform offering a wide range of digital assets for trading. It is known for its high liquidity and advanced trading features, catering to both beginners and experienced traders. Binance also provides additional services like staking, futures trading, and a secure wallet for storing assets.

Advantages and Disadvantages of Binance

Binance Commissions and Fees

Binance charges competitive fees, starting at 0.1% for spot trading, which is further reduced when using Binance Coin (BNB). It offers transparent and tiered fee structures based on trading volume. Withdrawal fees vary depending on the cryptocurrency. These low fees make Binance an attractive option for high-frequency traders.

#3. Gate.io

What is Gate.io?

Gate.io is a cryptocurrency exchange offering a wide range of digital assets and trading options. It supports spot trading, futures, and margin trading, appealing to both beginners and experienced traders. Known for its extensive coin selection, Gate.io also prioritizes security and user-friendly interfaces for seamless transactions.

Advantages and Disadvantages of Gate.io

Gate.io Commissions and Fees

Gate.io employs a tiered fee structure based on trading volume, offering competitive rates for active traders. The maker-taker fees start at 0.2% but decrease for higher-tier users. Withdrawal fees vary depending on the cryptocurrency, which can sometimes be relatively high. Overall, Gate.io balances affordability with the range of services offered.

#4. Bitkub

What is Bitkub?

Bitkub is a cryptocurrency exchange platform based in Thailand, offering users a reliable way to buy, sell, and trade digital assets. It caters to both beginners and experienced traders with an easy-to-navigate interface and a wide range of cryptocurrencies. Bitkub is regulated by the Thailand Securities and Exchange Commission, ensuring compliance and security.

Advantages and Disadvantages of Bitkub

Bitkub Commissions and Fees

Bitkub offers competitive trading fees, charging 0.25% per transaction for both makers and takers. Deposits in Thai Baht are free, but withdrawal fees vary depending on the cryptocurrency. While trading fees are straightforward, users should watch out for hidden costs in withdrawals and less favorable rates for large transactions.

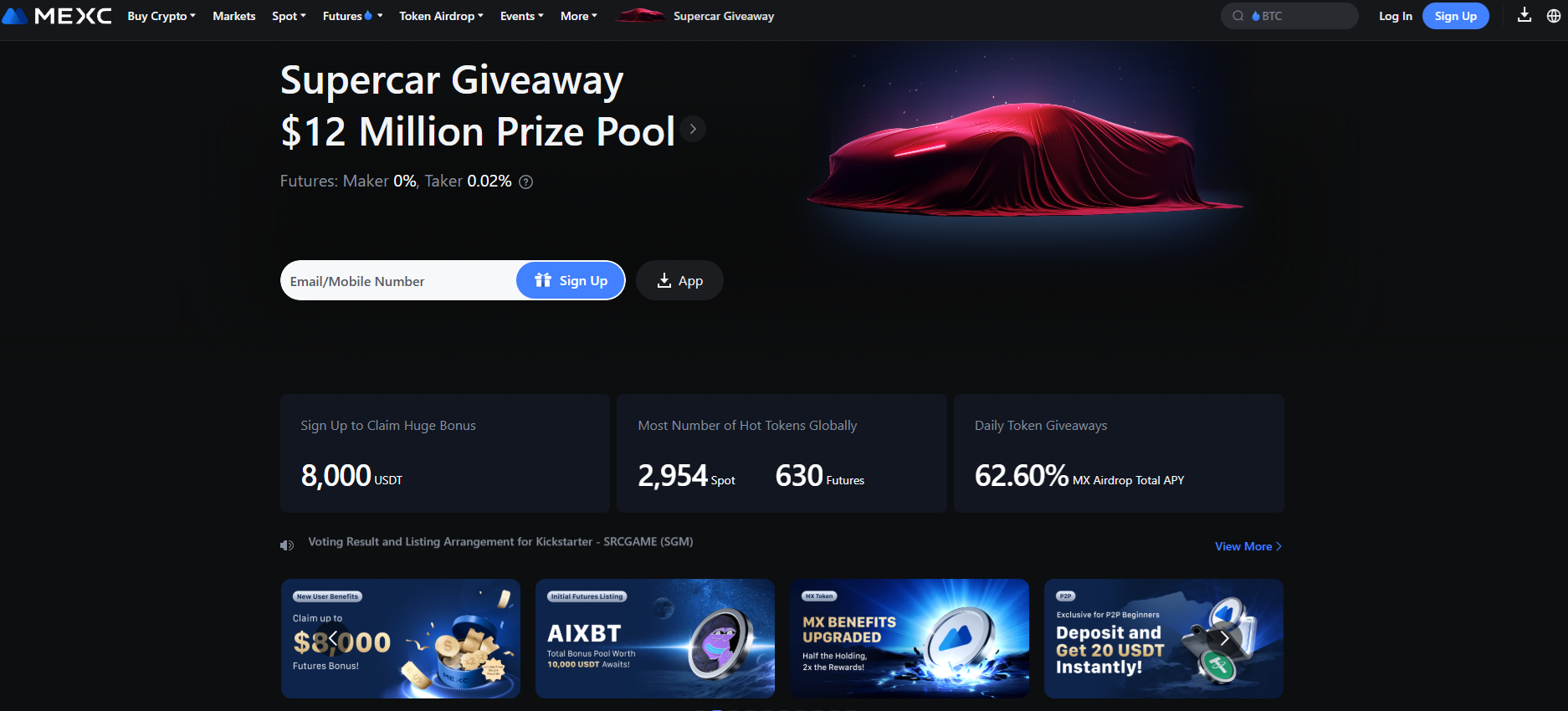

#5. MEXC

What is MEXC?

MEXC is a global cryptocurrency exchange that offers a wide range of digital assets for trading. Known for its user-friendly interface and advanced trading tools, it supports spot, margin, and futures trading. MEXC is popular for its low fees and extensive cryptocurrency selection, making it a go-to platform for both beginners and experienced traders.

Advantages and Disadvantages of MEXC

MEXC Commissions and Fees

MEXC charges competitive trading fees starting at 0.2% for both makers and takers, with further discounts available for holding its native token, MX. Withdrawal fees vary based on the cryptocurrency but are generally low. The platform does not charge deposit fees, making it appealing for cost-conscious traders. Its low-fee structure is one of its key selling points in the cryptocurrency market.

How to Choose the Right Crypto Broker in Thailand

Choosing the right crypto broker in Thailand requires careful consideration of key factors to ensure a smooth trading experience. Thai traders should prioritize robust security measures to safeguard client funds and digital assets. Evaluate trading platforms for features like a user-friendly interface, low trading fees, and diverse trading options such as cryptocurrency exchanges, CFD trading, and futures trading. It's essential to verify the broker’s compliance with the Securities and Exchange Commission and their adherence to a strong regulatory framework. Check for multiple deposit methods like bank transfers and ensure the availability of extensive educational resources and strong customer support to assist both professional traders and crypto traders with varying trading styles.

Common mistakes include neglecting to assess trading fees, withdrawal fees, and the broker’s fee structure, which can erode profits for active traders. Avoid platforms with limited trading instruments, insufficient regulatory compliance, or a lack of advanced trading tools like technical analysis features. Traders should also steer clear of platforms with poor liquidity or inadequate market research tools, as these can hinder effective trading strategies. Choosing brokers without a proven track record in managing crypto assets and retail investor accounts increases the risk of losing money rapidly in the volatile crypto market.

Also Read: The 5 Best Offshore Brokers in Thailand in 2024: Ultimate Choice

Conclusion

Choosing a reliable broker is crucial for success in financial markets, especially for Thai traders exploring options like crypto trading platforms or trading forex. A broker's regulatory compliance and a strong regulatory framework ensure client funds are protected while offering access to diverse trading instruments like global stocks, currency pairs, and crypto assets. Features such as advanced trading tools, seamless trading, and low trading fees significantly enhance the trading experience, making it suitable for both retail investor accounts and professional traders.

Whether you're interested in futures trading, CFD trading, or exploring cryptocurrency exchanges, conducting proper market research and using brokers with extensive educational resources is key. Ensure the broker offers strong customer support, robust security measures, and multiple payment options like bank transfers. Starting with a minimum deposit, focus on developing trading strategies and understanding the risks, such as losing money rapidly. With the right preparation, you can confidently navigate the crypto market and make informed decisions on the best crypto brokers in Thailand.

FAQs

What is the best crypto broker for beginners in Thailand?

The best broker for beginners offers user-friendly interfaces, clear fee structures, and educational resources.

Are crypto brokers in Thailand regulated?

Yes, most reputable brokers in Thailand adhere to local regulations set by financial authorities.

How do I start trading cryptocurrency in Thailand?

Choose a regulated broker, create an account, deposit funds, and start trading via their platform.