If you're a trader in South Korea, choosing the right forex broker can make a big difference in your success. With so many options out there, it’s essential to find a broker that offers low spreads, secure platforms, and local support. In this guide, we’re covering the 5 best Forex brokers in South Korea for 2024, considering factors like regulation, trading fees, and the ease of depositing and withdrawing funds. Whether you’re new to trading or have years of experience, these brokers offer features that make them a great fit for Korean traders.

From regulated platforms to advanced trading tools, we’ll help you find the right broker to meet your needs. We’ll highlight each broker’s advantages, including the availability of MetaTrader 4 and 5, as well as mobile apps for traders who prefer to stay connected on the go. Let's see and discover which broker is the best fit for your trading style in 2024!

What to Consider When Choosing a Forex Broker in South Korea

When selecting a forex broker in South Korea, there are a few key factors to keep in mind that can help you make the best choice for your trading needs.

- Regulatory oversight: The first thing you should look for is whether the broker is properly regulated. It’s important to choose a broker that is regulated by trusted authorities like the Financial Supervisory Service (FSS) in South Korea, or well-known international bodies such as the FCA, CySEC, or ASIC. This helps ensure your funds are protected, and the broker follows strict industry standards.

- Low spreads and commissions: The tighter the spreads, the lower your trading costs will be. Brokers with low spreads can help you maximize profits by minimizing the difference between the bid and ask prices. Make sure to also check if there are any hidden commissions that could add up over time.

- User-friendly trading platforms: A good platform makes a big difference in your trading experience. Look for brokers that offer well-established platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are popular for their ease of use and advanced charting tools. Some brokers may also offer their own proprietary platforms, which can be great as long as they are intuitive and reliable.

- Local customer support: Having access to Korean language support can be a lifesaver, especially if you run into any issues or need help understanding your trading tools. Also, brokers that offer local payment methods make it easier to deposit and withdraw your funds.

- Available currency pairs: Ensure that your broker offers a broad selection of currency pairs, including the South Korean won (KRW). Having access to a variety of pairs means you can diversify your trading and take advantage of more market opportunities.

The 5 Best Forex Brokers in South Korea

#1. AvaTrade: Best Overall for Traders in South Korea

What is AvaTrade?

AvaTrade is a globally recognized broker offering a wide range of trading instruments, including forex, cryptocurrencies, stocks, commodities, and indices. It operates under the regulation of several top-tier financial authorities, such as ASIC in Australia, CySEC in Cyprus, and CBI in Ireland, ensuring a secure trading environment for its users. AvaTrade provides access to popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside its own AvaTradeGO mobile app, making it highly accessible for traders in South Korea. The broker is known for offering comprehensive educational resources, which makes it a great choice for both beginners and experienced traders.

Advantages and Disadvantages of AvaTrade

AvaTrade Fees and Commissions

In terms of fees and commissions, AvaTrade primarily earns through spreads, meaning there are no additional commissions on most trades. Spreads on major currency pairs like EUR/USD start from 0.9 pips, which is competitive in the market. However, traders should be aware of an inactivity fee of $50 after three months of no account activity, and an annual administration fee after 12 months of inactivity. There are no fees for deposits or withdrawals, making it a cost-effective option for most South Korean traders.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. Exness

What is Exness?

Exness is a globally recognized forex broker established in 2008, regulated by top-tier financial authorities such as CySEC, FCA, and FSA in various jurisdictions. It offers a wide range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal. Exness is known for its user-friendly platforms, high leverage options (up to unlimited), and 24/7 multilingual customer support, making it a popular choice for traders in South Korea. The broker is particularly appreciated for its fast execution, secure fund handling through segregated accounts, and advanced trading tools.

Advantages and Disadvantages of Exness

Exness Fees and Commissions

Exness offers competitive pricing, depending on the account type. The Standard accounts come with spreads starting from 0.2 pips and no commission, while the Raw Spread and Zero accounts offer even tighter spreads starting from 0.0 pips, with a commission ranging from $0.05 to $3.50 per lot per side. Additionally, Exness provides free deposits and withdrawals and does not charge any inactivity fees, making it a cost-effective option for South Korean traders.

OPEN AN ACCOUNT NOW WITH EXNESS AND GET YOUR WELCOME BONUS

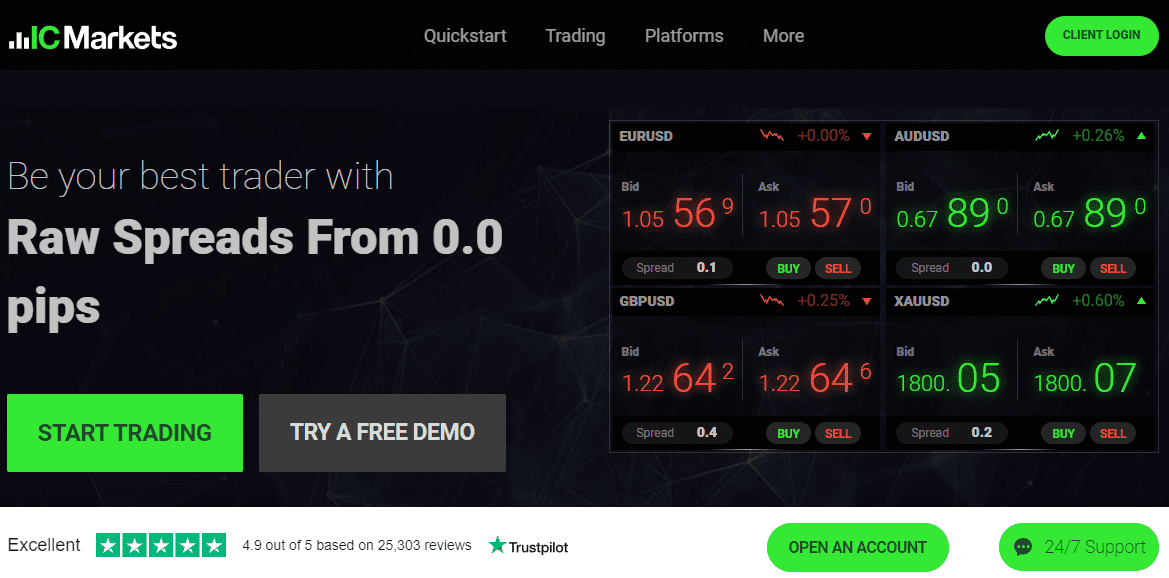

#3. IC Markets

What is IC Markets?

IC Markets is a globally recognized forex and CFD broker, founded in 2007 and regulated by authorities such as ASIC (Australia), CySEC (Cyprus), and the FSA (Seychelles). It offers a range of robust trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView, making it highly versatile for traders in South Korea. IC Markets is known for its tight spreads, fast execution, and reliable trading conditions, making it a top choice for South Korean traders, particularly those engaged in scalping or high-frequency trading.

Advantages and Disadvantages of IC Markets

IC Markets Fees and Commissions

IC Markets offers competitive pricing with spreads starting from 0.0 pips on their Raw Spread account. For this account type, a commission of $3.50 per lot per side is charged. Standard accounts have no commission and start with spreads from 1.0 pips. Additionally, the broker does not charge any deposit or withdrawal fees, which is a great advantage for traders managing their accounts from South Korea.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

#4. XM

What is XM?

XM is a globally recognized forex and CFD broker, regulated by top-tier authorities such as CySEC, FSC, FSA, DFSA, FSC, and FSCA, providing traders in South Korea with a high level of trust and security. XM offers access to over 1,000 financial instruments, including forex, commodities, cryptocurrencies, and indices, through robust platforms like MetaTrader 4 and MetaTrader 5. With a minimum deposit as low as $5, XM is an attractive choice for both beginner and advanced traders, offering features like leverage up to 1000:1 and dedicated customer support.

Advantages and Disadvantages of XM

XM Fees and Commissions

Regarding fees and commissions, XM offers tight spreads, with accounts like the XM Ultra Low Account offering spreads starting from 0.6 pips on major forex pairs. Most account types have no commission on forex trades, but the Shares Account charges a $7 commission per lot. XM also charges overnight swap fees for positions held after 10 PM GMT and an inactivity fee after 90 days of no activity. Importantly, XM does not charge deposit or withdrawal fees, making it cost-effective for South Korean traders.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

#5. FBS

What is FBS?

FBS is a widely recognized broker that has gained popularity in South Korea due to its low minimum deposit (as low as $5) and access to high leverage up to 1:3000. Regulated by authorities like CySEC, ASIC, and the FSC of Belize, FBS provides a secure trading environment with features like MetaTrader 4 and 5 platforms, negative balance protection, and a variety of account options suited for both beginners and experienced traders. Its commitment to providing educational resources and transparent trading conditions makes it a top choice for South Korean traders.

Advantages and Disadvantages of FBS

FBS Fees and Commissions

FBS offers tight spreads starting from 0.7 pips on major currency pairs, and commission-free trading on most account types. However, there are overnight fees for positions held after market close, and small withdrawal fees, especially for methods like Skrill and Neteller. FBS does not charge inactivity fees, which is a relief for traders who don't trade frequently.

OPEN AN ACCOUNT NOW WITH FBS AND GET YOUR WELCOME BONUS

How to Get Started with a Forex Broker in South Korea

Getting started with a forex broker in South Korea is a straightforward process. Whether you're new to trading or just looking for a new broker, following these steps will get you up and running in no time.

Step 1: Choose a Trusted Broker

The first step is to choose a regulated forex broker that is reliable and suits your needs. Look for brokers that are regulated by top authorities like CySEC, ASIC, or the FSC. Make sure the broker offers essential features like Korean language support, access to MetaTrader 4 or 5, and favorable trading conditions such as low spreads and commissions.

Step 2: Open an Account

Once you’ve selected your broker, go to their website and open a trading account. Most brokers have a variety of account types, like Standard, Micro, or ECN accounts, so choose one that fits your budget and trading goals. You’ll need to provide some personal information and documents like your ID for verification.

Step 3: Fund Your Account

After your account is approved, you’ll need to deposit funds to start trading. Brokers usually support a variety of payment methods such as credit cards, bank transfers, or e-wallets like Skrill and Neteller. Some brokers allow deposits as low as $5, making it easy to get started without a large initial investment.

Step 4: Download the Trading Platform

Next, download the trading platform that your broker provides. Most brokers in South Korea support MetaTrader 4 or 5, which are popular for their advanced charting tools and ease of use. You can also trade using mobile apps if you prefer to trade on the go.

Step 5: Start Trading

Once your funds are in your account and the platform is ready, you’re good to go! Start with a demo account if you want to practice without risking real money. When you’re comfortable, switch to your live account and begin trading with real funds. Make sure to use the educational resources provided by your broker to improve your skills.

Conclusion

Choosing the right forex broker in South Korea is essential for a smooth and profitable trading experience. Brokers like Exness, AvaTrade, and FBS stand out for their combination of low fees, strong regulation, and reliable trading platforms like MetaTrader 4 and 5. Whether you're just starting out or are an experienced trader, it's important to select a broker that fits your trading style and offers the right tools for success. Consider factors like local support, currency options, and trading conditions before making your choice. With any of these top brokers, you'll be well-equipped to enter the forex market confidently!

Also Read: The 5 Best Forex Brokers in Thailand in 2024

FAQs

What should I look for in a forex broker in South Korea?

Make sure the broker is regulated by authorities like CySEC or FSC, offers low spreads, and has user-friendly trading platforms such as MetaTrader 4 or 5. Also, check if they have Korean language support and local payment options.

Are there any fees I should be aware of when trading forex in South Korea?

Yes, common fees include spreads, commissions, and overnight swap fees. Some brokers also charge withdrawal fees, while others might have an inactivity fee after a period of no trading.

Can I open an account with a low deposit in South Korea?

Yes, many brokers like FBS and Exness allow you to start trading with a low minimum deposit, sometimes as little as $5. This makes it easy for beginners to get started without needing a large amount of capital.