When it comes to forex trading, picking the right forex broker can be a game-changer, especially if you're trading from Spain in 2026. With a bustling foreign exchange market and plenty of forex brokers in Spain to choose from, it’s essential to find a trading platform that’s not only reliable but also regulated by the National Securities Market Commission. Spanish forex traders often look for brokers with solid customer service, fair fees, and trading tools to help them succeed. In this article, we’ll take you through the 5 best forex brokers in Spain—perfect for both new and experienced traders looking to boost their trading experience this year.

So, why does the choice of a forex broker matter so much? Each trading platform brings unique features, fee structures, and tools to the table. A good forex broker should offer accessible and straightforward trading accounts, real-time data, and a user-friendly trading platform—all while maintaining legal compliance. We’ve carefully selected brokers that deliver all this and more, keeping forex trading legal and profitable for forex traders in Spain. Whether you're a forex trader just starting or a seasoned pro, our picks for the best forex brokers are here to make your trading journey smoother and more secure.

Why Choosing the Right Forex Broker in Spain Matters

Choosing the right forex broker in Spain is a big deal, especially with the potential risks and rewards of the foreign exchange market. With many brokers available, it’s crucial to select one that is regulated to ensure your funds are secure and that trading is conducted fairly. Regulated brokers follow strict guidelines from bodies like the National Securities Market Commission (CNMV) and ESMA. This regulation isn’t just for peace of mind; it directly impacts your ability to trade confidently, knowing there’s protection against unfair practices and a framework in place to secure client funds.

Here’s why choosing a regulated and reliable broker is essential:

- Regulatory Protection: Regulated brokers must follow strict rules to protect client funds, such as keeping them separate from the broker’s funds, reducing the risk of misuse.

- Lower Trading Costs: Comparing spreads and commissions is key, as these fees can add up. Look for brokers with competitive spreads, especially if you’re a frequent trader.

- Reliable Trading Platforms: User-friendly platforms, like MT4 or MT5, along with mobile options, are essential for quick, efficient trading.

- Quality Customer Support: Having access to responsive customer support can be a lifesaver if you encounter issues with your trading account.

- International vs. Local Brokers: While international brokers may offer advanced tools, local Spanish brokers might provide better customer support and familiarity with forex trading legal requirements specific to Spain.

The 5 Best Forex Brokers in Spain

#1. AvaTrade: Best Overall for Traders in Spain

What is AvaTrade?

AvaTrade is a popular forex and CFD broker known for its diverse trading platforms and extensive global regulation. Licensed by top authorities, including the Central Bank of Ireland and regulators in Japan, Australia, and South Africa, AvaTrade provides Spanish traders with a high level of security and transparency. AvaTrade offers both MetaTrader 4 and 5, the proprietary AvaTradeGO mobile app, and the options-focused AvaOptions, making it a versatile choice for traders at all levels. With its vast range of tradable assets, from forex pairs to commodities and cryptocurrencies, AvaTrade’s reliability and strong regulatory framework make it one of the best brokers in Spain.

Advantages and Disadvantages of AvaTrade

AvaTrade Fees and Commissions

In terms of fees, AvaTrade is competitive, offering commission-free trading with costs built into the spreads. These spreads are generally low for major pairs, though they can widen during high-volatility periods. AvaTrade also has minimal fees for deposits and withdrawals, and they offer flexible funding options, including credit cards, e-wallets, and wire transfers, making it accessible for various types of forex traders.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

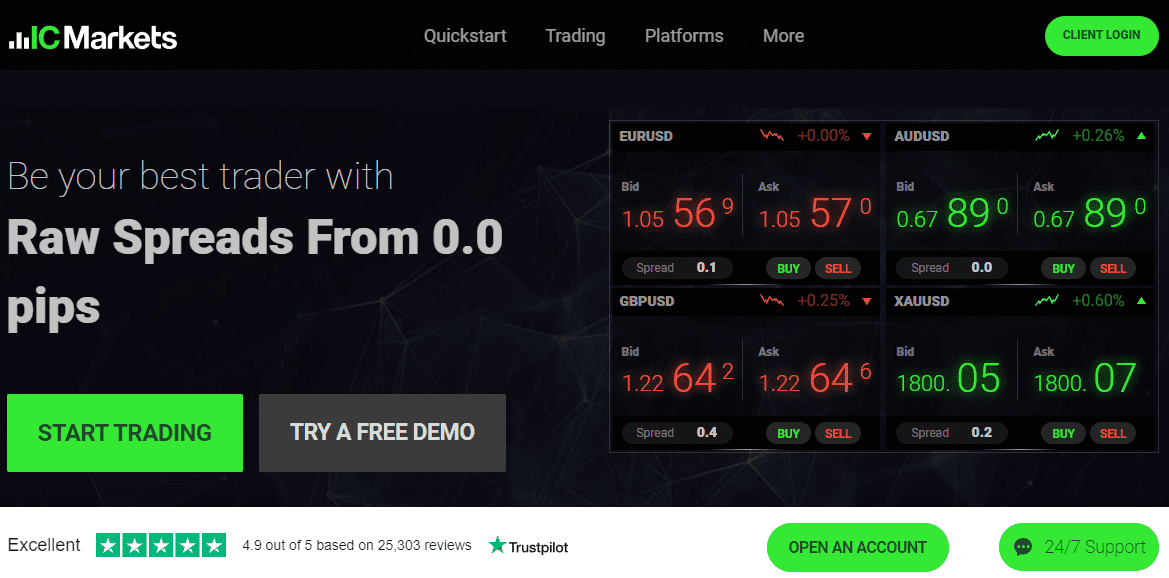

#2. IC Markets

What is IC Markets?

IC Markets is a highly regarded broker among Spanish forex traders for its tight spreads and rapid execution speeds. Known for its robust regulation under ASIC and CySEC, IC Markets provides a secure and reliable environment for forex trading. Traders can access MetaTrader 4, MetaTrader 5, and cTrader, each equipped with advanced charting tools and algorithmic trading capabilities. With access to a broad selection of trading instruments including forex, indices, commodities, and stocks, IC Markets supports both scalpers and long-term traders alike.

Advantages and Disadvantages of IC Markets

IC Markets Fees and Commissions

IC Markets offers two main account types: the Standard Account with no commission and a Raw Spread Account with low commissions. The Raw Spread Account has spreads as low as 0.0 pips, ideal for high-frequency traders. Both accounts feature competitive trading costs, making IC Markets a cost-effective option in the Spanish market.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

#3. Pepperstone

What is Pepperstone?

Pepperstone is a well-respected broker offering a wide array of trading platforms and tools, such as MetaTrader 4, MetaTrader 5, and cTrader, designed to cater to both beginners and experienced traders. Regulated by multiple authorities, including ASIC, CySEC, and BaFin, Pepperstone is known for its strong compliance and customer trust. Spanish traders benefit from its efficient customer support, multiple funding options, and the ability to trade in numerous asset classes like forex, commodities, and cryptocurrencies.

Advantages and Disadvantages of Pepperstone

Pepperstone Fees and Commissions

Pepperstone's fee structure is straightforward and low-cost. Its Razor Account provides access to tight spreads with a small commission per trade, while the Standard Account offers commission-free trading with slightly higher spreads. This setup allows traders to choose based on their strategy, whether low-cost or high-frequency trading.

OPEN AN ACCOUNT NOW WITH PEPPERSTONE AND GET YOUR WELCOME BONUS

#4. XM

What is XM?

XM is a globally respected brokerage offering traders access to a wide range of instruments—including forex, stocks, commodities and indices—via the popular MetaTrader 4 and MetaTrader 5 platforms. It features a low minimum deposit, tight spreads, and generous flexibility such as leverage up to 1:1000 (depending on jurisdiction). XM is multi-regulated, with oversight from authorities such as the Cyprus Securities and Exchange Commission (CySEC) and others including the FSC, FSA, DFSA and FSCA, providing strong protection and governance. For traders in Spain, where regulatory transparency and investor protections are vital under the Comisión Nacional del Mercado de Valores (CNMV) framework, XM stands out as one of the best brokers because it combines robust regulation, competitive trading conditions and global experience.

Advantages and Disadvantages of XM

XM Commissions and Fees

XM charges no per-lot trading commission on its Micro and Standard accounts, meaning all trading costs are incorporated into the spread, which for the Standard account starts at around 1.6 pips on major currency pairs. Traders holding positions overnight may incur swap/rollover fees, and an inactivity fee typically applies if the account remains inactive for 90 days or more.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

#5. Tickmill

What is Tickmill?

Tickmill is a popular choice for low-cost trading, particularly known for its ECN accounts with ultra-low spreads. Regulated by FCA and CySEC, Tickmill provides a high level of security and transparency for Italian traders. The broker offers MetaTrader 4 as its main trading platform and supports various strategies, including scalping and copy trading. Tickmill is also well-suited for algorithmic traders who rely on automated trading systems.

Advantages and Disadvantages of Tickmill

Tickmill Fees and Commissions

Tickmill offers some of the lowest spreads in the market, with spreads starting from 0.0 pips in the Pro account, where a small commission is charged per trade. For standard accounts, spreads start from 1.6 pips with no commission. Tickmill does not charge for deposits or withdrawals and has no inactivity fees, making it a cost-effective choice for a range of traders.

OPEN AN ACCOUNT NOW WITH TICKMILL AND GET YOUR WELCOME BONUS

How to Get Started with a Forex Broker in Spain

If you're ready to start forex trading in Spain, the process can be straightforward if you follow a few essential steps. Choosing the right broker, setting up an account, and understanding how to trade responsibly are crucial to getting off to a solid start in the forex market. Here’s a guide to help you get started.

Step 1: Educate Yourself

Before jumping in, take some time to understand the basics of forex trading. Familiarize yourself with key terms like currency pairs, pips, leverage, and market analysis. Many brokers and financial platforms offer free educational resources, including online courses, webinars, and tutorials, which are valuable for understanding market behavior and improving your trading skills.

Step 2: Choose a Reliable Broker

A key step is selecting a reputable broker regulated by the National Securities Market Commission (CNMV) or other recognized bodies like ESMA. Look for brokers that offer competitive spreads, user-friendly trading platforms, and dependable customer support. Ensure your chosen broker supports the trading instruments you’re interested in, whether it's major currency pairs, commodities, or indices.

Step 3: Open a Trading Account

After choosing a broker, the next step is to open a trading account. Most brokers offer various account types, including demo accounts for practice. Start with a demo account to get a feel for the trading platform and test different strategies without risk. Once you're comfortable, you can move to a live account and fund it according to your budget and risk tolerance.

Step 4: Develop a Trading Plan

Creating a trading plan is essential for maintaining discipline. Your plan should outline your financial goals, preferred trading times, and strategies for entering and exiting trades. Include risk management techniques, like setting stop-loss orders, to protect against significant losses. A clear plan helps prevent impulsive decisions and keeps you focused on long-term success.

Step 5: Start Trading with Caution

With a funded account and trading plan, you’re ready to start trading. Begin with smaller trades to test the waters and stick to your plan, analyzing market trends and using tools like technical indicators. Remember, the forex market can be volatile, so apply risk management strategies carefully, and avoid overextending your position.

Step 6: Keep Learning and Improving

Forex trading is a continuous learning journey. Stay updated on economic news and global events that can impact currency prices. Regularly evaluate your trades to identify areas for improvement and adjust your strategy as needed. Engaging with trading communities or learning from more experienced traders can also provide valuable insights to enhance your skills.

Conclusion

Choosing the best forex broker in Spain can make a big difference in your trading journey. Whether you're a beginner or an experienced trader, the right broker provides the tools, customer support, and security you need to trade with confidence. Each broker has unique strengths, from low fees to powerful trading platforms, so take the time to consider what suits your trading style best. Ultimately, regulated brokers that offer fair fees, a range of trading instruments, and responsive support are great choices for Spanish traders looking to get the most out of their forex trading experience.

Also Read: The 5 Best Forex Brokers in Italy in 2026

FAQs

What are the benefits of choosing a regulated broker in Spain?

Regulated brokers must follow strict guidelines to protect your funds and provide a safe trading environment. They’re required to maintain client fund protection, offer fair trading conditions, and follow best practices, which can give you peace of mind.

How much money do I need to start trading forex in Spain?

The amount varies by broker, but many offer accounts with low minimum deposits starting around €100. It’s smart to start with an amount you can afford to lose as you learn and build confidence.

Can I try forex trading without using real money?

Yes, most brokers offer demo accounts that allow you to practice trading with virtual funds. Demo accounts are a great way to learn the platform, test strategies, and get comfortable before risking real money.