In an age where markets move by the second, having dependable forex mobile apps in your pocket has become critical. The Asia Forex Mentor team has meticulously analyzed and compiled this list of the 10 Best Mobile Forex Apps, choosing only those that satisfy the highest standards of credibility, functionality, and customer happiness. Whether you're new to forex trading or an experienced trader, this article is for you.

We'll go over the best forex trading apps , highlighting how they differ and explaining what makes each one unique, from pricing transparency to charting tools, convenience of use to customer support. Whether you're looking for a reliable mobile trading app for on-the-go analysis or want to connect with reputable forex brokers using your phone, this article will help you identify the finest option about forex trading in 2025.

What are Mobile Forex Apps and Why Does It Matter?

A mobile forex trading app is a smaller version of a forex trading platform that works on smartphones and tablets. Its major job is to connect mobile forex traders with the forex brokers they choose to work with. This lets them access the forex market from anywhere, at any time. You can keep an eye on current pricing, place trades, and manage risk in real time with these trading applications.

This flexibility is very important for active traders because the market is open 24 hours a day and reacts right away to news. A mobile app lets traders take advantage of spontaneous trading opportunities without being stuck at a desk, which keeps them in touch with the flow of the global financial markets.

Most mobile trading platforms these days do more than just execute trades. They have extensive and advanced charting tools, notifications, news feeds that are built in, and even educational materials. Some apps include robust charting tools that let users try out different trading strategies while they're on the road. The best thing about it is how easy it is to use. You may trade quickly, easily, and at any time. The downside is that smaller screens might make it tougher to do extensive analysis, and trades may be interrupted by shaky internet connections. Trading apps are still important for both beginners and professionals who seek quick, dependable, and well-informed access to the world of forex trading.

How to Choose the Best Mobile Forex Apps

When it comes to picking the best forex app, it's less about the brand names and more about finding the one that works for you. First, look at performance: a good forex app should work well on both iOS and Android devices and link with most forex brokers that offer different types of trading accounts. Take a detailed look at the mobile trading experience. Is it easy enough for regular traders to use, or does it have advanced trading features for advanced traders?

An excellent app lets you do good technical analysis on the move by giving you access to technical indicators, drawing tools, and mobile charting. You won't miss any crucial market moves or new market news with helpful features like an economic calendar, price alerts, push notifications, or personalized trading alerts.

Cost and flexibility are important as well. You can practice, gain access and start trading without risking real money with certain apps, and others work with third-party software or a web trader platform for a more seamless trading experience. A good platform should handle a large selection of currency forex pairs, including main and exotic currency pairs, as well as other types of assets like trading CFDs, or even mutual funds. The proper option lets mobile traders access financial markets, use effective trading methods, and have a balanced trading experience that makes it easy to understand markets while giving them reliable trading tools and continuing support.

How We Chose the Tools

At Asia Forex Mentor, our team carefully reviewed leading forex trading apps to create this list of the best mobile forex trading apps for 2025. We tested mobile apps from trusted forex brokers, checking speed, reliability, and security. Each app was assessed for features, functionality, and trading strategies that support both beginners and active traders.

We also weighed feedback from forex traders, overall reputation, and competitive pricing compared to peers. The mobile forex trading apps that made the cut stood out for ease of use, responsive customer care, real time price alerts and unique advantages such as excellent charting tools or extended market hours.

10 Best Forex Mobile Apps List

#1. IG Trading

What is IG Trading?

IG Trading is a mobile forex trading app created by IG Group, one of the most well-known forex brokers in the business. It enables traders to access a variety of markets, such as forex, CFDs, indices, and commodities, directly from their phones. The software is intended for both novices and experienced traders, with a simple layout, quick execution, and dependable features. What distinguishes IG is its combination of robust charting tools, a good regulatory reputation, and integrated learning via IG Academy.

Advantages and Disadvantages of IG Trading

IG Trading Pricing and Features

IG Trading is free to download on iOS and Android, and there are no membership costs. Costs are incurred through spreads, commissions, and overnight funding, depending on the instrument. Spreads on key currency pairings, such as EUR/USD, begin at about 0.6 pips, though pricing varies by account type and area. The program provides comprehensive charting with more than 28 technical indicators, price alerts, news integration, and chart-based trading. It also provides access to educational resources through IG Academy. Limitations include decreased functionality in some places (for example, iOS PWA instead of native app in certain countries) and restricted product access due to legislation.

#2. CMC: Trading App

What is CMC: Trading App?

The Next Generation mobile forex trading app from CMC Markets gives both new and experienced traders access to more than 12,000 financial assets, such as forex, commodities, indices, ETFs, and shares. It works well on both iOS and Android and has significant features including configurable dashboards, tracking client sentiment, and visualizations that look good on mobile devices. What sticks out is the ability to manage trades on charts without any problems, get real-time notifications, and have a huge range of instruments to choose from. This makes it a great choice for traders who want both depth and convenience of use.

Advantages and Disadvantages of CMC: Trading App

CMC: Trading App Pricing and Features

The CMC Markets mobile trading app is free to use and does not require a membership; pricing is based on spreads and commission. The FX Active account has spreads starting at 0.0 pips on six main currency pairs and a 25% spread reduction on 300+ more pairs, with a flat cost of US$2.50 each US$100,000 notional traded. The software provides comprehensive charting capabilities (over 25 technical indicators and 15 drawing tools), mobile-optimized charts, customisable watchlists, client sentiment tracking, Reuters news, and a full economic calendar with push alerts. FX Active pricing varies by region/account, crypto is only available as CFDs (not tangible), and there is a dormant account cost for inactivity.

#3. FOREX.com

What is FOREX.com ?

FOREX.com Mobile program is a mobile forex trading program created by GAIN Capital (part of StoneX) that allows traders to buy and sell more than 80 worldwide currency pairs via their phones or tablets. It's designed for both new and experienced traders, with a clear interface, one-swipe trading, and real-time alerts. What distinguishes it is how easily it integrates with its web and desktop trading platforms, provides comprehensive charting via TradingView, and features Performance Analytics for tracking your approach. The broad instrument access and instructional reach make it popular worldwide.

Advantages and Disadvantages of FOREX.com

FOREX.com Builder Pricing and Features

The FOREX.com mobile app is free to download on iOS and Android, with no subscription or one-time cost necessary. Spreads and commissions are the sources of trading costs: the Standard account employs variable spreads (for example, 1.4 pips EUR/USD in the US), whereas the RAW Pricing account offers spreads as low as 0.0 pips plus a $7 per $100,000 round-turn commission. The software contains more than 60 technical indicators, 50 drawing tools, 14 chart kinds, real-time price alerts, a Performance Analytics dashboard, an economic calendar, integrated Reuters news, and access to sample accounts with $50,000 in virtual assets. Regional limits on some account kinds and features, app performance issues on occasion, and inactivity penalties in accounts with no trading activity are all examples of limitations.

#4. OANDA Forex Trading

What is OANDA Forex Trading?

OANDA Global Markets offers the OANDA Mobile App for both iOS and Android. It lets you trade FX and CFDs quickly and reliably from anywhere in the globe. It is made for both new and experienced traders, with features like easy chart integration, adjustable order settings, and consistency between platforms. The app is unique since it has built-in TradingView charting, a large choice of instruments (forex, cryptos, indices, metals, shares, and commodities), and the ability to execute trades in a variety of ways. It also has useful features including real-time alerts, options for risk and profit parameters, and a clean, mobile-friendly user interface.

Advantages and Disadvantages of OANDA Forex Trading

OANDA Forex Trading Pricing and Features

The OANDA Mobile App is free to download and use; there are no monthly or one-time costs. Spreads and fee structures vary by instrument and account type, with FX and CFD spreads being competitive but widening during volatile or low-liquidity periods. The app has TradingView's powerful charting technology (real-time charts, indicators, and drawing tools), customized order tickets with risk and profit settings, real-time push notifications, an economic calendar, market news, and demo account support. It supports MT5 and webtrader connectivity, and its instruments include currency pairs, cryptocurrencies (as CFDs), indices, metals, commodities, and stocks. Limitations include crypto-only CFD exposure (no spot cryptocurrency), regional restrictions on features and account types, and potential inactivity penalties.

#5. XTB – xStation

What is XTB – xStation?

XTB's mobile forex trading app, xStation Mobile, gives both new and experienced traders access to over 3,000 worldwide markets, including forex, indices, commodities, share CFDs, and ETFs, via iOS, Android, and Windows smartphones. It is intended for easy on-the-go mobile trading, with real-time account management, interactive charts, customisable alerts, and the ability to switch between demo and actual accounts instantaneously. What distinguishes it is its award-winning interface and integrated teaching base, which make it simple to analyze markets, place trades, and remain up to date on market news and analysis.

Advantages and Disadvantages of XTB – xStation

XTB – xStation Pricing and Features

You can download the xStation Mobile App for free. It has both active and demo accounts, each with €100,000 or the same amount in virtual money. Pricing is based on two types of accounts: Standard, which has floating spreads starting at 0.9 pips on EUR/USD and no commission, and Pro, which has tighter market spreads down to 0.1 pips and a commission of about $3.50 per side ($7 round-turn) on forex trades. Some of the most important features are interactive charting with technical indicators, customized alerts, bulk closing of orders, an economic calendar, and comprehensive trade management, which includes changing orders. The app works on all major platforms, including Android, iOS, and Windows. Some of the problems are that instruments may not be available in all jurisdictions, there are no popular MT4/MT5 platforms for people who desire them, and dormant accounts are charged inactivity fees.

#6. Pepperstone Mobile App

What is Pepperstone Mobile App?

The Pepperstone Mobile App lets you trade forex, indices, commodities, shares, and cryptocurrencies (via CFDs) on both iOS and Android. It works for both new and experienced traders who demand quick execution, chart-based trading, and easy account management. The program has very tight spreads (as low as 0.0 pips on Razor accounts), configurable watchlists, and fast one-click trading that lets you respond quickly to changes in the global financial markets. It focuses on both simplicity and power, with features that let traders take advantage of trading opportunities no matter where they are.

Advantages and Disadvantages of Pepperstone Mobile App

Pepperstone Mobile App Pricing and Features

You don't have to pay anything to get the Pepperstone Mobile App. There are no membership or one-time fees. Trading costs come from spreads and commissions. There are two main types of accounts at Pepperstone: Standard (just spreads) and Razor (tight raw spreads from 0.0 pips + commission). The software works on most devices and contains features including different types of charts, technical indicators, watchlists, real-time pricing, position management, push alerts, market news, and a demo account with $50,000 in virtual money. One drawback is that bitcoin trading is only offered as CFDs, which are riskier, and some account types or platform features may not be available in all areas.

#7. IC Markets Mobile App

What is IC Markets Mobile App?

The IC Markets Mobile application is a free mobile forex trading program for both iOS and Android. It is useful for both new and experienced traders. It lets you trade forex and CFDs on a wide range of assets, including commodities, indices, equities, futures, bonds, and cryptocurrencies. It has tight spreads, works with many platforms (MetaTrader 4, MetaTrader 5, cTrader, TradingView, and WebTrader), lets you manage your account from within the app, and sends you alerts in real time.

Advantages and Disadvantages of IC Markets Mobile App

IC Markets Mobile App Pricing and Features

You can download the app for free and don't have to pay a membership or one-time fee. The costs of trading come from spreads and commissions. There are two types of accounts: Standard (just spreads, with a markup of about 0.8 pips) and Raw Spread (spreads starting at 0.0 pips plus a commission of about $7 every round turn). Some of the features are access to a large range of instruments, real-time charting with more than 30 technical indicators, adjustable layouts, an economic calendar, quick deposits and withdrawals, and support in many languages 24/7. Some of the drawbacks are that features may be different in different areas and there may be costs for inactivity.

#8. SaxoTraderGO

What is SaxoTraderGO?

Saxo Bank has a mobile forex trading program called SaxoTraderGO that works on both iOS and Android devices. It helps both new and experienced forex traders by allowing them access to more than 70,000 instruments, such as forex, CFDs, stocks, ETFs, options, futures, bonds, and more. The app is different from others because it has a lot of research tools, real-time market data, advanced technical indicators, and the one-of-a-kind “Account Shield” risk-management feature. The software also works on both online and desktop platforms, so you can have a seamless mobile trading experience across all of your devices.

Advantages and Disadvantages of SaxoTraderGO

SaxoTraderGO Forecast Pricing and Features

You may download and set up SaxoTraderGO for free, and you don't have to pay a monthly fee to use the platform. However, some services, such Level-2 market data, do require a premium membership. The price depends on the trading tier. As you move up from Classic to Platinum to VIP, the spreads get tighter and the commissions go down. The app has a lot of useful tools, such as real-time market data, curated news and research through an in-depth Research hub, over 62 technical indicators, sketching tools, trade signals, an economic calendar, and strong risk management features like “Account Shield” and margin alarms. Some of the limitations are that premium data (Level-2) costs money, lower-tier accounts cost more, and some advanced capabilities are only available to higher-tier or volume-based accounts.

#9. AvaTrade Mobile App

What is AvaTrade Mobile App?

The AvaTrade Mobile program is the broker's own mobile forex trading program. It lets traders use MT4 accounts to trade in markets all around the world from their iOS or Android devices. You may open an account, put money in it, and trade all from the app. It's made for traders who want everything in one place, with an easy-to-use interface that lets them trade, fund, and manage their accounts all in one place.

Advantages and Disadvantages of AvaTrade Mobile App

AvaTrade Mobile App Pricing and Features

There is no membership or one-time fee to download and use the AvaTrade Mobile App. Spreads, rollover/overnight fees (for CFDs), and sometimes commissions depending on the market and area are how trading charges come about. The program works with MT4 and has demo and live accounts, live quotations, charting tools, and a mobile-friendly interface for making deposits, taking money out, and managing trades. Some limitations are that the availability of instruments varies by country and some features are only available in certain regulatory regions.

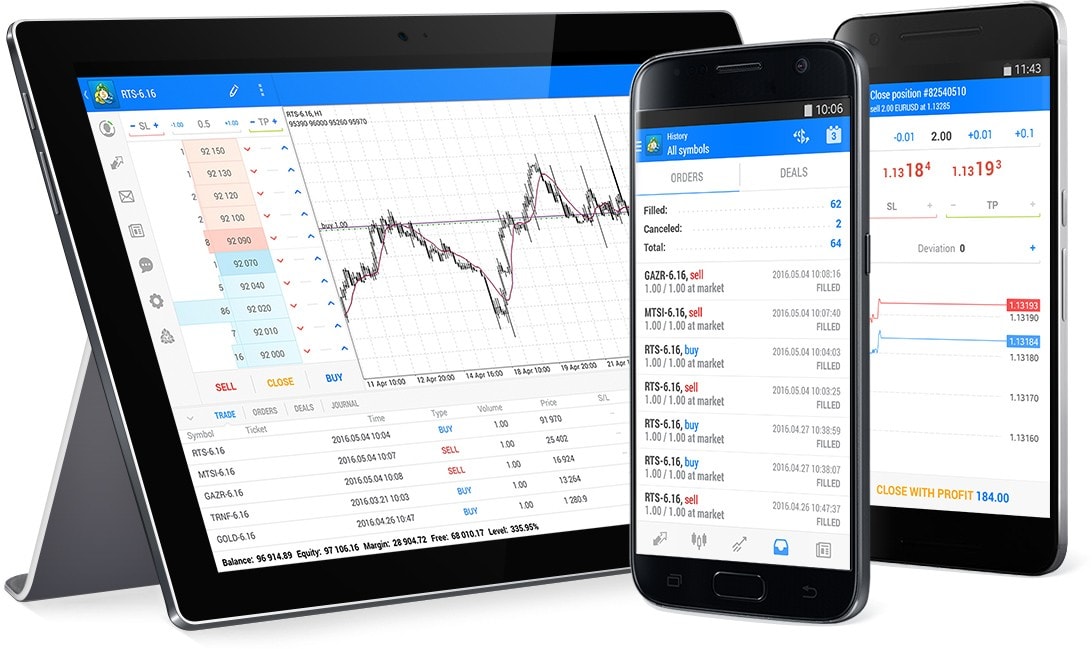

#10. MetaTrader 5 Mobile App

What is MetaTrader 5 Mobile App?

MetaTrader 5 is a free mobile forex trading app developed by MetaQuotes that allows traders to trade forex, equities, futures, and other exchange instruments from their Android smartphones and tablets. It caters to both novices and experienced traders, providing a comprehensive set of tools for both simple and advanced trading methods. What distinguishes it are its dual position accounting systems (netting and hedging), market depth (“Level 2” order book), a diverse range of order types, and a wealth of technical indicators and drawing objects. It seeks to provide professional-grade mobile functionality by integrating MQL5 services, push alerts, and financial news.

Advantages and Disadvantages of MetaTrader 5 Mobile App

MetaTrader 5 Mobile App Pricing and Features

MetaQuotes' MetaTrader 5 Mobile App for Android is completely free to download and use, with no membership or one-time fee. All essential features, including charting tools (3 chart kinds, 9 timeframes), about 30 built-in indicators, 24 graphical objects (lines, shapes, Gann, Fibonacci, Elliott), a complete set of order functions (market/pending/stop orders), and access to open positions and trading history, are free. Users connect to the brokers of their choice, therefore fees like spreads, commissions, and instrument availability are determined by the broker. Push notifications, live news, virtual hosting (VPS), and copy trading (signals) are all supported. Limitations include a crowded interface when multiple tools are active, a tiny screen size that may make comprehensive analysis difficult, and performance/features that rely greatly on the broker's implementation.

Tips for New Users

If you're new to trading apps or begin trading, the best thing to do is take your time and look at numerous possibilities before choosing one. A lot of brokers let you open a demo account with fake money so you may practice without putting your own money at risk. This is a great way to learn how a forex trading platform works. Check to see how easy it is to use the app, if it gives you timely market news, and if the tools work with your trading style.

When entering the forex market or other financial markets, focus on features that matter most to mobile traders, such as chart readability, order execution speed, and account management functions. Avoid common mistakes like over-leveraging or chasing trades without proper analysis. Instead, use alerts, risk-management tools, and educational resources many trading apps provide. Testing multiple platforms ensures you’ll find one that matches your needs before you begin live trading.

Also Read: Should You Refinance Your Mortgage in 2025? 10 Reasons You Might Want To Act Now

Conclusion

One of the most crucial things for anyone trading forex is to choose the correct app-based trading instrument. The correct mobile app not only helps you get things done quickly, but it also helps you do smarter market and technical analysis, which gives traders more control over their strategies.

Our list includes some great choices, such MetaTrader 5, a well-known trading platform, and IG Trading App, which is known for being reliable and having good research. These highlight how flexible today's tools have gotten. Each one lets you trade a wide range of assets and has great tools for maintaining a forex account. Ultimately, the ideal pick depends on what you want to achieve, so try out different apps and find the one that makes you feel confident enough to trade clearly and with discipline.