Investing in the stock market is one of the smartest ways to grow wealth, but choosing the right broker can make all the difference. South Africa offers a range of top-tier brokers, each catering to different needs, whether you're a beginner or a seasoned trader. Did you know the South African stock market has grown by over 30% in the last decade? If you're ready to jump in, this guide will break down the 25 best stock brokers in South Africa, their features, and why they're worth considering!

What Makes a Good Stock Broker?

A good stock broker is characterized by a combination of trustworthiness, functionality, and support. Regulation is paramount (one of the regulators is Financial Sector Conduct Authority), as licensed brokers in forex trading adhere to stringent rules, ensuring the safety of client funds and transparency in operations in their retail investor accounts. Trustworthiness in forex broker is built through a solid reputation, verified user reviews, and a history of reliable service, making these factors non-negotiable in the selection process.

Fees and trading platforms significantly impact the trading experience. Look for brokers with competitive, transparent fees and robust platforms offering real-time data, analytical tools, and ease of use for your informed trading decisions. Educational resources and customer support further enhance the experience, providing guidance for both beginners and seasoned traders in the global financial markets. Efficient account management ensures seamless deposits, withdrawals, and portfolio tracking, adding to overall satisfaction and avoid losing money rapidly for diversified trading strategies.

1. Interactive Brokers – The Best Overall Broker

What is Interactive Brokers?

Interactive Brokers is a multinational brokerage firm headquartered in Greenwich, Connecticut, offering a comprehensive electronic trading platform for a diverse range of financial instruments, including stocks, options, futures, forex, bonds, and funds. Operating across 150 global markets in 34 countries, it caters to both individual and institutional investors. The firm is recognized for its advanced trading technology and competitive pricing, providing clients with direct market access and a suite of sophisticated trading tools.

Advantages and Disadvantages of Interactive Brokers

Interactive Brokers Commissions and Fees

Interactive Brokers offers low commissions across various products without added spreads, ticket charges, platform fees, or account minimums. For U.S. stocks and ETFs, the IBKR Lite plan provides $0 commissions, while the IBKR Pro plan offers a tiered pricing structure based on trade volume. Options and futures trading incur competitive per-contract fees, and margin rates are among the lowest in the industry. Clients should be aware of potential market data fees and other charges that may apply based on account activity and services utilized.

OPEN AN ACCOUNT NOW WITH INTERACTIVE BROKERS AND GET YOUR WELCOME BONUS

2. eToro – Best for Low Fees

What is eToro?

eToro is a social trading and multi-asset investment platform that enables users to trade a variety of financial instruments, including stocks, cryptocurrencies, and ETFs. Founded in 2007, it has gained popularity for its CopyTrader feature, allowing users to replicate the trades of experienced investors. eToro operates under regulatory oversight from authorities such as CySEC in the EU, FCA in the UK, FinCEN in the United States, and ASIC in Australia.

Advantages and Disadvantages of eToro

eToro Commissions and Fees

eToro offers commission-free trading on stocks and ETFs for most users, though residents of certain countries may incur a small commission. Cryptocurrency trades are subject to a 1% fee.Additional charges include a $5 withdrawal fee and a $10 monthly inactivity fee after 12 months of no trading activity.

OPEN AN ACCOUNT NOW WITH ETORO AND GET YOUR WELCOME BONUS

3. EasyEquities – Best for Beginners

What is EasyEquities?

EasyEquities is an online investment platform that enables users to invest in stocks, ETFs, and other financial instruments across various markets, including South Africa, the U.S., and Australia. It offers a user-friendly interface and supports fractional share investing, making it accessible to both novice and experienced investors. The platform operates under the regulatory supervision of authorities such as the Financial Sector Conduct Authority (FSCA) in South Africa and the Australian Securities and Investments Commission (ASIC) in Australia.

Advantages and Disadvantages of EasyEquities

EasyEquities Commissions and Fees

EasyEquities charges a brokerage fee of 0.25% per transaction, with no registration, monthly platform, or inactivity fees. Deposits via bank transfer are free, but credit card deposits incur a fee of ZAR 1.60 plus 2.3% of the deposited amount. Currency conversion fees are 2% above the mid-FX spot rate, which is considered relatively high.

OPEN AN ACCOUNT NOW WITH EASY EQUITIES AND GET YOUR WELCOME BONUS

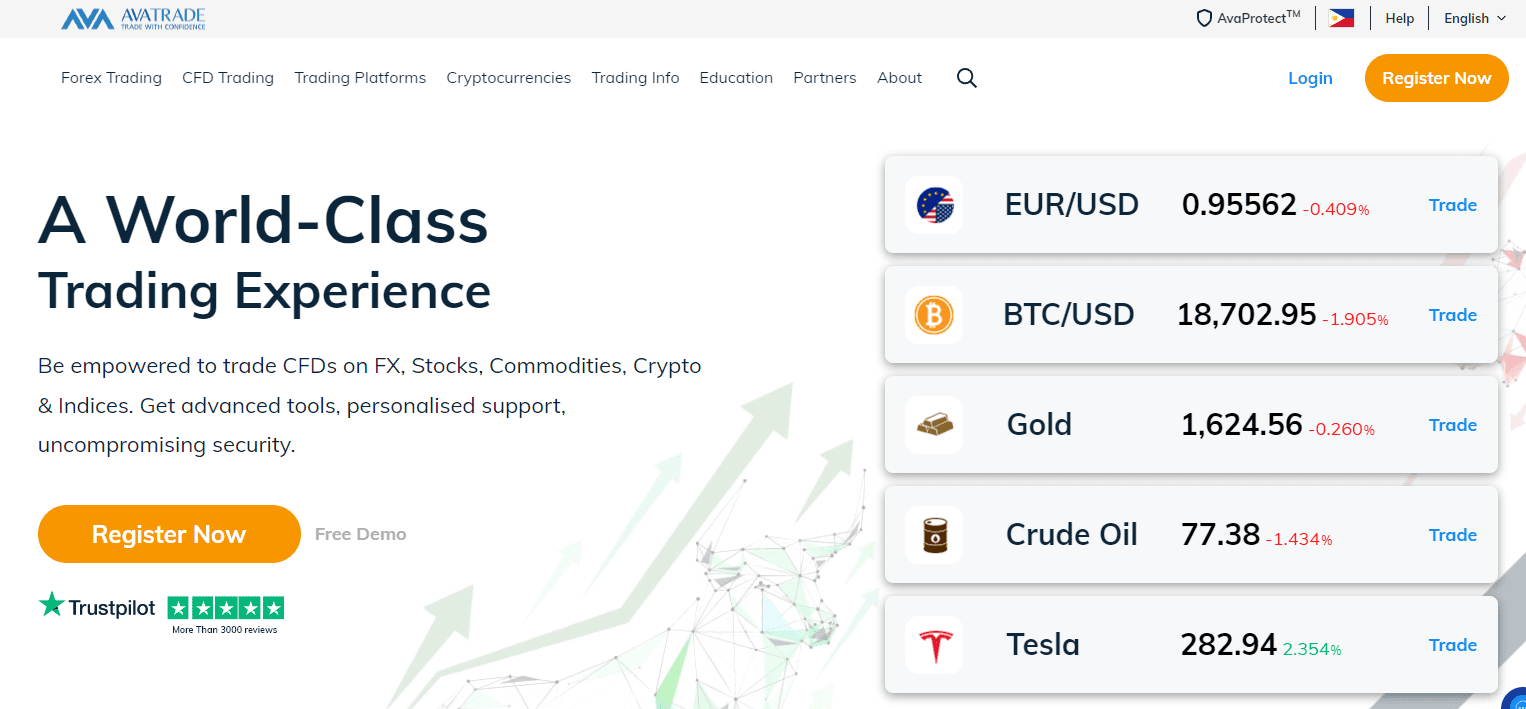

4. AvaTrade – Best for Advanced Traders

What is AvaTrade?

AvaTrade, established in 2006, is a globally regulated online brokerage offering a diverse range of financial instruments, including Forex, commodities, indices, stocks, and cryptocurrencies. With over 400,000 registered customers worldwide, the company executes more than two million trades monthly, surpassing $70 billion in total trading volumes per month. AvaTrade provides multiple trading platforms, such as MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO, catering to both novice and experienced traders.

Advantages and Disadvantages of AvaTrade

AvaTrade Commissions and Fees

AvaTrade operates on a spread-only model, meaning it does not charge commissions on trades; instead, it earns through the bid-ask spread. For example, the average spread for the EUR/USD pair is approximately 0.9 pips, which is competitive within the industry. However, the broker imposes an inactivity fee of $50 per quarter after three consecutive months of inactivity and an additional administration fee of $100 after twelve months of non-use. Notably, AvaTrade does not charge deposit or withdrawal fees, making transactions more cost-effective for active traders.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

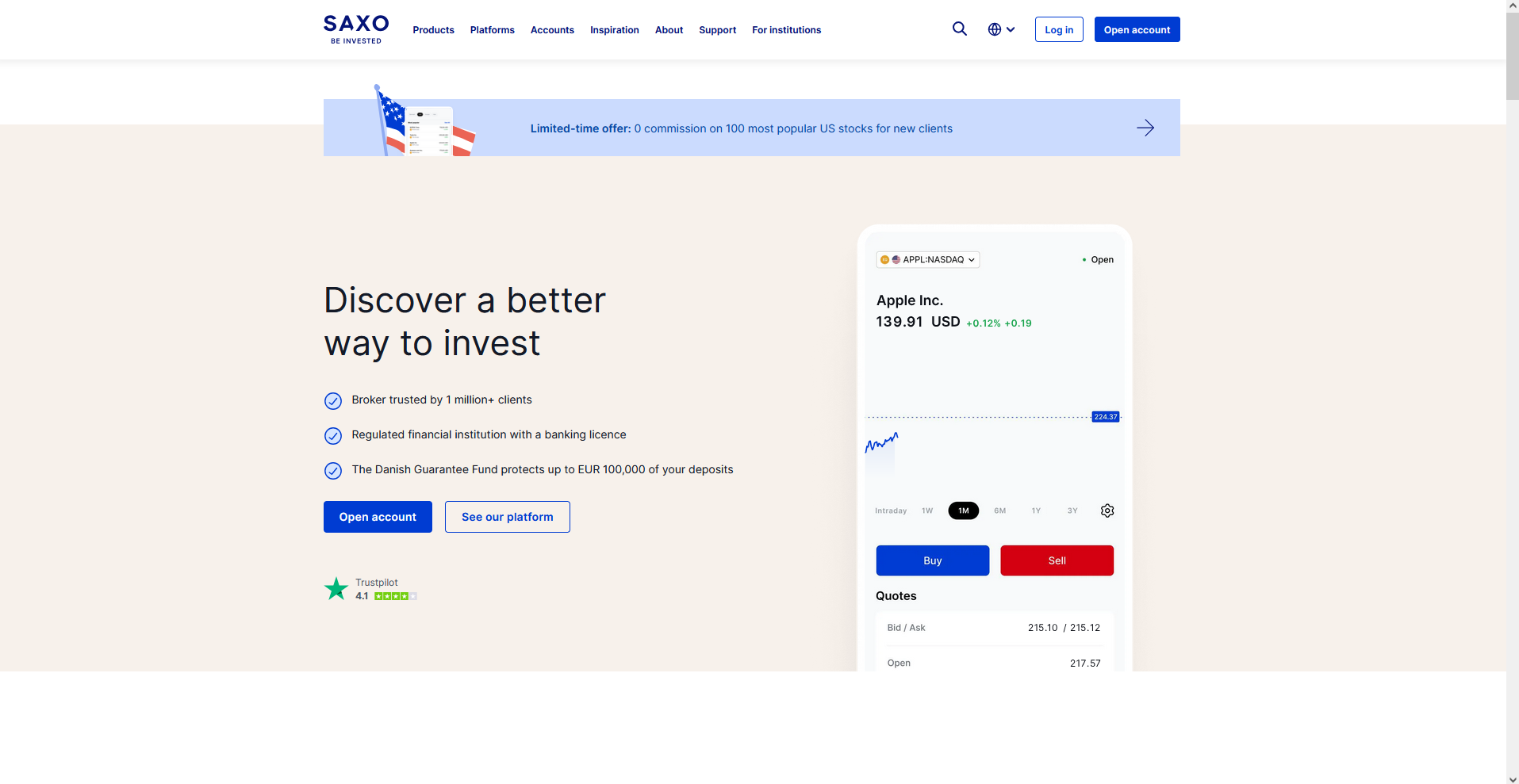

5. Saxo Bank – Best for International Markets

What is Saxo Bank?

Saxo Bank is a Danish investment bank specializing in online trading and investment services. Founded in 1992, it offers clients access to a wide range of financial instruments, including Forex, stocks, CFDs, futures, and bonds, through its advanced trading platforms. Operating globally, Saxo Bank serves both retail and institutional clients, emphasizing transparency and regulatory compliance.

Advantages and Disadvantages of Saxo Bank

Saxo Bank Commissions and Fees

Saxo Bank's commission and fee structure varies across asset classes and account tiers. For stocks and ETFs, commissions start at 0.08% of the trade value, with minimum charges depending on the market. Forex trading is typically commission-free, with costs embedded in the spreads, which can be as low as 0.4 pips. However, the bank imposes a custody fee of 0.15% per annum on held assets, subject to a minimum monthly charge, which can be waived under certain conditions.

OPEN AN ACCOUNT NOW WITH SAXO BANK AND GET YOUR WELCOME BONUS

| Rank | Name | Description |

| 6 | IG | Offers an array of educational resources, including articles, videos, webinars, and guides, designed to aid beginners in learning about trading and refining their skills and strategies. With its user-friendly interface, IG Group makes the trading learning curve smoother for newcomers, allowing for easy navigation and comprehension of the platform. Similar to many other trading platforms, IG Group may provide a demo account, permitting beginners to practise trading with virtual funds. This invaluable tool aids in learning and gaining experience without the fear of real money loss. Regulation and security are paramount, as IG Group is a regulated broker, instilling confidence in beginners by ensuring adherence to regulatory standards and providing a secure trading environment. A diverse range of tradable instruments, including stocks, forex pairs, commodities, indices, and cryptocurrencies, empowers beginners to explore various markets and assets. If IG Group offers a mobile trading app, beginners can conveniently trade on their smartphones or tablets, allowing them to monitor their trades while on the move. Reliable customer support from IG Group is available to assist beginners who may have questions or require guidance while using the platform. Furthermore, IG Group’s provision of risk management tools, such as stop-loss and take-profit orders, equips beginners with the means to manage their trades and mitigate potential losses. |

| 7 | Plus500 | Recognized for its simplicity and user-friendly interface, making it an excellent choice for beginners. Its straightforward design enables newcomers to quickly grasp and navigate the platform, facilitating an easy start to trading. Plus500 offers a demo account, allowing beginners to practise trading without risking real money. This feature is invaluable for learning and gaining experience before venturing into live trading. Plus500 offers a diverse range of tradable instruments, including stocks, indices, cryptocurrencies, commodities, and forex pairs. This versatility enables beginners to explore various markets and assets. As a regulated broker, Plus500 provides a sense of security for beginners worried about the platform’s legitimacy. Regulatory oversight ensures that the broker adheres to industry standards. Plus500 also offers a mobile app, allowing beginners to trade conveniently on their smartphones or tablets. Educational resources, including articles, videos, and tutorials, are available to help beginners understand the basics of trading and enhance their skills. Additionally, Plus500 provides risk management tools like stop-loss and take-profit orders, assisting beginners in managing their trades and reducing potential losses. With potentially low minimum deposit requirements, Plus500 is accessible to beginners looking to start trading with a modest initial investment. |

| 8 | XM | XM is a top choice for stock traders seeking a straightforward and flexible trading experience. It offers over 600 companies as CFDs, allowing investment in global stocks without commissions to capitalize on rising and falling markets. The minimum deposit is $5, making it accessible for all levels. Platform options include MT4, MT5, and XM WebTrader for desktop, mobile, or web-based trading. XM provides daily market updates, technical analysis, and a personal account manager for guidance. It features a “no re-quotes” policy for quick, transparent order execution and multilingual customer support. XM stands as a respected forex broker that delivers share trading and stock options to allow access to world stock markets. XM operates user-friendly platforms that let traders invest in stocks from major exchanges, including NASDAQ and NYSE, and additional marketplaces. |

| 9 | Exness | Exness, regulated by CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA, has a $10 minimum deposit. It facilitates share and stock trading via CFDs on global exchanges, with spreads from 0 pips and leverage up to 1:2000. Platforms include MT4, MT5, and Exness Terminal, supporting instant withdrawals and over 100 payment methods. Negative balance protection and 24/7 support ensure a secure environment for beginners and pros alike. Exness is a trusted broker offering secure and transparent trading conditions for South African traders. |

| 10 | IC Markets | IC Markets is regulated by ASIC, CySEC, FSA, SCB, with a $200 minimum deposit. It supports share and stock trading through CFDs, offering raw spreads from 0 pips and leverage up to 1:500. The platform includes MT4, MT5, and cTrader, with tools like VPS hosting and algorithmic trading. Withdrawals are fee-free, and it provides extensive market analysis, making it ideal for active traders needing high liquidity and advanced features. Low forex CFD fees. Easy and fast account opening. Free deposit and withdrawal. Recommended for forex and CFD traders who value easy account opening and free deposit/withdrawal options. |

| 11 | FP Markets | FPMarkets is regulated by ASIC, CySEC, FSCA, FSA, FSC, CMA, with a $100 minimum deposit. It specializes in CFD share and stock trading, providing zero-spread accounts and leverage up to 1:500. MT4, MT5, and cTrader platforms include VPS and fast execution under 1 second. With no withdrawal fees and extensive instruments over 10,000, it's designed for cost-conscious traders needing advanced analytics and security. |

| 12 | Pepperstone | Fast and fully digital account opening. Seamless and free deposit and withdrawal. Great educational materials. Recommended for forex traders looking for great account opening and customer service. Minimum deposit $0. Fees class Low. Deposit methods include Bank transfer, Credit/debit cards, POLi, BPay, PayPal, Neteller, Skrill, Union Pay, MPESA, AliPay, PIX Brazil, SPEI Mexico, PAYID. Withdrawal methods same as deposit. Withdrawal fee $0. Time to open account 1 day. Inactivity fee No. 74-89% of retail CFD accounts lose money. |

| 13 | HFM | HFM is regulated by FSCA, FCA, DFSA, FSA, CMA, with a minimum deposit of $0. It offers share and stock trading through CFDs, providing access to global markets with competitive spreads and leverage options. The platform supports various account types, including micro and standard accounts, with no commissions on trades and fast execution times. Educational tools and 24/5 customer support are available, making it suitable for diverse traders seeking low-cost entry and reliable regulation. |

| 14 | OctaFX | OctaFX, regulated by CySEC, MWALI, FSCA, requires a $25 minimum deposit. It enables share and stock trading via CFDs on major exchanges, featuring tight spreads from 0 pips and leverage up to 1:500. The broker provides MT4 and MT5 platforms, demo accounts, and multiple deposit options like bank transfers and e-wallets. With over 1,000 CFDs available, it focuses on cost-effective trading for South African users, including negative balance protection and fast order execution. |

| 15 | Fusion Markets | Low trading and non-trading fees. Fast and easy account opening. Great customer service. Recommended for forex traders looking for low fees and a chance to use the MetaTrader 4 platform. Minimum deposit $0. Fees class Low. Deposit methods include Bank transfer, Credit/debit cards, Interac, PayPal, PayID, Crypto, BinancePay, Skrill, Neteller, JetonBank, Mifinity, SticPay, ZotaPay, DragonPay, VNPay, VAPay, XPay, DuitNow, fasaPay, DurianPay, FPX, Pix, MPESA. Withdrawal methods same as deposit. Withdrawal fee $0. Time to open account 1 day. Inactivity fee No. 74-89% of retail CFD accounts lose money. |

| 16 | Axi | Low forex fees. No withdrawal/deposit fees. Fully digital account opening. Recommended for forex traders familiar with the MetaTrader 4 platform. Minimum deposit $0. Fees class Low. Deposit methods include Bank transfer, Credit/debit cards, Neteller, Skrill, Sofort, GiroPay, iDeal, Polish Internet Banking, Global Collect, China Union Pay. Withdrawal methods same as deposit. Withdrawal fee $0. Time to open account 1 day. Inactivity fee Yes. 71.4% of retail CFD accounts lose money. |

| 17 | Admirals | Low forex CFD fees. Free and fast deposit and withdrawal. Straightforward account opening. Recommended for forex traders who are familiar with the MetaTrader trading platforms. Minimum deposit $100. Fees class Low. Deposit methods include Bank transfer, Credit/debit cards, Skrill, PayPal, Klarna, Neteller, SafetyPay, AstroPay, Trustly, Rapid Transfer, NganLuong, Perfect Money. Withdrawal methods same as deposit. Withdrawal fee $0. Time to open account 1 day. Inactivity fee Yes. 75% of retail CFD accounts lose money. |

| 18 | Swissquote | Access to many markets and products. Relevant and fast customer service. Rock-solid background. Recommended for affluent investors who value safety and are OK with higher fees. Minimum deposit $0. Fees class High. Deposit methods Bank transfer, Credit/debit cards. Withdrawal methods Bank transfer. Withdrawal fee $10. Time to open account 1 day. Inactivity fee Yes. |

| 19 | MEXEM | Low stock and ETF fees. Excellent multilingual customer support. Extensive product selection. Recommended for investors looking for low fees and sophisticated trading tools. Minimum deposit $0. Fees class Average. Deposit methods Bank transfer. Withdrawal methods Bank transfer. Withdrawal fee $0. Time to open account 1 day. Inactivity fee No. |

| 20 | Webull | Provides access to the entire US market, not just the subset on EasyEquities; interface is better than EasyEquities; cheaper than EasyEquities; can only fund from a bank account in your own name, no third-party platforms. Webull – the best broker for beginners in South Africa in 2025. Free stock/ETF trading. High interest on uninvested cash. Fast and easy account opening. |

| 21 | SatrixNOW | SatrixNOW focuses on index-tracking funds and unit trusts, offering a straightforward, passive strategy for long-term investing. It is limited to Satrix products, including ETFs and unit trusts with a strong track record at the South African Listed Tracker Awards. Regulation and investor protection: SatrixNOW is FSCA licensed, and because it sells ETFs and unit trusts directly, users own the underlying assets and enjoy associated rights, unlike CFD-based platforms, making it a safe, low-risk option. Fees: The platform uses a tiered annual admin fee of 0.50% on the first R500,000, 0.40% on R500,000–R1 million, and 0.30% above R1 million, with standard transaction costs. Investment options: Limited to Satrix’s own ETFs and unit trusts. Minimum investment and accessibility: No minimum required, allowing starts with any amount. |

| 22 | BROKSTOCK | BROKSTOCK is an all-in-one trading app where users can trade shares, ETFs, gold, forex, and crypto from a single account. It has a low minimum deposit of R100 and a simple, flat commission structure, appealing to both new and active traders. Regulation and investor protection: The FSCA licences BROKSTOCK as an Over-the-Counter Derivatives Provider (ODP), and all trades are offered as CFDs, meaning users don’t own assets directly but speculate on price movements, suitable for short-term trading. Fees: Charges a flat 0.49% per trade across all asset classes, with no withdrawal or deposit fees. Investment options: Shares, ETFs, gold, forex, and crypto, all via CFDs. Minimum investment and accessibility: Requires a R100 minimum deposit. |

| 23 | iFX Brokers | iFX Brokers is designed for advanced traders seeking exposure to forex, commodities, indices, and crypto, offering multiple account types: Standard, Premium, Raw, and VIP, each with different fee structures and spreads. Regulation and investor protection: Authorised by the FSCA as an ODP, it offers only CFDs, so trades are contracts rather than asset ownership; it provides segregated accounts, negative balance protection, and insurance coverage. Fees: Spreads start from 0 pips on Raw accounts but rise to 1.6 pips on Cent accounts; some accounts charge a $6 commission per trade; manual deposits carry a 2.5% fee. Investment options: Specialises in forex, commodities, indices, and cryptocurrencies via CFDs, better for active traders. Minimum investment and accessibility: Standard accounts have no minimum, but Premium ($250) and VIP ($1,000) accounts raise the entry bar. |

| 24 | PSG Wealth | PSG Wealth is a full-service broker in South Africa, offering personalized advice, portfolio management, and access to research and analysis. It caters to investors seeking hands-on guidance, with higher fees compared to discount brokers. Regulated by the FSCA, it ensures client funds are protected in segregated accounts. Suitable for those needing professional management and comprehensive support for investing in shares, ETFs, and bonds on the JSE and global markets. |

| 25 | OANDA | OANDA is recognised for its mobile trading apps, such as the fxTrade mobile and MetaTrader mobile platforms. It is included in the list of the best forex trading apps in South Africa, delivering essential features like powerful trading tools, integrated research, and advanced charting. The apps ensure a smooth user experience for traders managing orders and executing trades. OANDA accepts residents from South Africa and supports forex trading with reliable mobile accessibility. OANDA offers a diverse range of tradable instruments, empowering beginners to explore various markets and assets. |

Comparing the Best Brokers in South Africa

Interactive Brokers

- Fees: Low fees; $1.0 per US stock trade.

- Features: Wide range of products, advanced research tools, and interest paid on cash balances.

- Platform: Desktop, web, and mobile.

- Unique Selling Point: Extensive market access and professional-grade tools for all traders.

eToro

- Fees: Commission-free trading with transparent spreads.

- Features: Social trading, copy trading, and beginner-friendly interface.

- Platform: Web and mobile.

- Unique Selling Point: Unique social trading features and cost-effective trading options.

EasyEquities

- Fees: Low trading fees; affordable access to local and global markets.

- Features: User-friendly interface, demo accounts, and extensive educational tools.

- Platform: Web and mobile.

- Unique Selling Point: Perfect for beginners with fractional share investing options.

MetaTrader 5 via AvaTrade

- Fees: Competitive spreads and no hidden charges.

- Features: Advanced charting tools, algorithmic trading, and customizable platforms.

- Platform: Desktop, web, and mobile.

- Unique Selling Point: Designed for advanced traders seeking high-speed execution and precision tools.

Saxo Bank

- Fees: Premium pricing with competitive rates for high-volume trading.

- Features: Access to global markets, currency conversion, and a diverse range of products.

- Platform: Desktop, web, and mobile.

- Unique Selling Point: Unmatched international market access for global diversification.

How to Choose the Right Broker for You

Choosing the right broker involves aligning their features with your investment goals. If you're a beginner, prioritise brokers with educational resources and user-friendly platforms like demo accounts to practice trading without risk. For advanced traders, tools like advanced charting, algorithmic options, and access to diverse assets should take precedence.

It's crucial to evaluate brokers beyond short-term incentives like sign-up bonuses. Consider long-term value through competitive fees, platform reliability, and customer support. Testing platforms through demo accounts provides insights into usability and features, helping you ensure the broker aligns with your trading style and objectives.

Also Read: The Best Binary Options Brokers in South Africa for 2026

Conclusion

South Africa’s stock market offers immense opportunities, and choosing the right broker is your first step to success. Whether you prioritize low fees, beginner tools, or advanced platforms, the 25 best stock brokers in South Africa listed here provide options for every investor. Ready to start your investment journey? Choose a broker today and take the leap toward financial growth!

FAQ

What is a stockbroker?

A stockbroker acts as an intermediary between investors and the stock market, facilitating the buying and selling of securities such as shares, bonds, and exchange-traded funds. In South Africa, these professionals or platforms help individuals access the Johannesburg Stock Exchange and international markets. They provide tools for research, trade execution, and portfolio management. Choosing one involves considering factors like regulatory compliance, user interface, and educational resources to ensure a secure and efficient trading experience tailored to your investment goals, whether you're focusing on long-term growth or short-term trades.

How do I choose the right stockbroker in South Africa?

Selecting a suitable stock broker requires evaluating your trading style, experience level, and financial objectives. Prioritize those regulated by the Financial Sector Conduct Authority for fund safety. Assess fees, including transaction costs and inactivity charges, to minimize expenses. Look for intuitive platforms with mobile access, real-time data, and analytical tools. Beginners may benefit from educational materials and demo accounts, while advanced users need sophisticated charting and algorithmic options. Compare multiple options based on market access, customer support availability, and overall reliability to align with your needs.

What are the key features of a good stock broker?

A reliable stock broker offers a user-friendly platform with advanced charting, real-time quotes, and customizable dashboards. It should provide diverse asset classes, including local and global stocks, ETFs, and forex. Security features like two-factor authentication and segregated accounts are essential. Educational resources, such as webinars and tutorials, help build knowledge. Efficient customer support via multiple channels ensures quick issue resolution. Low, transparent fees without hidden charges, combined with fast execution speeds, enhance the trading experience, making it suitable for both novices and experienced investors aiming for optimal returns.

Are stock brokers in South Africa regulated?

Yes, reputable stock brokers operating in South Africa must be licensed by the Financial Sector Conduct Authority, which enforces strict standards for transparency, client fund protection, and ethical practices. This regulation helps prevent fraud and ensures fair market operations. Investors should verify a broker's authorization through official registries to avoid unlicensed entities. Regulated brokers typically offer segregated accounts, negative balance protection, and compliance with anti-money laundering rules, providing peace of mind and recourse in disputes, ultimately fostering a safer environment for trading activities.

What fees should I expect from a stock broker?

Stock brokers charge various fees, including brokerage commissions per trade, which can be flat rates or percentages of transaction value. Additional costs may include platform usage, currency conversion, withdrawal, and inactivity fees after periods of non-use. Spreads on forex or CFD trades represent the difference between buy and sell prices. Some offer commission-free options for certain assets like stocks or ETFs. Always review the fee schedule to understand total costs, as low fees can significantly impact profitability, especially for frequent traders managing diverse portfolios.

How can beginners start trading with a stock broker?

Beginners should first educate themselves on market basics through free online resources or broker-provided tutorials. Open a demo account to practice trading without real money risk. Choose a regulated broker with low minimum deposits and user-friendly interfaces. Fund your account via bank transfer or card, starting small to build confidence. Set clear investment goals, diversify holdings, and use risk management tools like stop-loss orders. Monitor trades regularly, learn from mistakes, and seek advice from support teams to gradually develop a sustainable trading strategy.

What is the difference between a full-service and discount broker?

Full-service brokers provide comprehensive advice, research reports, and personalized portfolio management, ideal for those needing guidance but often at higher fees. Discount brokers focus on low-cost trade execution with minimal advisory services, suiting self-directed investors who prefer independence. In South Africa, both types access the same markets, but full-service options may offer advanced tools for complex strategies, while discounts emphasize affordability and simplicity. Your choice depends on experience level; novices might start with discounts and upgrade as they gain expertise.

Can I trade international stocks through South African brokers?

Many South African brokers enable access to global markets, allowing trades in international stocks, ETFs, and indices from exchanges like NYSE or LSE. This diversification helps mitigate local market risks. However, consider currency conversion fees and tax implications, such as withholding taxes on foreign dividends. Ensure the broker supports multi-currency accounts and provides real-time international data. Regulatory compliance ensures secure cross-border transactions, making it easier to build a globally balanced portfolio without needing multiple accounts.

What is fractional share investing?

Fractional share investing allows purchasing portions of a stock rather than whole shares, making high-priced securities accessible with smaller investments. This feature democratizes trading, enabling diversification even with limited capital. In South Africa, it's useful for building portfolios gradually, especially in volatile markets. Investors pay proportional fees and receive dividends accordingly. It promotes long-term strategies like dollar-cost averaging, reducing entry barriers for beginners and encouraging consistent saving habits without requiring large upfront sums.

How important is customer support for stock brokers?

Quality customer support is crucial for resolving issues like account setup, trade disputes, or technical glitches promptly. Look for brokers offering 24/5 or multilingual assistance via chat, email, or phone. Responsive teams enhance user confidence, especially during market volatility. Educational support through FAQs and guides aids learning. In South Africa, where time zones affect global trading, reliable help ensures uninterrupted access, preventing potential losses from delays and fostering a positive overall experience for all trader levels.

What risks are involved in stock trading?

Stock trading involves market risk from price fluctuations, potentially leading to losses. Liquidity risk occurs if assets can't be sold quickly without price impact. Currency risk affects international trades due to exchange rate changes. Leverage amplifies gains but also losses, risking more than initial investment. Economic events, company news, or geopolitical factors can cause volatility. Diversification, stop-loss orders, and thorough research mitigate these, but always trade with money you can afford to lose, emphasizing informed decision-making.

How do I open a trading account in South Africa?

To open a trading account, select a regulated broker and complete an online application with personal details, ID verification, and proof of address. This complies with know-your-customer regulations. Choose account type based on experience—standard for beginners or advanced for pros. Fund via bank transfer, card, or e-wallet, often with low minimums. Activate by confirming email or phone. Practice on a demo before live trading to familiarize with the platform, ensuring a smooth start to your investment journey.

What educational resources should a broker provide?

Brokers should offer webinars, video tutorials, and articles on market analysis, trading strategies, and risk management. Glossaries explain terms, while economic calendars highlight events. Interactive quizzes and e-books build foundational knowledge. For South Africans, localized content on JSE specifics is valuable. Demo accounts allow hands-on practice. Advanced resources like technical indicators guides suit experienced users. These tools empower informed decisions, reducing errors and enhancing long-term success in volatile markets.

Is mobile trading available with stock brokers?

Most stock brokers provide mobile apps for trading on smartphones or tablets, offering real-time quotes, charts, and order placement. This flexibility allows monitoring portfolios anytime, ideal for busy investors. Features include push notifications for price alerts and secure biometric logins. In South Africa, apps support local payment methods and JSE access. Ensure compatibility with your device and test usability. Mobile trading promotes active management, but always use secure networks to protect sensitive financial data.

What is copy trading and how does it work?

Copy trading lets users automatically replicate strategies of experienced investors, mirroring their trades in real-time. It's beginner-friendly, requiring no deep market knowledge. Select performers based on historical returns, risk levels, and asset focus. Allocate funds proportionally; gains or losses follow accordingly. Fees may apply for subscriptions. In South Africa, it diversifies exposure without constant monitoring. However, past performance isn't guaranteed, so research thoroughly and set limits to manage risks effectively.

How are taxes handled in stock trading in South Africa?

In South Africa, stock trading profits are subject to capital gains tax, calculated on disposal gains exceeding annual exclusions. Dividends face withholding tax, varying by residency. Keep records of transactions for accurate reporting to SARS. Brokers may provide tax certificates, but ultimate responsibility lies with you. Consult professionals for complex portfolios. Strategies like tax-free savings accounts minimize liabilities. Understanding rules prevents penalties, ensuring compliance while optimizing after-tax returns on investments.

What is leverage in trading?

Leverage allows controlling larger positions with smaller capital, borrowing from the broker to amplify potential returns. For example, 1:10 leverage means R1,000 controls R10,000. It's common in forex and CFDs but heightens risks, as losses are magnified. In South Africa, regulations cap leverage to protect retail investors. Use cautiously with stop-losses to avoid margin calls. It's suited for experienced traders; beginners should start unleveraged to build skills without excessive exposure.

How can I protect my investments from market volatility?

To safeguard against volatility, diversify across asset classes, sectors, and regions to spread risk. Use stop-loss orders to automatically sell at predetermined prices, limiting losses. Employ hedging strategies like options for protection. Stay informed via news and analysis to anticipate shifts. Maintain a long-term perspective, avoiding emotional decisions. In South Africa, focus on stable JSE blue-chips alongside internationals. Regular portfolio rebalancing ensures alignment with goals, mitigating impacts from economic fluctuations.

What is a demo account and why use it?

A demo account simulates real trading with virtual funds, allowing practice without financial risk. It mirrors live market conditions, including tools and data. Ideal for testing strategies, learning platform navigation, and building confidence. In South Africa, it's essential for understanding local market dynamics before committing capital. Switch to live once proficient. It reduces beginner errors, promotes disciplined habits, and helps evaluate broker suitability without pressure.

How do economic events affect stock trading?

Economic events like interest rate changes, GDP reports, or inflation data influence market sentiment, causing price swings. Positive news boosts confidence, raising prices; negative triggers sell-offs. In South Africa, events such as Reserve Bank announcements or global commodity shifts impact JSE heavily. Traders use calendars to prepare, adjusting positions accordingly. Understanding correlations aids prediction, but unpredictability remains. Diversification and vigilance help navigate these, turning potential risks into opportunities for informed investors.