For equity traders, concepts such as contango vs backwardation may not be unimportant for a normal market, but these terms symbolize crucial ideas for commodity traders. To be an accomplished investor in commodity futures markets, it’s paramount to figure out the course and slope of the normal futures curve.

The terms contango and backwardation are used in the futures market and can specify if the delivery price of a given asset is larger or lower than the present spot price. This enables investors to estimate if the best option is to purchase a financial instrument at a spot price. Alternatively, they will implement contracts for future delivery.

Typically the concepts previously named are implemented for the following commodities such as oil, precious metals, and energy. They are plotted on the curve to receive an impression of the shape of the curve.

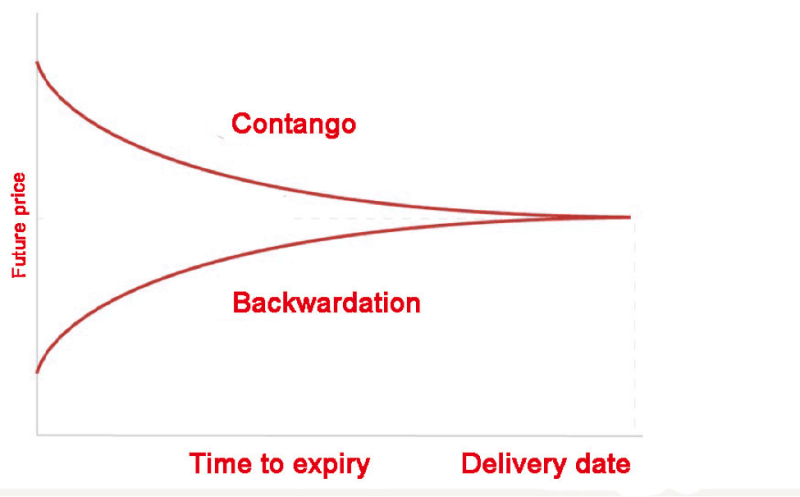

A usual futures curve will be sloping upward signaling the price increase in the commodity within a specific time.

Alternatively, the inverted curve will display the commodity's price decline over time.

It's time to dissect contango and backwardation and learn how to use this concept in trading strategies that can produce profits for traders.

Also Read: What Is Backwardation?

Contents

- The Importance of Contango and Backwardation

- What Is Contango?

- The Conditions the Produce Contango

- Contango Futures Contract Examples

- Backwardation Explained

- Examples of Backwardation

- Contango vs Backwardation

- Trading with Contango

- Profiting from Backwardation

- Final Thought

- FAQs

The Importance of Contango and Backwardation

Learning the differences between contango and backwardation enables investors to improve their performance by understanding the dynamic of spot prices and how they get connected to future prices, which also gets named the futures curve.

Although the futures were initially created for commodity traders to sell a product at a future date and secure the present price, this idea is not appealing to all investors that are active in the commodities markets. And some may not be interested in directly possessing the product being traded.

For example, a retail trader can purchase a gold futures contractand not assume delivery of 100 kilograms of gold. They may trade for the profit potential, and this is the contrast between the contract's initial price and the closing price.

What Is Contango?

The term contango gets used to describe if a commodity futuresprice is over the spot price. This can get depicted with an example. If you consider that the spot price of ABC Crude Oil today is $50 per barrel. And you purchase a futures contract that will that expire in eight weeks, if the owner of that contract collects the oil and must pay $55, this signals the market is in contango.

The reason is in the fact that the expense of the forward contract is larger than the spot price or the anticipated future price.

With time, the contract will go nearer to the spot price as it closes on the expiration date. Because of this, baring the rise in the price over the paid price paid, the worth of the contango contract is going to decline and encounter the spot price at expiration.

But in case the spot price remains identical, the contract that was purchased for $55 will get valued at $50 during the expiration of the expires. And this is known as the futures curve.

The Conditions the Produce Contango

Contango is the product of factors that contribute to any of the traded commodities to experience higher prices in the future result of anything that causes prices to be higher in the future respective to the present, this mostly correlates to demand and supply.

This can result from a conviction among investors that the spot price will rise in the future, offering an opportune chance to secure the price at the moment, even if it is over the present spot price.

Contango can emerge because of the “cost of carry”. Traders could be forced to pay more for a commodity that will not be shipped to them for a couple of months. The reason is simple you may not be able to store the product.

You are paying the original seller of the contract to warehouse the product you bought from him. That sustains a larger cost of carry that gets manifested as a higher-than-spot price.

Contango Futures Contract Examples

A market that is in contango will face moderate depletion in the futures price to encounter the forecaster spot price at the contract's delivery. But when a futures contract's price stays over the spot price in contango, investors may benefit by exploiting the price difference.

Let’s look at a hypothetical example of crude oil from North Dakota that is typically in contango because of the expanse of carry of oil, which necessitates storage until it gets used.

If the spot price of crude oil is $80, and the futures contract's price is $90 for delivery in four weeks. An investor can purchase the futures contract with the expectation that the price of oil will increase over $90 before the arrival of the expiration date.

Backwardation Explained

Backwardation gets used to describe a situation when the future price is under the spot or expected spot price. It is very obvious that backwardation is the reverse situation of contango, but it's also rarer when compared to contango, and the reason for this is the fact that backwardation favors markets with supply and demand changes that occur seasonally.

The futures market for natural gas is frequently in backwardation, this is due to a spike in demand during the heating season in the winter, which creates supply shortages. Investors will assume a position in the backwardation market if they anticipate a decline in natural gas prices, and this is a possibility when the supply rises, and the demand stays at the preceding level.

Examples of Backwardation

For example, we can assume that the spot price of crude oil is $40 per barrel. In this situation when an investor purchases an oil forward contract whit expiry in four months and the contract holder accepts their oil and must pay $45, this signals the market is experiencing backwardation. The reason is that the future delivery's price is lower than the present spot price.

With time, as that contract advances to the expiration date, it will reach nearer to the spot price. Because of this, the $40 will get to $45, considering that the spot price remains the same.

Gasoline Backwardation

One commodity that is regularly in demand is gasoline, but it's also important to know that the supply is stable, and when gasoline is in backwardation the futures contract's price is lower than the cash spot price.

For example, the cash price can be 1. 2475 and the price two weeks later, on a forward contract, is 1.2014. The prices will move in a downward trajectory the further out it goes.

Gold Backwardation

Gold is not usually in backwardation. It is a precious metal that gets used as a medium for the storage of wealth during turbulent political or economic times. Because in circumstances like this, investors are increasingly buying gold, they are improving its value.

The only tricky segment is that gold gets typically traded in the US dollar, and this means that meaning that the variations in the currency interest rates can drive gold into contango or backwardation.

Natural Gas Backwardation

Although backwardation is a rarity for the natural gas market. But it doesn't mean it's absent, and in situations when some contracts are not in contango when compared to others, it can cause backwardation.

Let’s imagine that the present spot price for natural gas is $4.15. A few weeks later, it is $4.82, then $5.25, $5.47, but after a couple of weeks it declines to $4.95, and that is cheaper than the previous month. After this, there is another decline of $4.69, and these contracts are moving in backwardation.

This market is not in backwardation currently, the value for forward contracts stays higher than the spot price. However, if the price is $4.37 in the upcoming months and the contracts get priced under that. In this case, backwardation will emerge.

Contango vs Backwardation

There are the polar opposites, in the case of a contango futures prices decline in the direction of the spot price while backwardation is a situation where the price of futures prices moves in the direction of the spot price.

Basically, contango contracts possess an innate downward inclination. And when contracts are in backwardation it has a predilection to move upwards. In both cases, future and spot prices merge when the contract expires.

In both circumstances, these inclinations influence the contracts, and may not automatically have anything to do with the course of the commodity's price. When a forward contract is in contango, it's not a signal that the price will decline, actually it indicates that a given contract may not succeed to meet the spot price, but the spot can also increase.

Formulating a trading strategy that gets established on a definite condition can turn unprofitable if the circumstances shift fast.

Trading with Contango

Select the instrument, although contango and backwardation contracts are typical for the commodities market, they can get traded in the Forex market. When creating a trading strategy, an option is to go short and then purchase a further out contract. This can secure a lower purchasing price and a higher sell price.

But there is a risk when implementing a short-selling strategy, and investors have to weigh in the qualities they possess before committing to a tactic. Observe the markets, and follow the latest developments that can influence the assets price.

Always consider a risk management option, such as a stop-loss order to reduce risk when trading outright in the futures markets. Yet the effect may not be desirable.

Also Read: Risk Reward Ratio Ultimate Guide

Profiting from Backwardation

Most investors focus on trading contango, but that doesn't mean backwardation is not a profitable option. The futures price in backwardation is over the spot price. In this case, investors can purchase a futures contract with the intent to go higher to intercept the spot price. If the commodity's price is moving higher it can be profitable.

When futures prices go under the predicted price, it could signal that investors are expecting reduced interest for the commodity. When the price chartverifies this by displaying a downtrend, the investor can want to sell the futures contract, assuming a reduced price in the future.

A backwardation is a profitable option. But not an easy method that comes down to the choice to sell or purchase an asset. Some other factors to take into account are the trend of the commodity and the quantity of backwardation present.

Final Thought

Learning the difference between futures contracts as they relate to the backwardation contango dynamic can help to escape losses.

The easiest way to understand contango and backwardation is that the contango market occurs when the assumption is that the futures price will be larger than the spot price, while normal backwardation happens if traders forecast that the futures price will be cheaper than the spot price.

Contango and backwardation are inverted futures curve structures that are obvious in the futures market and can get dependent on several factors.

FAQs

Which Is Better Contango or Backwardation?

It depends on the market circumstances, backwardation can produce positive results, and contango will yield negative results for a holder of a long futures position. The opposite is true for a holder of a short futures position, where contango offers positive results, a backwardation yields negative results.

What Are Contango and Backwardation?

Contango and backwardation get used to describe the forward curve in commodity markets. If in contango, the forward price is higher than the spot price. While the opposite is the case with a backwardation, where the forward price is lower than the spot price.

Is Oil In Contango or Backwardation?

Oil is present in both contango and backwardation. Although, it's very rare for backwardation.

Why Is It Called Contango?

The term dates from 19th century England and the assumption is that it is a product of the corruption of terms such as continuation or contingent.