Global Sell-off Slows Down

The intense global sell-off seen yesterday appears to be stabilizing. Risk indicators such as the VIX, yen, and Swiss franc are holding steady for now. This sharp sell-off has multiple causes, but a significant factor is the unwinding of the carry trade.

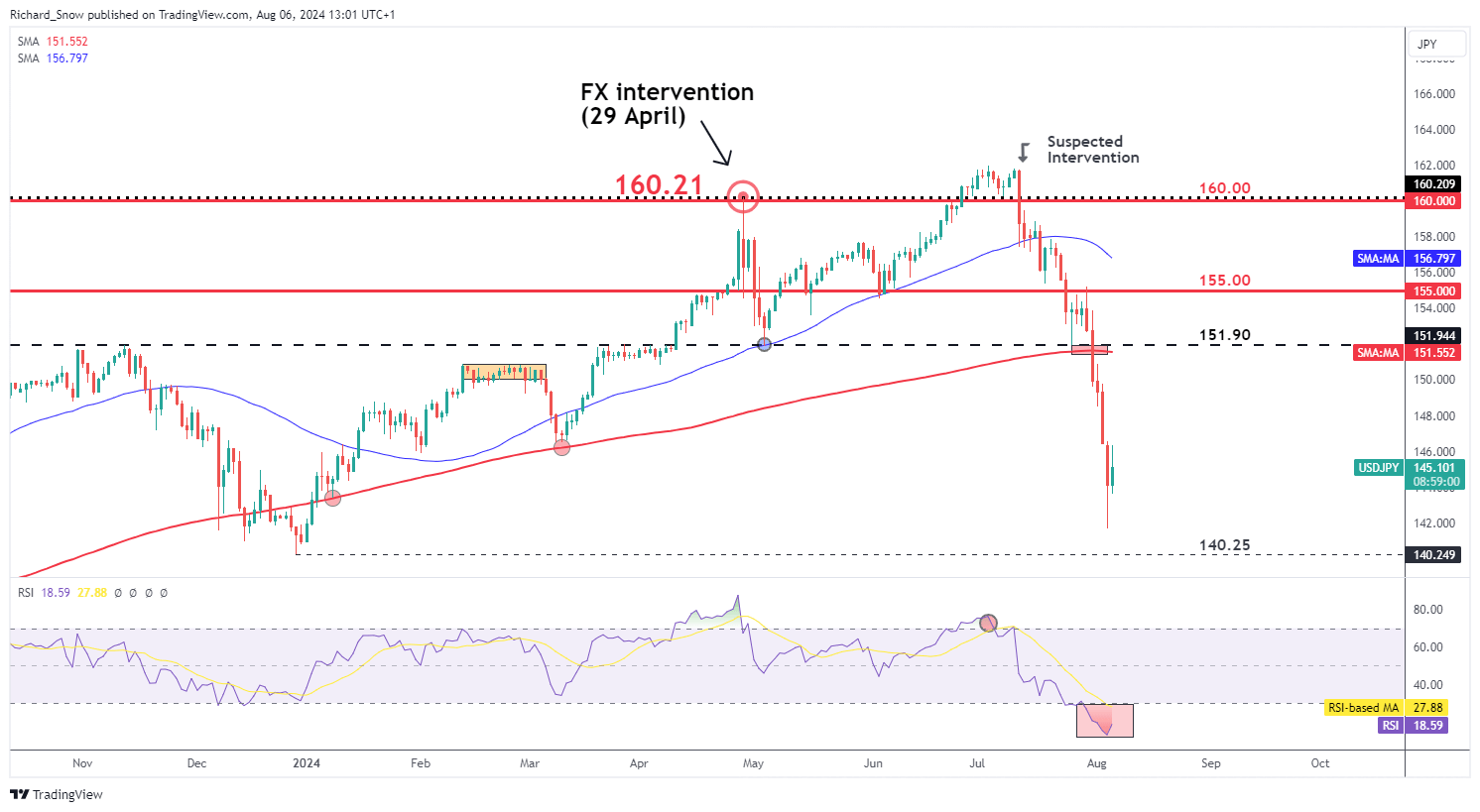

Monetary Policy Shifts Impacting USD/JPY

With the Fed gearing up for a rate cut and the Bank of Japan (BoJ) tightening its monetary policy through rate hikes, a drop in USD/JPY seemed inevitable. However, the rapid decline has surprised the markets. Investors have long borrowed yen at low interest rates to invest in higher-yield assets like stocks or treasuries.

Markets currently estimate a 75% chance that the Fed will initiate the rate-cutting cycle with a 50 basis point (bps) reduction in September, rather than the usual 25 bps, due to the US unemployment rate rising to 4.3% in July. This concern weakened the dollar, and the BoJ's surprise hike last month strengthened the yen, narrowing the interest rate gap and disrupting long-standing carry trades.

Investors and hedge funds with yen-denominated loans have been forced to liquidate other investments quickly to cover these debts. As the yen appreciates rapidly, it requires more foreign currency to purchase yen and settle these loans.

This week, Fed members have tried to calm the markets, acknowledging the softened job market but cautioning against overreacting to one labor report. The Fed recognizes that maintaining high rates hinders economic activity and employment, balancing the fight against inflation with the employment mandate.

The Fed is expected to announce its first rate cut since the hiking cycle began in 2022. The debate now is whether the cut will be 25 bps or 50 bps, with markets assigning a 75% chance to the latter, increasing the downward pressure on USD/JPY.

While the RSI remains deeply in oversold territory, the market could continue to fall as long as the Fed and BoJ maintain their respective policies. The next support level for USD/JPY is 140.25, though a short-term correction is possible given the extent of the recent sell-off.

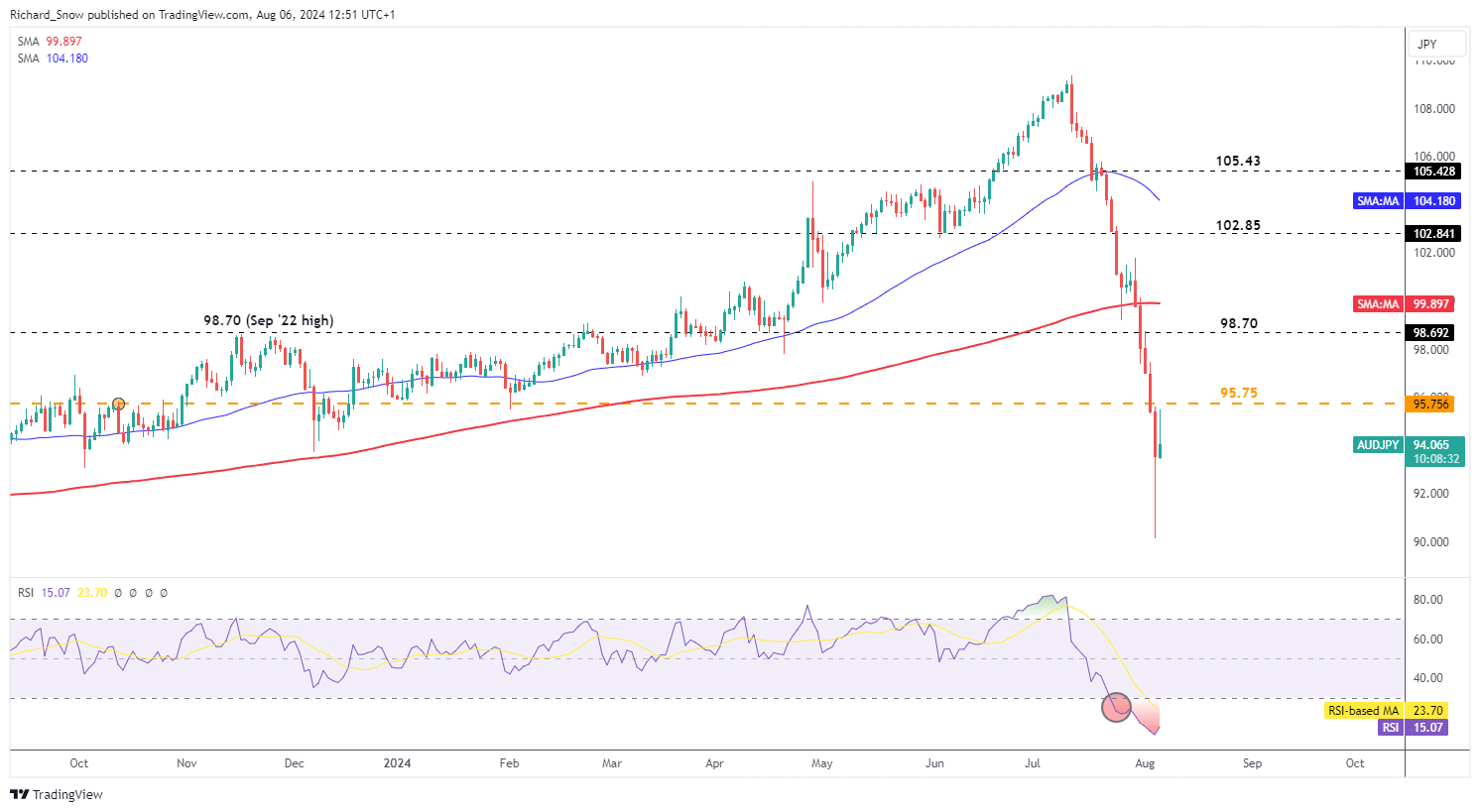

AUD/JPY Reflects Risk Sentiment

The AUD/JPY pair serves as a barometer for risk sentiment. The Australian dollar typically correlates with the S&P 500, rising with positive risk sentiment and falling with negative sentiment. In contrast, the yen is a safe-haven currency, benefiting from uncertainty and panic.

AUD/JPY has seen a sharp decline since its peak in July, breaking through the 50 and 20-day SMAs with little resistance. Yesterday's intra-day spike lower and subsequent rebound suggest a short-term correction, with the pair rising at the time of writing.

This recovery has been supported by RBA Governor Michele Bullock, who stated that a rate cut is not imminent, boosting the Aussie. Her comments followed positive inflation data, which has quelled prior rate hike talks.

The next resistance level is 95.75, with support at yesterday's spike low of 90.15.