Position in Rating | Overall Rating | Trading Terminals |

198th  | 1.4 Overall Rating |    |

IFC Markets Review

If you’ve been trading long enough, you’ve probably come across brokers that provide a wide range of features, including narrow spreads, specialized interfaces, and even synthetic instruments. IFC Markets is a moniker that frequently appears in forums, review sites, and trader circles.

But here’s the real question: Is IFC Markets a reliable broker or a risky offshore option for serious traders?

In this thorough review, we’ll go over everything you need to know about IFC Markets, including regulation and safety, spreads, tradingtools, platforms, and even genuine trader feedback, so you can decide whether it’s worth incorporating into your trading strategy.

What is IFC Markets?

IFC Markets is a retail FX and CFD broker that was founded in 2006 by the IFCM Group, which also comprises a FinTech firm and two licensed brokerage divisions. IFC Markets has more than 650 FX, commodities, indices, stocks, ETFs, and crypto instruments available to more than 210,000 traders in 80 countries. Traders use their own money through MT4, MT5, or NetTradeX.

IFC Markets is regulated by the BVI FSC and Malaysia's LFSA. Both are mid-tier regulators, but the broker makes sure that funds are kept separate, protects against negative balances, and offers innovative retail trading tools like the Portfolio Quoting Method for making synthetic assets.

Is IFC Markets Regulated and Safe?

Two offshore regulatory bodies license IFC Markets:

- IFCMARKETS. CORP is regulated by the BVI Financial Services Commission (license no. SIBA/L/14/1073).

- IFC Markets Ltd is authorized by the Labuan Financial Services Authority (LFSA) in Malaysia (license no. MB/20/0049).

Additionally, IFC Markets SA is regulated under the Financial Sector Conduct Authority in South Africa, further expanding its regulatory oversight. As a regulated broker, IFC Markets demonstrates a commitment to safety, reliability, and trust, which is crucial for traders seeking protection from fraud and malpractice.

The best regulators, FCA, ASIC, and MAS, do not regulate IFC Markets. This limits client fund safeguards and compensation.

Separate accounts, negative balance protection (in some countries), and professional indemnity insurance are standard safety elements. It's not low-risk by global standards, but experienced traders who understand offshore hazards may be okay.

What Can You Trade with IFC Markets?

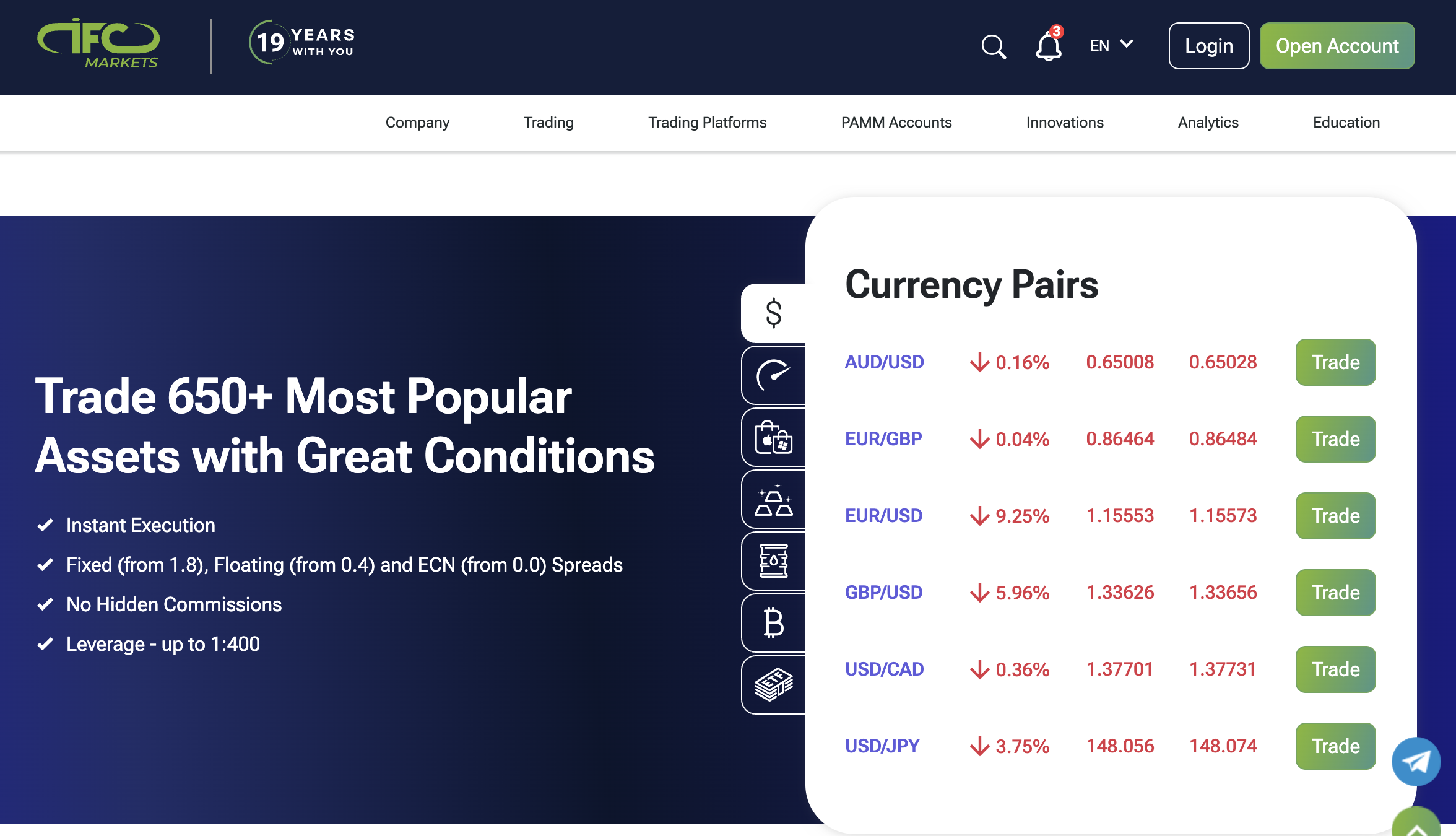

IFC Markets offers a wide range of over 650 tradable instruments across multiple asset classes, making it appealing to traders who want portfolio diversity and asset class diversification. The asset classes include:

- Forex – 50+ currency pairs including majors, minors, and exotics

- Stocks & ETFs – US, European, and Asian equities + global ETFs, all available as stock CFDs. Trading stock CFDs allows you to speculate on price movements without direct ownership, often with lower trading costs and greater accessibility.

- Indices – Popular benchmarks like the S&P 500, DAX, and Nikkei Commodities – Gold, silver, oil, and softs like wheat and coffee

- Cryptocurrencies – BTC, ETH, LTC, XRP (via CFDs)

- Synthetic Instruments – Unique to IFC Markets, using their proprietary Portfolio Quoting Method (PQM), traders can create custom assets by combining multiple instruments into a single synthetic pair.

This PQM feature stands out, especially for sophisticated traders or those using varied hedging techniques. Rather than simply reacting to the market, traders can create their own pricing relationships, such as trading Google versus Oil or Apple versus Gold, which is not available with most brokers.

Overall, IFC Markets is ideally suited to both traditional and innovative trading approaches, particularly those who enjoy experimenting with pair combinations or worldwide exposure.

IFC Markets Spreads, Fees, and Commissions

IFC Markets offers two main account types: NetTradeX and MetaTrader (MT4/MT5), each with different pricing models.

- Floating spreads (MetaTrader) start from 0.4 pips on major pairs like EUR/USD — ideal for traders who want tighter spreads during active market hours.

- Fixed spreads (NetTradeX) begin at 1.8 pips — useful for those who prefer price stability during volatile news events.

Commissions for stock and ETF trading vary by asset and platform, but typically range from 0.1% to 0.15% per transaction. Index and commodity CFDs, on the other hand, are commission-free, with costs included in the spread.

In short, IFC Markets is not the cheapest broker available, but their straightforward cost structure and choice of fixed vs variable spreads provide traders with flexibility based on their trading approach. Traders should also consider deposit and withdrawal fees or procedures as part of their overall trading costs.

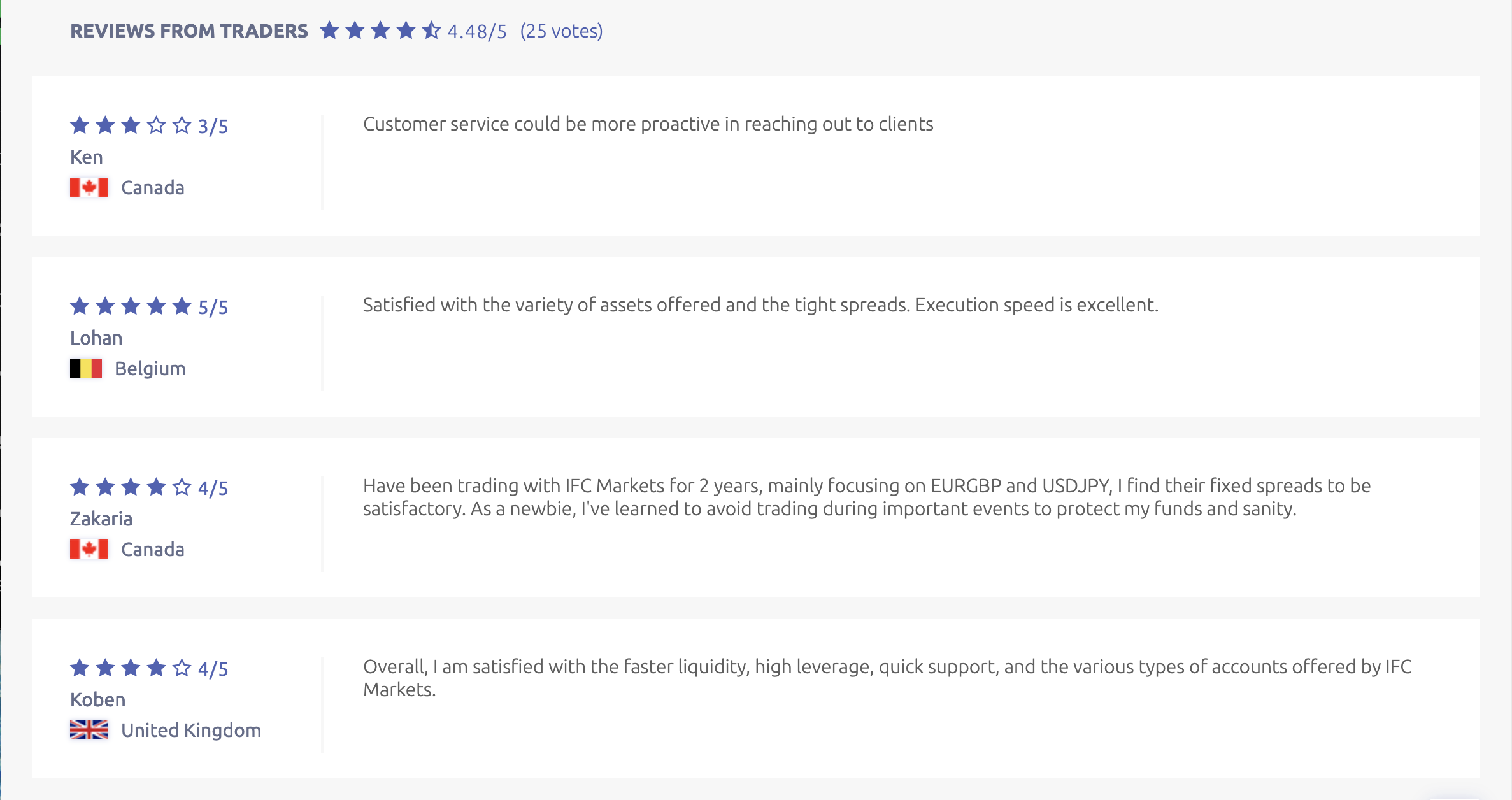

IFC Markets Customer Reviews

Trader feedback on IFC Markets is generally excellent, particularly in terms of smooth execution and diversified trading options, but there are a few warning flags.

Traders at fx-list.com complimented IFC for its tight spreads on major pairs including EUR/USD, good leverage options, and platform dependability. However, some noticed the lack of guaranteed stop-loss tools or advanced order types.

However, HelloSafe and InvestorTrip provide negative reviews. Account balance changes labeled “loans,” server slowdowns, and spread hikes are complaints. The 500-pip spread on a gold deal announced during non-news hours raised worries about execution under limited liquidity.

Many traders consider IFC Markets to be reliable in terms of reliability, multi-platform support, and speedy withdrawals. However, if you rely heavily on advanced order protection or demand perfect live help, it's worth considering the user-reported friction spots.

Trading Platforms and Tools Offered by IFC Markets

IFC Markets has three trading platforms: MT4, MT5, and NetTradeX. MT4 is quick and easy to use, while MT5 offers additional market data and can fill partial orders. NetTradeX is different from other platforms since advanced traders can create their own synthetic instruments.

IFC Markets supports the GeWorko Method through NetTradeX, which lets traders create new instruments from various assets. You can analyze MetaTrader trading signals and Autochartist technical pattern detection tools. An economic calendar, market mood data, and Claws & Horns technical analysis reports are included. The broker offers IFC Markets trading calculators, margin estimators, and training for beginners to intermediate traders. The platform includes algorithmic, discretionary, and other trading tactics.

These platform features and tools play a crucial role in supporting effective risk management for traders.

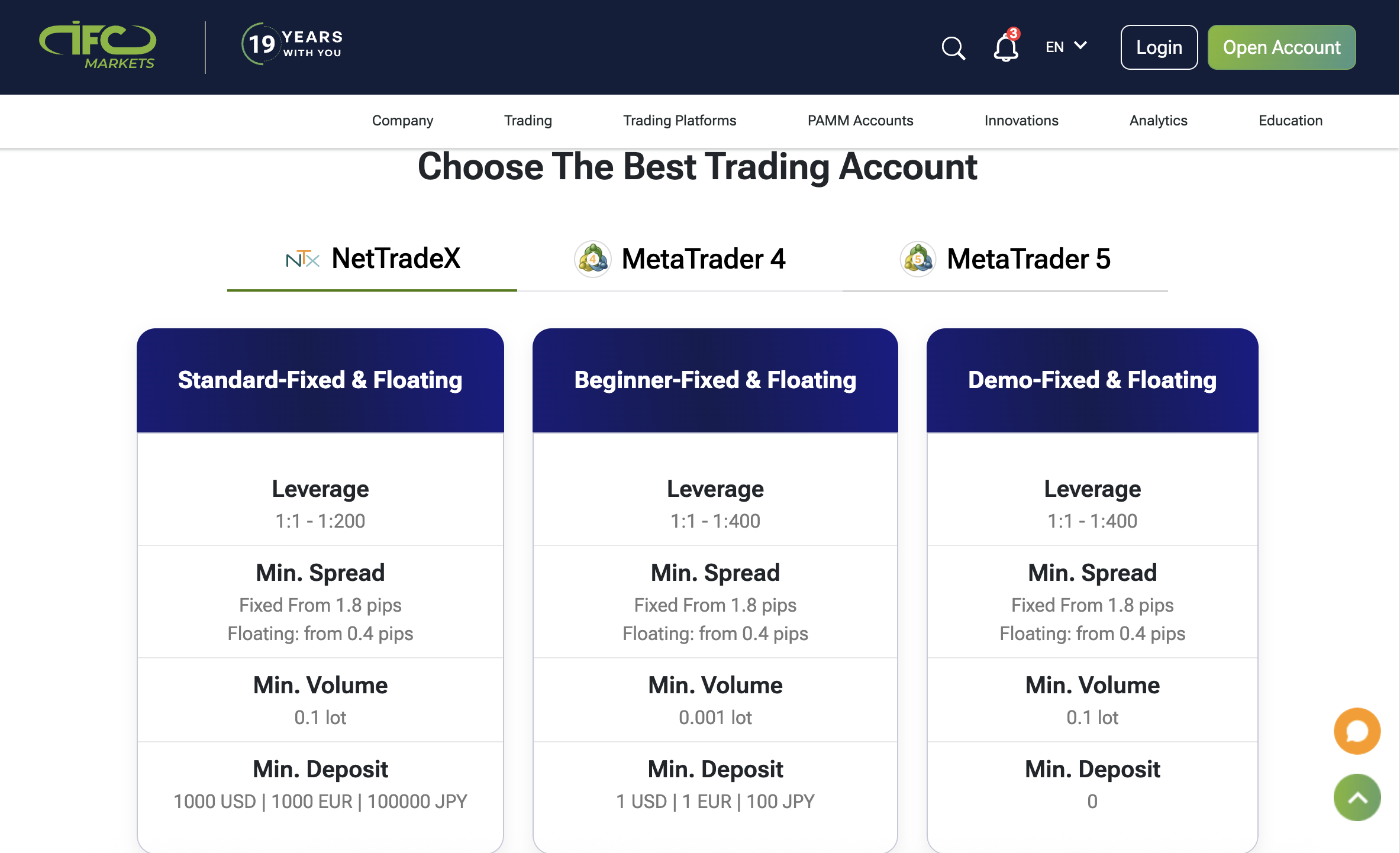

IFC Markets Account Types & Leverages

IFC Markets offers three types of accounts on its supported platforms: standard, beginner accounts, and demo. These accounts are accessible on NetTradeX, MetaTrader 4, and MetaTrader 5, with fixed and floating spreads to suit traders’ needs. The broker supports a wide range of account base currencies, allowing international clients to fund their accounts in their preferred currency.

- Standard Account – minimum deposit of $1,000, minimum volume 0.1 lot, leverage up to 1:200

- Beginner Accounts – starts from just $1, minimum volume 0.001 to 0.01 lot, leverage up to 1:400. Beginner accounts are designed to be highly accessible for new traders, making it easy to start trading with a low entry threshold.

- Demo Account – free to open, mimics real trading conditions, leverage up to 1:400

Fixed and floating spreads start at 1.8 and 0.4 pips for all account types. MetaTrader 5 supports PAMM managed investment accounts. Traders can open swap-free Islamic accounts. Muslim traders can deal ethically with these swap-free, interest-free, Sharia-compliant Islamic accounts. Islamic account establishment is simple and meets Islamic financing requirements.

Leverage varies according to account type and regulatory control, with a maximum of 1:400 permissible under offshore rules. Clients regulated by CySEC in the EU are subject to ESMA limits of 1:30 unless they are professional traders.

IFC Markets is suitable for a wide range of clients, and new traders will benefit from the accessible beginner accounts, low minimum deposits, and supportive onboarding resources.

Customer Support at IFC Markets: Is It Reliable?

IFC Markets provides 24 hour multilingual customer assistance via live chat, email, phone, and a comprehensive Help Center on its website. Support is offered in over 18 languages, including English, Spanish, Arabic, Chinese, and Russian, making it accessible to traders worldwide. During active trading hours, the live chat tool replies promptly and efficiently to simple questions.

Trader opinions vary. Others claim peak-time delays, but others describe speedy, helpful service. All accounts seem to get same service. Essential support from IFC Markets may take time to resolve critical or complex issues.

IFC Markets Pros and Cons

IFC Markets Withdrawal Fees and Options

You can withdraw money from IFC Markets using bank transfers, cards, e-wallets (Skrill, Neteller, WebMoney), and cryptocurrencies like Bitcoin, Ethereum, and USDT. African traders can simplify with M-Pesa and local banks. Crypto and e-wallets process in one to two business days, faster than banks.

The broker does not charge internal withdrawal fees, however third-party costs may apply. Bank wire transfers, for example, can range between $30 and $50, depending on the bank. The minimum withdrawal amount varies, ranging from $1 for Skrill to $100 for bank transfers, and all withdrawals are subject to frequent security checks.

Also Read: Binance Review – Latest 2026 Review by Traders

Our Final Verdict on IFC Markets

IFC Markets balances accessibility with caution. A broker licensed by the BVI FSC and Labuan FSA adds respectability, but these are offshore regulators, not the FCA or ASIC. Although IFC Markets is licensed, serious traders should consider the regulatory protection.

For low costs, MT4, MT5, NetTradeX, and synthetic trading tools, IFC Markets is a fantastic alternative for beginner and intermediate traders. As it is regulated outside and doesn't have Tier-1 surveillance, it may not meet high-capital or institutional traders' security requirements. IFC Markets is still a good and useful choice for retail users who care about accessibility and ease of use.

IFC Markets has received several recent industry awards, highlighting its credibility and recognition within the trading community. Its achievements in world business, including international accolades, further establish its reputation in the global financial industry.

IFC Markets Review: FAQ’s

Is IFC Markets regulated and safe for forex trading?

Yes. The British Virgin Islands Financial Services Commission (BVI FSC) and Malaysia's Labuan Financial Services Authority (LFSA) supervise IFC Markets. These licences verify the broker's legality, although they are offshore regulators and give less trader protection than FCA or ASIC. Traders should manage risk.

What trading platforms does IFC Markets offer?

They support MetaTrader 4 (MT4), MetaTrader 5 (MT5), and their own NetTradeX. These platforms are desktop, online, and mobile. NetTradeX offers additional strategy-building tools not present on MT4 or MT5 using the GeWorko Method for synthetic instrument design.

What are the minimum deposit and leverage options at IFC Markets?

IFC Markets requires $1 for standard accounts and $5,000 for professional accounts. Account type and asset determine leverage, which ranges from 1:1 to 1:400. Offshore legislation allows large leverage, but beginners should utilize it cautiously.