Position in Rating | Overall Rating | Trading Terminals |

9th  | 4.5 Overall Rating |   |

OCTA REVIEW

With the increasing popularity of online trading, it’s no surprise that the number of brokers available to traders is growing. Octa is one of those brokers, and it’s gaining considerable attention among traders. That’s why our team of review experts at Asia Forex Mentor is reviewing Octa to see if it’s worth your time and money.

Forex trading just got easier with Octa, the premier international broker that offers advantageous and transparent conditions to all traders. From 0.6 pip spreads to no commission on deposits or withdrawals — everything is designed for your success! Whether you are a beginner or an experienced trader, Octa allows any trading strategy so you can reach peak performance in the Forex market.

Since its launch in 2011, Octa has been providing reliable trading services to traders of all levels. Its focus on security and customer service sets it apart from its competitors. In addition, Octa provides its clients with an array of features and tools to make their trading experience as stress-free and profitable as possible.

In this detailed review, our team at Asia Forex Mentor will go into detail and give you an in-depth look at what Octa offers, including its trading platforms, account types, fees and commissions structure, customer support, and more. So, let’s get started!

What is Octa?

Octa is an international online broker founded in 2011. It offers a range of services for Forex, CFD, and Cryptocurrency trading. With its CySEC and FSCA licenses, Octa offers incredibly advantageous conditions for Forex traders. To date, Octa is used by clients from 180 countries who have opened more than 52 million trading accounts as their gateway to the financial markets—but this broker is particularly popular in the countries of the Asia-Pacific region.

Whether you’re a risk-taking trader or an investor who prefers to emulate the portfolios of others, its services will cater to your needs. Octa has won about a hundred industry awards, including Best CFD Broker Asia 2025 and Best Customer Service Broker 2024.

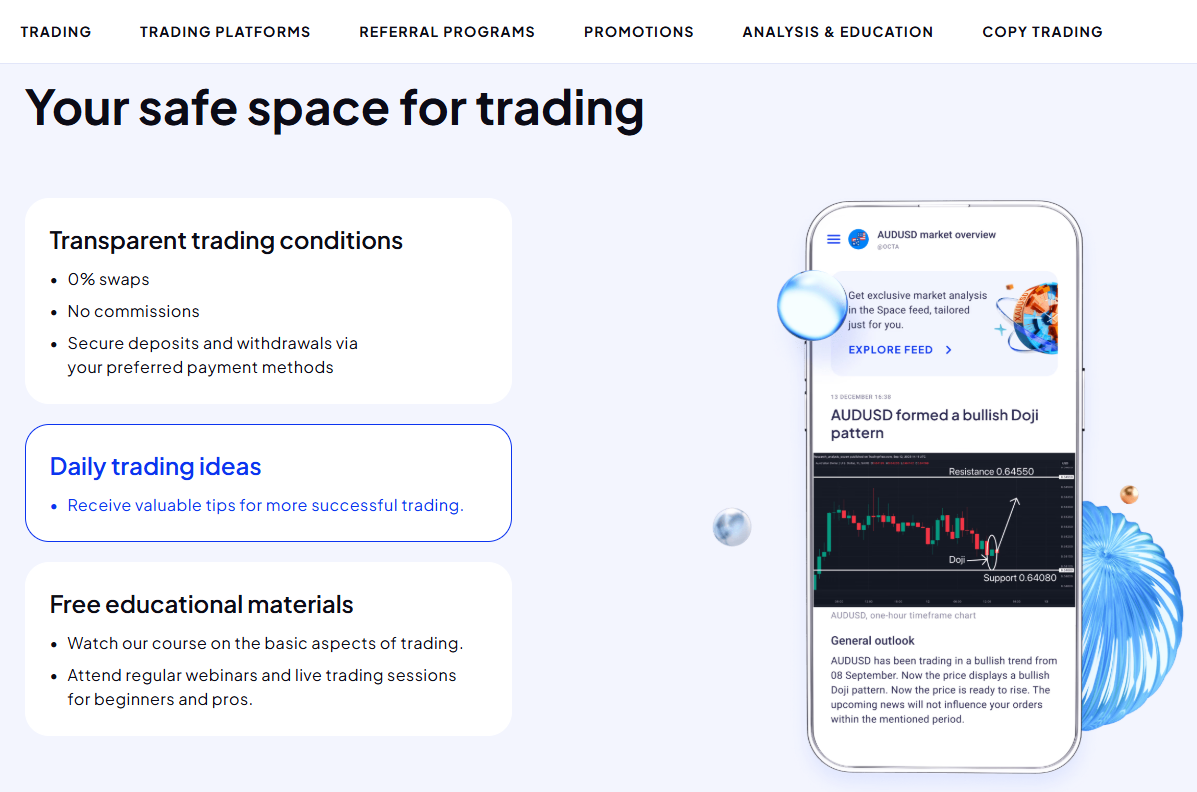

Octa offers proven platforms for trading, such as MetaTrader 4, MetaTrader 5 and OctaTrader. All of these platforms are suitable for beginners and professional traders alike. OctaTrader is the broker’s own platform integrated right into the app—meaning, you don’t have to use a separate app to trade. Login, market information and trading are all conveniently located in one place. OctaTrader is also integrated with Space, a customisable feed with market information and up-to-date trading ideas from Octa analysts.

Advantages and Disadvantages of Trading with Octa

Benefits of Trading with Octa

Octa provides an array of trading instruments for its clients, low spreads, and multiple commission-free deposit and withdrawal options. Plus, you’re protected from any negative balance. Along with traditional trading options like currency pairs, metals, and CFDs, you can now trade Bitcoin Cash, Litecoin, Bitcoin, Ethereum, and Ripple cryptocurrencies from this platform.

Octa has designed its trading terminals to be compatible with any device with internet access, complete with features such as one-click trading, advanced charting, and comprehensive technical analysis. To ensure customer security and the privacy of transactions, they have employed cutting-edge technologies for added peace of mind. SSL and 128-bit encryption safeguard the user’s personal accounts, while 3D secure technology processes credit and debit cards with unparalleled security.

The broker offers its clients the classic MetaTrader 4 and 5 trading platforms and its own OctaTrader platform — a popular choice for many traders. Whether you prefer mobile or desktop versions, there’s something here to suit your needs. If installing the platform on your device isn’t an option, you can trade directly using a web browser.

Octa Pros and Cons

Pros

- Regulated by MISA, FSCA, FSC and CySec

- High maximum leverage up to 1:1000

- Wide asset choice across seven sectors

- Best mobile trading experience

- Advanced charting capabilities

- Competitive spreads and zero fees

Cons

- Low asset selection compared to some other brokers

Analysis of the Main Features of Octa

4.5 Overall Rating |

4.3 Execution of Orders |

4.2 Investment Instruments |

4.5 Withdrawal Speed |

4.5 Customer Support |

4.2 Variety of Instruments |

4.5 Trading Platform |

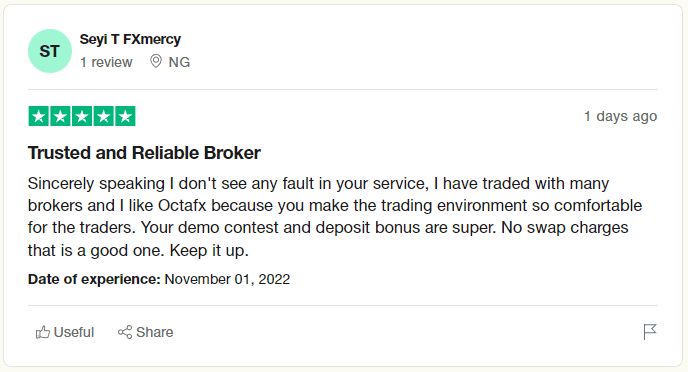

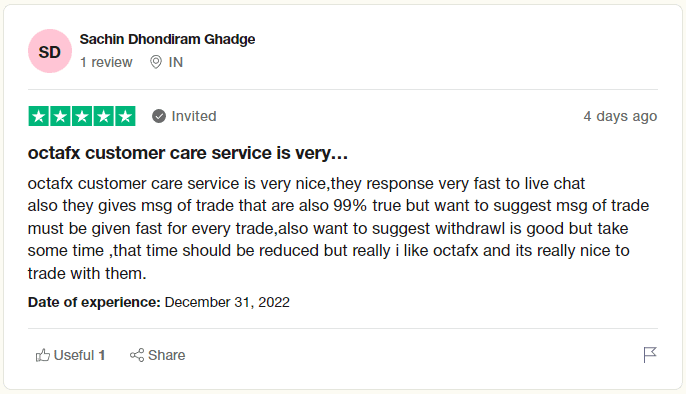

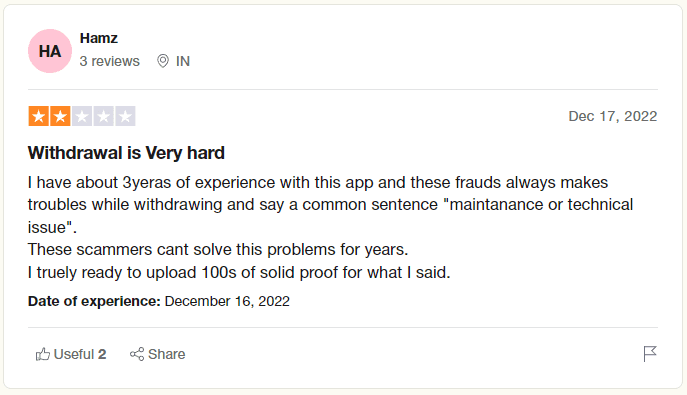

Octa Customer Reviews

While many well-known traders and reviewers have commended Octa’s services, its customers have had a positive overall experience. This broker has been around since 2011 and has steadily gained a reputation in the Forex industry.

Many users have praised Octa for its competitive spreads, no swap charges, diverse assets, payment options, and security features. They also appreciate the customer support service, with some customers noting how quickly their questions were responded to and how helpful the agents were.

However, we have come across some negative reviews online. Some users were disappointed with the limited number of assets offered and the hard withdrawal process. Overall, the majority of customers are happy with their experience trading with Octa.

Octa Spreads, Fees, and Commissions

Octa Spreads

With Octa, traders can enjoy spreads as low as 0.6 pips on EUR/USD – the lowest in the market! But, of course, the list of available spreads may vary depending on various factors, such as which financial instrument is being traded or any changes to market conditions at that particular time, and even your account type.

Octa Trading Fees

To cover the expenses of each trade, traders are often obligated to pay brokers trading fees. However, Octa is unique because it offers commission-free trading with internal markups on raw spreads as an alternative to commissions. Meaning, you do not pay other commissions on top of spreads.

Swap Charges

Swap rates on leveraged overnight positions can be one of the most expensive trading costs. Therefore, traders must consider this when considering their total fees per trade so that they are aware of a huge expense depending upon their strategy.

Octa stands out from the rest of its competitors by not charging swap rates, providing a considerable cost advantage. Many brokers offer this type of trading without swap fees to Islamic traders but counterbalance it with increased markups or other charges in trade conditions. However, at Octa, all clients are treated equally, and no hidden fees take the place of swaps—something that gives Octa traders an edge over others on the market.

Minimum Deposit Fee

Octa requires a minimum opening balance from 25 USD, depending on the country, to start trading. This is a competitive minimum deposit for an MISA-regulated broker, allowing traders to access the markets with relatively low capital. It’s also worth mentioning that deposits come with no commissions.

Deposit/Withdraw Fee

Octa requires no fees for deposits and withdrawals. However, if you deposit in a currency other than USD, you may need to check the exchange rate to ensure you’re depositing the right amount.

Octa Inactivity Fee

Octa is committed to allowing clients to manage their portfolios as they desire, without any trading pressure or inactivity fees. This ensures that traders can make investment decisions safely, knowing there are no hidden costs to discourage them from investing wisely.

Octa Commissions

Octa charges no commission on any transactions; a few pips increase the spread to cover all broker fees required for executing trades.

Octa Leverage

Octa is the perfect platform for traders seeking maximum leverage of 1:1000 for forex and 1:200 for cryptocurrency, with no swap rates and negative balance protection. This makes it an ideal choice for scalpers looking to take advantage of a highly leveraged trading account without unnecessary fees! Furthermore, with Octa’s unbeatable features, you can rest assured that your investments will be safe and secure.

How Octa Fees Compare to other Brokers

Account Types

Below are the three common types of Octa accounts:

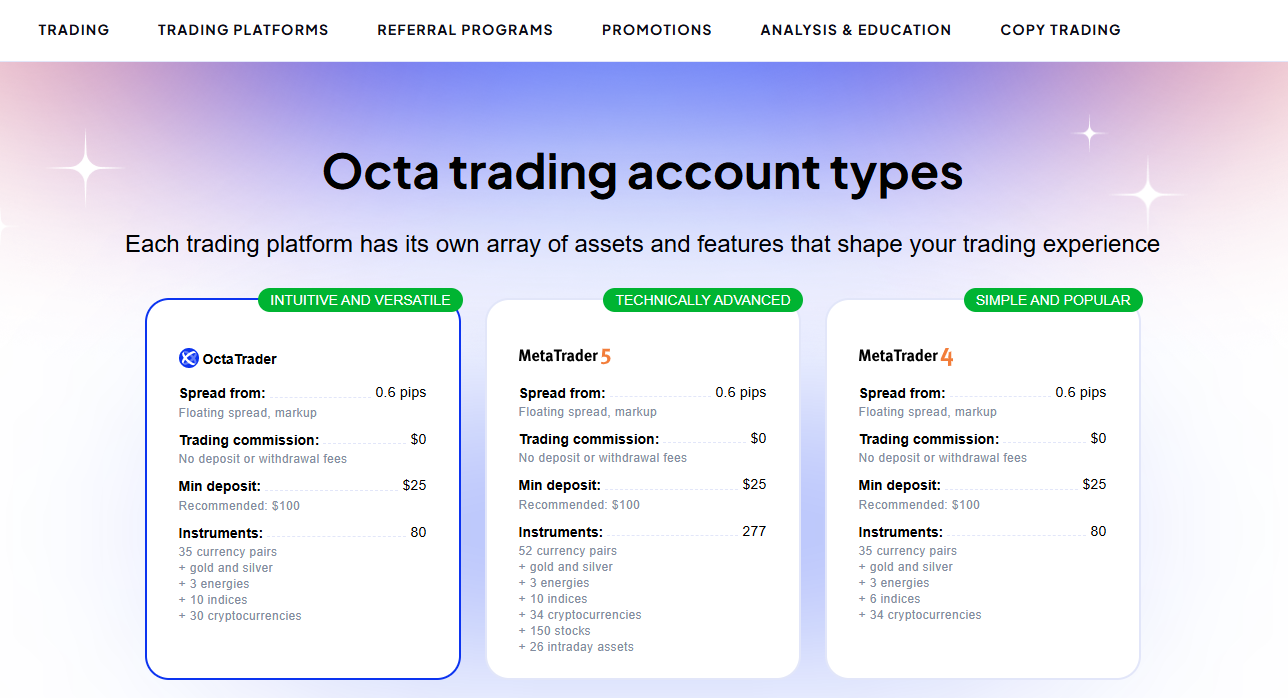

Octa MetaTrader4

Octa MT4 offers a wide range of CFDs for trading – 35 currency pairs, gold and silver, indices, and 30+ cryptocurrencies. The spreads start from 0.6 pips, making Octa one of the most cost-effective brokers on the market.

Octa MetaTrader5

Octa’s MT5 account is specially tailored for traders with more advanced trading knowledge. It offers an extensive selection of assets, having recently added six new indices to its portfolio of offerings. Moreover, traders can benefit from the spreads starting at 0.6 pips!

OctaTrader

The OctaTrader account is the latest addition to Octa’s lineup of trading accounts. It has a user-friendly interface and various features that make it suitable for both beginners and experienced traders. With its one-click trading and instant execution, traders can take advantage of fast and reliable trading right from their fingertips. OctaTrader also offers Space, a built-in feed with trading ideas and market analysis from Octa analysts—and an opportunity to copy ideas right from the feed right on the graph.

Octa Demo Account

Traders can open MT4/MT5 demo accounts without expiration on Octa and practise trading without making a deposit. The adjustable virtual balance and leverage on these platforms enable traders to create more realistic results when testing their EAs and fixing bugs, making them ideal tools for algorithmic traders looking to improve their strategies or beginners who want to feel the market without risk.

How To Open Your Account

Here is a step-by-step guide to opening an account on Octa:

- Go to the Octa official website and click on Open account.

- As the sidebar appears on the screen, fill in all the credentials like name, email, and password.

- You will get the confirmation email; click on the verification link.

- Verify your identity by providing the documents and details required by the broker, such as a copy of your ID or passport and proof of address.

- Once the verification is done, select your trading platform among the available options.

- Set up your trading account by setting leverage and making a deposit.

- You have successfully opened your Octa account and can start trading!

- Get started today by making your initial deposit and uploading a verification document.

What Can You Trade on Octa

With only 52 currency pairs, 30+ cryptocurrency pairs, commodities, and index CFDs to choose from at Octa, you can focus on the lucrative assets that provide high liquidity.

Below are the instruments that you can trade on Octa:

Commodities: As a trader, you can trade CFDs on metals, gold and gas.

Currency pairs: You can trade 52 different currency pairs, including major pairs such as EUR/USD, GBP/USD, and USD/JPY.

Index CFDs: You can trade Index CFDs on the most popular indices like S&P 500.

Cryptocurrencies: Octa provides access to CFDs on Bitcoin, Litecoin, Ethereum, Ripple, and others.

Octa Customer Support

Octa is committed to providing a secure and reliable trading environment. Their customer support team is available 24/7 via live chat and email, promptly providing traders with a resolution to their queries.

According to the trader’s reviews, we have found out that Octa customer service is friendly, helpful and super fast.

Advantages and Disadvantages of Octa Customer Support

Contacts Table

Security for Investors

Withdrawal Options and Fees

- Octa’s finance team acts swiftly upon withdrawal requests. Typically, the processing is completed between 1-3 hours after the request has been submitted. There are also instant withdrawal options.

- You can withdraw your money in various ways, including bank transfers, bank cards, Neteller, and Skrill. For those looking to make digital payments, cryptocurrency withdrawal is also available.

- The minimum amount that can be withdrawn varies depending on the payment method; Visa allows withdrawals beginning at $20. On the other hand, Skrill and Neteller allow withdrawals starting from as low as $5, 0.00096000 BTC, and 0.00500000 ETH, respectively.

Octa vs Other Brokers

Let’s compare Octa with some other popular and reliable brokers.

#1. Octa vs Avatrade

Avatrade is one of the most popular brokers in the market with its exceptional reliability. As it is a low-risk broker with an overall trust score of 93 out of 99, it is widely trusted by professional traders worldwide. Since its establishment in 2006, Avatrade has proven to be a leading online Forex and CFD broker. Avatrade is an online broker with 300,000 registered customers from over 150 countries worldwide, and it envisions empowering traders with trading stability and reliability.

Octa is a well-known broker that offers commission-free multi-asset trading on both the MT4 and MT5 platforms. It provides a range of trading options suited for different types of traders, from beginners to more experienced investors.

When both of these brokers are compared, Avatrade wins because of its multiple trading platforms, including MT4/5, Web Trader, Mobile App, Vanilla options, and social trading. Not only that, but this broker also offers multilingual customer support and over 1250 financial instruments. Contrary to Octa, Avatrade also supports global stock trading and has a variety of payment methods.

#2. Octa vs Roboforex

Roboforex is another reputable and recognized broker with exceptional trading features. It is regulated by the Cyprus Securities and Exchange Commission (CySEC) and has various trading platforms, including MT4, MT5, Mac, Web Trader, cTrader, Tablet, and Mobile Apps. It also enables traders to access various financial markets, including Forex, FTSE, Indices, Dax, IPO, Nikkei, and many more.

Octa offers its traders to trade up to fifty financial instruments, while Roboforex offers around a hundred. The more financial instruments, the more diverse portfolio the traders can have. Moreover, the minimum deposit required for Roboforex is $10, while that of Octa is $25. This makes Roboforex an ideal broker for traders of all stages, from beginners to professionals. Also, Roboforex has over 4.56 million clients from almost 169 countries.

Financial instruments offered by Roboforex include cryptocurrencies, Forex, CFDs, shares, indices, commodities, crypto indices, and ETFs. Whereas those offered by Octa include commodities, cryptocurrencies, Forex, CFDs, and indices. Not only has that, but Roboforex enabled traders to trade FX with high leverage levels. It also has a variety of account types traders can get excellent trading on Prime, ECN, and R StocksTrader accounts. All these exceptional features are what make Roboforex better than Octa.

#3. Octa vs Alpari

Alpari is one of the best brokers for beginners but also has optimum features for professionals. It is a trusted and credible broker with competitive trading fees. It also provides a low-risk trading environment with a trust score of 90 out of 99 and low spreads. Like most other popular and reliable brokers, Alpari also provides four live accounts with higher minimum deposits linked to better trading conditions and tighter spreads. This is why it is a preferred broker for both beginners and experienced traders.

Alpari has been providing its services in the foreign exchange market since 1998, which gives it high credibility. It offers forex, CFD, and binary options trading in a wide-ranged market with various account types, low spreads, and multiple financial instruments. While Octa has quite a small selection of tradeable instruments, its commission-free trading and the low minimum deposit are something that traders like.

Alpari International offers its traders forex with a range of massive pairs, including a variety of major, minor, and exotic pairs. All of these pairs ensure laddered leverage and competitive spreads. On the contrary, Octa offers leveraged trading on currencies with floating spreads from 0.6 pips. The choice between both brokers completely depends on the trader’s choice and how they are looking to trade, and with what brokers.

How Octa Compare against other Brokers

Conclusion: Octa Review

Octa is an impressive trading platform that provides various asset classes and instruments. It has low entry deposits of about 25 USD depending on the country, making it accessible to everyone, plus a 50% deposit bonus for non-EU customers on an unlimited number of deposits. In addition, you will benefit from leverage and copy trading support – two great features combined in this very affordable package. All in all, Octa offers superior value for money.

Forex trading can be daunting and overwhelming, especially for new traders. Octa offers a secure platform to help beginners explore the world of currency trading without fear. In addition, this option is cost-effective, and their customer support team is available 24/7, Monday through Sunday, to answer any questions you may have!

Experienced traders with more complex strategies will find great value in Octa’s extra small spreads, no commissions, and allowance of all trading methods such as hedging, scalping, and automated trading. It also provides excellent customer service plus lots of trader education resources to help guide investors — making it a superb platform for those who are just starting or would like to deploy an existing strategy.

Octa Review FAQs

Is Octa legit?

Yes, Octa is a legit and reliable broker that is properly regulated. It is registered in Bonovo Road – Fomboni, Island of Moheli, Comoros Union, enabling it to provide its services to traders from around the globe. Moreover, it is regulated by the MISA, FSC, FSCA and CySEC.

Is Octa regulated?

Octa is backed by the MISA, FSC, FSCA and CySEC and its membership with The Financial Commission. This international organization provides dispute resolution services for forex brokers and traders. As a result, you can trust Octa to guarantee your financial security.

Is Octa good for beginners?

Octa is an excellent broker for traders of all levels, especially beginners. It offers low spreads, a minimum deposit of $25, and commission-free trading. Additionally, it has various account types that enable traders to start with the basic account and progress to more sophisticated accounts. Octa also has a wide variety of educational resources that can help traders improve their trading skills.