Pepperstone Review

Pepperstone is a leading Australian-based forex broker that has been providing trading services to clients from around the world since 2010. Pepperstone's reputation as a reliable and reputable broker has earned it several industry awards, including the ‘Best Forex ECN Broker' and ‘Best Forex Trading Support' awards from the UK Forex Awards. Additionally, the broker is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC).

As we move forward with this 2023 review, we will provide a comprehensive assessment of Pepperstone services, including its trading instrument, platform, pricing, account types, and more. We will also examine the broker's educational resources, customer support, and other features to give you a complete understanding of what you can expect as a Pepperstone trader. Whether you are a beginner or an experienced trader, this review will help you determine if Pepperstone is the right broker for your needs.

What is Pepperstone?

Pepperstone is a leading online forex and CFD broker, offering a range of trading instruments, including forex, commodities, cryptocurrencies, and indices. The company was founded in 2010 in Melbourne, Australia, and has since grown to become one of the largest forex brokers in the world, with clients in over 150 countries.

Pepperstone is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK and operates under strict regulatory guidelines to ensure the safety and security of its clients' funds and personal information. The company offers a range of platforms, including the popular Meta Trader 4 and Meta Trader 5 platforms, as well as a range of proprietary trading tools and resources.

Pepperstone is known for its low spreads and competitive pricing, as well as its fast execution speeds and reliable trading infrastructure. The company offers a range of account types to suit traders of all levels and preferences, from beginner-friendly demo accounts to advanced institutional accounts.

Advantages and Disadvantages of Trading with Pepperstone

Pepperstone is an online forex and CFD broker that provides traders with access to a wide range of financial instruments, including forex, indices, commodities, cryptocurrencies, and more. Here are the advantages and disadvantages of trading with pepperstone.

Benefits of Trading with Pepperstone

Pepperstone is a highly reputable and respected online forex and CFD broker that offers a range of benefits for traders. Here are some of the key benefits of trading with Pepperstone:

- Tight spreads and competitive pricing: One of the biggest advantages of trading with Pepperstone is the low spreads and competitive pricing. The broker offers some of the tightest spreads in the industry, making it an attractive choice for traders looking to reduce trading costs and maximize profits. Additionally, Pepperstone does not charge any commissions on trades, making it an affordable option for traders of all levels.

- Reliable trading infrastructure: Pepperstone has invested heavily in its trading infrastructure to ensure that its platform is fast, reliable, and stable. The broker's trading servers are in the Equinix data centers in New York, London, and Tokyo, which provides fast and reliable connectivity to major global liquidity providers. This results in fast execution speeds and minimal downtime, which is critical for traders who rely on the platform for their trading activity.

- Multiple platform and tools: Pepperstone offers a range of platform and tools to suit the needs and preferences of traders of all levels. This includes the popular Meta Trader 4 and 5 platforms, as well as a range of proprietary trading tools and resources, such as c Trader and Smart Trader Tools. Additionally, Pepperstone offers a range of educational resources and trading tools to help traders improve their skills and make informed trading decisions.

Pepperstone Pros and Cons

Pepperstone is a reputable online forex and CFD broker that provides traders with access to a range of financial instruments and platforms. Here are some pros and cons of trading with Pepperstone:

Pros:

- Competitive pricing

- Wide range of trading instruments

- Fast execution

- Strong regulatory framework

Cons:

- Limited research and educational resources

- No social trading platform

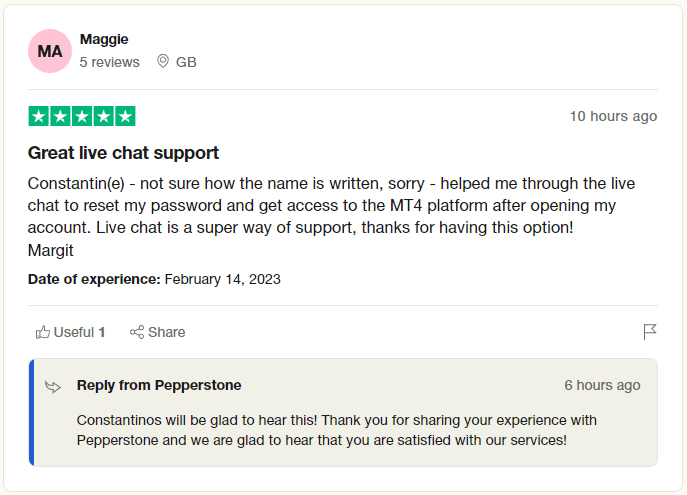

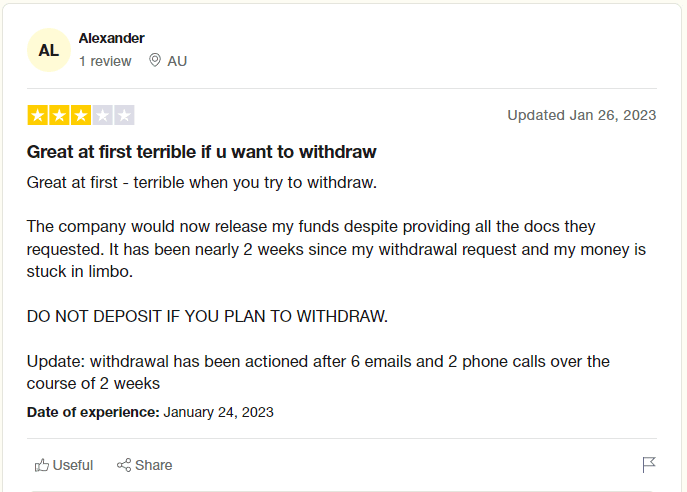

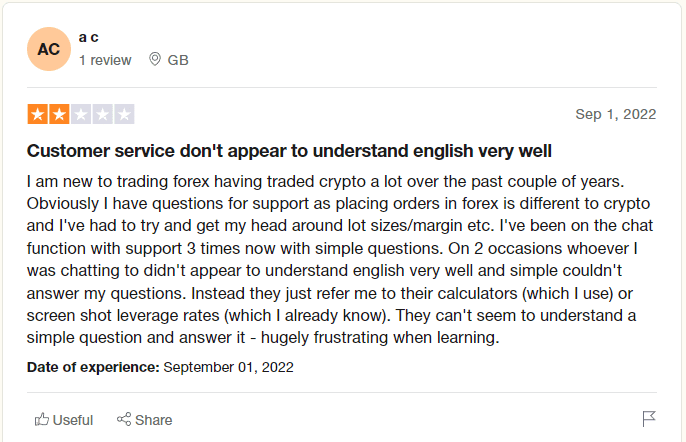

Pepperstone Customer Reviews

The customer reviews of Pepperstone are generally positive, with many customers praising the broker's competitive pricing, fast trade execution, and reliable customer service. Some customers have reported issues with the trading platform freezing up during high volatility periods, and some have reported difficulty withdrawing funds in a timely manner. However, overall, Pepperstone has a strong reputation among traders and is generally well-regarded in the industry.

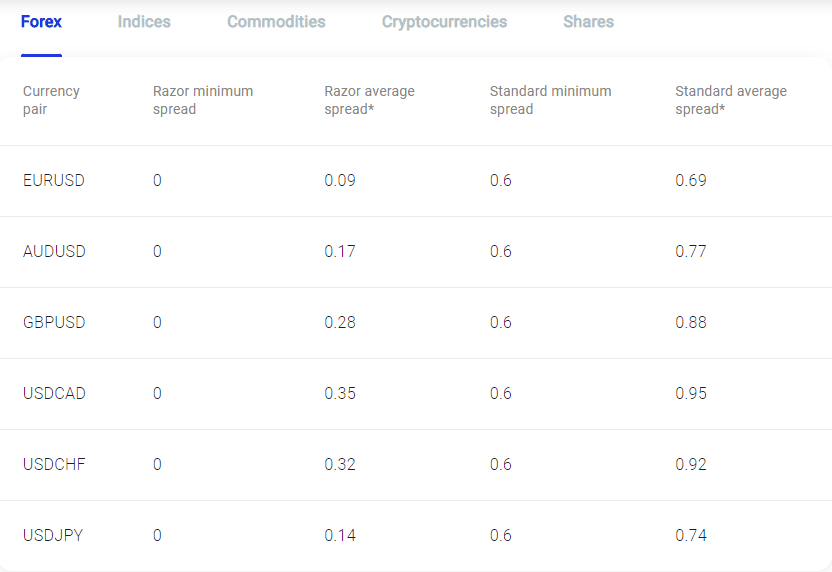

Pepperstone Spreads, Fees, and Commissions

It is an online broker that offers trading services for a variety of financial instruments, including forex, commodities, and cryptocurrencies. Here's an overview of Pepperstone's spreads, fees, and commissions:

Spread

Pepperstone offers variable spreads, which means that the spread can change depending on market conditions. The typical spread for major forex pairs like EUR/USD and USD/JPY is around 0.16-0.30 pips. Spreads for other instruments can vary widely, depending on the liquidity and volatility of the market.

Fees

Pepperstone does not charge any deposit or withdrawal fees for most payment methods, but some payment methods may have fees. For example, deposits made through international bank transfers may be subject to bank fees. There is also an inactivity fee of $15 per month if you do not trade for six consecutive months.

Commissions

Pepperstone charges commissions for trading forex and some other financial instruments. The commission rate depends on the account type you have. For example, if you have a Razor account, which is designed for active traders, you will be charged a commission of $7 per round turn lot (i.e., $3.50 per side) for trading major forex pairs. The commission for trading other instruments may vary. If you have a Standard account, which is designed for more casual traders, you will not be charged a commission for forex trades, but the spreads will be higher.

Account Types

It offers three different account types to suit the needs of different traders. Here's an overview of the account types offered by Pepperstone:

Standard Account

The Standard account is designed for traders who are looking for a simple and easy-to-use trading account. This account type does not charge commissions for forex trades, but the spreads are typically higher compared to other account types. The minimum deposit required to open a Standard account is $200.

Razor Account

The Razor account is designed for more active traders who are looking for tighter spreads and lower trading costs. This account type charges a commission of $7 per round turn lot (i.e., $3.50 per side) for forex trades, but the spreads are typically lower compared to the Standard account. The minimum deposit required to open a Razor account is $200.

Swap-Free Account

The Swap-Free account is designed for traders who follow Islamic principles and do not want to pay or earn interest on overnight positions. This account type is also available for traders who are not based in the Islamic world but would like to avoid paying or earning interest. The Swap-Free account charges a fixed fee on each lot traded, and the spreads are like the Standard account. The minimum deposit required to open a Swap-Free account is $200.

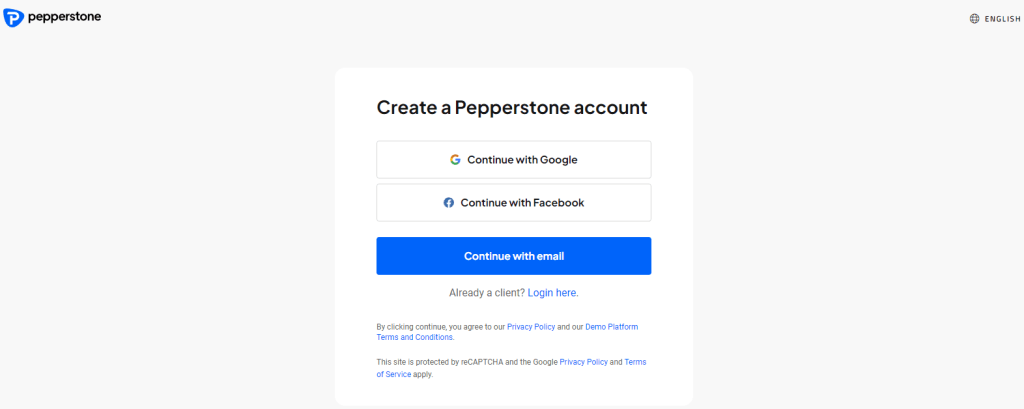

How To Open Your Account?

Opening an account with Pepperstone is a simple and straightforward process. Here are the steps to follow:

Visit the Pepperstone website

Go to the website of pepperstone and click on the “Open Account” button in the top right corner.

Choose your account type

Select the account type that you would like to open. It offers three account types: Standard, Razor, and Swap-Free.

Fill out the application form

Fill out the online application form with your personal details, including your name, email address, phone number, and country of residence.

Provide identification documents

Upload copies of your identification documents, such as a passport or driver's license, and a proof of address, such as a utility bill or bank statement.

Verify your account

Once you have submitted your application and identification documents, it will review your application and verify your account. This process may take up to 24 hours.

Fund your account

Once your account has been verified, you can fund your account using one of the available payment methods. It offers a variety of payment options, including credit/debit cards, bank transfers, and online payment systems.

Start Trading

Once you have funded your account, you can start trading on the platform of your choice. It provides access to a range of platform, including Meta Trader 4 and Meta Trader 5, as well as c Trader. There are also many retail investor accounts and trading cfds available in financial markets.

What Can You Trade on Pepperstone?

It offers trading in over 60 currency pairs, including majors, minors, and exotic pairs. It is used as a smart trader tools in many pepperstone trading platforms.

Indices

You can trade CFDs on some of the most popular stock market indices, such as the US30, UK100, and GER30. There are many pepperstone trading account available for trading strategies.

Shares

It allows trading in shares from some of the largest companies in the world, including Apple, Amazon, and Facebook.

Commodities

You can trade CFDs on precious metals like gold and silver, as well as energy products like oil and gas.

Cryptocurrencies

It offers trading in several popular cryptocurrencies, including Bitcoin, Ethereum, and Ripple.

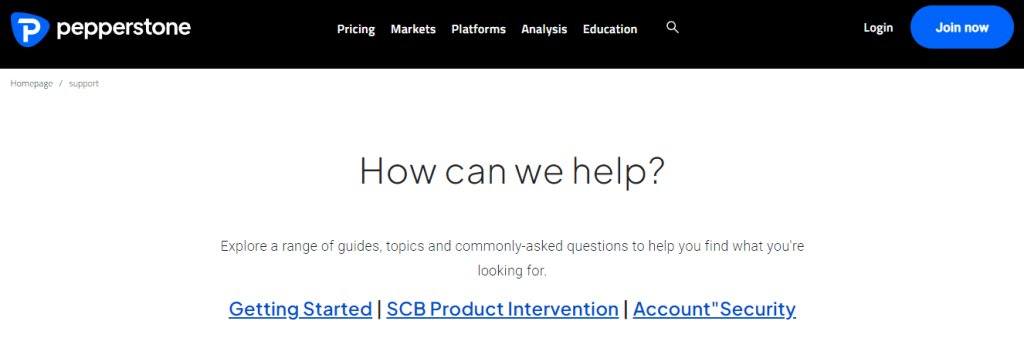

Pepperstone Customer Support

Pepperstone is known for having excellent customer support, which is one of the reasons why the broker has won multiple awards for its service. Our experts at AFM who have used Pepperstone's customer support have found it to be highly responsive, helpful, and efficient.

Pepperstone offers 24/5 customer support via phone, email, and live chat, which means that traders can get in touch with a representative quickly and easily if they have any questions or issues. Our experts have found that the live chat feature is particularly useful, as it allows for quick and efficient communication with a support representative.

In addition to its direct customer support, Pepperstone also provides a range of educational resources to help traders improve their skills and knowledge. This includes webinars, tutorials, and a range of articles and guides that cover a variety of trading topics. Our experts have found these resources to be highly informative and helpful for traders of all skill levels.

Overall, our experts at AFM have found Pepperstone's customer support to be highly effective and efficient, and would recommend the broker to traders who are looking for excellent service and support.

Live Chat:

You can chat with a customer support representative in real-time by clicking on the “Live Chat” button on the Pepperstone website.

Email: You can email your queries or concerns to Pepperstone's customer support team at support@pepperstone.com.

Phone: You can call it's customer support team at the following numbers:

Australia: +61 3 9020 0155

UK: +44 800 0465473

International: +61 3 9020 0155

It's customer support team is available 24/5 and can assist you with any questions or issues you may have regarding your account, trading platform, or any other aspect of their services. There is also a UK financial conduct authority that is always available for help in mobile trading.

Advantages and Disadvantages of Pepperstone Customer Support

Here are some of the advantages and disadvantages of Pepperstone's customer support:

Security for Investors

Pepperstone is a well-regulated and established forex broker that takes the security of its investors seriously. It also has many trading accounts. A lot of retail investor accounts and cfd trading available in trading signals. Here are some of the advantages and disadvantages of Pepperstone's security measures:

Withdrawal Options and Fees

It is a global forex and CFD broker that offers several withdrawal options for clients. The available withdrawal options are as follows:

- Bank transfer

- Credit/debit card

- PayPal

- Neteller

- Skrill

It does not charge any fees for withdrawals; the client's financial institution or bank accounts may charge fees for receiving the funds. A lot of retail investor accounts and trading cfds available in capital markets authority. Additionally, the time it takes for withdrawals to be processed may vary depending on the withdrawal method chosen and the client funds and location. It's recommended to check with it directly or the specific withdrawal method provider to ensure you understand any fees or processing times associated with your chosen method.

Pepperstone Vs Other Brokers

Pepperstone is a well-regulated broker that offers multiple trading platforms, competitive spreads, and low fees. Its customer support is available 24/5. Other brokers such as IG and Oanda offer similar features, but each may have their own unique advantages and disadvantages. It's important to compare different brokers and find one that suits your individual trading needs.

#1. Pepperstone vs Avatrade

Here is a summary of the comparison between Pepperstone and Avatrade:

Pepperstone

- Regulated by ASIC and FCA.

- Offers Meta Trader 4 and 5, and c Trader trading platforms.

- Competitive spreads and low fees.

- 24/5 customer support through multiple channels.

- Regulated by multiple financial regulators.

- Offers its own proprietary platform, Ava Trade GO, as well as Meta Trader 4 and 5.

- Competitive pricing.

- 24/5 customer support, but some reports of slower response times

Pepperstone is a better option for traders who are looking for lower spreads on forex pairs, as the broker is known for offering competitive spreads. Additionally, Pepperstone offers both MetaTrader 4 and MetaTrader 5 platforms, which are highly popular among traders.

#2. Pepperstone vs Roboforex

Here is a summary of the comparison between Pepperstone and Roboforex:

Pepperstone

- Regulated by ASIC and FCA

- Meta Trader 4 and 5, c Trader

- Competitive spreads and low fees

- 24/5 customer support through multiple channels

- Forex, CFDs, commodities, cryptocurrencies, and more

- Regulated by IFSC and CySEC

- Meta Trader 4 and 5, c Trader, R Trader

- Variable spreads and commissions on some account types

- 24/7 customer support through multiple channels

- Forex, CFDs, cryptocurrencies, stocks, and more

There are several reasons why someone might prefer Pepperstone, including its multiple regulatory registrations, user-friendly trading platform, competitive fees and spreads, and its wide range of instruments, especially cryptocurrencies.

#3. Pepperstone vs Alpari

Here is a summary of the comparison between Pepperstone and Alpari:

Pepperstone

- Regulated by ASIC and FCA

- Meta Trader 4 and 5, c Trader

- Competitive spreads and low fees

- 24/5 customer support through multiple channels

- Forex, CFDs, commodities, cryptocurrencies, and more

Alpari

- Regulated by multiple financial regulators, including the FSC in Mauritius and the Financial Commission

- Meta Trader 4 and 5, and its own proprietary platform, Alpari International and Dubai financial services authority.

- Variable spreads and commissions on some account types

- 24/5 customer support through multiple channels, including live chat in multiple languages

- Forex, CFDs, commodities, cryptocurrencies, and more.

There are several reasons why someone might prefer Pepperstone, including its multiple regulatory registrations, user-friendly trading platform, competitive fees and spreads, and its wide range of instruments, especially cryptocurrencies.

Conclusion: Pepperstone Review

Pepperstone is an online forex and CFD broker that offers competitive pricing, fast execution, and a wide range of trading platforms and tools. The broker has a strong regulatory framework and is trusted by traders around the world.

Overall, Pepperstone is a solid choice for both novice and experienced traders who are looking for a reliable and transparent broker with a wide range of trading instruments and features. However, it's important to note that trading always involves risks, and it's important to fully understand the risks involved before making any investment decisions.

Pepperstone Review FAQs

Is Pepperstone a trusted broker?

Pepperstone is generally considered a trusted and reputable broker in the industry. The broker has received multiple awards and accolades for its services and platforms and has been recognized by reputable organizations for its excellence in areas like customer support and overall user experience. The news trading, manual trading, professional traders and trading cfds are also available.

Is Pepperstone regulated?

Yes, Pepperstone is a regulated broker. Pepperstone Group Limited is authorized and regulated by the Australian Securities and Investments Commission (ASIC) under registration number ACN 147 055 703 and holds an Australian Financial Services License (AFSL) number 414530.

Pepperstone Limited, which operates in the UK and Europe, is authorized, and regulated by the Financial Conduct Authority (FCA) under registration number 684312. Pepperstone Markets Limited, which operates in the Bahamas, is licensed, and regulated by the Securities Commission of The Bahamas (SCB) under registration number SIA-F217.

What is Pepperstone minimum deposit?

The minimum deposit required to open an account with Pepperstone varies depending on the type of account and the currency. For the standard account, the minimum deposit is 200 units of the account currency, which could be USD, EUR, GBP, CHF, AUD, CAD, JPY or Dubai financial services authority.

For the Razor account, the minimum deposit is 200 units of the account currency as well, except for JPY accounts, which require a minimum deposit of 20,000 JPY. Pepperstone also offers a range of account types with different minimum deposits, such as the Active Trader account, which has a minimum deposit of 25,000 units of the account currency.