What if quantitative trading allowed you to trade without fear, emotion, or hesitation, relying only on logic and numbers to guide your moves? This is where data meets discipline, helping traders uncover profitable trading opportunities in ever-changing financial markets. Instead of guessing, quant traders depend on quantitative analysis, statistical analysis, and data mining to identify consistent patterns hidden in historical market data.

Through proven quantitative trading strategies, every quantitative trader learns to transform complex information into a structured and repeatable trading strategy. These systems, often built as automated trading systems, test ideas, execute trades, and adapt to shifting market conditions faster than human reactions allow. Once exclusive to hedge funds and elite quantitative trading firms, quant trading is now open to curious learners ready to grow. With guidance, structure, and discipline, numbers can become your strongest ally in every trading decision.

What is Quantitative Trading?

Quantitative trading is a modern approach to investing where traders use numbers, logic, and data analysis instead of emotions. It focuses on studying patterns in financial markets using mathematical models, trading algorithms, and advanced tools from computer science. By applying this quantitative discipline, traders design and test each trading strategy before risking real money, creating a structured path toward consistency and control.

Most quantitative trading firms and hedge funds rely on quant trading to identify profitable trading opportunities that traditional analysis often misses. These trading firms build trading systems that automatically spot trading opportunities and perform trade execution with precision. Supported by backtesting on historical data, every idea is tested under different market movements before being applied live. With the rise of machine learning, data science, and algorithmic trading, quantitative trading strategies have become the foundation of high frequency trading and modern quantitative finance.

History of Quantification

Photo Credit: corporatefinanceinstitute.com

The roots of quantitative trading trace back to Harry Markowitz, who, in 1952, introduced statistical models and mathematical computations for portfolio management. His doctoral thesis in the Journal of Finance became the foundation of quant trading, influencing how traders approached market conditions with data and discipline. During the 1970s, quant traders and investment firms began applying his ideas, earning Markowitz the title “father of quantitative trading.”

In the same decade, the Designated Order Turnaround (DOT) system allowed the New York Stock Exchange to process electronic trades and provide real-time data through Bloomberg terminals. This innovation marked a turning point, leading to faster quantitative trading systems and the rise of high frequency trading. By 2009, most trades were powered by automated systems built on mathematical models. Despite early skepticism, hedge funds and major financial institutions continue to rely on quantitative trading strategies to make data-driven, confident trading decisions.

Pros and Cons of Quant Trading

Pros

One major advantage of quantitative trading is its ability to replace emotions with logic and structured decision-making. It relies on data analysis, research methods, and clear mathematical reasoning to create consistency across financial markets. Many quantitative trading firms and trading firms use these methods to build automated systems that test, adjust, and execute trades effectively. This approach helps traders spot trends early, develop confidence, and manage risk more efficiently through disciplined testing and refinement.

Cons

Despite its strengths, quantitative trading has challenges that can limit success if not properly managed. It requires continuous updates as market conditions change, making old models unreliable over time. Many trading firms struggle with the complexity and cost of maintaining accurate systems for live performance. Without flexible risk management frameworks, traders risk depending too much on data and losing awareness of real-world factors that affect market behavior.

Strategy Identification for Quantitative Traders

The first step in quantitative trading is strategy identification, where quant traders learn to recognize patterns and market opportunities through measurable data. In this phase, traders explore trading techniques that fit both their tools and goals, adapting to changing market conditions with discipline. Professionals in financial institutions and investment banks use research-driven methods and statistical models to uncover potential profits from market inefficiencies. With the help of machine learning and data driven strategies, traders can now design smarter systems that grow with emerging technologies.

Every trader begins by studying past data to build ideas using cutting edge technology and structured testing methods. They group possible strategies into portfolios, optimize them, and measure results through continuous performance evaluation. Concepts like statistical arbitrage and financial engineering help traders refine their edge, while careful observation of market conditions ensures the strategy remains effective. This process trains traders to analyze large datasets with accuracy and patience.

Once a strategy is identified, it must be tested using historical data and simulated scenarios before trading live. Market makers and advanced trading desks rely on backtesting to confirm if a strategy can thrive in real-world market conditions. With structured machine learning models and adaptive systems, modern traders reduce human intervention and improve precision. Strategy identification is therefore the foundation of success, guiding every step that follows in quantitative trading.

Quantitative Trading Strategies

There are many quantitative strategies available, but every quantitative trader should begin with the five most practical and effective ones. Each approach uses logic, mathematical models, and trading algorithms to help traders execute trades with confidence while keeping risk management in check. Let’s explore these innovative strategies that shape how modern quantitative trading works across global markets and various asset classes.

1. Mean Reversion Strategy

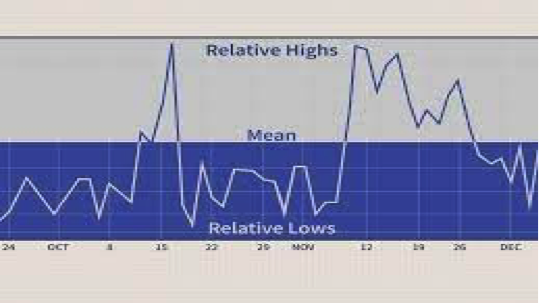

This strategy assumes that prices of financial assets always return to their average value after extreme changes. A quantitative trader writes codes to identify patterns where prices move too far from their mean, creating clear market trends for buying or selling. Using automated trading systems, trades are executed the moment a price returns to its average. This approach relies heavily on precision, technical skills, and understanding how market efficiency naturally restores balance.

Photo credit: investopedia.com

2. Statistical Arbitrage

This method builds on mathematical models that compare related stocks to find pricing gaps within financial markets. When one stock moves differently from its group, the trader acts to profit when prices realign. It’s a fast, data-driven style that often uses automated trading to execute trades instantly. However, constant risk management is essential, as market conditions can quickly shift and impact performance.

Photo credit: seekingalpha.com

3. Trend Following

Also called momentum trading , this strategy tracks market trends to ride large movements as long as they remain strong. A trader watches market conditions and sentiment to detect when a big move begins. Once momentum builds, automated trading tools follow the direction until signs of reversal appear. This approach rewards patience and discipline while emphasizing timing and adaptability.

Photo credit: tradingstrategiesguide.com

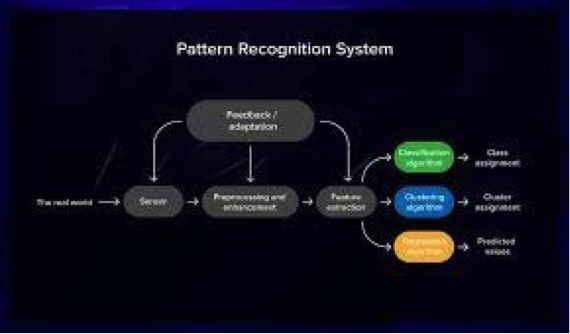

4. Algorithmic Pattern Recognition

This strategy focuses on teaching computers to identify patterns in trading behaviors, especially among large financial institutions. It helps predict when major players plan to execute trades, allowing traders to respond strategically. With advanced coding and mathematical models, these systems analyze market conditions and detect repetitive trading behaviors. The result is faster reaction time and improved understanding of how market efficiency evolves.

Photo Credit: serokell.io

5. ETF Rule Trading Strategy

This technique looks at Exchange Traded Funds and how they react when indexes add or remove stocks. When an index changes, ETFs must adjust their holdings, creating short-term market trends. By anticipating these changes, traders can execute trades ahead of time for consistent gains. Success depends on data accuracy, technical skills, and the ability to learn quantitative trading with patience and structure.

Strategy Backtesting

Once a strategy is identified, quant traders must test its strength through a process called strategy backtesting . This crucial step ensures the chosen idea performs well using historical data before being applied to live markets. In quantitative trading firms and professional trading firms, backtesting helps confirm if a strategy can handle real market conditions without emotional interference. It allows traders to see how different quantitative trading ideas would have behaved across time, helping refine systems before risks appear.

For backtesting to succeed, accurate and clean tick data must be available, along with realistic transaction costs and platform reliability. Many quant traders use software tools like Python, TradeStation, or Excel to test results. Reliable data ensures that the results reflect actual market behavior instead of misleading assumptions. Trading firms often enhance this process using artificial intelligence to simulate responses under different market conditions and detect potential flaws early.

After testing, traders evaluate how much profit and risk a system carries by reviewing results and performance scores. The goal is to minimize drawdowns while maintaining strong returns. Once satisfied with the outcomes, quantitative trading firms use the insights gained to build automated execution systems. Strategy backtesting is where theory meets proof, guiding a quant trader toward confident, data-backed trading decisions.

Execution Systems

In quantitative trading, execution systems bring trading plans to life by turning tested strategies into real market actions. After backtesting confirms a strategy’s strength, brokers use these systems to send and manage trades efficiently. Depending on design, execution can be manual, semi-automatic, or fully automated trading, each offering different levels of control and speed. For beginners, understanding this stage means learning how ideas become executed trades in live market conditions.

A well-built execution system relies on accuracy and timing to reduce trading errors and unnecessary costs. Traders must monitor transaction costs, including commissions, slippage, and spreads, as these small differences can greatly impact profits. Proper design helps maintain performance levels close to those achieved during backtesting. This discipline ensures smoother operations and reliable outcomes across different trading sessions.

However, even the best execution systems can face issues during live trading. Performance divergence may occur due to market volatility, hidden biases, or technical bugs. Traders must constantly test and update systems to maintain accuracy and minimize unexpected losses. In quantitative trading, mastering execution is not just about speed, it’s about precision, consistency, and confidence when every second truly matters.

Risk Management

In quantitative trading, risk management is the safety net that protects traders from unexpected losses and system failures. Even with strong strategies, errors can occur through biased backtesting, unstable networks, or broker failures. A disciplined quantitative trader always prepares for these risks by checking systems, setting limits, and keeping backup plans ready. Consistent monitoring helps maintain stability and builds confidence when trading under uncertain market conditions.

Beyond technology, traders must also manage emotional control, capital allocation, and personal discipline. It’s not just about numbers, it’s about protecting every decision made in the process. Proper risk awareness ensures that even when market conditions shift or systems slow down, trading remains steady and well-balanced. In every strategy, managing risk is what separates consistent traders from those who trade on hope rather than structure.

Quantitative vs Algorithmic Trading

Many new traders often confuse quantitative trading with algorithmic trading, even though they serve different purposes. Quantitative trading focuses on creating strategies using data, logic, and mathematical models to find profitable market patterns. It teaches traders how to analyze information and design systems that respond to specific market conditions. This process is about thinking deeply, testing ideas, and building methods that work before any trade happens.

On the other hand, algorithmic trading focuses on automating those strategies to execute trades faster and more efficiently. It uses technology to carry out decisions instantly, minimizing human delay and emotional influence. While quantitative trading builds the plan, algorithmic trading runs it like a disciplined assistant that never sleeps. Together, they form the backbone of modern trading, where research meets automation and knowledge transforms into consistent, confident action.

Developing Automated Trading Systems as a Quant Trader

Quantitative trading relies on automation, and every quantitative trader must understand how to build systems that think and act logically. Here are the key elements that make up an effective automated trading system:

-

Finding the right market to trade

Begin by choosing suitable markets and instruments such as stocks, options, or futures. Study each market carefully and gather historical data to understand price behavior, volatility, and trading volume. This helps create a strong foundation before designing the system. -

Building features and trading signals

Develop features such as moving averages or price ratios that help identify trading signals. Signals can include open, close, high, or low prices, which indicate when to enter or exit a trade. The goal is to turn market behavior into measurable data your system can interpret. -

Deciding on trade execution strategy and trading costs

Choose how trades will be executed while considering costs like spreads, commissions, and slippage. Even small costs can affect long-term profitability, so every trade should be carefully calculated and efficiently executed. -

Backtesting and performance evaluation

Test the strategy using historical data to see how it would perform under real market conditions. Backtesting helps identify strengths and weaknesses, allowing adjustments for better results. Consistent review and performance improvement ensure that every strategy remains reliable and profitable over time.

Also Read: Best Forex Strategy For Consistent Profits

Conclusion

In the world of quantitative trading, success comes from curiosity, patience, and constant learning through practice. Every trader begins by trying to gain knowledge about data, systems, and strategy design. Over time, they develop confidence through testing and refining methods that align with their goals. True mastery happens when traders understand how their systems react to different market conditions and adjust with discipline.

As market participants, quantitative traders contribute to better market making and smoother trading activity by providing structure and liquidity. This field is a living quantitative subject, always evolving as technology advances and new ideas emerge. The path may seem complex, but every small improvement brings traders closer to stability and precision. In the end, success belongs to those who stay consistent, adapt, and trust the process of growth and discovery.

FAQ's

-

What is Quantitative Trading in simple terms?

Quantitative trading uses computer algorithms, statistics, and programming to identify profitable trading opportunities through data-driven analysis and research on historical market behavior. -

What is Backtesting in trading?

Backtesting checks how well a strategy could perform by testing it on historical and out-of-sample data before using it in live trading. -

What do I need to know to start Quantitative Trading?

You need a good understanding of programming, statistics, and automated trading systems, along with knowledge of strategies, risk management, and consistent practice through study and real-world testing.