Crypto trading is a race, and liquidity is the fuel. Without it, trades slip, costs climb, and opportunities vanish. The right liquidity apps give traders the depth to move fast and stay ahead.

At Asia Forex Mentor, we reviewed the top crypto liquidity apps trusted by both beginners and experts. These platforms offer deep pools, token swaps, yield farming, and decentralized exchange aggregation. In this guide, you’ll see features, supported wallets, pricing, and security, helping you pick the right tool. With the right app, traders can optimize execution, manage risks, and stay competitive in the evolving DeFi and crypto markets.

What is Liquidity and Why Does It Matter?

In today’s fast-moving crypto markets, liquidity makes the difference. Without the right tools, traders face wide spreads, delayed execution, and unnecessary losses. Liquidity apps solve this problem by tracking market depth in real time, spotting price changes, and executing trades with accuracy.

The best liquidity apps go further. They offer cash flow forecasts, consolidate data, and support liquidity planning for smarter financial decisions. With real-time visibility, streamlined processes, and advanced forecasting, these tools improve both trading performance and financial management. Integrated cash management systems monitor inflows, unify multiple accounts, and deliver precise positioning for effective bank management.

At Asia Forex Mentor, we tested leading liquidity apps trusted worldwide. Our list of ten platforms gives traders an edge, whether refining entries, reducing slippage, or managing risk. By the end, you’ll know which tools maximize execution, safeguard capital, and keep you ahead. Choosing the right provider means evaluating liquidity depth, service offerings, and market strength to ensure optimal results in today’s competitive crypto markets.

How to Choose the Best Liquidity Apps

Choosing the right crypto liquidity app can shape your trading success. In fast markets, every second matters for execution and price. The best apps deliver real-time depth, precise order book data, and seamless execution to minimize slippage and secure strong pricing. Look for features like multi-exchange aggregation, liquidity tracking, and transparent pricing to stay ahead of market shifts.

Pricing also matters. Free apps exist, but premium ones offer deeper metrics and insights that improve decisions. Integration is equally important, your app should work smoothly with brokers, wallets, and platforms. Ease of use cannot be ignored. A well-designed program helps beginners and pros track liquidity, manage cash flow, and execute efficiently. With intuitive dashboards, training, and strong support, crypto liquidity management becomes simpler, faster, and more effective.

How We Chose the Tools

The Asia Forex Mentor team reviewed top crypto liquidity apps to find reliable DeFi tools for traders. We focused on token swaps, liquidity provision, staking, yield farming, and decentralized exchange aggregation. Real-world performance, platform reputation, and user feedback guided our choices to ensure reliability for both beginners and pros.

Ease of use and smooth wallet integrations with MetaMask, Coinbase Wallet, and other DeFi wallets were priorities. Pricing mattered too, from trading fees and gas optimization to rewards for liquidity providers. Apps with strong historical data tools ranked higher for better forecasting accuracy.

Security was non-negotiable. We favored platforms with safe smart contracts, stable on-chain execution, and unique advantages like deep liquidity pools, low slippage, and multi-chain support. Both DeFi and traditional liquidity solutions were assessed, with platforms offering custody, risk management, or clear frameworks ranking highly. From this, we identified ten apps that deliver performance, security, and advanced features for today’s DeFi market.

10 Best Liquidity Providers App List

1. Uniswap

What is Uniswap?

Uniswap is one of the biggest decentralized exchanges (DEXs) created on the Ethereum blockchain. It lets people swap, earn, and offer liquidity for tokens without a central authority. It uses an automated market maker (AMM) approach instead of regular order books, which speeds up trading and doesn't require permission. Uniswap is great for crypto traders, liquidity providers, and DeFi fans since it has deep liquidity pools, a lot of trading activity, and works well with many wallets.

Advantages and Disadvantages of Uniswap

Uniswap Pricing and Features

Uniswap is free to use, though trading fees range from 0.05% to 1% depending on the chosen pool. It runs on a strong AMM system, allowing token swaps, liquidity provision, and smooth integration with DeFi wallets like MetaMask and Coinbase Wallet. UNI token holders shape governance, giving the community a voice in upgrades and policies. The platform works on web, browser, and mobile wallets, running seamlessly on Ethereum. Still, users must account for high Ethereum gas fees and remember that Uniswap supports only crypto trades, not traditional cash transactions.

2. Binance

What is Binance?

Binance is one of the biggest cryptocurrency exchanges in the world that started in 2017. It gives people all over the world a place to buy, sell, and trade hundreds of cryptocurrencies. Binance is a good choice for beginners, retail traders, and professional investors since it has a lot of liquidity, low costs, and powerful trading tools. The platform also lets you trade futures, stake, save, buy NFTs, and establish new crypto projects. Users can get lower costs and access to special services with its own cryptocurrency, BNB.

Advantages and Disadvantages of Binance

Binance Pricing and Features

Binance is one of the biggest crypto exchanges. It has minimal trading costs, starting at 0.1% for spot trades and 25% off when you pay using BNB. It supports over 350 cryptocurrencies and offers a lot of different services, such as trading options, futures, and spots, as well as staking, saves, and P2P transfers. The platform may be used on the web, on mobile devices, and through an API, so it works for both new and experienced traders. But U.S. customers can only use Binance.US in specific areas, and the platform has had trouble with regulators in some places, which could limit some capabilities.

3. Kraken

What is Kraken?

Kraken is a well-known U.S.-based cryptocurrency exchange that started in 2011 and opened for business in 2013. It offers a safe place to trade a wide range of digital assets using real money. It offers spot, futures, margin, staking, OTC, and NFT trading, and it wants to add more services for many assets, like stock and ETF trading. Kraked is a trusted choice for both retail and institutional customers since it follows the rules, has solid security measures, and is open about its proof-of-reserves.

Advantages and Disadvantages of Kraken

Kraken Pricing and Features

Kraken has a tiered maker-taker fee model that starts at about 0.25% for makers and 0.40% for takers on spot trades. The fees go down as the number of trades goes up. For futures, maker fees can be as low as 0.02% and taker fees can be as low as 0.05%, and both types of fees go down as volume goes up.

Kraken offers flexible staking, letting users stake assets without waiting through unbonding periods. It supports margin and futures trading, giving access to leverage and professional tools like OTC and institutional APIs. The platform works across web, iOS, Android, and APIs for algorithmic strategies. Deposits are generally free, though withdrawal fees vary by asset and service. Kraken recently expanded by adding commission-free trading for over 11,000 U.S.-listed stocks and ETFs, making it a versatile choice for traders.

4. Curve

What is Curve?

Curve is a decentralized exchange (DEX) and automated market maker (AMM) made just for swapping stablecoins and other assets with little slippage. It started in early 2020 and works through liquidity pools on chains like Ethereum, Polygon, Optimism, and Arbitrum. The Curve DAO is in charge of governance, and the CRV token is utilized for voting and rewards. What makes it stand out is its streamlined algorithm, which puts efficiency in stablecoin trading and lowering trading expenses first.

Advantages and Disadvantages of Curve

Curv Pricing and Features

Curve charges a flat swap price of about 0.04% for each transaction. Half of this fee goes to liquidity providers, and the other half goes to CRV token holders. However, these rates can fluctuate based on DAO governance votes. It is great for trading stablecoins because it has many optimized liquidity pools, such as the “Curve Factory” for making your own pools. Users can connect through a web-based interface that works with common DeFi wallets. There is no mobile app at this time. Curve never retains user funds because it is non-custodial, therefore users are always in charge.

5. Balancer

What is Balancer?

Balancer Finance is an automated portfolio manager and decentralized finance (DeFi) technology that runs on Ethereum. Users can make liquidity pools with up to eight tokens in any ratio, and these pools are automatically rebalanced to keep the goal weights, like an index fund that works on smart contracts. Liquidity providers get trading fees and BAL governance tokens for helping the protocol.

Advantages and Disadvantages of Balancer

Balancer Pricing and Features

Balancer Finance doesn't charge subscription fees. Instead, liquidity providers get a cut of the trading fees that customers pay when they exchange inside their pools, as well as BAL governance tokens as rewards. It is quite flexible because it can dynamically weight up to eight tokens, automatically rebalance, and has multiple types of pools (public, private, smart) for different strategies. There is no separate mobile app, but users can connect using a web interface that works with DeFi wallets like MetaMask and Coinbase Wallet. Liquidity providers always have full control over their money because the platform is not custodial.

6. Bancor

What is Bancor?

Bancor is a decentralized finance (DeFi) technology that lets you automatically convert tokens on-chain without the need for order books. It uses the Bancor Network Token (BNT) to make it easier to exchange across chains and provide liquidity. The system works completely on-chain and can be used with any blockchain that supports smart contracts, which makes it flexible.

Advantages and Disadvantages of Bancor

Bancor Pricing and Features

Bancor charges a 0.1% trading fee and gives you ways to provide liquidity, like single-token exposure and insurance against temporary losses. The platform works with a lot of different coins, however it mostly focuses on ERC-20 and EOS tokens. There is no mobile app for the platform, but users can access it through its web interface. Bancor puts a lot of emphasis on security and decentralization. It runs completely on-chain, so there is no need for middlemen.

7. Rhino.fi

What is Rhino.fi ?

Rhino.fi , which used to be called DeversiFi, is a decentralized finance (DeFi) platform that runs on Ethereum Layer 2 and lets users keep their own funds. It gives users easy access to swaps, staking, yield farming, and trading across more than 35 blockchains, all with lower gas fees and better anonymity. The platform uses zero-knowledge rollups and liquidity outposts to make cross-chain transactions quick and safe.

Advantages and Disadvantages of Rhino.fi

Rhino.fi Pricing and Features

Rhino.fi doesn't charge platform costs for bridging transactions. Users only have to pay the local gas fees of the chain they are going to. Transactions that cost less than $100 are free. Transactions that cost more than that can pay lower fees with the Alpha Key NFT. The platform lets you shift between 35 or more blockchains, leverages zero-knowledge rollups for fast, cheap transactions, and has developer tools including APIs and SDKs. There is no specialized mobile app; access is only over the web.

8. Kyber Network

What is Kyber Network?

Kyber Network is a multi-chain liquidity hub that helps decentralized applications (dApps), wallets, and users get liquidity from more than 100 sources on 16 supported chains, such as Ethereum, Polygon, Binance Smart Chain, and Avalanche. KyberSwap, its main offering, is a next-generation DEX aggregator that gets liquidity from several DEXs and its own pools to make sure that swap rates are as good as they can be.

Advantages and Disadvantages of Kyber Network

Kyber Network Pricing and Features

9. 1inch

What is 1inch?

1inch is a decentralized exchange (DEX) aggregator that sources liquidity from multiple DEXes to provide users with the best token swap rates. It is made for crypto traders who want to make transactions with little slippage and get the best prices on a variety of decentralized platforms. 1inch works with a lot of different cryptocurrencies, wallets, and blockchains. It also has extra features like limit orders and routing that uses less gas. It can be accessed by web and mobile apps for iOS and Android. This makes it good for both new DeFi users and experienced traders who want fast, decentralized trading solutions.

Advantages and Disadvantages of 1inch

1inch Pricing and Features

1inch is a decentralized exchange (DEX) aggregator that gets liquidity from many different platforms to give users the best token swap rates. It has a self-custodial wallet, a portfolio tracker, a physical/virtual crypto debit card, and gasless cross-chain swaps, among other things. You can get to the platform through online and mobile apps for iOS and Android. The 1INCH token is the governance token of the 1inch DAO. This means that those who own it can help make decisions.

10. SushiSwap

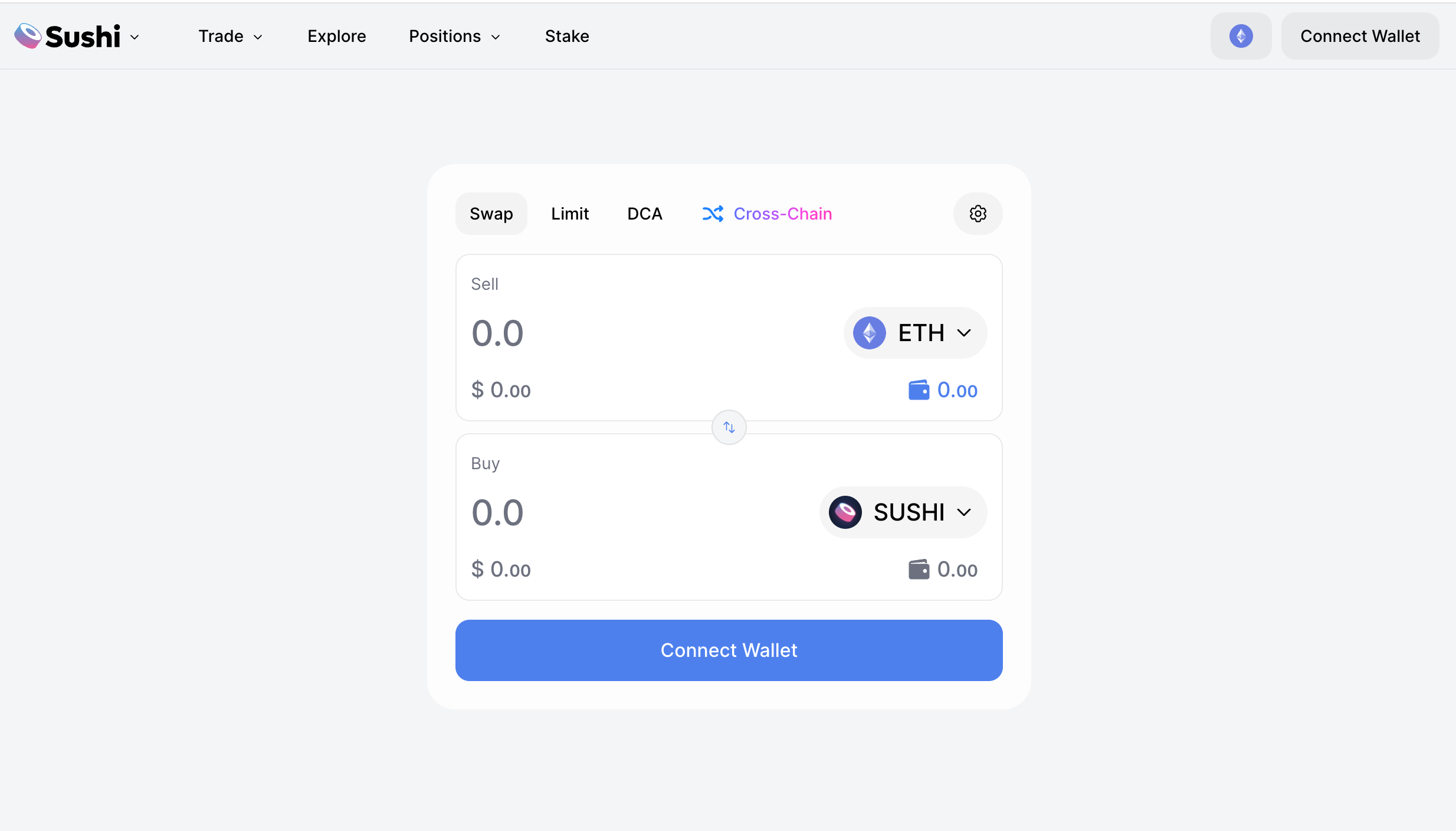

What is SushiSwap?

SushiSwap is a decentralized exchange (DEX) on Ethereum that lets anyone trade, stake, and receive rewards by providing liquidity. It started out as a fork of Uniswap, but it has since added its own features, such as yield farming, governance through the SUSHI token, and compatibility for many blockchains. The Sushi DAO makes decisions regarding the platform, which is run by the community.

Advantages and Disadvantages of SushiSwap

SushiSwap Pricing and Features

SushiSwap charges a fee for each trade, which is 0.3%. 0.25% of this goes to liquidity providers, and 0.05% goes to people who have SUSHI tokens. The SUSHI token lets you do things like yield farming, staking, and voting on the platform. It works with many blockchains, such as Ethereum, Binance Smart Chain, and Polygon, which gives users access to a wide selection of assets and cheaper transaction costs. You can use SushiSwap on both the web and your phone, which makes it easy to use on all of your devices.

Tips for New Users

If you’re new to liquidity apps, start smart. Using the wrong tool can waste both time and money. Begin with small amounts across different platforms to learn how they function, how trades execute, and what fees apply. We highlighted options suited for beginners, active traders, and pros. Some even serve mid-sized businesses with scalable solutions and real-time cash insights. Look for platforms with deep liquidity pools, low slippage, and broad token support. Features like limit orders, staking, and automated rebalancing help manage portfolios more effectively.

Avoid common beginner mistakes. Don’t overcommit to one pool, ignore impermanent loss, or swap tokens without reviewing contracts. Stay alert to scams and watch network fees, especially on Ethereum-based apps. To maximize benefits, use governance tokens where possible, approach yield farming with care, and track market conditions regularly. With patience and practice, new users can reduce risks, build confidence, and steadily get the most from decentralized trading.

Conclusion

Selecting the appropriate and best liquidity app or crypto liquidity solution is critical for effective DeFi trading. The platform you choose can affect transaction efficiency, trading fees, and access to large liquidity pools. Uniswap excels at token swaps with extensive ERC-20 compatibility, while Binance provides unparalleled worldwide liquidity and a diverse choice of cryptocurrencies for both novices and pros. New users should spend time exploring, testing, and comparing these tools to determine which platform best suits their trading needs. By making informed decisions, traders can maximize their tactics and fully realize the promise of decentralized finance.