Hey, what’s up guys? It’s Ezekiel Chew here.

So let me hit you with this. If you’ve ever taken what felt like a perfect trade, only to watch price reverse the moment you enter, boom, that’s not bad luck. That’s you trading right into institutional zones.

Most traders chase candles. But institutions don’t trade that way. They use VWAP. This is their compass for building positions, trapping liquidity, and controlling the entire move.

Here’s the part most people never learn. When you read VWAP the right way, it stops being just a simple line. It turns into a real strategy. This is the exact VWAP approach I use to pull in some of my biggest trades.

So today, I’m breaking down two VWAP trading strategies that I personally rely on. These are built to help you track where the big money is positioned. Stick with me on this one, because once you understand how institutions use VWAP, you’ll never trade it the same way again.

📺 Watch the full breakdown in this video:

What Is VWAP (And Why Most Traders Misread It)

First things first, let’s start with the foundation. VWAP stands for Volume Weighted Average Price. It sounds technical, but once you see it on the chart, it becomes simple.

VWAP shows you the average price where real money has actually traded, weighted by volume. It doesn’t care where the candles look nice. It shows where serious buying and selling actually happened.

On most platforms, you’ll find VWAP or Anchored VWAP inside the indicator list. You select it, click the starting point of the move, and the VWAP line plots itself from that anchor point. From there, that line becomes your compass.

When the price stays above VWAP, buyers are in control. When price dips below it, sellers take over. In a bullish market, VWAP often acts as support. In a bearish market, it acts as resistance.

This is why VWAP matters. In an uptrend, price will often pull back to VWAP before pushing higher, giving you very clean long opportunities.

When price breaks below VWAP and starts forming lower lows, that’s the first sign the trend is shifting. The same logic applies in a downtrend, just flipped.

Learning VWAP is only the foundation. The real edge comes from how you use it.

Step 1 — VWAP Reaction Zones

Here’s what kills most traders. They see VWAP, but they don’t see what’s around it.

Most traders treat VWAP like a solo indicator. That’s the mistake. Like any tool, VWAP’s real power shows when it works together with price action.

You don’t trade VWAP alone. You pair it with your key zones. Support, resistance, trend lines. These are the areas where reactions actually happen.

When VWAP lines up with a key zone, it’s no longer a coincidence. It’s the market giving you a clue.

Picture this. You’re in a strong uptrend. Price is making higher highs and higher lows. You anchor VWAP at the start of the move.

Price pulls back and taps into the VWAP line, and that same area lines up with a key support zone.

What happens next? Long weak candles start forming. You see rejection. You see buyers strength. This isn’t noise. This is confirmation.

You’ll often see multiple touches in that zone. Each touch that holds builds bullish pressure.

When price finally breaks the trend line and prints a higher high, that’s your signal. The pullback is over. The next leg of the trend has begun.

This is where VWAP and structure work hand in hand.

We’re not guessing. VWAP confirms what the candles are already telling you. When VWAP and your key zone align, that’s a high-quality continuation setup.

The same logic applies in a downtrend. Anchor VWAP at the start of the move down.

Price pulls back into VWAP and a resistance zone. You see long wick candles. And all you need to do is You don’t jump in just because VWAP gets rejected once.

You wait for confirmation. A break in structure. A lower low. A trend line break. That’s proof the pullback is done and the selling is resuming.

When VWAP and resistance align, that’s your sweet spot. Confluence, clarity, and conviction all come together.

Step 2 — Multi-Timeframe VWAP Precision

What separates average traders from sharp traders is the ability to read between timeframes.

The market is never flat. What looks calm on one timeframe is chaos on another. If you rely on only one timeframe, you’ll often be late.

Multi-timeframe VWAP lets you read the story inside the story.

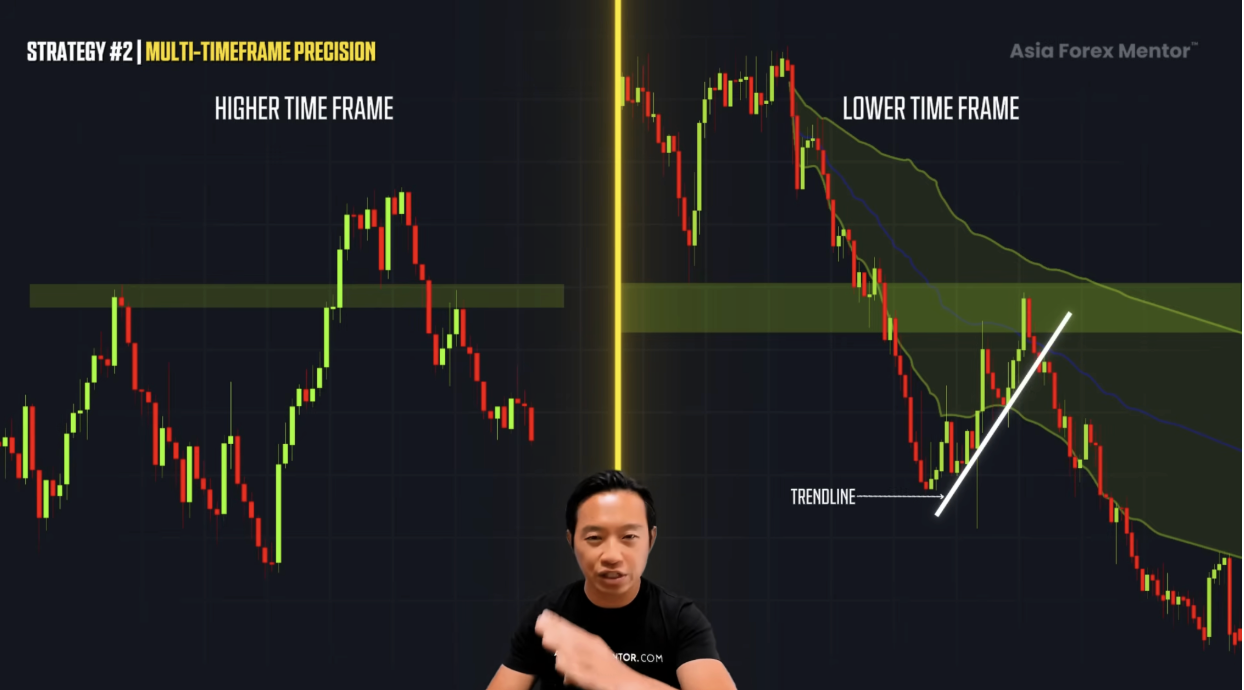

Let’s say you’re in a strong uptrend and you start seeing divergence. Price breaks below a key zone and forms a lower low. That’s your first warning that momentum is shifting.

You anchor VWAP at the start of that move. You wait. Price pulls back toward VWAP, and it pulls back into the same key zone.

You see a long wick candle form. That’s a reaction, but it’s not confirmation yet.

A single reaction can still be a trap. So what do we do? We zoom in.

Drop to a lower timeframe. Now you see the smaller swings, the real fight between buyers and sellers. You draw a mini trend line across those highs.

When price breaks below that line, that’s your sniper entry.

This is how you enter before the crowd. This is what multi-timeframe precision gives you. Control, timing, and clarity.

VWAP Is a Zone, Not a Line

Here’s something important you need to understand. VWAP doesn’t need to be touched perfectly.

Sometimes price reacts near VWAP, not exactly on it. That’s still valid. VWAP is a reaction zone, not a ruler.

When VWAP, volume, and structure all react in the same area, that’s your green light.

Once the reaction forms and price breaks above or below your mini trend line, that’s your entry. This is how you get precise.

VWAP is about rhythm. It’s about reading behavior, not chasing perfection.

VWAP Strategy Summary

VWAP is not just a line. It’s a story.

On its own, VWAP tells you which side of the market is in control. You layer it with key zones, probability increases. When you add multi-timeframe confirmation, precision increases even more.

When VWAP zones, support and resistance, rejection candles, lower timeframe structure, and momentum signals align, trading stops feeling random. It becomes controlled. It becomes repeatable.

Once confirmation shows up, you enter with conviction.

FAQ's

What is VWAP in the simplest way?

VWAP shows the average price where most trading actually happened, weighted by volume. It helps you see whether buyers or sellers are in control and where price is likely to react, instead of guessing based on candles alone.

Why do traders use VWAP instead of just indicators?

Most indicators react to price after it moves. VWAP shows where real money already traded. This makes it easier to trade with the market direction instead of fighting it.

Should VWAP be used alone?

No. VWAP works best when combined with support and resistance, structure, and confirmation candles. VWAP shows the area to watch, but price action tells you when to enter.