The world of Artificial Intelligence (AI) is red-hot, and at its core sits Nvidia. For investors eyeing this tech giant, May 28, 2025, was highlighted by some as a crucial date. The sentiment? It might have been the last opportunity to grab this “magnificent” AI stock at what was considered a “cheap” price, especially before its highly anticipated fiscal 2026 first-quarter earnings report.

So, why the urgency around this specific date? Here are the compelling reasons put forth for considering Nvidia stock before the market closed on May 28:

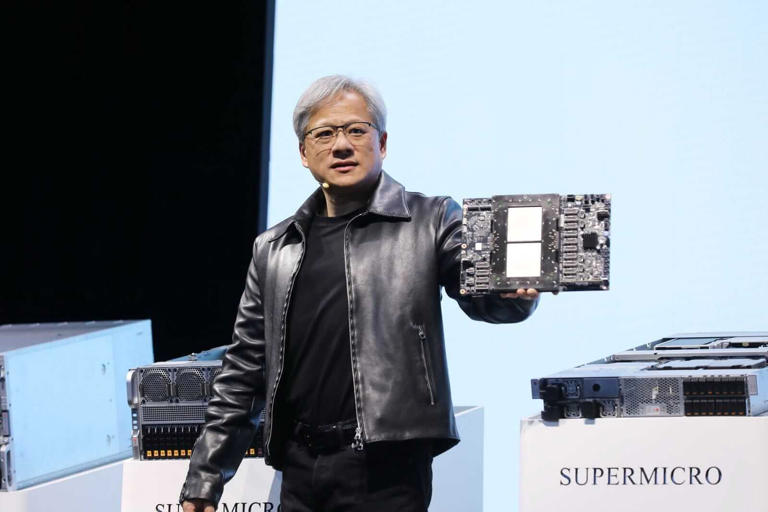

1. Unstoppable Demand for AI Chips

The AI revolution is centered on Nvidia, which supplies technology for important businesses and scientific investigations. Both the demand for and the growth in demand for advanced AI chips are considered to be picking up speed. Because there is always demand for its hardware, the company is likely to keep experiencing growth in profitability. A significant part of the world’s AI hardware spending still belongs to Nvidia.

2. Still an Attractive Valuation (Even After the Surge)

Regardless of its high share price, which had risen by 28% the month before, experts still thought Nvidia looked attractive to investors. We are not just focused on the present price but also on how the company will grow going forward. Since Nvidia is a leader in AI and at the center of its industry boom, many believed its share price was fair and made it worth buying. To many people interested in AI, the thought of it being ‘cheap’ seemed like a good reason to invest.

3. Poised to Crush Earnings Expectations

A lot of excitement filled the market, reports showed, since investors thought Nvidia could beat Wall Street expectations in its first fiscal period. This was not just optimism; widespread belief in the company’s success held that AI chips would create much more demand than analysts were expecting. Healthy earning reports tend to propel the stock upwards instantaneously. It was expected that, should these predictions come true, purchases made later would cost more than earlier ones.

4. Guidance Set for Take-Off

Along with its strong results for sales and earnings, the solid state of AI hardware spending was seen as a big help for what lies ahead for Nvidia. Positive expectations for the following quarters can greatly increase investors’ confidence, which usually leads to major rises in estimated share prices. For people who waited past May 28, they missed the early leap caused by Nvidia’s impressive growth predictions.

Basically, the message was that for those willing to join Nvidia in investing in AI, the days leading up to its May 28 results represented a valuable one-time opportunity. With strong AI and investors predicting top results, the firm’s fans wanted to jump in fast to get the best rates.