Position in Rating | Overall Rating | Trading Terminals |

193rd | 4.5 Overall Rating |

|

GFF Brokers Review

Choosing a trustworthy broker is essential for long-term trading success. The broker must ensure transparent pricing, stable platforms, and secure fund management, minimizing risks from poor execution or system failures. While many brokers offer similar financial products, what truly distinguishes them is their dependability and quality of customer support. Partnering with a solid broker enables traders to concentrate on strategy and risk management without concerns about hidden fees, platform issues, or delays in execution.

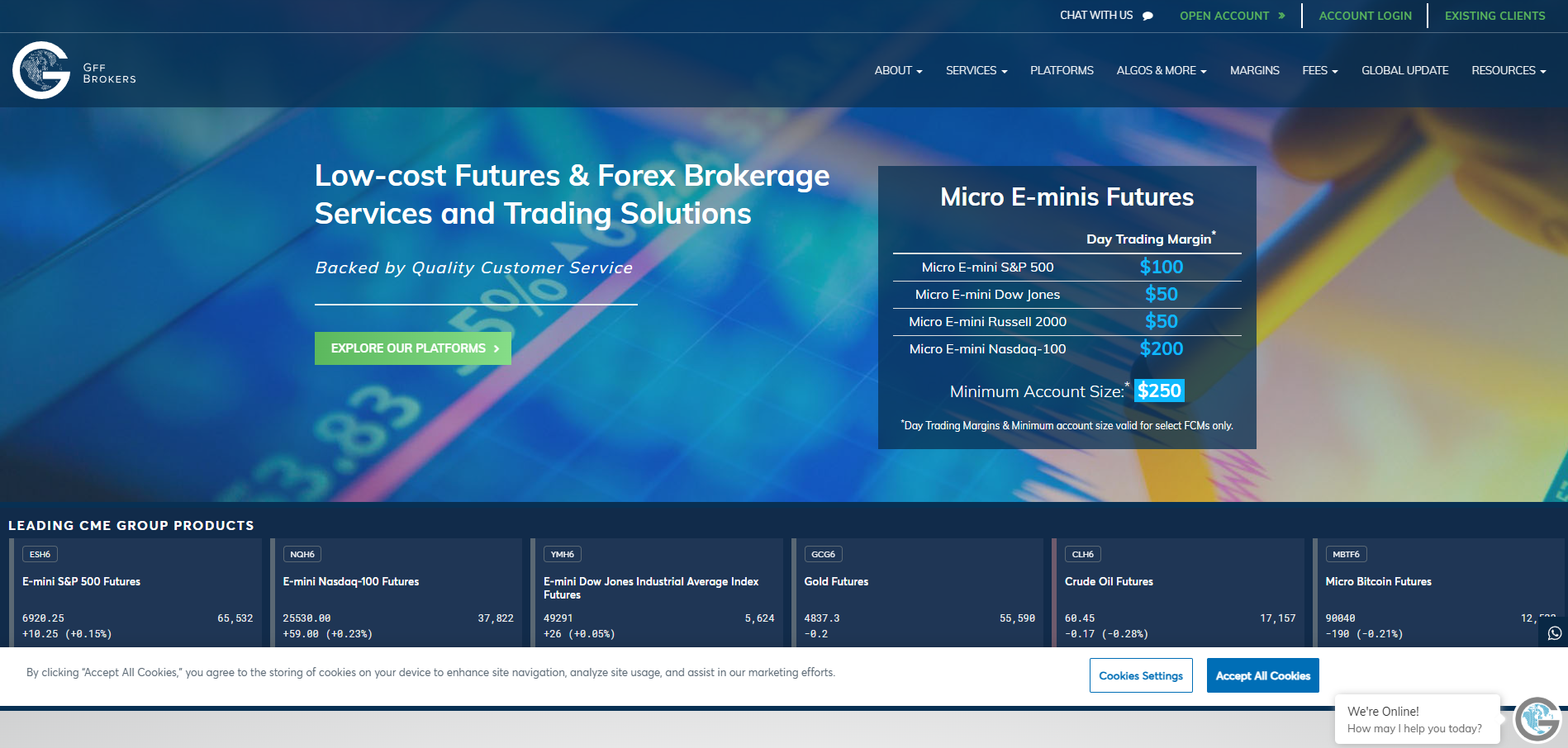

GFF Brokers is a US-based introducing broker offering low-cost access to futures, options, and forex markets. Known for competitive pricing, advanced multiple trading platforms, and expert support, it serves both new and experienced traders. GFF Brokers is registered with the CFTC and a member of the NFA, providing 24/5 phone support and personalized service. The firm also offers educational resources and supports automated trading strategies.

In this detailed review, we will explore GFF Brokers, a trusted name in the trading industry known for its low-cost access to global futures, options, and forex markets. We will examine the broker's competitive pricing, advanced trading platforms, and exceptional customer support, highlighting how it caters to both new and experienced traders. Additionally, we’ll delve into the firm’s commitment to transparency, educational resources, and the regulatory credibility it holds as a CFTC-registered and NFA-member broker, ensuring a secure and reliable trading experience.

What is GFF Brokers?

GFF Brokers was established in 2017 by Greg Khojikian, a seasoned professional who envisioned a “next-generation” brokerage that bridged the gap between low-cost automation and high-touch customer service. Shortly after its formation, the company made a pivotal move by acquiring Global Futures (Global Futures Exchange & Trading Co., Inc.), a firm that had been a fixture in the industry since 1998. This acquisition allowed GFF Brokers to immediately inherit decades of expertise, a robust technical infrastructure, and a veteran team of brokers, effectively launching the new entity as a major contender in the retail futures and forex space from day one.

In the years following, GFF Brokers aggressively expanded its market share through technological innovation and further strategic acquisitions. A major milestone occurred in late 2024, when the firm acquired Stage 5 Trading Corporation, along with its associated brands like Apex Futures and Sierra Futures. This move integrated Stage 5’s specialized trading tools and automated “Leader-Follower” programs into GFF’s ecosystem. Today, the firm operates as a prominent Independent Introducing Brokerage (IIB) in Calabasas, California, supporting over 25 trading platforms and maintaining a 24-hour in-house support desk to serve a global clientele.

Benefits of Trading with GFF Brokers

Trading with GFF Brokers gives you low-cost access to global futures, options, and forex markets along with a suite of powerful trading platforms featuring dynamic charting, real‑time analytics, customizable tools, and API access to fit different trading styles. The firm’s futures and forex brokerage services include nearly 24‑hour support, professional guidance on order execution and clearing, and friendly, industry‑experienced support across multiple channels like phone, email, and chat.

GFF Brokers is registered with the CFTC and a member of the NFA, adding a layer of regulatory credibility and trust. Traders also benefit from educational resources, guides, market tools, and support for automated trading systems to help refine strategies and improve decision‑making. Additionally, GFF Brokers offers a free personalized broker consultation, where a licensed broker discusses your trading goals and questions to help optimize your approach before you commit

GFF Brokers Regulation and Safety

GFF Brokers is a fully regulated US-based broker, registered with the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA). This strong regulatory oversight ensures that GFF Brokers complies with strict US financial regulations, providing traders with peace of mind that their funds are secure and that the firm adheres to industry best practices. By being regulated under the CFTC, GFF Brokers ensures maximum transparency and accountability in all aspects of its operations.

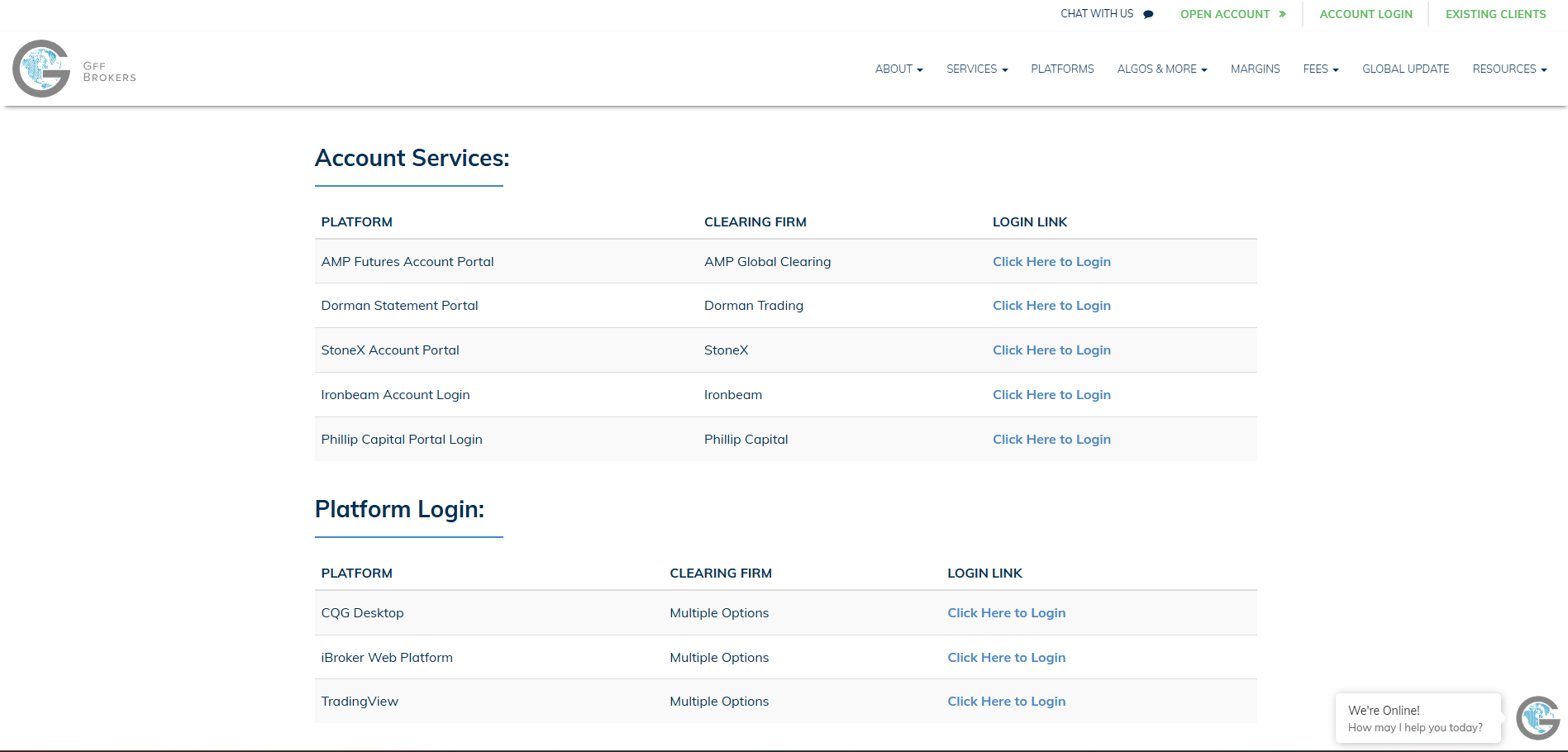

To safeguard client interests, GFF Brokers ensures that client funds are kept in segregated accounts with well-capitalized Futures Commission Merchants (FCMs), such as Dorman Trading, Ironbeam, Phillip Capital, and StoneX. This means that client funds are protected and kept separate from the firm’s operating funds, in full compliance with CFTC regulations. Additionally, GFF Brokers is committed to transparency by recording all trading-related communications, as required by CFTC Regulation 1.35(a), to enhance accountability and ensure that traders can trust the integrity of the services.

While GFF Brokers offers secure trading environments and reliable clearing firms, it is important to note that futures, options, and forex trading still carry substantial risks. GFF Brokers provides educational resources to help traders better manage these risks, empowering them to navigate market challenges with greater confidence.

GFF Brokers Pros and Cons

Pros

- A registered Independent Introducing Broker (IIB) with the CFTC and NFA

- Segregated client funds held with reputable Futures Commission Merchants (FCMs) for added security

- Offers free broker consultation for personalized trading guidance

- Support for automated trading strategies, making it ideal for algorithmic traders

Cons

- Limited product offerings compared to some larger brokers that may offer more asset classes

- Account setup and platform navigation can be complex or have a steep learning curve.

- Support is not available on weekends, which may inconvenience some traders.

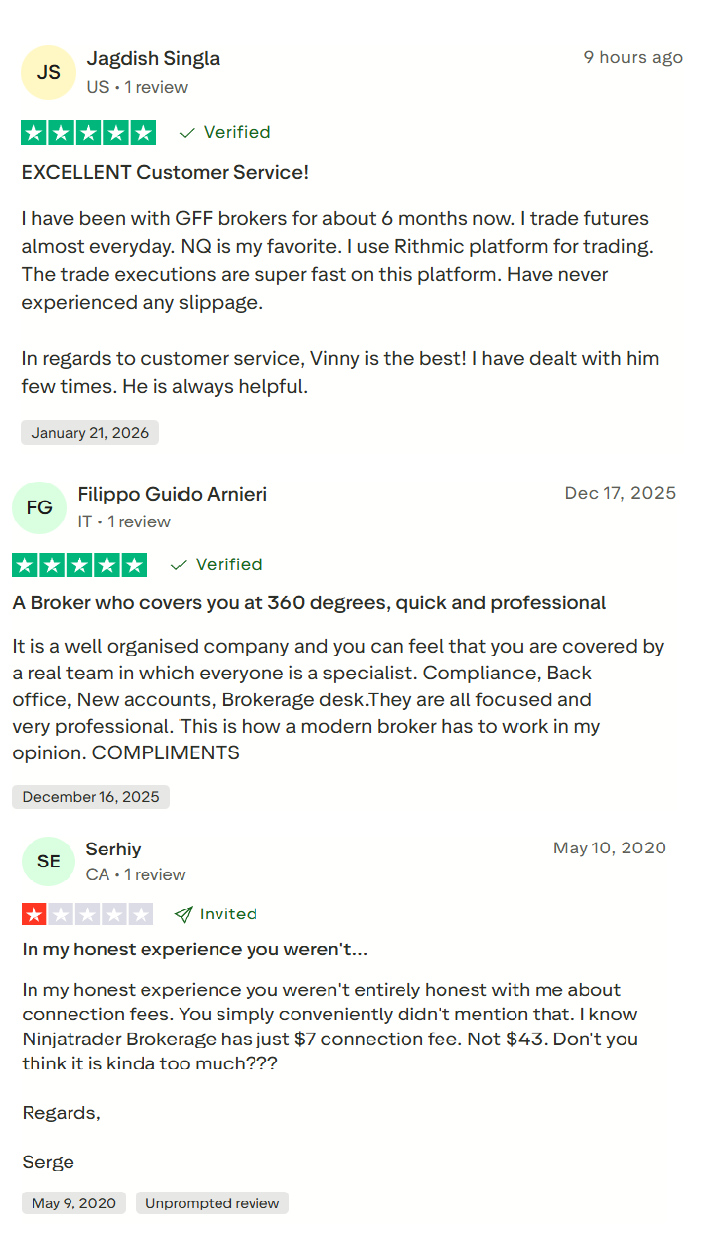

GFF Brokers Customer Reviews

Overall, customer feedback for GFF Brokers tends to be mostly positive, with many traders highlighting responsive, professional, and knowledgeable customer support and a sense of being supported by a real team throughout the trading process. Reviewers on platforms like Trustpilot rate the broker around 4.7–4.9/5, praising the company’s clear communication, helpful staff, and reliable service, though a small number of comments mention concerns about email frequency or specific fee explanations. Many clients appreciate the personalized service and support during account setup and trading, reinforcing GFF Brokers’ reputation for strong customer interaction and service quality.

GFF Brokers Spreads, Fees, and Commissions

GFF Brokers does not publish fixed spreads or standard commission rates online; instead, commissions are quoted individually for each client based on factors like account size, account type, markets traded, trading volume, and the trading platform used, so costs can differ from one trader to another. This means traders must contact GFF Brokers directly to request a personalized commission quote tailored to their specific trading needs.

In addition to commission pricing, there are account‑related fees that can apply, depending on the clearing firm used. GFF Brokers’ fee schedule includes charges such as $5 per contract for call‑in orders, margin call fees, and liquidation fees, while services like 24/5 support and technical assistance are generally free. Other costs, such as wire transfer fees, currency conversion, inactivity charges, or printed statement fees, may vary by clearing firm, so it’s important for traders to review all potential fees before trading.

Account Types

GFF Brokers doesn’t offer a fixed list of preset account “tiers”; instead, when opening an account you begin by selecting whether you want to trade futures or forex and then choose a clearing firm that will hold and clear your trading activity, such as Dorman Trading, Ironbeam, Phillip Capital, or StoneX for futures, or Forex.com US for forex accounts.

Within these clearing relationships, GFF Brokers supports a variety of account structures — including individual, joint, IRA, corporate, trust, and other customized account types — that can be tailored to your trading needs and goals. After selecting your clearing firm and platform, the broker application process will walk you through completing the necessary forms and funding instructions for your specific account setup.

How to Open Your Account

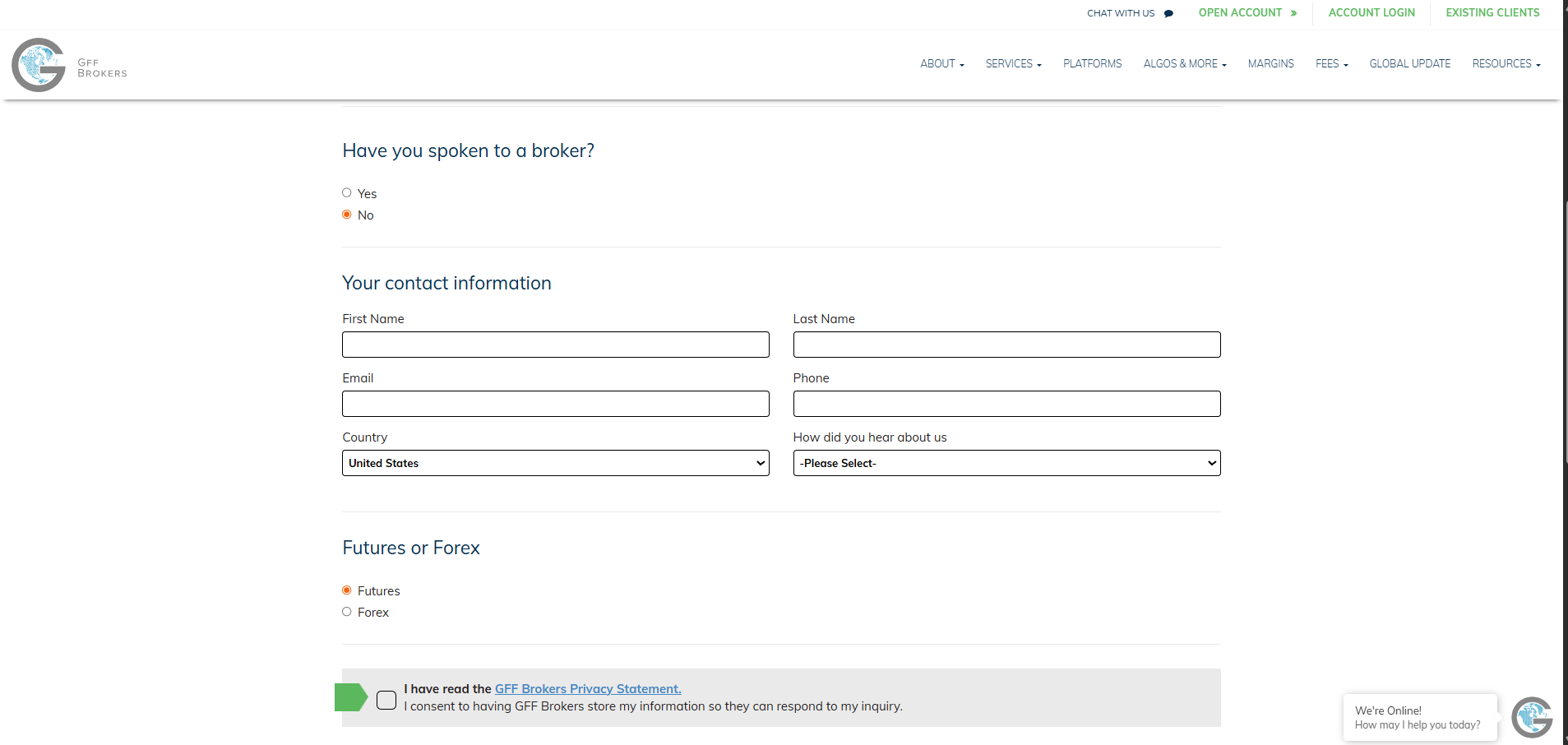

- Visit GFF Brokers' official site..

- Go to the Account section on the website to start the registration process.

- Choose “Yes” or “No” to indicate whether you’ve already had a conversation with a broker.

- Provide your first name, last name, email, phone number and country.

- Choose whether you plan to trade futures or forex.

- Check the box confirming you have read GFF Brokers' privacy statement

- Acknowledge consent for GFF Brokers to store your information for follow-up.

- Once completed, submit the form to begin the account setup process.

After submission, a representative will likely contact you to assist with account activation and further steps.

GFF Brokers Trading Platforms

GFF Brokers offers a wide selection of trading platforms designed to suit various trading styles and needs across futures, forex, and options markets. These platforms allow traders to choose the tools that best fit their experience level and trading approach. Whether you’re a beginner or an experienced trader, GFF Brokers provides advanced trading platforms equipped with dynamic charting, real-time analytics, depth-of-market data, and customizable interfaces to enhance trading decisions. The platforms also feature advanced routing tools and mobile access, ensuring traders stay competitive in fast-moving global markets.

Some of the professional-grade platforms supported by GFF Brokers include CTS T4, a comprehensive futures and options platform with real-time charts and advanced order types. Traders can also access specialized third-party platforms like Jigsaw Daytradr, MultiCharts.NET, NinjaTrader 7/8, and others. These platforms are connected to major data feeds such as GAIN, CQG, and Rithmic, providing flexible execution and in-depth analysis. Additionally, GFF Brokers’ commitment to quality service means that traders can often request demos or trials of these platforms before trading live, ensuring they find the most suitable platform for their needs. With exceptional customer service available through 24/5 support, GFF Brokers ensures a seamless trading experience, helping traders get the most out of their trading tools and strategies.

What Can You Trade on GFF Brokers

GFF Brokers provides access to a wide range of financial markets, including futures, options, and forex. Traders can engage in global futures trading across numerous asset classes, such as commodities, indices, and interest rates, allowing them to diversify their portfolios and manage risk. The broker also offers forex trading with access to major, minor, and exotic currency pairs, giving traders the opportunity to capitalize on global currency fluctuations. GFF Brokers' platforms support trading in options on futures, providing additional flexibility for hedging or speculating on market movements.

In addition to traditional market instruments, GFF Brokers supports automated trading strategies, allowing traders to implement algorithmic and quantitative approaches. With the help of advanced charting tools, real-time market data, and powerful analytics, traders can fine-tune their strategies across multiple asset classes. Whether you're a beginner looking to trade forex or a seasoned professional seeking access to complex futures contracts, GFF Brokers offers the tools and resources needed for trading in dynamic global markets.

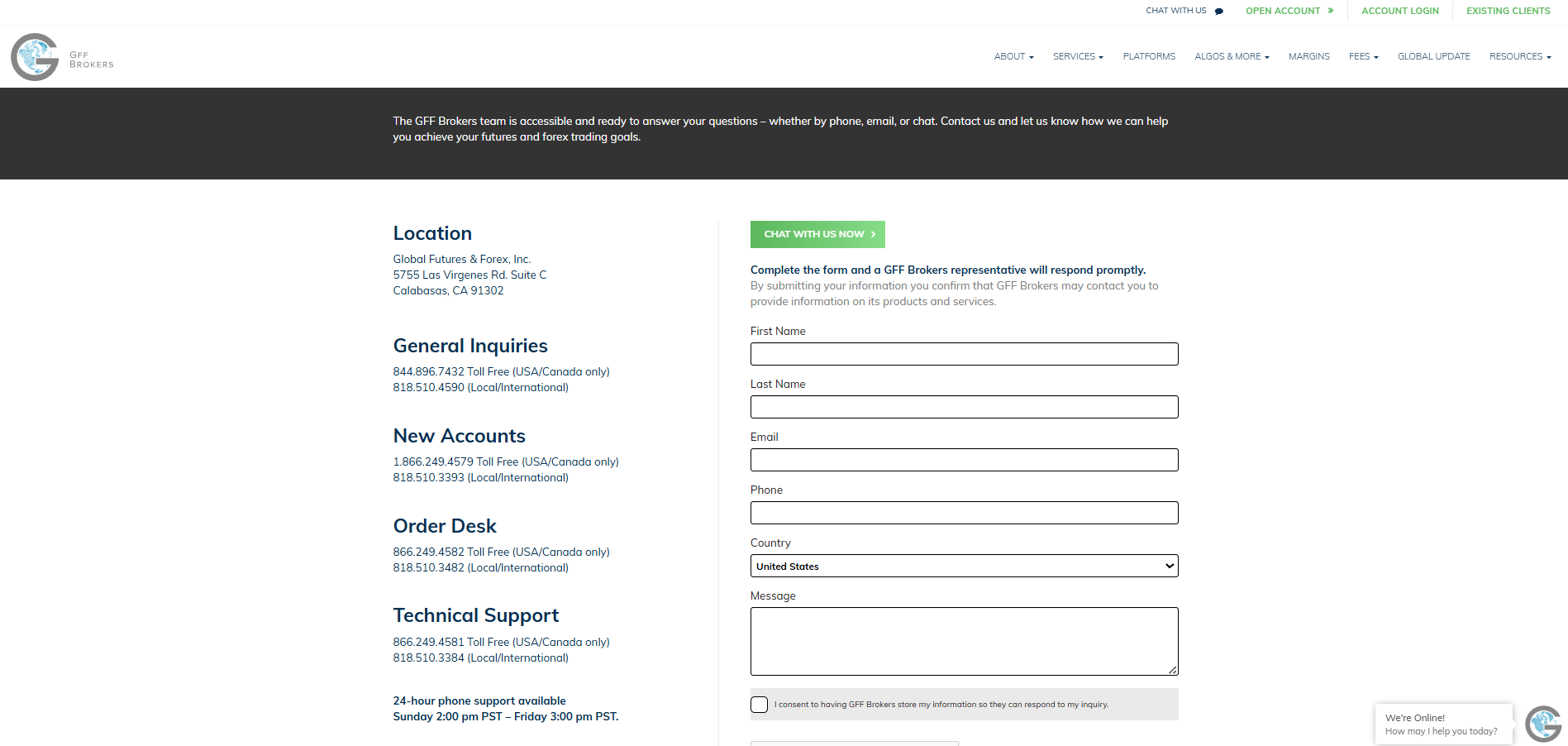

GFF Brokers Customer Support

GFF Brokers offers responsive customer support aimed at helping traders navigate setup, platform issues, account questions, and market access needs. Support is available 24 hours a day, 5 days a week (Sunday afternoon through Friday afternoon) via phone, email, and live chat with knowledgeable staff and industry veterans who understand both technical and trading concerns. Whether you're a new trader needing help with onboarding or an experienced trader troubleshooting a platform feature, GFF Brokers’ support team focuses on timely responses, clear communication, and personalized assistance to ensure clients get the help they need when markets are active.

What sets GFF Brokers apart is its commitment to quality customer service. Their experienced support staff ensures that clients receive expert guidance tailored to their individual needs. In addition, the broker provides a seamless withdrawal process, offering wire transfers and check withdrawals with transparent fees based on the clearing firm selected. This combined focus on customer care, technical support, and a secure withdrawal process makes GFF Brokers a reliable and cost-effective partner for traders at all levels.

Advantages and Disadvantages of GFF Brokers Customer Support

Withdrawal Options and Fees

GFF Brokers allows traders to withdraw funds via wire transfer or check, with specific fees depending on the clearing firm you use. For wire transfers, there is a fee that varies by clearing firm — for example, Dorman Trading typically charges around $30 for domestic wires and about €40/$40 for international wires, while StoneX (GAIN) charges around $25 domestic / $35 international. Ironbeam generally charges around $40 domestic / $60 international for outgoing wires, and Phillip Capital usually charges about $25 for outgoing wires. Standard check withdrawals are often free, though fees may apply for special delivery or multiple checks in a month depending on the clearing firm.

In addition to these direct withdrawal charges, traders should be aware of other related costs set by clearing firms, such as returned check fees or stop payment fees, which can apply if a withdrawal instruction needs to be reissued. It’s important to check with your specific clearing firm and GFF Brokers for the exact fees and processing times before requesting a withdrawal, as these details can vary by account type and firm.

GFF Brokers Vs Other Brokers

#1. GFF Brokers vs AvaTrade

GFF Brokers is a US-based broker specializing in futures and forex, offering customized clearing firm options and strong regulatory oversight through the CFTC and NFA. It focuses on professional traders who require tailored support and institutional-grade access to futures markets. In contrast, AvaTrade provides a broader offering of CFD products including stocks, commodities, and crypto, and is regulated in multiple jurisdictions, making it ideal for retail traders looking for diverse trading instruments and accessible platforms like MT4 and MT5.

Verdict: GFF Brokers is a solid choice for traders who want regulated US futures and forex access with institutional‑style execution and customized clearing options, making it better suited for professional or futures‑focused traders. AvaTrade is stronger for retail traders seeking a broader range of CFDs (including stocks and crypto) and more mainstream platforms like MT4/MT5. Choose GFF Brokers if your priority is futures markets and strict US regulation, and AvaTrade if you want diverse CFD instruments and accessible retail features.

#2. GFF Brokers vs RoboForex

GFF Brokers focuses on providing institutional-grade futures market access and customized services for futures and forex traders, with a strong regulatory framework in the US. RoboForex, however, is geared more toward retail traders, offering low minimum deposits, tight forex spreads, and advanced copy trading systems, with regulation in offshore jurisdictions. This makes RoboForex a strong choice for traders looking for flexibility and low-cost forex trading.

Verdict: GFF Brokers stands out for its US regulatory oversight (CFTC/NFA) and futures market emphasis, which appeals to serious traders and those needing institutional‑grade clearing flexibility. RoboForex excels for retail forex traders looking for low entry requirements, tight spreads, and copy‑trading features. Pick GFF Brokers if you prioritize regulated futures along with expert support, and RoboForex if your focus is cost‑effective forex trading with social/copy trading tools.

#3. GFF Brokers vs Exness

GFF Brokers offers a unique focus on futures and options, with personalized support and clearing firm flexibility under strict US regulations from the CFTC and NFA. Exness, in contrast, is primarily a forex broker known for its low-cost spreads, flexible leverage, and wide accessibility, operating under multiple global regulations. Exness is better suited for forex traders seeking competitive pricing and high leverage, while GFF Brokers stands out for its futures trading capabilities.

Verdict: GFF Brokers is the better fit for traders focused on regulated futures and options markets under a strict US framework, with personalized service and clearing firm choices. Exness is more appealing for forex traders who want ultra‑competitive pricing, flexible leverage, and fast execution across MT4/MT5. Choose GFF Brokers for futures access and strong oversight, and Exness for forex trading with low spreads and leverage flexibility.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH GFF BROKERS

Conclusion: GFF Brokers Review

GFF Brokers, also known as Global Futures & Forex Inc., offers a specialized platform for futures, options, and forex trading, with low-cost access and personalized customer service. Its strong CFTC and NFA regulation ensures traders can trade with confidence, knowing that their funds are segregated and secure with reputable Futures Commission Merchants (FCMs). GFF Brokers also stands out for its flexible account options and advanced trading platforms, which cater to a wide range of trading strategies, including automated trading. This makes it particularly suitable for experienced traders and professionals seeking institutional-level services in futures markets.

However, GFF Brokers' offering is relatively narrower compared to other brokers, focusing mainly on futures and forex, which may not appeal to traders looking for a broader range of products like stocks or cryptocurrencies. The account setup process and platform navigation can be complex, particularly for beginners. While 24/5 support is available, weekend assistance is not, which may be inconvenient for some traders. Despite these limitations, GFF Brokers is an ideal choice for those seeking professional futures and forex trading services, with the added benefit of regulatory oversight and personalized support.

Also Read: MarketsVox Review 2024 – Expert Trader Insights

GFF Brokers: FAQ’s

Who can trade with GFF Brokers?

It caters to both new and experienced traders interested in futures, options, and forex markets, including those using manual or automated trading strategies.

Is GFF Brokers a regulated broker?

GFF Brokers is registered with the CFTC and is a member of the NFA, ensuring adherence to strict US financial regulations.

How are client funds protected?

Client funds at GFF Brokers are kept in segregated accounts with reputable Futures Commission Merchants (FCMs). This ensures funds are separate from the broker’s operating capital, adding an extra layer of security.

OPEN AN ACCOUNT NOW WITH GFF BROKERS AND GET YOUR BONUS