LiteForex Review

Since 2005, Liteforex has focused on redesigning financial instruments and inventing different indices to help investors make more money. Their unique offerings and options offer a remarkable opportunity to diversify your portfolio and trade profitably.

However, if you're trading in new instruments, you'd often need detailed technical analysis, but Liteforex doesn't provide effective resources for analyzing exclusive instruments; hence, it can be a problem, especially for novice investors who have already invested a significant chunk of their investment due to higher minimum deposit requirements.

Liteforex has received mixed opinions from users; some traders appreciate their unique trading platforms and cashback, while others are bothered by the challenging account opening process and lack of AI support. If you're considering Liteforex, you shouldn't miss this review.

We shall thoroughly analyze their history, reliability, benefits, disadvantages, and whether you should sign up with them. Our goal is to help you evaluate the broker through a trader's perspective and make an informed decision. Let's go!

What is LiteForex?

The LiteFinance Global LLC hosts a group of investment companies that cater to investors with varying requirements. LiteFinance has been operating since 2005, and they launched LiteForex as a separate project in 2008 to allow efficient trading in forex and CFD markets.

However, in 2021, all Liteforex obligations were bought under the LiteFinance Global LLC, which enables users to trade in multiple markets and asset classes. We believe the move will help the company operate efficiently while resulting in investor benefits through a streamlined interface and monetary process.

LiteFinance has been famous for its innovation and security; it has been a forerunner in introducing new methods to ensure client safety and profitability. In 2021, Liteforex was one of the few brokers to allow Ripple currency deposits; hence, crypto investors could directly transact their funds to their Liteforex wallet.

In May same year, the company also launched two-factor authentication for clients that enhances security and prevents hacks and leakages. LiteFinance allows users to trade in more than 50 global markets for Crypto, CFDs, Forex, Global indexes, metals, and commodities. Their CFD market range is diverse and allows traders to maximize profits by filtering the best deals.

LiteForex is licensed by Cysec under license number HE230122; the Cysec license is reasonably credible, and we observe most Cysec brokers have legitimate services with a positive customer reputation. However, the Cysec license isn't as regarded as the SEC US or FCA licenses.

The Cysec license has fairly lenient compensation and indemnity insurance policies that allow offshore brokers to obtain regional permits. The website clarifies that Litefinance/Liteforex doesn't offer services in any EEA countries, USA, Israel, Russia, or Japan.

Advantages and Disadvantages of Trading with LiteForex?

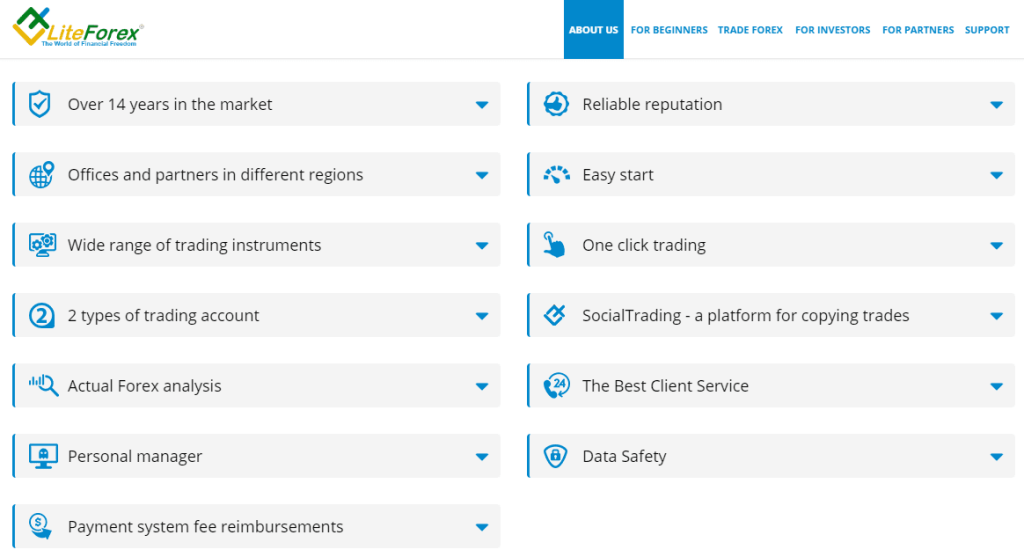

LiteForex has established a widespread reputation in the industry, and its specialization in forex markets can help traders make profitable deals. Here is a quick summary of their advantages and disadvantages.

Benefits of Trading with LiteForex

Markets are run based on investor sentiments; unexpected news can cause havoc in a trading market, and the investment can sink to pennies if your portfolio isn't diverse. We believe any investor can't create long-term gains by sticking to a single asset; they will need to diversify to minimize risk and make better profits on their trading account.

Liteforex is a good choice for investors following a diversification strategy; the Liteforex classic account can let you invest in Forex, metals, global indices, commodities, and other asset classes. You can make informed decisions by using their technical indicators and trading platforms.

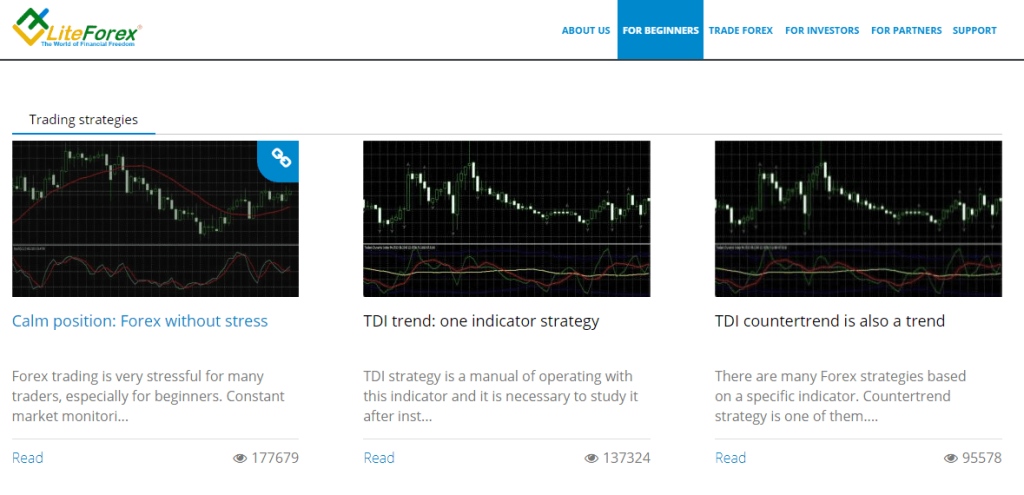

Another significant benefit of opting Liteforex is its resources for novice traders; we always encourage readers to learn before making their first trade, and Liteforex follows a similar philosophy for traders.

The company resources vary from an essential forex glossary to trading lectures, books, and strategies; you can start your learning procedure right from their official website, and as you complete a step, move on to the next.

We used some of Liteforex's resources, and they are decent at shaping investors' minds about a topic, but a little more elaboration would have been better.

Finally, we also appreciate Liteforex for its trading platforms and execution rates. In 2021, the company received the ‘best Forex trading tools and software in Africa' award by the prestigious Global brands' magazine; the broker offers MT4/5 and a mobile trading platform.

You can use the applications not only for technical analysis but also for the copy trade feature that lets you copy experienced traders and enjoy profits. The trading platforms have a high execution rate, and the average trading time is about 50 ms.

We found MT5 the best option for expert traders; it comes with 180+ technical indicators that can help you analyze multiple securities and make informed decisions.

LiteForex Pros and Cons

Pros

- Remarkable customer support

- Popular withdrawal and deposit methods

- In-Depth educational resources

- A demo Account is available.

Cons

- Risk ratings aren't identified for social trading.

- Spread extensions during high volatility

Analysis of the Main Features of LiteForex

4.4 Overall Rating |

4.4 Execution of Orders |

4.0 Investment Instruments |

4.3 Withdrawal Speed |

4.5 Customer Support |

4.3 Variety of Instruments |

4.3 Trading Platform |

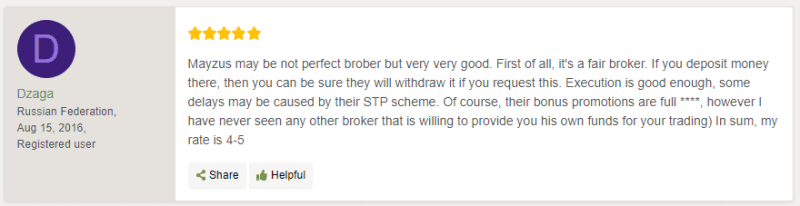

LiteForex Customer Reviews

Customer reviews are essential in establishing the legitimacy of a broker; LiteForex has obtained positive reviews from the majority of their clients, and their Trustpilot positive rating is more than 85%. Most traders admire Liteforex due to their withdrawal services; they appreciate the simplicity of filing a withdrawal and the time to transfer.

Traders have also found their trading platforms useful for everyday trading; the access of Mt4/5 allows experienced investors to use more than 180 technical indicators to judge the movements in security prices. Moreover, clients have also appreciated their support staff, who are always ready to help clients grow their portfolios.

The customer remarked the ‘new client cabinet' has helped them start on the right note and make decent profits. However, some client reviews suggest that Liteforex has failed to keep up with its promised bonus schemes; we can find multiple reports where the bonus winner wasn't announced on the due date. Let's move on to a detailed review of their services.

LiteForex Spreads, Fees, and Commissions

Costs play a fundamental role in a trader's success, and if your broker's cost structure doesn't fit your goals, we don't see you making any significant profits in the long run.

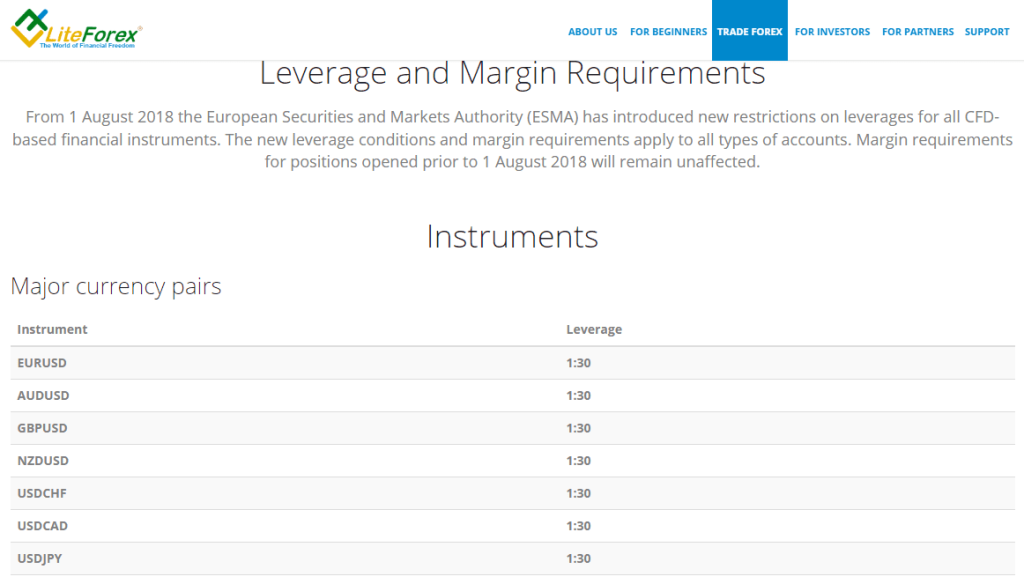

We found LiteForex's cost structure comparatively lower than the industry's; the forex spreads are significantly low for the classic and ECN accounts. For example, the EUR/USD currency pair can be traded at a spread of 0.1 pip, while the GBP/USD spread can be exchanged at 0.6 pip.

The less-common AUD/USD pair has a spread of 0.6 pip per lot, and the highest spread amongst major currency pairs is for USD/JPY at 1 pip. The rates are significantly low compared to other brokers in the industry; Forex.com typically charges 1.3 for a EUR/USD pair and 1.6 for a GBP/USD pair.

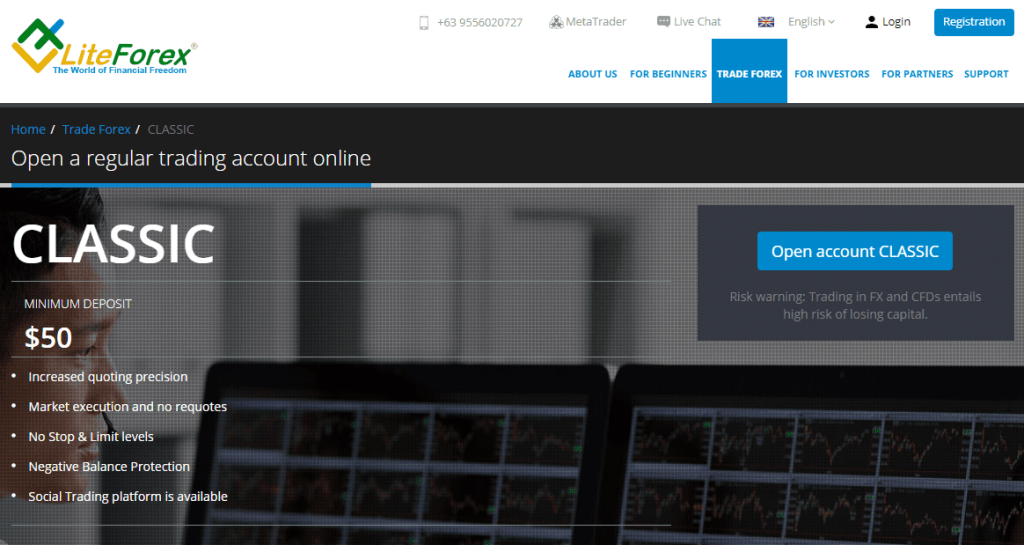

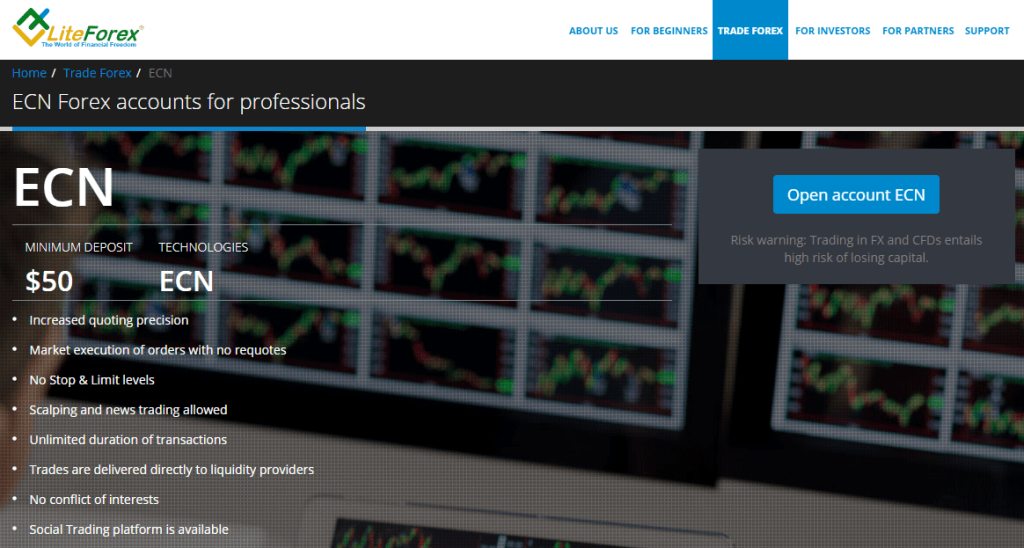

LiteForex has slightly higher minimum deposit requirements than the industry; the company's classic and ECN accounts require a deposit of $50, while other brokers let you open an account for as low as 10. However, the improved services and low spreads compensate for it.

A $10 and $20 per lot commission is charged for Forex crosses and Forex minors, respectively; the company also charges a maintenance fee of $3 every month. We haven't seen any leading broker charging a similar cost.

Liteforex also charges a swap fee for overnight trades; the swap fee and spreads are subject to change based on market volatility. Previous customers have reported the spreads to increase significantly in volatile markets, and we recommend potential investors close trades and hold securities if market volatility surges.

How LiteForex Fees Compare to other Brokers

Account Types

As you would have already found, Liteforex doesn't have diverse account offerings, but it doesn't make Liteforex any inferior.

Instead, the broker has two specifically designed account types to satisfy traders' needs in the forex market; the accounts come equipped with the latest trading platforms and offerings with low spreads.

- The classic account is designed for everyday traders looking to trade in a controlled atmosphere. The account requires a minimum deposit of $50 and gives you access to MT4/5 and social trading.

- It comes with a negative balance protection, so you don't owe any liabilities if the market goes down. Liteforex doesn't charge any commission from classic accounts, but it has floating spreads starting from 2.0 pips.

- ECN account is designed for professionals ready to dive deep into the market and make trades frequently. The ECN account faces no floating spreads, but a commission is charged starting from $5.

- Traders can make unlimited trades with negative balance protection enabled; Liteforex also allows scalping and news trading for ECN accounts that help traders earn more profits.

Your account type is essential in determining overall trading costs for your account; if you choose an inappropriate account, you will soon have to switch with both monetary and time losses.

Therefore, we always recommend investors study account types in fine detail and get their confusions answered by the officials. If you're unsure about the trading account, you can start your learning process with a demo account.

It provides access to all real-time features, and traders can trade with virtual money and employ their strategies to determine their efficacy. It is a great tool to adjudge your strategic performance before putting funds at stake.

How To Open Your Account?

Unlike other brokers, Liteforex doesn't have a single application for trading account signup; initially, traders are required to sign up to the platform, and they can verify their documents, phone number, and other KYC requirements in the next step.

We assume LiteForex has introduced the method to get the most signups for future email targeting; nonetheless, the two-step process is tedious and many traders may leave the process midway.

The application process is simple; you have to log on to the official Liteforex website, and you'll find the registration button at the top right. Once you click it, it'll take you to a form where you'd be required to insert your legal name, email, and password for the Liteforex account.

Next, you will be directed to a newer page for account verification; you'll be required to submit scanned copies of your national ID/passport, address proof, and other requisites.

We experienced the complete signup process, which could be improved for quicker signup; the two methods can be mixed to speed up the registration and help investors start their generation asap.

What Can You Trade on LiteForex?

Liteforex has a wide range of asset offerings in the foreign currency markets, and the supporting technical indicators are comprehensive to help in better predictability.

The company offers access to more than 50+ global currency markets, metals, indices, crypto, and oils; the financial instruments are intelligently designed to assist traders' profitability and help them make profits on derived assets.

Liteforex's recent movie with LiteFinance has also allowed traders to access several international markets for CFDs; you can use the MT4/5 and mobile trading application to trade in CFD markets in Australia, Europe, and other markets.

However, we advise investors to evaluate their CFD trades through multiple indicators and fundamental analysis to avoid losses; CFDs are high-risk assets with high volatility and can misfire if due diligence isn't taken.

Overall, LiteForex's offerings are comprehensive to assist traders in diversification; you can spread your portfolio across broad asset classes that will help you attain long-run profitability. However, the company doesn't provide trading in stocks and US bonds, so if you're looking to trade NASDAQ or NYSE stocks, you should look for other options.

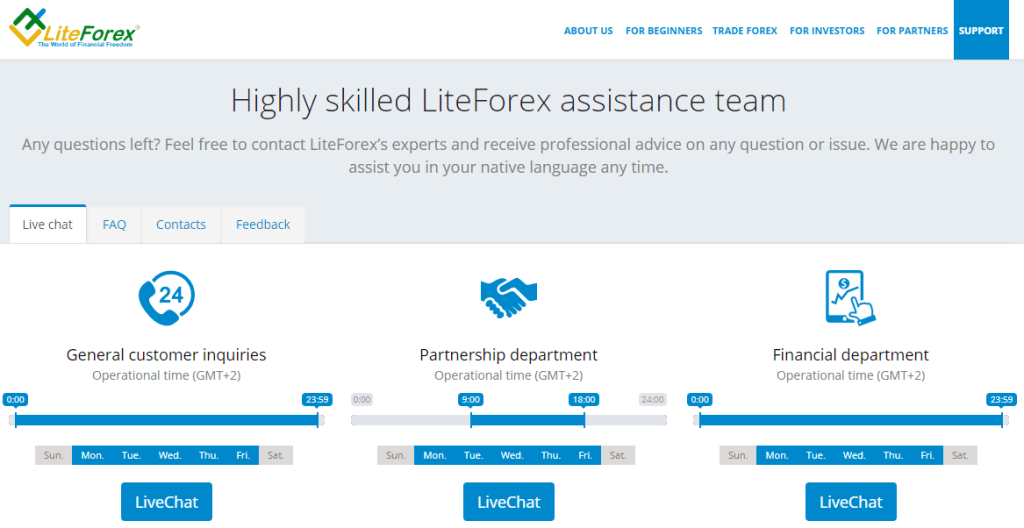

LiteForex Customer Support

Liteforex has received mixed opinions about its customer support; some traders found it fantastic at resolving their queries, while others argue that it could be more prompt. You can connect with Liteforex through live chat, phone, email, or specific social communities. We tried all possible communication methods with LiteForex and received a decent response.

The company has divided its support system into three sections that cater individually to general, technical, and trading questions.

We received the email response within 56 working hours, which is comparatively slower than other leading brokers. However, the waiting time for the phone call was insignificant, and the live chat was also acceptable.

The social communities are an excellent tool for novice traders to take informed early steps in the forex market; most of the group queries were answered by experts who were prior users of LiteForex.

If you're a new trader, you can use the communities to connect with experienced traders and learn their trading tactics. Customer support is available in 15 languages, and trading accounts are dealt with promptly.

As per our experience, LiteForex was quick to respond to general queries and questions, but for technical queries, the chat answers were delayed and calls were transferred repetitively. We believe it can be due to a lack of technically knowledgeable support staff. Overall, customer support is reliable and efficient, but there is significant room for improvement.

Advantages and Disadvantages of LiteForex Customer Support

Contacts Table

Security for Investors

Withdrawal Options and Fees

LiteForex allows investors to withdraw and deposit money in seven different ways; you can use a direct bank account, e-wallet, crypto wallet, wire, skrill, or other methods. However, as per the AML policy, an investor can only withdraw their amount in the source wallet. Therefore, you can only receive your funds in the same account used for the deposit.

The e-wallet and crypto transfer can take place immediately if the request was initiated during working hours, but for bank and wire transfers, the process can take up to 5 days- extending to 14 days for international card transfers.

As per the Client Agreement, Liteforex investments limited is obliged to use a manual transfer method to prevent fraud; the finance department approves the transfer. The withdrawal may get rejected if the AML laws are violated or the transfer account differs from the top-up account.

The transfer fees vary based on the trader's region and method; an e-wallet transfer includes a 2% charge by the intermediary- wire transfer may cost $25 per transaction. Investors can withdraw as low as $10 or equivalent in other denominations; you can have unlimited withdrawal requests in a month.

Withdrawal policies can be tricky, and a ‘big scam broker' can use the fine print to include predatory details that delay or reject your withdrawals. Therefore, we advise investors to follow due diligence and analyze the withdrawal policy before investing their income.

LiteForex Vs Other Brokers

#1. LiteForex vs Avatrade

Avatrade is a leading US broker, and they are authorized by multiple tiers 1/2 regulatory bodies; we would give Avatrade an edge against Liteforex due to their massive audience base and extended licenses. Both brokers specialize in offering crypto, Forex, and CFDs, and it makes a good comparison between the two brokers.

Avatrade also takes the lead in its streamlined account opening process; its account application is simple and can be completed in a few minutes; Liteforex has a comparatively complex mechanism that may be challenging for novice traders.

Avatrade also has better options for automated trading; they not only allow trading bots with comprehensive risk-return charts but also let you copy and implement experienced traders through Zulu trade.

On the contrary, LiteForex lets you copy expert traders, but they don't have any risk statistics for trading types that can result in wrong selection. However, we don't think automated trading should significantly impact your decision, but the withdrawal policy should.

LiteForex has disappointed investors with their slow withdrawals, and we also feel they should improve the process. Although their transaction methods are better than Avatrade, the process is several times slower, giving Avatrade an edge.

Our recommendation for any CFD/Forex trader would be Avatrade, as they have low commission charges and reliable history of making profitable trades.

#2. LiteForex vs Roboforex

Roboforex is another close option for novice traders; they are famous for unique and innovative financial markets and instruments. The company lets you trade in 8 different asset classes compared to Lite forex's 7.

Unlike Lite forex, Roboforex investors can trade in popular stocks and REITs, helping them with diversification.

Roboforex also takes the lead in smaller deposit accounts- they offer a micro account with a $10 minimum deposit and a minimum lot size of 0.001. Liteforex requires at least a $50 deposit for either ECN or Classic accounts.

The former also has improved automated trading options; it allows traders to opt for AI trading bots that monitor numerous securities and select the assets for the best rewards- LiteForex doesn't offer any similar option.

Nonetheless, Liteforex takes the lead in pip spreads for its currency pairs; robot forex currency pairs start at 2.0 for standard account types, but LiteForex lets you enjoy a minimum spread of 0.1 pip per lot.

Both brokers offer MT4/5 for all trading accounts, but Roboforex has a complementary Ctrader that adds to the list. However, we don't find Ctrader to make any significant difference as the technical tools are similar to other platforms.

Both brokers have similar offerings, but LiteForex can be a better choice for long-term traders due to their low spreads. However, if you're looking at trading as a side hustle, RoboForex would be a better option.

#3. LiteForex vs Alpari

When we compare brokers, the utmost importance is their reliability; if a broker isn't reliable, their lucrative services have no value, as investors tend to lose more in the long run.

Fortunately, both Alpari and LiteForex are regulated by FSA SVG and Cysec, respectively, so we can trust them with our investment; however, their lack of compliance with strict regulations in the US and UK suggests room for improvement.

Alpari lets users start their trade account with a minimum deposit of $5; they have seven different account types suited for traders with varying needs. Comparatively, Liteforex offers only a few choices that may limit them to specific audiences.

Alpari takes the lead in offerings and market access; you can trade Forex, crypto, stocks, CFDs, and metals with your Alpari account; however, stock trading isn't available for LiteForex traders.

Both companies have a similar fee and spread structure and offer commission-free and zero-spread accounts. You can test both of their services through their demo account offerings.

Alpari charges an inactivity fee if your account isn't operated for more than six months; although Liteforex doesn't have a solar fee, they charge a $3 maintenance fee every month.

The trading platform choices are similar, and forex traders can access MT4/5 and mobile trading apps for trading forex and other instruments.

The brokers are similar, but none offer their services in the US or UK. If you're from a different location, we will rate Alpari slightly higher than Liteforex due to their easier signup process.

How LiteForex Trading Options Compare against other Brokers

Conclusion: Liteforex Review

Broker selection is the make or break of your trading journey, and a wrong step can have dire consequences; Liteforex is a reliable broker licensed by Cysec and regulated by MiFID policies. Their diverse trading platforms offer numerous technical indicators to assist professional traders in making better trades.

The cost structure is lower than market leaders, and it gives their investors a better probability of making profits; however, some customers have shown mistrust in spread variation and doubt that LiteForex may rig them to reduce their earnings.

The signup process isn't streamlined, and we believe it could be enhanced for a better experience. Similarly, the withdrawal policy is slow and tedious, which may delay investor payments for more than a reasonable period.

We have reviewed Liteforex thoroughly, and the broker didn't show any significant weakness or drawback; it has some loopholes that can be fixed for a better trading experience. The platform is a good choice for both expert and novice traders, as it has numerous technical tools and educational resources to support their growth.

LiteForex Review FAQs

Is LiteForex a trusted broker?

The best parameter to judge a broker's legitimacy is their licenses. LiteForex has a Cysec license and is regulated under MiFID legislation. Although the license isn't as credible as FCA or SEC, it ascertains their legitimacy. The company also has more than 15 years of history, making them a safer option.

However, we came across several reviews that accuse LiteForex of rigging their spreads during volatile markets that caused investors losses.

What is the minimum deposit in LiteForex?

LiteForex offers two account types- ECN and Classic; The ECN account is for professional traders and comes with increased trading facilities. Both accounts require a minimum deposit of $50.

How long does it take to withdraw from LiteForex?

Liteforex's biggest deficiency is its slow withdrawal process; your withdrawal request is processed manually by the finance department, meaning you can't complete a transfer on non-working days.

The withdrawal transaction can take up to 5 more days to complete after it is accepted. If the withdrawal is an international fund transfer, it can take more than 14 days.