GKFX Review

As a prominent player in the Forex and CFD trading industry, GKFX Prime is renowned for its broad portfolio of over 400 trading instruments, competitive pricing, precise execution, and robust regulation.

This review conducts an exhaustive analysis of GKFX, examining its strengths and potential weaknesses, in a bid to present a comprehensive understanding of the broker. By synthesizing expert opinions with real-world trader experiences, this review aims to aid potential investors in making informed decisions.

What is GKFX?

Established in 2012, GKFX Prime emerged as a leading brokerage firm recognized for its innovation and world-class customer service. It is the brand name of AKFX Financial Services Ltd which is under regulation by Malta Financial Services Authority (MFSA). The broker has successfully etched its mark on a global scale, serving clients across 20 countries and providing services in 12 languages.

Offering a variety of instruments including Forex, Stocks, Indices, Commodities, and Cryptocurrencies, GKFX Prime proves to be a competitive player in the trading industry.

Throughout its operation years, GKFX Prime has undergone name changes, operating under entities such as GKFX and GKFX Pro. Currently, based on available information, GKFX does not operate in the UK but is regulated in Malta.

Advantages and Disadvantages of Trading with GKFX?

Benefits of Trading with GKFX

The appeal of trading with GKFX Prime is multifaceted. Rooted in strong regulation and operational transparency, GKFX Prime is a broker that garners trust in the trading community. Endorsed by the Financial Services Commission (FSC), the broker carries out its operations in adherence to globally recognized financial standards. This rigorous regulation provides traders with the confidence that their investments are secure and that the broker operates with integrity and transparency.

One key advantage of trading with GKFX Prime is the seamless account opening process. Recognizing that a complex and lengthy procedure can be off-putting, GKFX Prime has streamlined this process to ensure that new traders can set up their accounts and start trading as swiftly as possible. This user-friendly approach extends beyond trading account set-up, with the broker's commitment to maintaining an accessible and straightforward trading environment.

In terms of costs, GKFX Prime provides an impressive value proposition. The broker offers average trading costs that align with industry norms, making it an attractive option for both new and experienced traders. These costs are further complemented by competitive pricing and tight spreads across all markets. Whether you're trading forex, commodities, or cryptocurrencies, you can expect a competitive trading landscape that strives to keep your costs low and potential profits high.

One of the defining features of GKFX Prime is its powerful trading software. As technology continues to transform the landscape of forex trading, GKFX Prime stays ahead of the curve by providing cutting-edge trading platforms. Traders can leverage advanced charting tools, real-time market data, and a suite of analytical tools to aid in decision-making. Furthermore, the broker offers a selection of platforms, including MetaTrader 4 and WebTrader, which cater to the varied needs of its global clientele.

Additionally, GKFX Prime provides a wealth of educational resources to empower traders. From beginners to seasoned traders, everyone can benefit from these materials to improve their understanding of the markets and refine their trading strategies.

Lastly, GKFX Prime has garnered acclaim for its customer service. Traders can avail themselves of 24/5 customer support, with a team of dedicated professionals providing assistance in 14 languages. This commitment to excellent service fosters a supportive trading environment and helps traders resolve any issues promptly and efficiently.

GKFX Pros and Cons

Pros:

- Excellent global reputation, with operations in over 20 countries

- A wide variety of trading platforms, coupled with competitive trading conditions

- Cutting-edge technical solutions and tools

- High-quality educational resources and research materials

- Quality customer support in multiple languages

Cons:

- Customer support is not available 24/7

- Trading conditions may vary based on the specific entity

- Only offshore entities are currently available

- Spreads may be higher for certain instruments

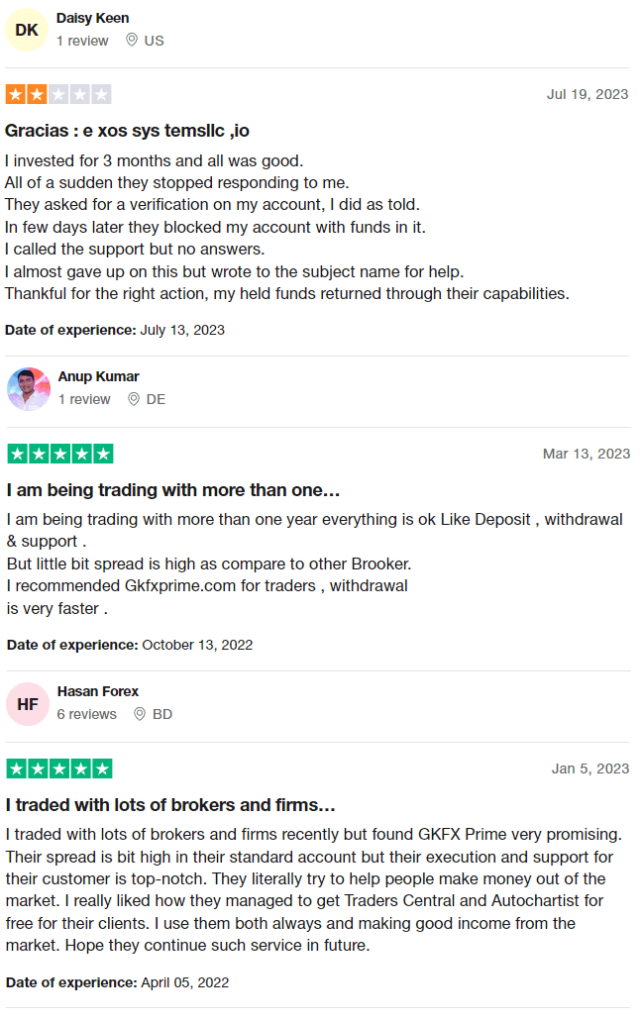

GKFX Customer Reviews

Reviewing customer experiences, one finds both appreciation and criticism. While some users were satisfied with their trading experience, citing swift withdrawals and good customer support, others expressed concerns over high spreads. A few faced account-related issues but ultimately expressed satisfaction with the resolution process.

Overall, customers have praised GKFX Prime for its excellent customer support, speedy withdrawal process, and helpful trading tools, despite minor grievances over higher spreads.

GKFX Spreads, Fees, and Commissions

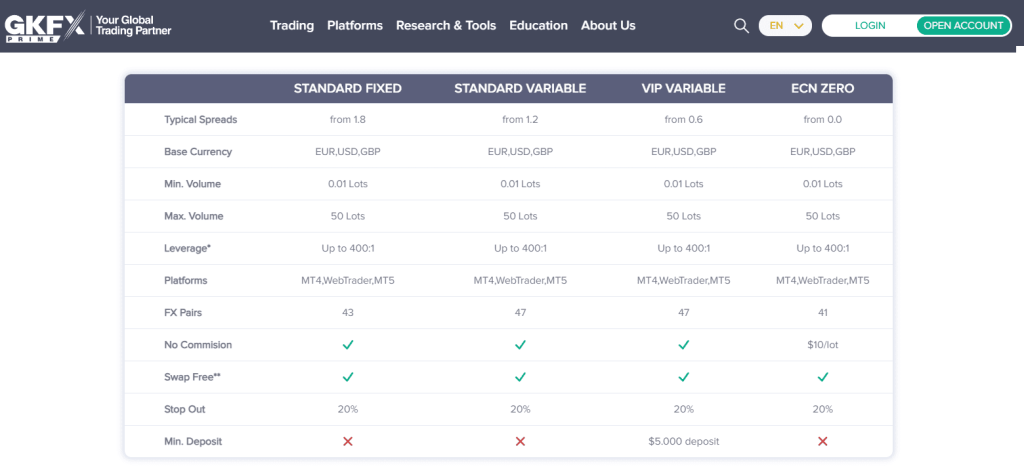

GKFX Prime prides itself on offering competitive tight spreads across all markets. The broker provides traders with the option to choose between fixed and variable spreads, for example, the typical spread for EUR/USD is 1.2 pips. With the exclusion of the ECN Zero account, all other account types come with no commissions, offering competitive pricing across all trading instruments.

Account Types

GKFX Prime offers a variety of account types tailored to meet various trading needs:

Standard Fixed

Ideal for beginners, offering quick access to top markets with low pricing, fixed spreads for popular CFDs, and no commissions or additional fees.

Standard Viable

Also great for beginners, offering varied spreads, quick market access, and low pricing for CFDs with no commissions or additional fees.

VIP Variable

Exclusively tailored for high-net-worth individuals, offering competitive pricing, access to top-notch tools and charts, and special features like free access to VPS.

ECN Zero

This account type is optimal for currency trading, offering spreads as low as 0.0 on major pairs with a $10 commission per round lot.

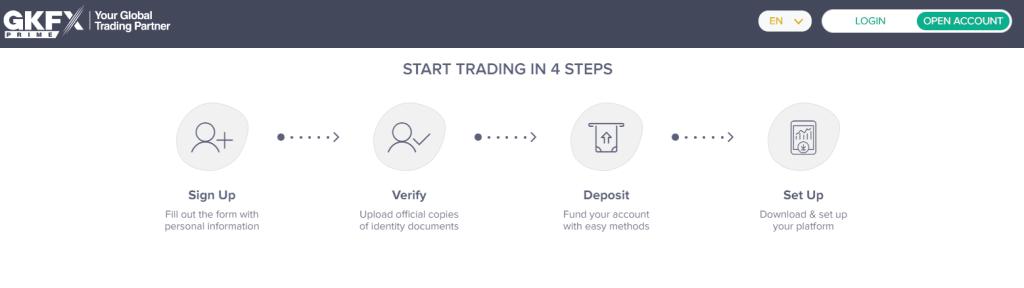

How to Open Your Account

Opening an account with GKFX is simple and straightforward:

- Navigate to the “Open Account” page on the GKFX website.

- Provide the required personal information, including your name, email, phone number, etc.

- Verify your personal data by uploading the necessary documentation, such as proof of residence and a valid identification document.

- Upon activation and verification of your account, you can deposit funds and start trading.

What Can You Trade on GKFX

GKFX Prime is a comprehensive trading platform that offers access to a wide array of trading instruments. This expansive range ensures that traders can diversify their portfolios and leverage opportunities across different markets. Here's a closer look at what you can trade on GKFX:

- Forex: As a leading Forex broker, GKFX Prime offers traders the opportunity to trade various currency pairs. This includes all the major pairs, such as EUR/USD, GBP/USD, and USD/JPY, as well as a selection of minor and exotic pairs. This extensive selection allows traders to tap into the dynamic Forex market with its 24-hour trading schedule and high liquidity.

- Stocks (Shares): GKFX Prime allows traders to invest in shares of leading global companies. Traders can participate in the performance of these companies, offering the potential for significant profits.

- Indices: Indices trading is another exciting opportunity offered by GKFX Prime. Traders can speculate on the price movements of major global indices, including the Dow Jones, S&P 500, NASDAQ, FTSE 100, and more.

- Commodities: Commodity trading is a crucial part of any diversified portfolio. At GKFX Prime, traders can speculate on the price movements of various commodities, including energy commodities like oil and natural gas, precious metals like gold and silver, and agricultural commodities.

- Cryptos: With the rising popularity of cryptocurrencies, GKFX Prime offers traders the opportunity to trade some of the most popular digital currencies like Bitcoin, Ethereum, and Litecoin.

GKFX Customer Support

Customer support is an integral part of the trading experience. The GKFX Prime team understands this and has dedicated a lot of resources towards ensuring that their clients receive top-notch customer service. Available 24 hours a day, 5 days a week, their support team is prepared to handle any queries or issues that traders may encounter.

You can reach the support team via email and phone. They offer support in 10 different languages, reflecting their commitment to serving their diverse global clientele effectively. This multilingual support ensures that language barriers do not hinder the resolution of issues, providing a more seamless trading experience for users.

Apart from reactive support, GKFX Prime also provides proactive assistance in the form of a comprehensive FAQ section on their website. This section provides answers to a wide array of questions, from account opening and GKFX trading platforms to deposit and withdrawal processes.

Advantages and Disadvantages of GKFX Customer Support

Security for Investors

Withdrawal Options and Fees

GKFX Prime does not impose any internal fees for deposits or withdrawals and offers a broad range of payment methods. Traders can effortlessly withdraw their profits or recoup their initial investment at any time.

Withdrawal methods offered by GKFX Prime include Bank Wire, VISA, MasterCard, American Express, FasaPay, Jeton, Maestro, Neteller, SOFORT, UnionPay, and WebMoney. However, it's recommended to verify the availability of these methods as per the broker's regulations.

GKFX Vs Other Brokers

#1. GKFX vs AvaTrade

GKFX and AvaTrade are both highly reputable brokers, each with its own strengths. GKFX Prime offers a wider range of trading instruments, over 400, including Forex, Stocks, Indices, Commodities, and Cryptocurrencies. On the other hand, AvaTrade offers over 1,250 financial instruments, catering to a broader client base across more than 150 countries.

AvaTrade also boasts a higher number of monthly transactions, with about two million compared to GKFX Prime. Both brokers are well-regulated, offering peace of mind for traders. AvaTrade has the added advantage of having more physical locations, with offices in Australia, Ireland, the British Virgin Islands, and Japan.

Verdict: AvaTrade appears to edge out GKFX Prime due to its larger selection of financial instruments, broader client base, and additional physical locations. However, traders who prioritize specific instrument types like Cryptocurrencies may find GKFX Prime more suited to their needs.

#2. GKFX vs RoboForex

RoboForex, like GKFX, offers a broad range of trading options with more than 12,000 and eight asset classes. RoboForex stands out with its robust selection of trading platforms – MetaTrader, cTrader, or RTrader.

It also offers unique contests on demo accounts, allowing winnings to be paid into real trading accounts. However, GKFX Prime has the advantage of providing a broader range of financial instruments and operating in more than 20 countries.

Verdict: While RoboForex offers a wider selection of trading platforms and unique features like its demo account contests, GKFX Prime's broader range of financial instruments and greater global reach may make it a more attractive option for traders looking to diversify their portfolios across multiple markets.

#3. GKFX vs Exness

Exness, a Cyprus broker, offers CFDs for stocks, energy, metals, and more than 120 currency pairings, including cryptocurrencies and stocks. The broker's total monthly trading volume is a whopping USD 325.8 billion.

Exness offers the possibility of earnings on small deposits due to its unlimited leverage offer, a feature not available with GKFX Prime. However, GKFX offers a larger selection of trading instruments and has an established presence in more than 20 countries, providing multilingual support in 14 languages.

Verdict: For traders who prioritize high leverage, Exness would be the preferable choice. However, for those who value a more extensive range of financial instruments and more global coverage, GKFX Prime would be the more attractive broker.

Conclusion: GKFX Review

In conclusion, GKFX Prime is a formidable broker in the Forex and CFD trading industry. Offering over 400 financial instruments, competitive pricing, and excellent execution, the broker provides an appealing and reliable trading environment for investors globally. Its well-regulated status offers traders peace of mind while trading. Additionally, its exceptional customer service and multilingual support set it apart from many of its competitors.

Despite its few drawbacks, such as lack of 24/7 customer support and variances in conditions based on entities, GKFX Prime continues to be a preferred choice for many due to its user-friendly interface, variety of account types, easy account opening process, and advanced trading tools.

GKFX Review: FAQs

Can I trade cryptocurrency with GKFX Prime?

Yes, you can trade cryptocurrency with GKFX Prime. The broker offers a variety of cryptocurrencies in addition to Forex, Stocks (Shares), Indices, and Commodities.

What is the minimum deposit requirement for a GKFX Prime account?

GKFX Prime has a very client-friendly approach when it comes to the minimum deposit. All its account types, including Standard Fixed, Standard Variable, VIP Variable, and ECN Zero, don't require a minimum deposit amount to start trading.

Is GKFX Prime a well-regulated broker?

Yes, GKFX Prime is a well-regulated broker. It is authorized by the Financial Services Commission (FSC), which adds an extra layer of security and trust for its clients.