Gold's Trading Range Holds Potential

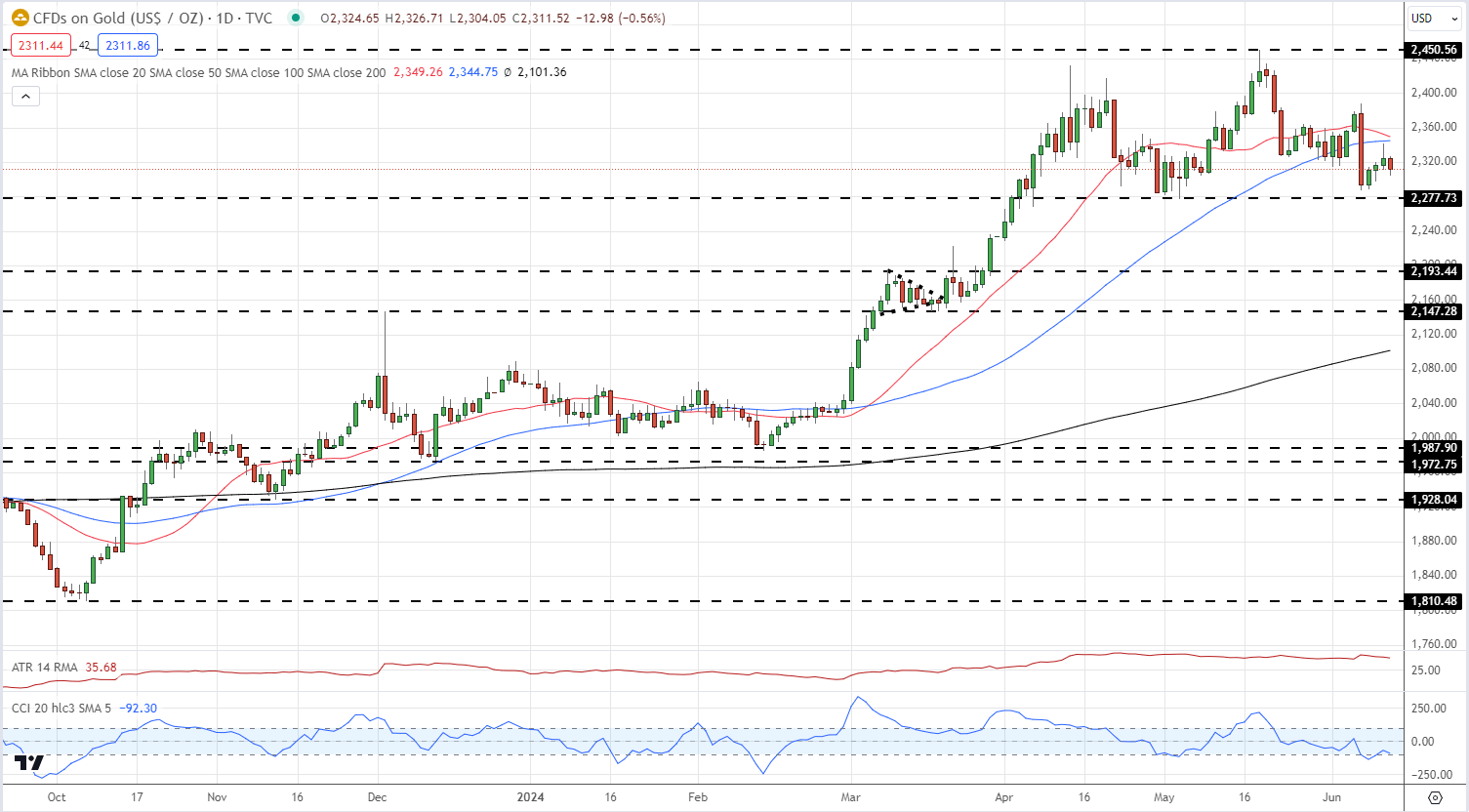

Gold's price action on the daily chart has settled into a familiar range-bound pattern, suggesting potential for range trading in the coming weeks. For traders to capitalize on this, the crucial support level must remain intact, requiring precise risk management strategies including tight stop-loss orders.

Since April, gold has fluctuated between $2,278/oz and $2,450/oz. The support level, tested and held in late April and early May, recently neared breach during a selloff that brought prices within $10 of support before rebounding.

However, a downturn below the 20- and 50-day simple moving averages signals a negative trend, while the Commodity Channel Index (CCI) indicates potential oversold conditions. A reversal above these moving averages, akin to early May, is necessary to target the upper resistance once more.

Currently, gold is priced at $2,311/oz. A stop-loss order at $2,250/oz is advisable to mitigate risks of a further drop.

Retail Sentiment and Gold Prices

According to the IG Retail Client Sentiment report, 61.66% of traders are net-long, with a ratio of 1.61 to 1 favoring long positions. Compared to yesterday, there’s an 8.60% decrease in net-long positions, yet on a weekly basis, there’s an 8.67% increase.

Net-short positions have slightly increased by 2.78% since the last session but have dropped by 8.25% over the week.

Our contrarian analysis suggests that the prevalent net-long positioning might hint at a continued price drop. Nonetheless, the recent shifts in trader positions, showing a decrease in net-longs from yesterday but an increase from last week, indicate a mixed sentiment among investors, impacting the trading outlook for gold.