BoE Rate Decision Looms: Hold Expected Amid Economic Signals

The Bank of England (BoE) is poised for its Thursday meeting, anticipated to maintain interest rates at their highest in 16 years. Observers will keenly analyze comments from Governor Bailey and the Monetary Policy Committee (MPC), especially about the prospects of a rate cut. With inflation trending favorably, a stagnant economy in April, and easing job market pressures, the stage is set for monetary adjustments.

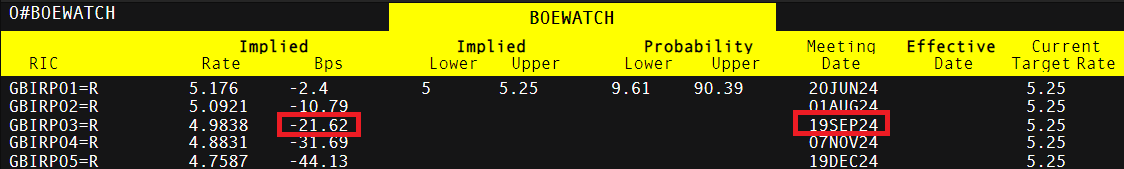

A significant shift in market expectations might occur if May’s inflation shows further decline, coupled with a dovish tilt in the MPC. Despite historical voting patterns suggesting a 7-2 split favoring holding rates, any dovish surprises could prompt an earlier rate adjustment, possibly as soon as August, although markets currently see November as more probable.

Implied Interest Rate Path (in Basis Points)

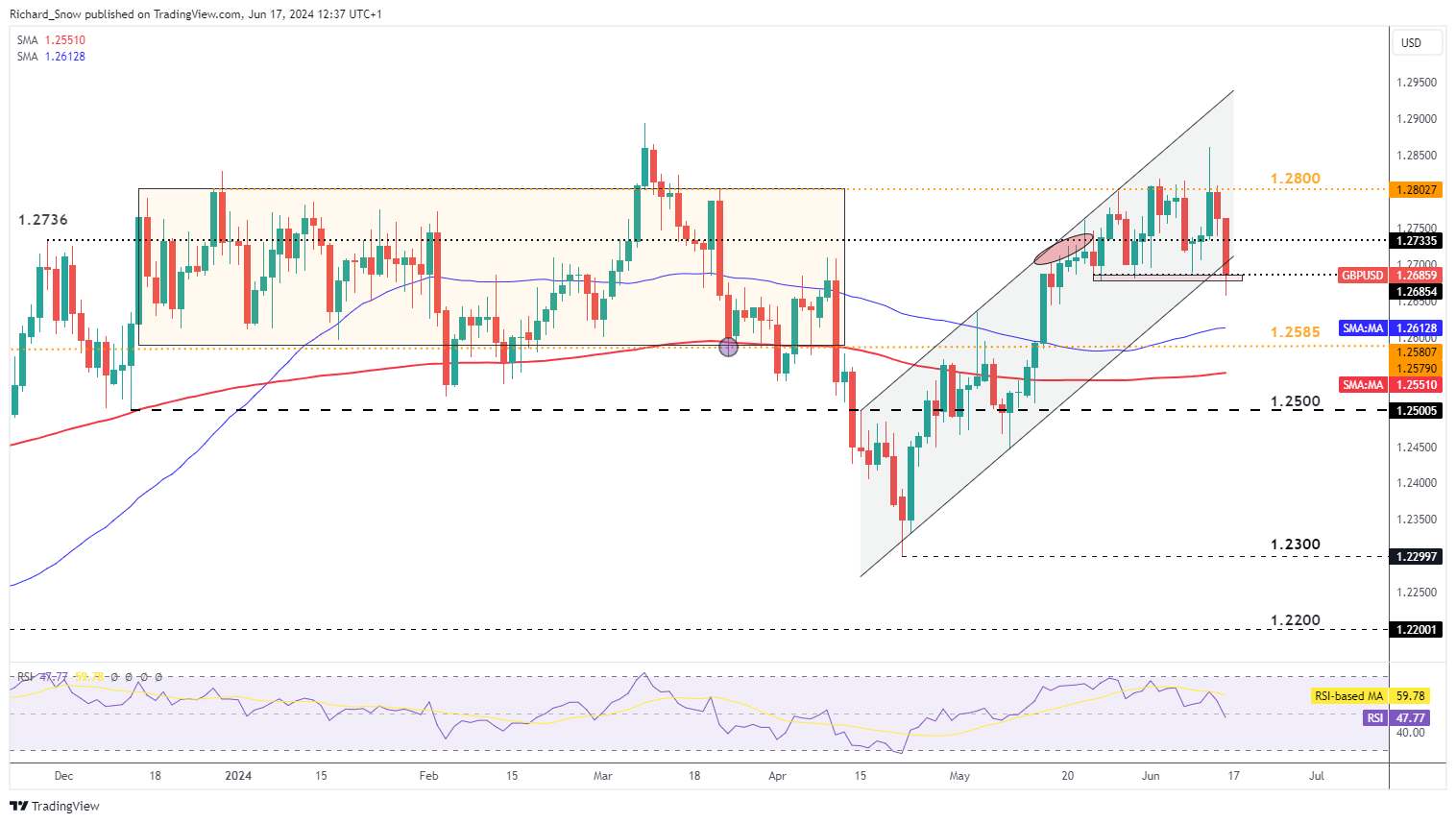

GBP/USD: Potential Downside After FOMC Adjustments

Despite a strong performance against the dollar earlier this year, Sterling faces potential decline post-FOMC projections. From a technical stance, GBP/USD finds itself testing a crucial support at 1.2680. A further drop is supported by technical indicators, with RSI just crossing below 50, suggesting room for additional decline without immediate overheating concerns.

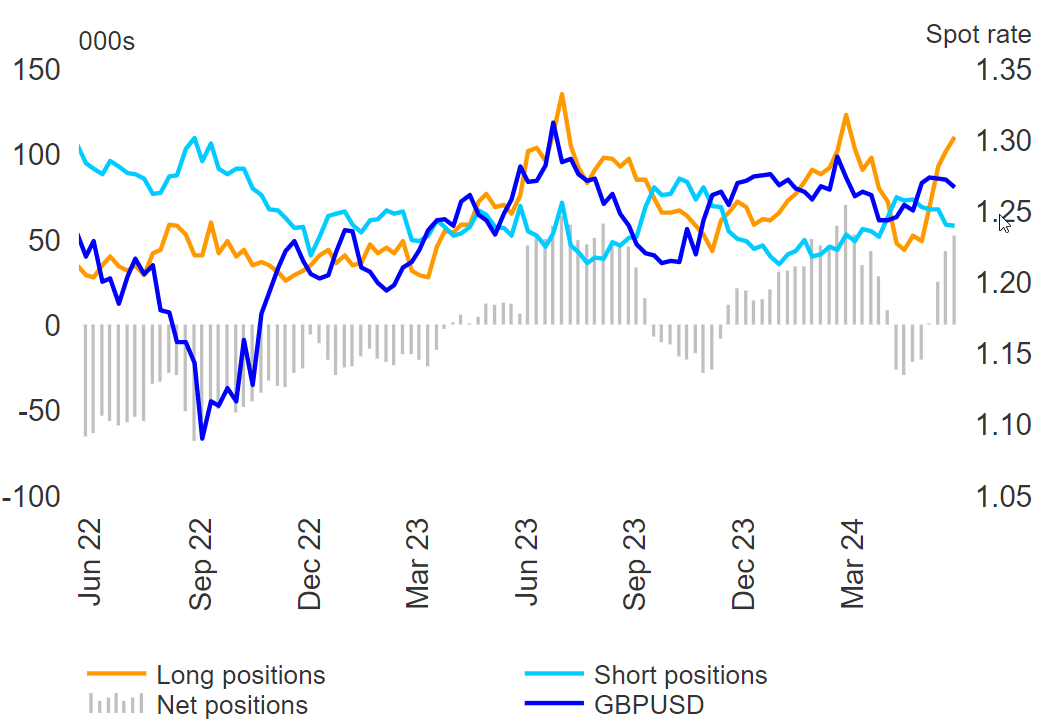

Large speculators and institutions have significantly increased GBP long positions, creating vulnerability to a dovish shift. This “smart money” has historically preceded downturns in GBP/USD, suggesting possible rapid unwinding of long positions if the BoE surprises.

CBOE Commitment of Traders Report (CoT) – Data accurate up until Tuesday 11 June

SNB Decision: Rate Cut Expected Despite Currency Strength

The Swiss National Bank (SNB) also meets on Thursday, with markets anticipating another 25-basis point reduction. Although Switzerland’s interest rates are already low, the SNB may cut further, influenced by Chairman Thomas Jordan’s remarks on the risks of a weak franc, which recently appreciated sharply.

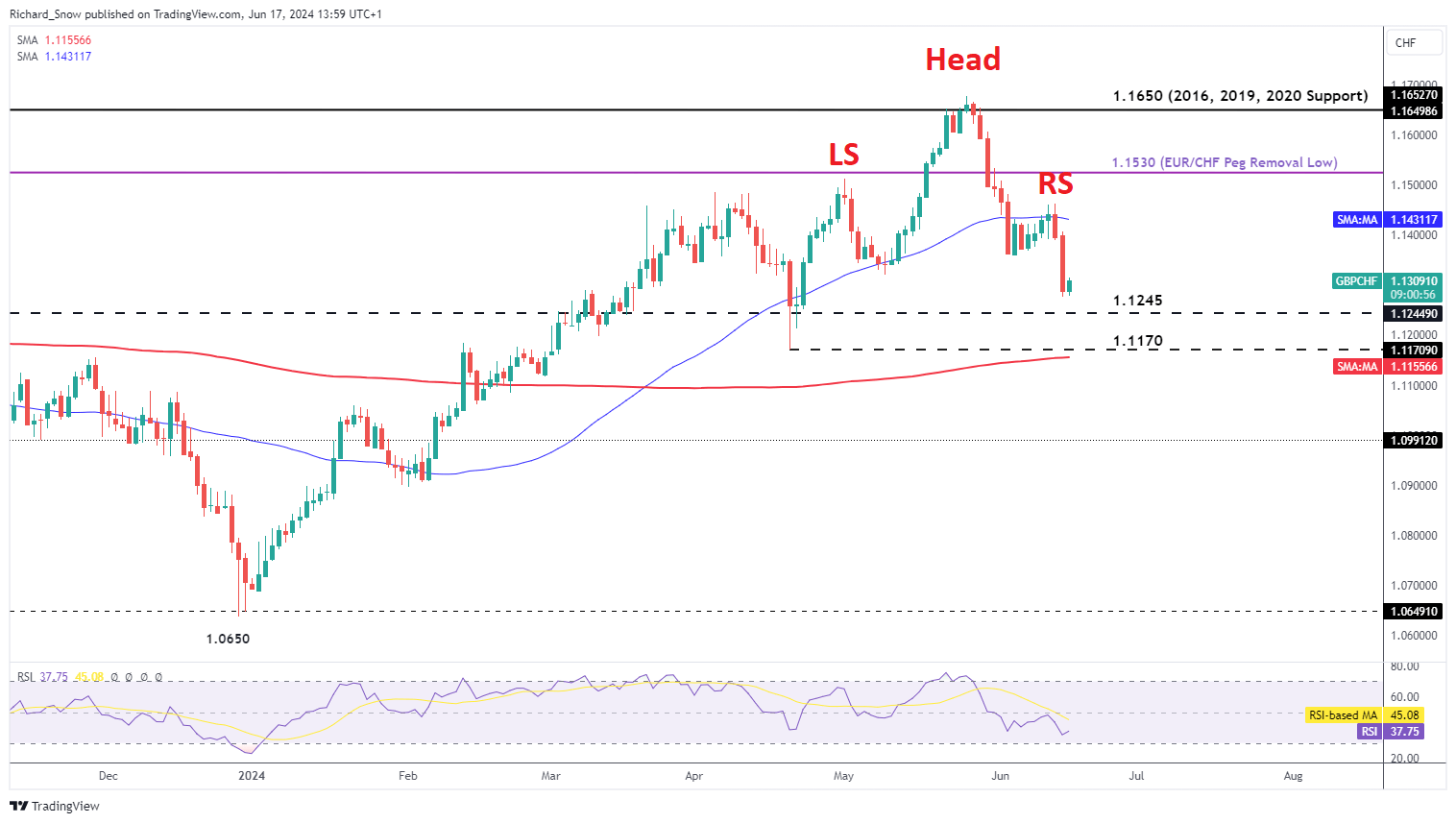

GBP/CHF is currently indicating a longer-term reversal pattern, trading just above significant support at 1.1245. If dovish scenarios unfold both in the UK and Switzerland, GBP/CHF could target a lower swing at 1.1170, whereas a hold above 1.1245 could push the pair towards 1.1462.

GBP/CHF Trading Levels to Watch

This analysis serves to guide investors through the critical points and potential scenarios affecting GBP/USD and GBP/CHF as major central banks near their rate decisions.