Subdued Inflation Progress, RBA Holds Rates

The Reserve Bank of Australia (RBA) has maintained its monetary policy settings despite acknowledging the challenges in steering inflation back to its target range.

During today’s announcement, RBA Governor Michele Bullock highlighted the uncertain economic outlook, remarking that achieving the inflation target smoothly remains unlikely. She also disclosed that the board had contemplated a rate hike.

Despite notable progress since the inflation peak in 2022, consumer price levels persist above the RBA’s desired 2-3% range. The latest figures show an annual headline consumer price increase of 3.6%. Excluding volatile items and holiday travel expenses, the core inflation stands at 4.1%, mirroring figures from December 2023.

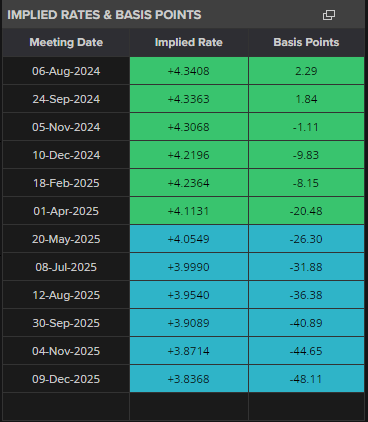

Forecasters see minimal chance of a rate increase in Q3, with potential rate reductions not anticipated until Q2 2025.

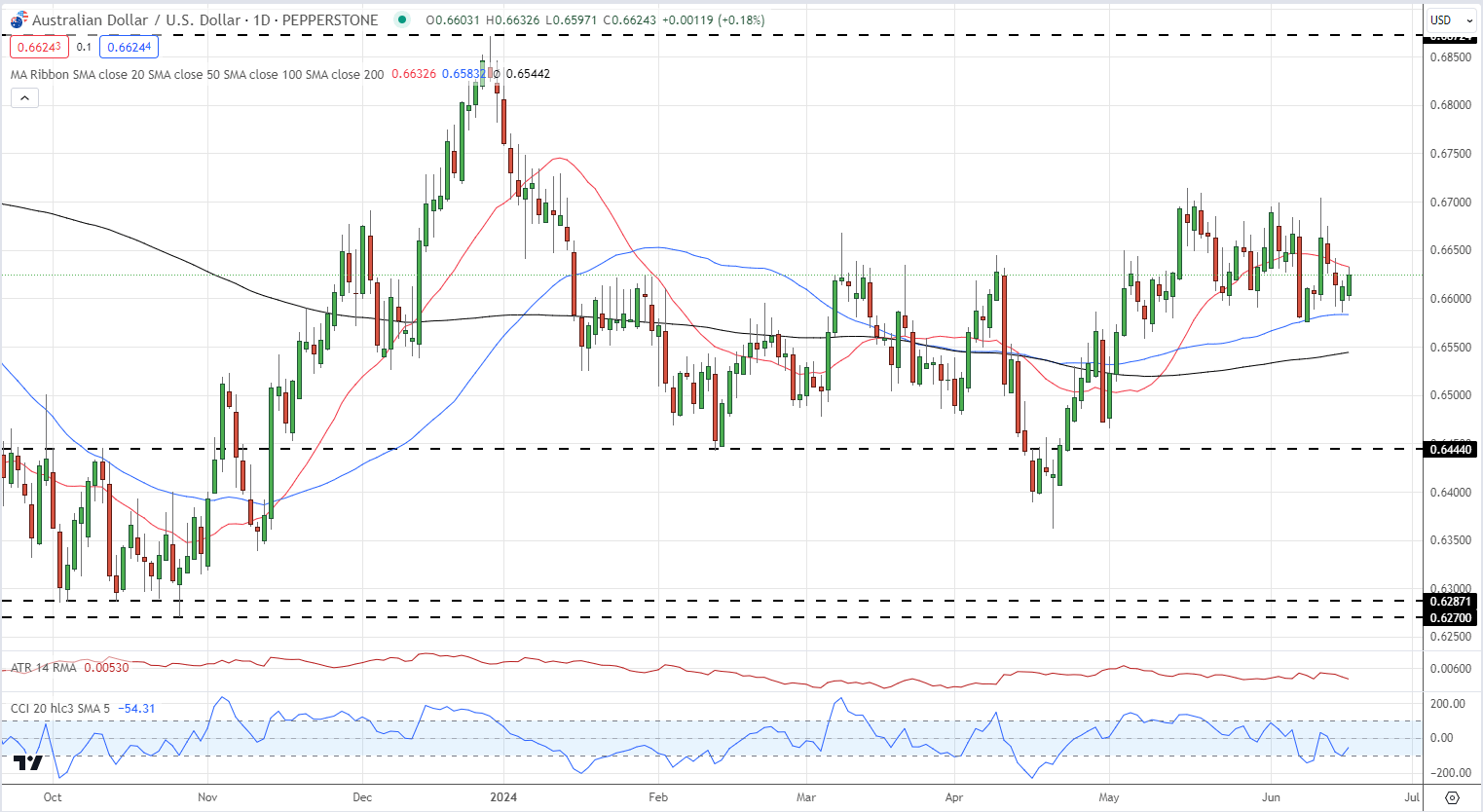

AUD/USD Edges Higher Post-RBA Decision

Following the RBA’s announcement, the Australian dollar has seen modest gains against the US dollar. The AUD/USD pair has been trading within a tight band for the past six weeks, with expectations to continue this trend in the near term.

The CCI indicator suggests an oversold condition, and the 20-day simple moving average is currently being tested. Key support lies at 0.6575, with resistance around 0.6650.

AUD/USD Daily Analysis

Market sentiment data from IG retail clients indicates that 65.54% are net-long on AUD/USD, with a long-to-short ratio of 1.90 to 1. Compared to yesterday, net-long positions have increased by 5.11%, and by 1.01% from last week, while net-short positions have risen by 4.10% from yesterday but dropped by 3.92% compared to last week.

Contrarian views on crowd sentiment suggest that the increased long positions could indicate potential declines in AUD/USD prices. The growing preference for long positions both from yesterday and last week supports a stronger bearish outlook for the currency pair.