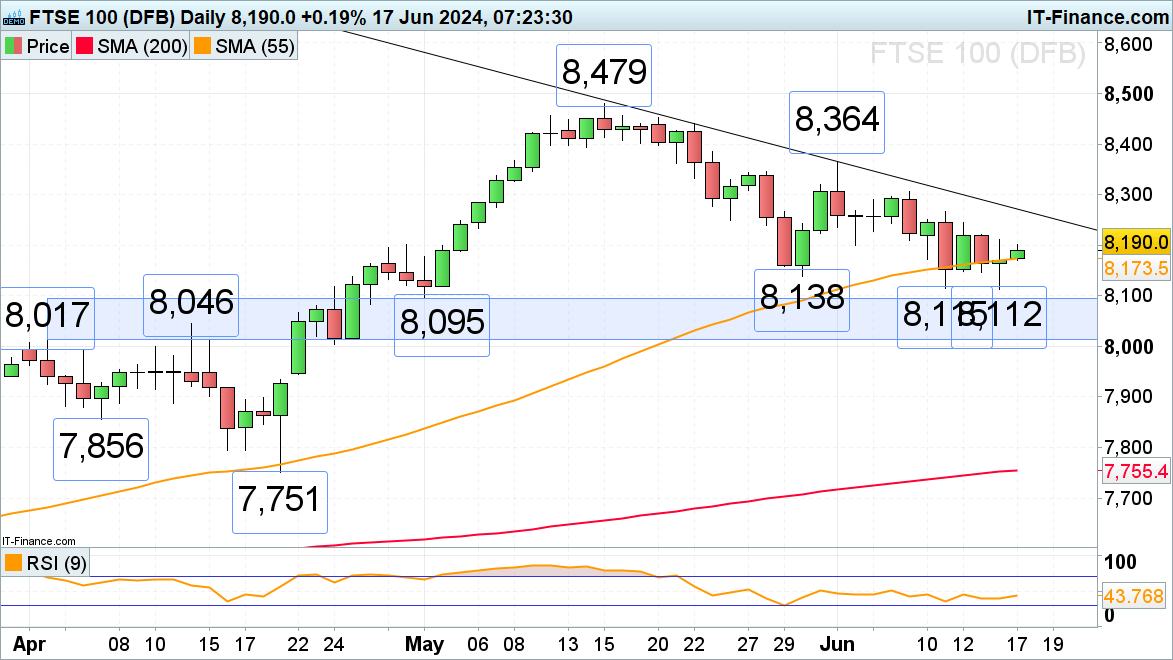

FTSE 100 Attempts Recovery

The FTSE 100 is aiming to recoup recent losses, influenced by its European counterparts amid political upheavals from elections. Currently, the UK’s leading index has risen above its 55-day SMA, now at 8,173, with last Thursday’s peak of 8,220 nearing once again.

Should the index dip below the recent low of 8,112, it might target the range between 8,095 and 8,017—a zone that marks the highs of early to mid-April and the lows of late May.

For a bullish resurgence, the index needs to breach the high from last Tuesday at 8,266.

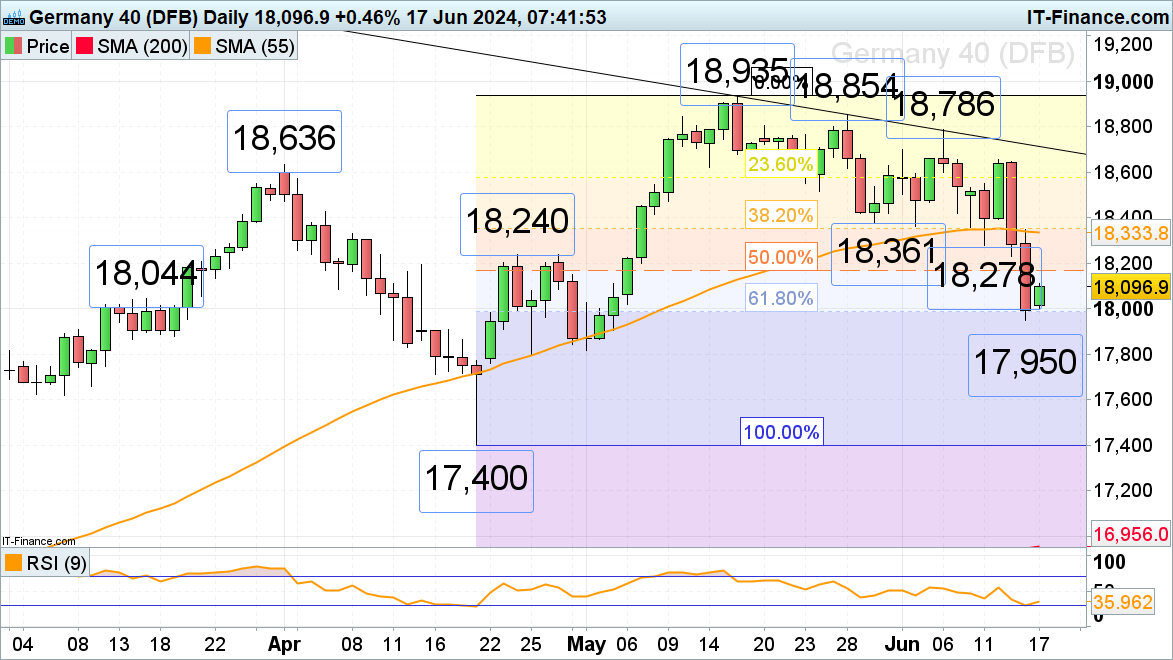

DAX 40 Strives to Maintain Post-Drop Level

The DAX 40 seeks to stabilize above the low of 17,950, reached during last Friday’s sell-off. This downturn was spurred by a shift in the European political landscape and the announcement of unexpected legislative elections in France.

The index is striving to stay above this level, which coincides with the 61.8% Fibonacci retracement of the recent April-to-May rally.

A breach below could see it testing the mid-March low at 17,865.

Resistance is currently positioned at the 50% Fibonacci level of 18,170, with the late April peak at 18,240 looming above.

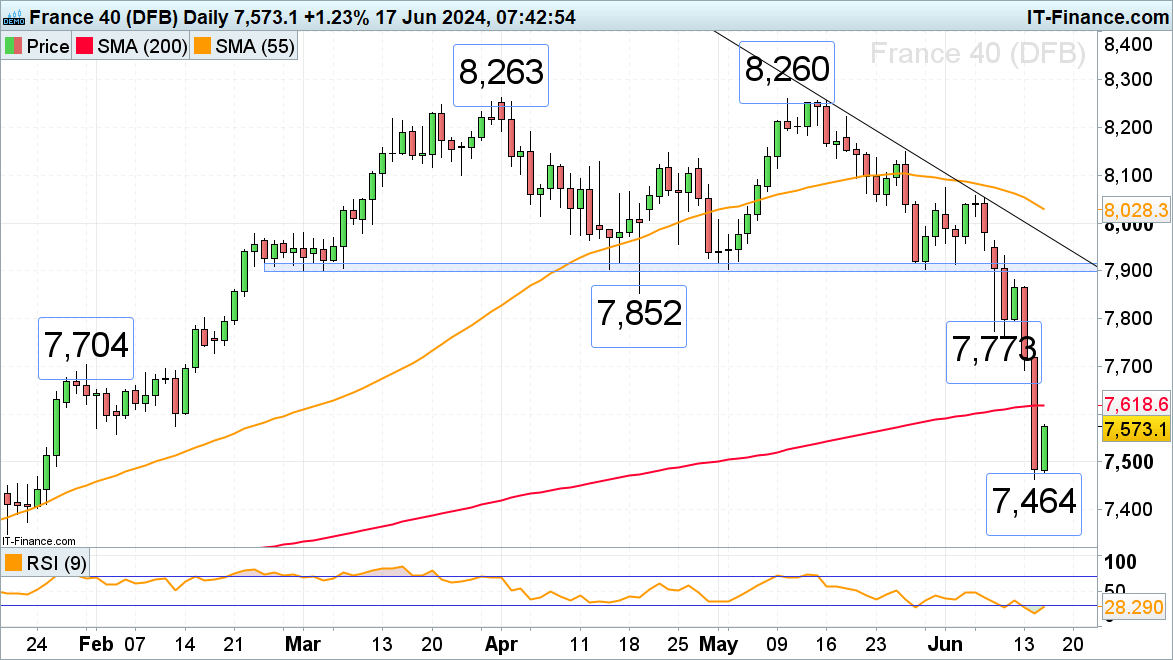

CAC 40 Aims to Overcome Recent Lows

The CAC 40 experienced a significant downturn last week, declining over 5% to 7,464 amid substantial outflows following the announcement of snap legislative elections in France by President Emmanuel Macro. This was a reaction to the far-right’s strong performance in recent European elections.

The index now eyes the 200-day SMA at 7,619 as potential resistance, with the late January high of 7,704 just above. Should it break below the recent low of 7,464, the December high at 7,653 might provide some support. Failing that, the index could descend towards the 7,281 mark, noted as the January low.