French Elections Set the Stage

The initial round of the French elections is slated for this Sunday, with the right-wing National Rally (RN) party leading in the polls but lacking sufficient seats to form a government. Recent polls suggest the RN will garner between 31.5% to 35% of the vote, followed by the People’s Front, a left coalition, with about 28% to 29.5%.

President Macron’s alliance is trailing with 19.5% to 22% of the votes. As the current ruling party ranks third, this fragmented voting outlook is expected to impact not only French assets but also the Euro in the upcoming days. The final vote will take place on Sunday, July 7.

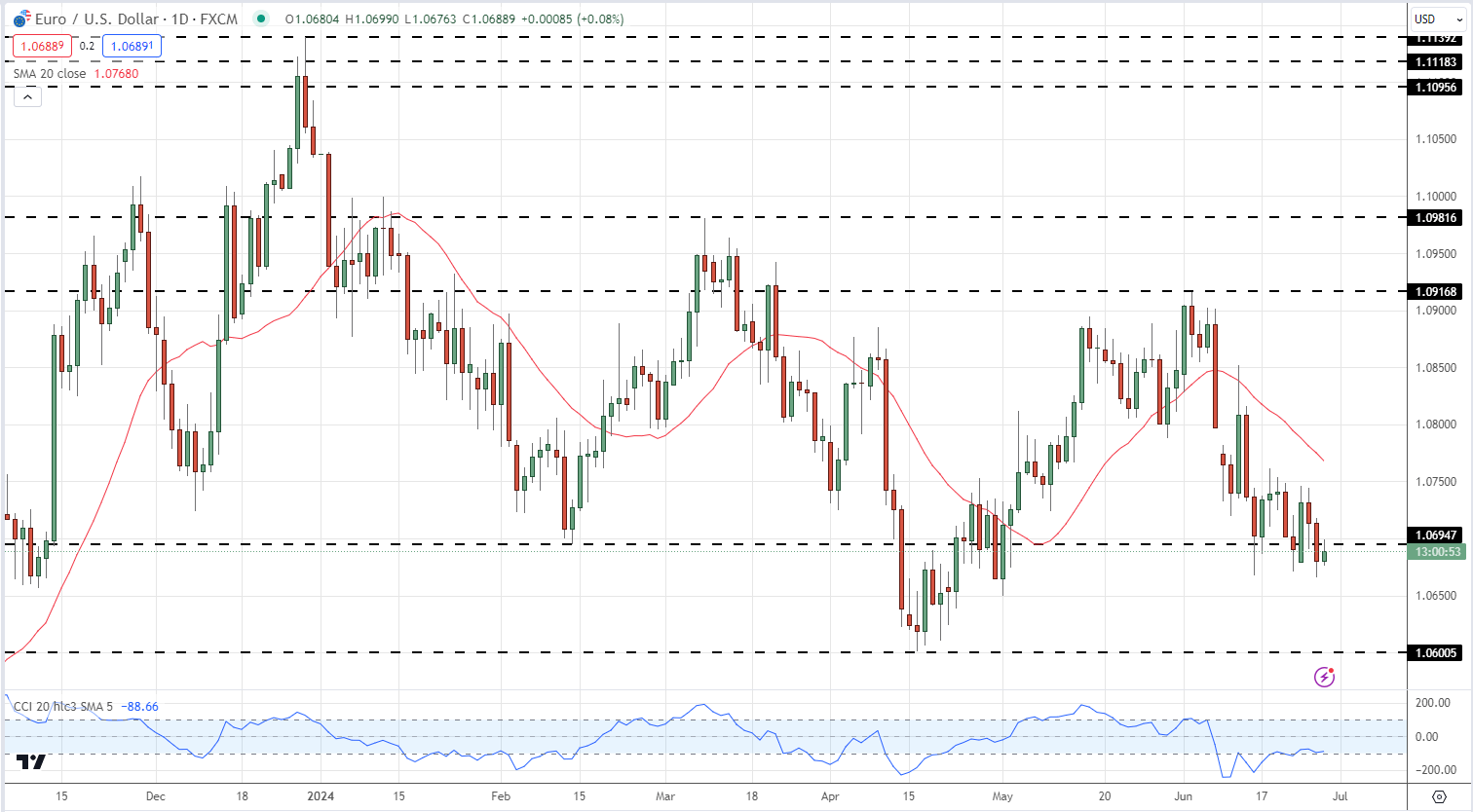

Impact on EUR/USD

EUR/USD, the most actively traded FX pair, has been experiencing downward pressure due to a robust US dollar and a weakening Euro. Today, traders will be eyeing the release of the US durable goods data and the final US Q1 GDP figures.

However, the key focus remains on Friday’s US core PCE report, which could significantly influence EUR/USD trading ahead of the weekend. These critical US data releases, coupled with the French elections, are preparing grounds for heightened volatility in the EUR/USD market.

Retail Trader Sentiment and EUR?USD Outlook

According to retail trader data, 66.18% of traders are currently net-long, with the long-to-short ratio at 1.96 to 1. The number of net-long traders is 14.14% higher than yesterday and 25.04% higher than last week, while net-short traders have decreased by 14.48% since yesterday and 22.26% from last week.

Given our contrarian view to crowd sentiment, the overwhelming net-long positions suggest that EUR/USD prices may continue to decline. With traders increasing their net-long positions compared to yesterday and last week, this amplifies our bearish outlook for the EUR/USD, hinting at potential further drops.