The EURUSD currency pair opened with a notable positive gap on Monday, reflecting market reactions to the French election results. Marine Le Pen’s far-right party secured a victory in the first round on Sunday, albeit with a narrower margin than expected. This outcome has stirred speculation regarding the party's ability to secure an absolute majority in the forthcoming July 7 run-off, adding a layer of political uncertainty to the market.

Short-Term Highs and Moving Averages

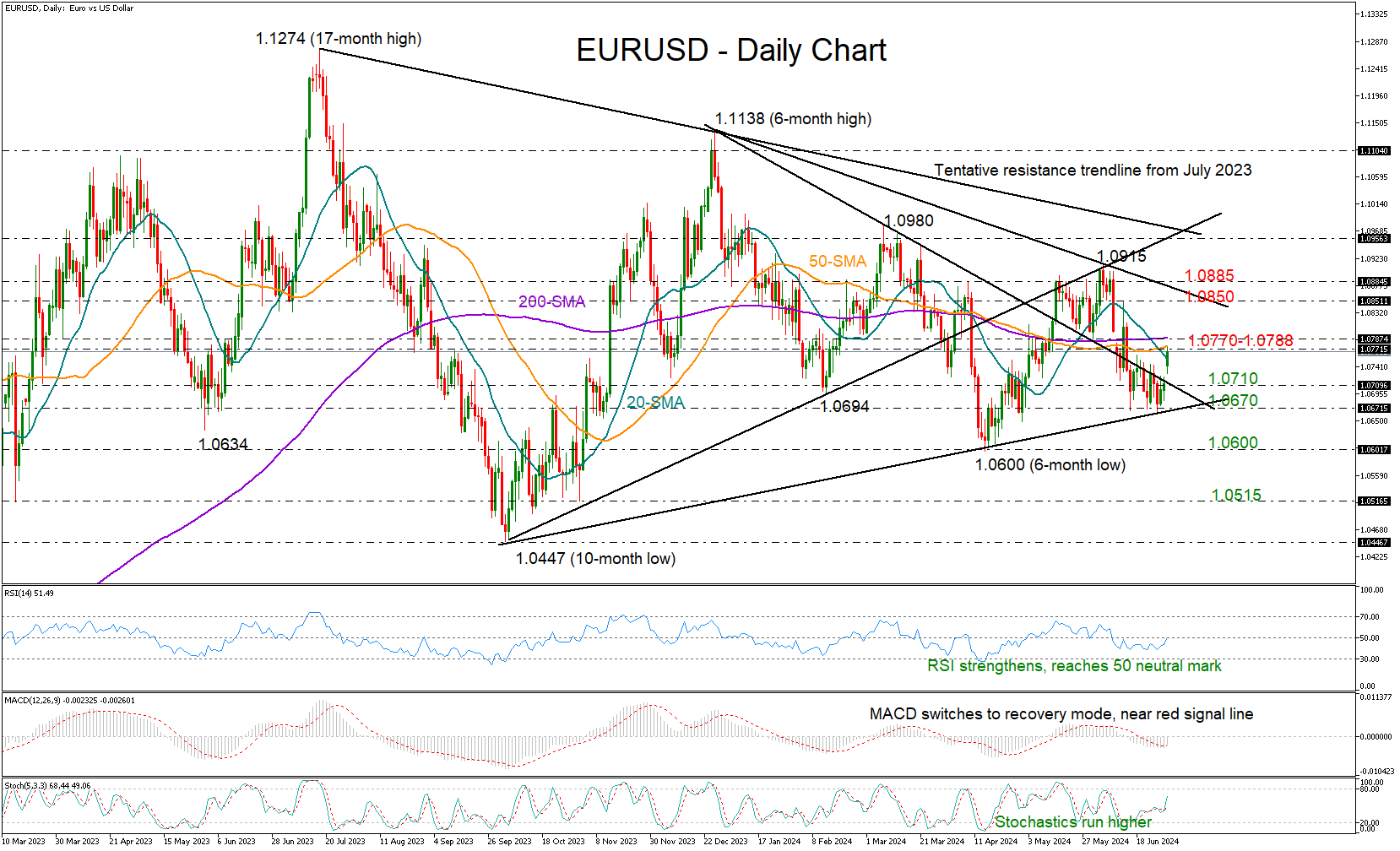

The EURUSD surged to an almost three-week high of 1.0742, but the upward momentum was capped by the 20- and 50-day simple moving averages (SMAs). For the pair to sustain and extend its gains, a close above 1.0788, which is near the 200-day SMA, is essential. Breaking this resistance could propel the pair towards the 1.0850-1.0885 range, with further potential to reach the ascending trendline from October 2023, currently around 1.0955.

The recent bounce from the critical support trendline at 1.0660 indicates a possible new bullish phase. Technical indicators also show positive signs, although the Relative Strength Index (RSI) remains below the 50 neutral mark and the Moving Average Convergence Divergence (MACD) hovers near its red signal line in negative territory. On the flip side, a drop below the crucial support at 1.0670 could empower sellers, leading to a decline towards 1.0600 and potentially targeting the 1.0515 region if bearish momentum continues.

Political Uncertainty and Market Sentiment

The French election outcome has introduced a significant degree of uncertainty into the market. Investors are wary of the potential for prolonged political instability if Le Pen’s party struggles to secure an absolute majority. This scenario could lead to a more cautious approach from market participants, influencing the EURUSD's movements in the short to medium term.

Analysts suggest that while the EURUSD is showing signs of bullish momentum, caution is warranted. “The market is reacting to the immediate political developments in France, but the broader economic implications are still unclear,” said Jane Doe, chief economist at Big Bank. “Investors should keep an eye on both technical levels and political headlines as they navigate this uncertain landscape.”

Upcoming Data and Federal Reserve Policies

The French election is just one of several factors influencing the EURUSD. Upcoming economic data releases and Federal Reserve policies will also play critical roles in shaping market sentiment. Traders will be closely monitoring these developments, alongside the political situation in France, to gauge the future direction of the currency pair.

Key Levels to Watch:

- Resistance: 1.0742, 1.0788, 1.0850-1.0885, 1.0955

- Support: 1.0670, 1.0600, 1.0515

With the next round of the French election approaching and other economic factors at play, the market is poised for potential volatility.