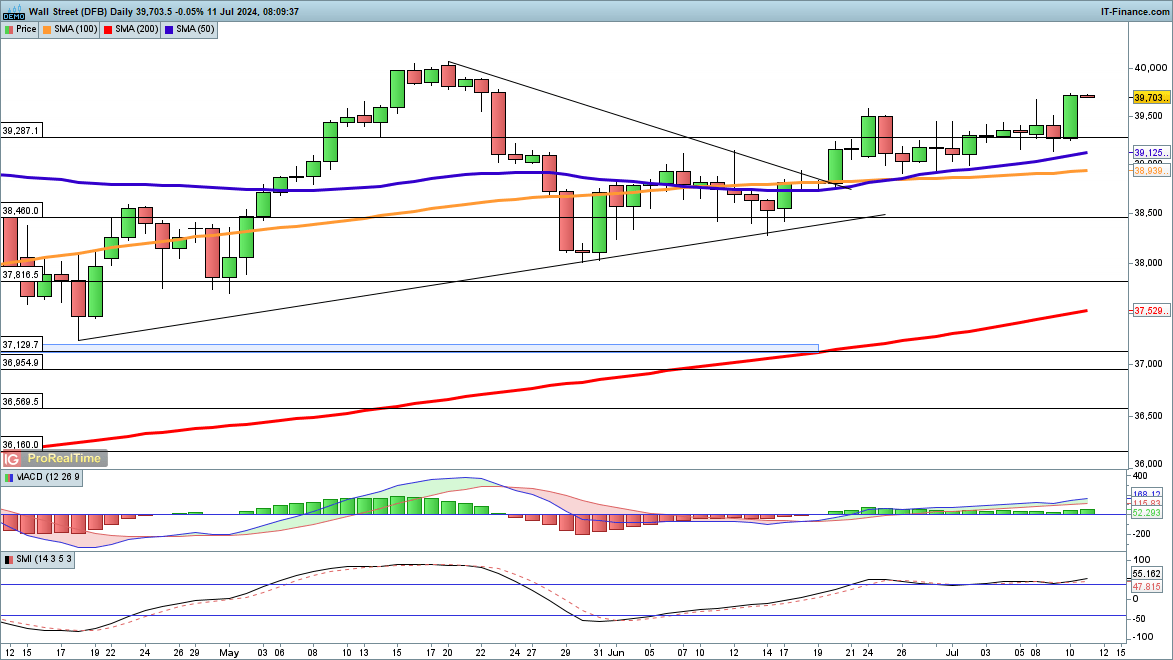

The index has achieved notable gains, rallying to a seven-week high, although it still lags behind the May record highs, unlike the S&P 500 and Nasdaq 100. Further gains aim at that May peak of 40,080. For now, higher intraday lows suggest a bullish momentum, with a short-term positive outlook as long as the price stays above the 50-day simple moving average (SMA), currently at 39,125.

A close below 39,000 would negate the short-term bullish outlook and could potentially lead to levels of 38,500 and then 38,000.

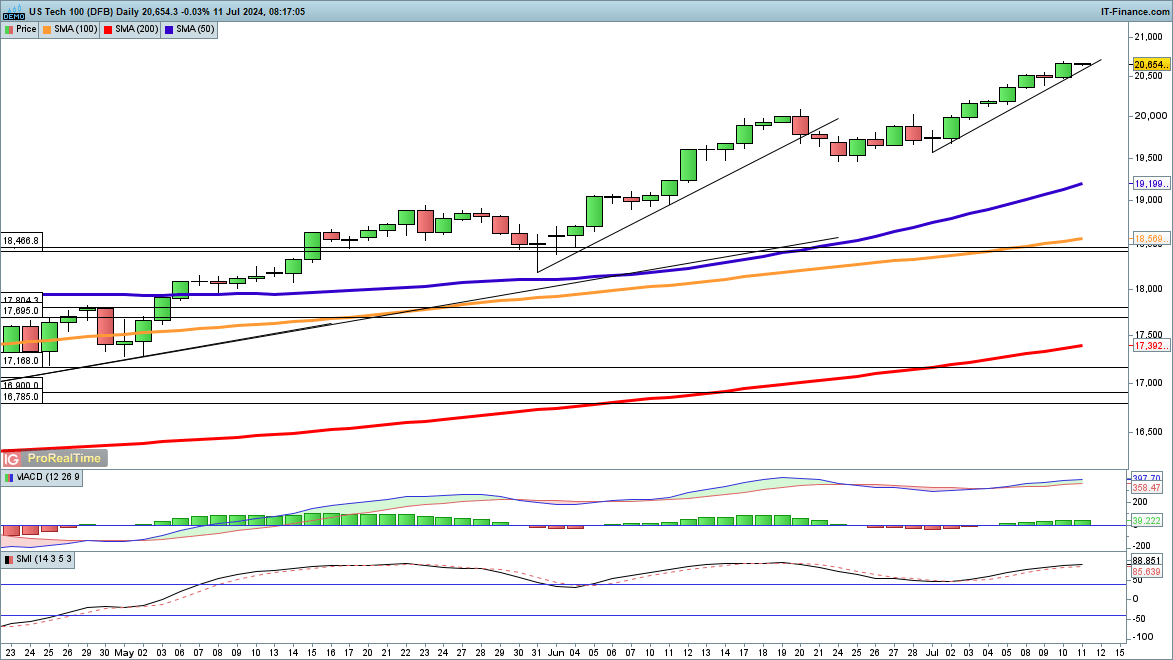

Continued Record Highs

The index hits another record high, showing no signs of pre-CPI nervousness. The trendline support from the 1 July low continues to bolster the short-term, but a close below 20,500 might suggest a temporary high has been reached.

So far, there's little indication of any significant pullback starting.

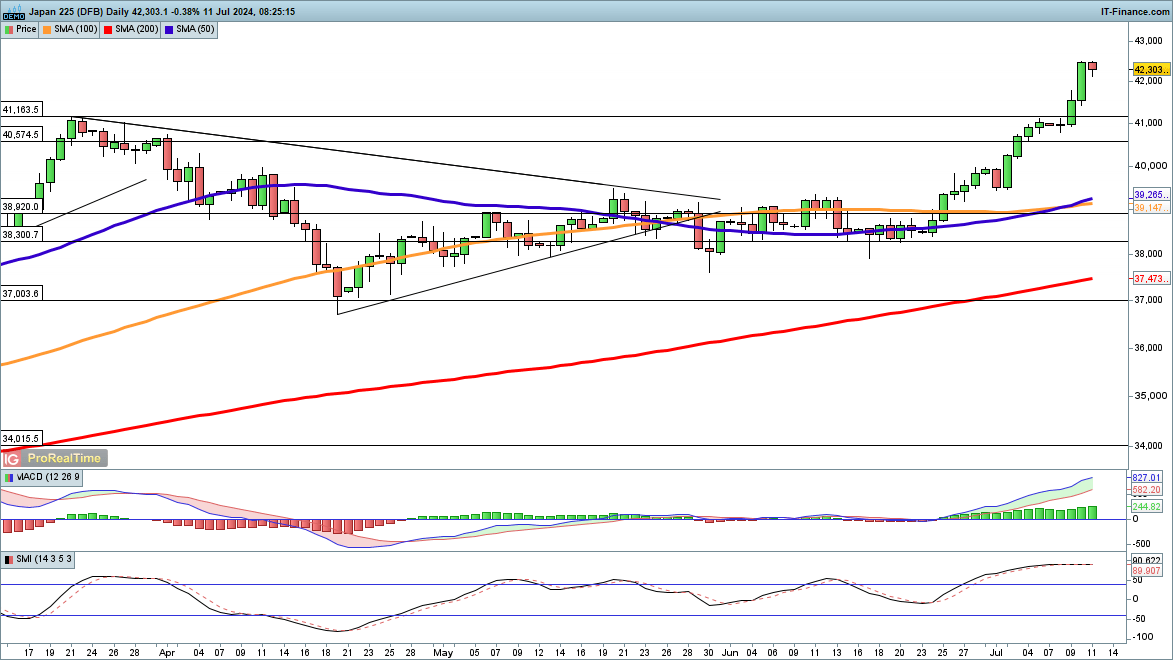

Significant Monthly Increase

The index has surged approximately 12% in less than a month, surpassing 42,000 for the first time ever. Short-term consolidation might be ahead, yet the overall bullish outlook remains solid. A short-term pullback might target 41,163, the previous record high.