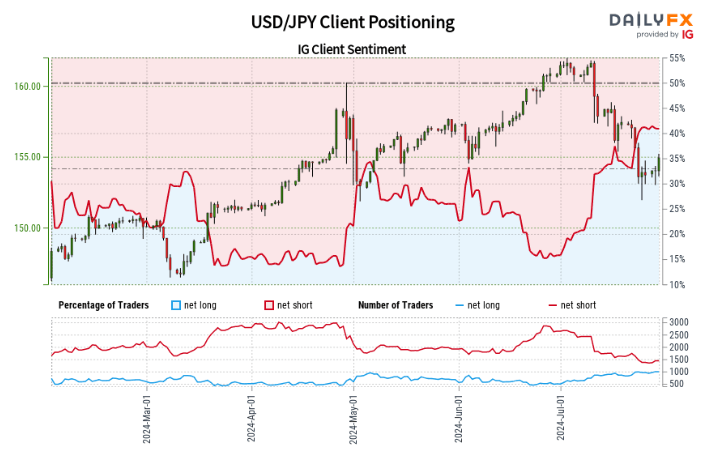

Gold Analysis

Analysis of retail trader positioning indicates 56.19% are net-long, with a long-to-short ratio of 1.28 to 1. Net-long traders have decreased by 2.47% since yesterday and 3.96% from last week, while net-short traders have increased by 7.34% since yesterday but decreased by 4.98% from last week.

Using a contrarian approach to market sentiment, it is suggested that Gold prices may continue to decline, given the net-long position of traders. However, the positioning is less net-long than yesterday but more net-long than last week. This blend of current sentiment and recent shifts results in a mixed trading outlook for Gold.

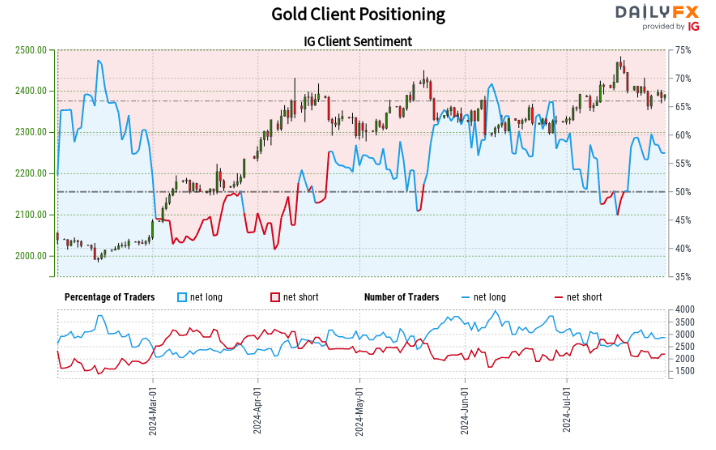

Oil – US Crude Analysis

Retail trader data reveals 84.07% are net-long, with a long-to-short ratio of 5.28 to 1. Net-long traders have increased by 11.02% since yesterday and 18.68% from last week, while net-short traders have decreased by 7.18% since yesterday and 34.26% from last week.

Our contrarian approach to market sentiment suggests Oil – US Crude prices may continue to decline, given the net-long position of traders. The increase in net-long positions both since yesterday and last week reinforces a stronger bearish contrarian trading bias for Oil – US Crude.

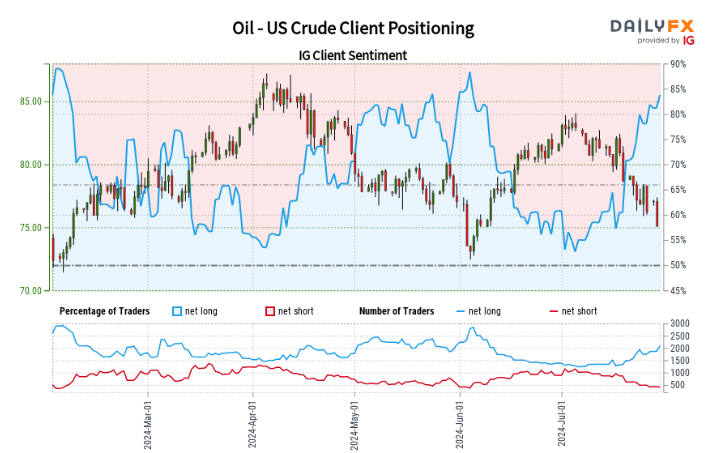

USD/JPY Analysis

Retail trader positioning shows 40.25% are net-long, with a short-to-long ratio of 1.48 to 1. Net-long traders have increased by 1.25% since yesterday and 7.52% from last week, while net-short traders have increased by 0.77% since yesterday but decreased by 16.88% from last week.

The analysts' approach to market sentiment suggests USD/JPY prices may continue to rise, given the net-short position of traders. However, traders are less net-short than yesterday and compared to last week. These recent shifts in sentiment indicate that the current USD/JPY price trend may soon reverse lower, despite traders remaining net-short.