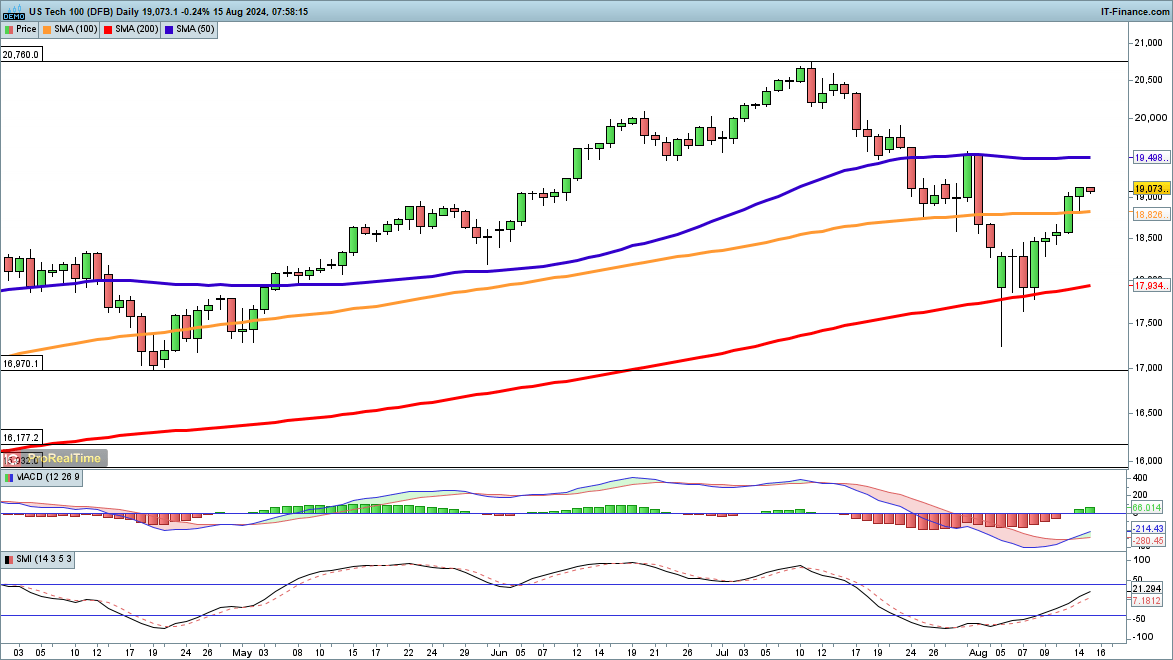

Nasdaq 100 Continues Its Upward Momentum

The Nasdaq 100 has experienced a strong rally over the past week, rebounding sharply off its 200-day simple moving average (SMA). The next targets are the 19,500 highs observed on July 31 and August 1, followed by the 50-day SMA. Beyond these levels, the 20,000 mark comes into focus.

Currently, there’s no sign of a reversal. However, if the index drops below 18,800, this could signal potential short-term weakness, possibly bringing it back toward the 200-day SMA and the August lows around 17,500.

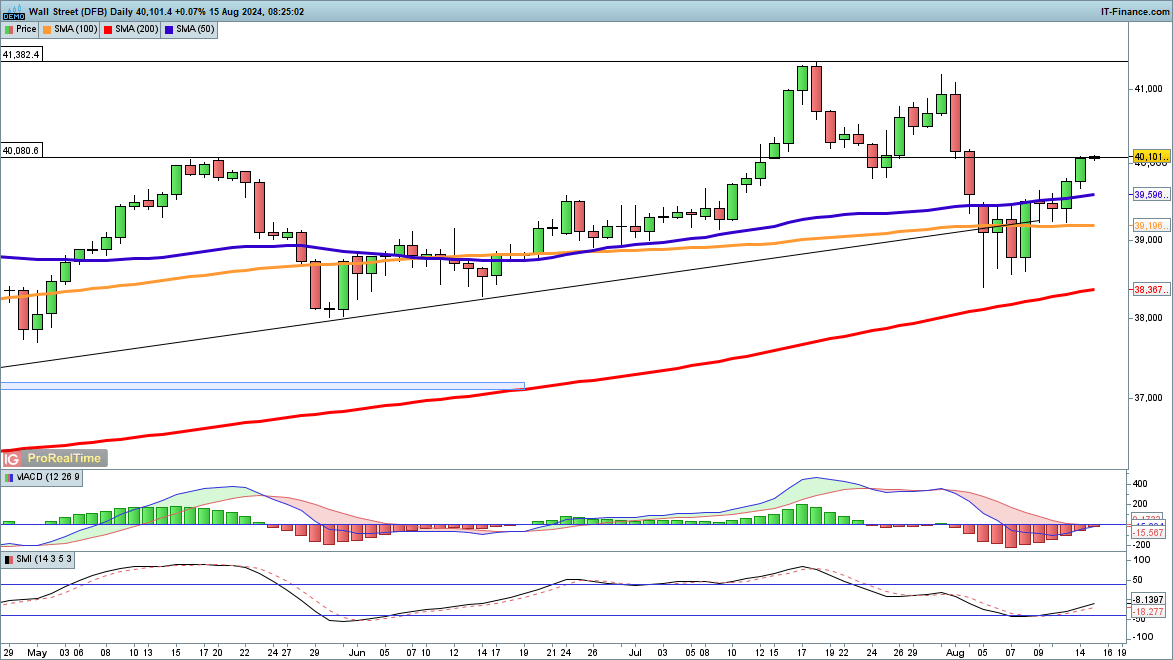

Dow Reclaims 40,000 Mark

The Dow Jones has also continued its upward movement, surpassing the 40,000 level. In early trading, it is challenging the 40,080 highs from May.

If this momentum persists, the Dow could advance to 41,000 and then to the all-time high of 41,382. A reversal below 39,000 would be necessary for sellers to push the index toward retesting the early August low near 38,500.

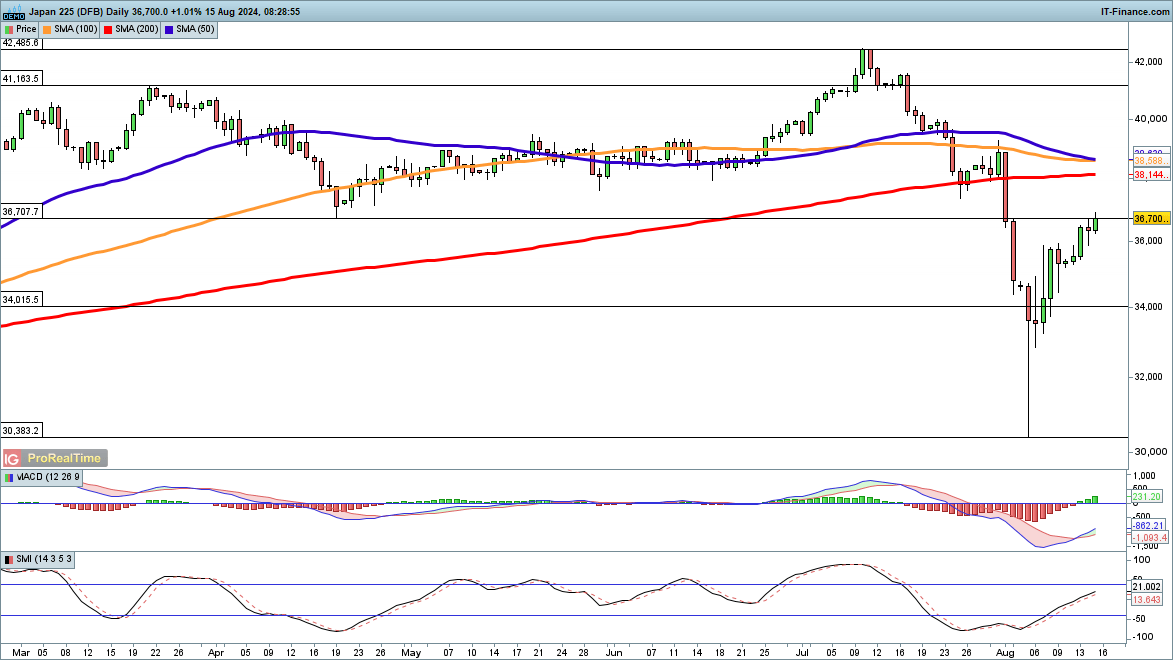

Nikkei 225 Extends Gains

The Nikkei 225 has managed to recover all its losses from the August 5 opening, along with those from August 2. This robust rebound shows no signs of slowing down.

Further gains could target the 200-day SMA at 38,144, provided the index successfully closes above the 36,707 level, which was the low in mid-April.