Economic Expansion in Q2 Aligns with Expectations

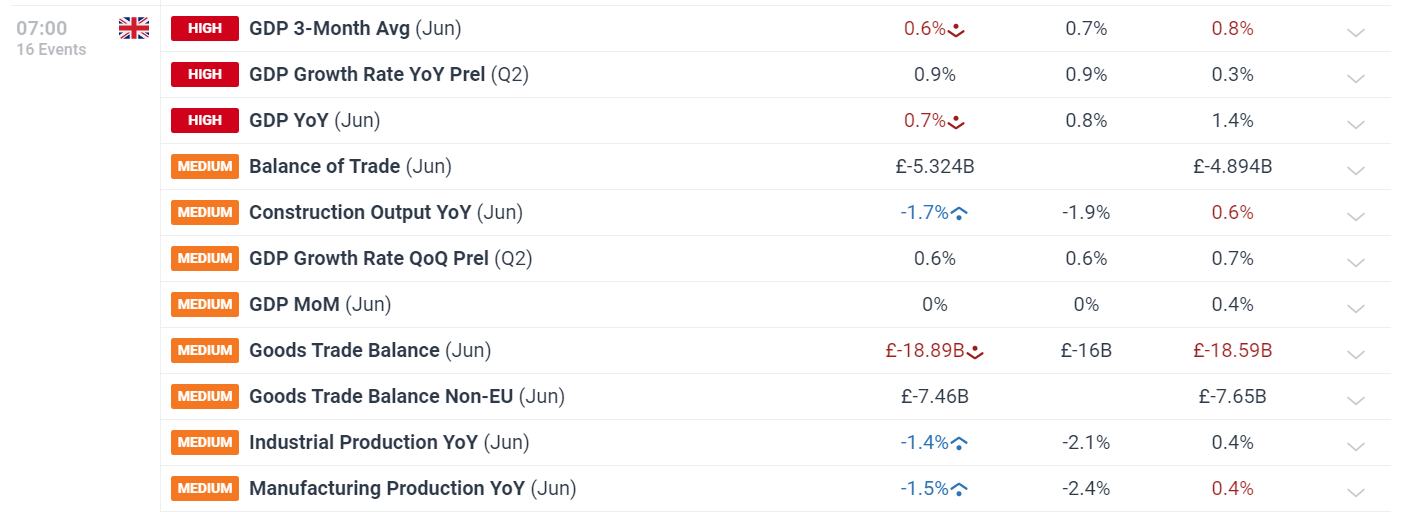

The UK's economic growth for Q2 met expectations, showing a 0.6% quarter-on-quarter increase. Despite challenges during the recent rate hiking cycle, the UK economy has begun to display signs of recovery. This comes just ahead of the latest Bank of England (BoE) meeting, where the monetary policy committee opted to lower interest rates for the first time since March 2022.

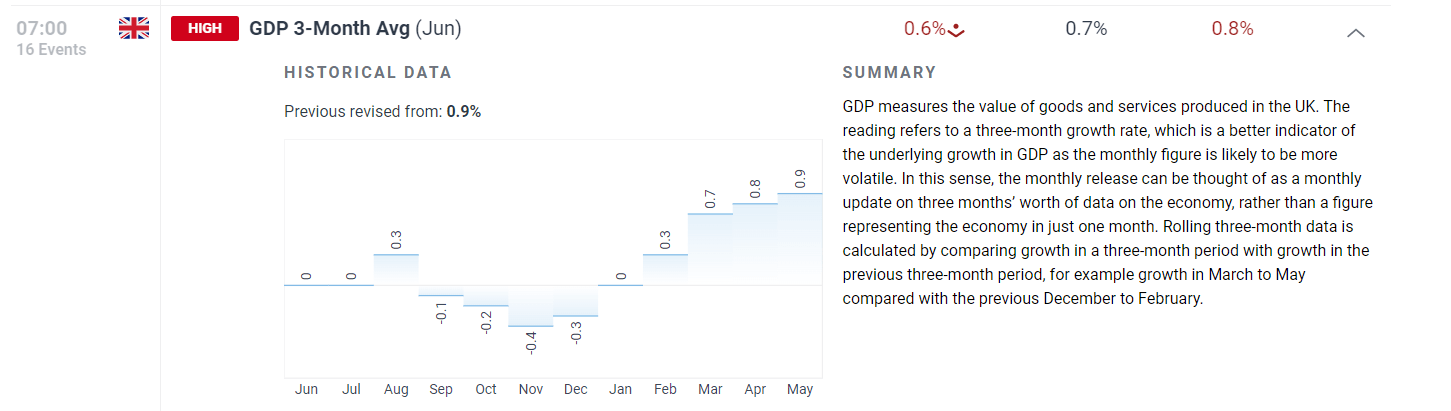

The economy expanded by 0.6% in Q2, following a stronger 0.7% growth in Q1, according to preliminary estimates. While GDP data often undergoes revisions as more information becomes available, the current figures suggest a promising outlook. A more reliable indicator, the three-month average ending in June, reveals that growth has moved away from stagnant or negative territory. However, June's performance was less encouraging, with 0% growth compared to May, as a decline in the services sector was offset by robust manufacturing output.

GBP/USD Shows Resilience Amid Mixed Inflation Data

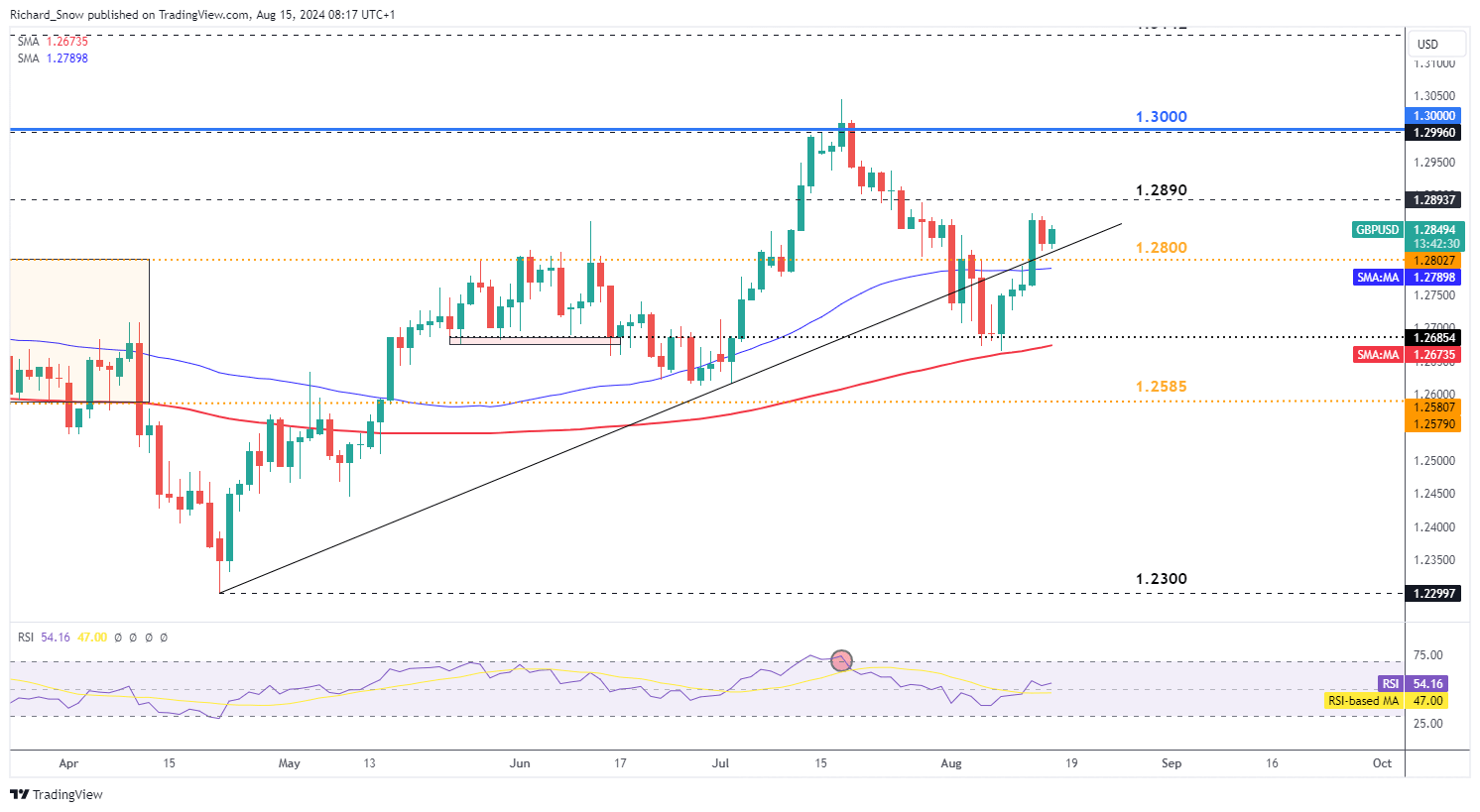

The GBP/USD pair has seen a partial recovery following a significant July selloff, with bullish traders eyeing a bounce from trendline support in anticipation of further gains. The latest UK inflation data presented a mixed picture, as July's inflation increase was lower than expected. The Bank of England had previously signaled that inflation would remain above the 2% target for an extended period, even after reaching this key level. While inflation is not expected to spiral out of control, any upside surprises could provide support for sterling, especially as the possibility of a 50 basis point rate cut from the Federal Reserve looms. An aggressive early rate cut cycle could weaken the dollar, benefiting GBP/USD.

Following a rebound from the 200-day simple moving average (SMA) near the previous support level of 1.2685 (May and June 2024), the GBP/USD pair has broken through trendline support, which previously acted as resistance. Bulls are now focused on holding this support level, with the 1.3000 level in sight. Support is clustered around 1.2800, trendline support, and the 50 SMA.