Dow Jones Futures

Dow Jones futures experienced a slight rise on Sunday evening, along with S&P 500 and Nasdaq futures. Investors are focusing on the upcoming Federal Reserve meeting, where policymakers are expected to cut rates for the first time since the Covid crisis of 2020.

The stock market saw a strong revival, with the S&P 500 and Nasdaq posting their best weekly gains of the year, reclaiming their 50-day moving averages after last week's sell-off. Both the S&P 500 and Dow Jones are approaching all-time highs, with many leading stocks showing buy signals.

Optimism is high among investors due to Fed rate cuts and artificial intelligence, both serving as major catalysts for the ongoing market rally.

Nvidia (NVDA) CEO Jensen Huang expressed the growing demand for the company's AI chips, stating it's “incredible.” He added that production for the next-gen Blackwell chips is already in full swing. Nvidia stock surged, boosting other AI-related stocks and the broader market.

Several stocks such as Arista Networks (ANET), Interactive Brokers (IBKR), Shift4 (FOUR), DoorDash (DASH), Royal Caribbean (RCL), Meta Platforms (META), Sea (SE), and Microsoft (MSFT) are displaying buy signals. This article will highlight a total of 25 stocks currently in buy zones.

Investors are actively making moves, though all eyes are on the upcoming Fed meeting.

Nvidia, DoorDash, and Meta stock are featured on IBD Leaderboard. Interactive Brokers stock is highlighted on SwingTrader. Microsoft stock is a part of IBD Long-Term Leaders. Nvidia, Arista Networks, Meta Platforms, and Royal Caribbean stock are also featured on the IBD 50 list.

Fed Meeting Sept. 17-18: How Much Will Powell Cut Rates?

The Federal Reserve will meet on Tuesday-Wednesday, with an official statement expected at 2 p.m. ET on Wednesday. Fed Chair Jerome Powell is scheduled to speak at 2:30 p.m. ET.

The consensus is that the Fed will lower interest rates, though the size of the cut remains uncertain. Markets are divided on whether the first rate cut will be 25 or 50 basis points.

Currently, the market has nearly priced 100 basis points of rate cuts by year-end, with over a 50% chance of seeing 125 basis points.

Fed officials will release an updated “dot plot” outlining their rate projections alongside economic forecasts. Investors will closely monitor Powell’s remarks for insight into the pace of future rate cuts. A small rate cut or indications of gradual reductions could dampen market expectations.

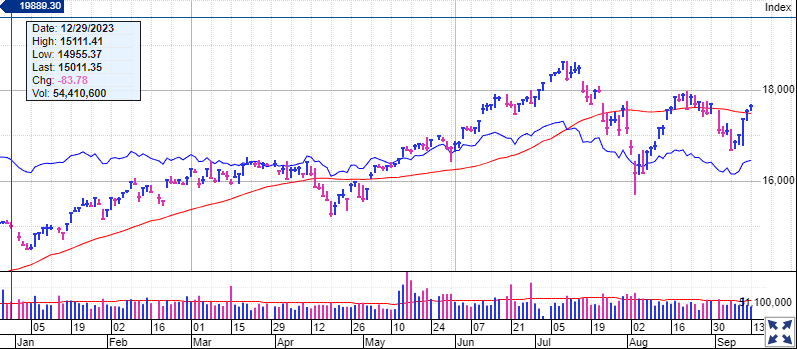

Last week saw a strong rebound in the stock market rally following the previous week’s heavy selling pressure.

The Dow Jones Industrial Average climbed 2.6%, while the S&P 500 surged 4%, and the Nasdaq composite jumped 5.95%, marking their best weekly performance of the year. The small-cap Russell 2000 also surged by 4.4%.

On Friday, Sept. 6, the Nasdaq closed below its Aug. 13 follow-through day low, signaling a bearish trend. The S&P 500 avoided this but came close.

The market saw a turning point on Wednesday, with a strong reversal after an initial sell-off. The S&P 500 closed above its 50-day moving average, with the Nasdaq following suit on Thursday. By Friday, the Dow and S&P 500 were nearing record highs, and the Russell 2000 and S&P MidCap 400 surpassed key levels.

Several leading stocks, particularly in tech, entered buy zones last week.

The 10-year Treasury yield fell by 6 basis points to 3.65%, while U.S. crude oil futures rose 1.45% to $68.65 a barrel after hitting a 52-week low.

Growth ETFs had a strong week, with the Innovator IBD 50 ETF (FFTY) soaring 6.95%. The iShares Expanded Tech-Software Sector ETF (IGV) climbed 4.8%, buoyed by Microsoft. Meanwhile, the VanEck Vectors Semiconductor ETF (SMH) jumped 10.2%, driven by Nvidia.

Other notable ETFs include:

- SPDR S&P Metals & Mining ETF (XME): up 8.2%

- U.S. Global Jets ETF (JETS): up 3.7%

- SPDR S&P Homebuilders ETF (XHB): up 6.5%

- Energy Select SPDR ETF (XLE): up 3.7%

- Health Care Select Sector SPDR Fund (XLV): up 1.4%

- Industrial Select Sector SPDR Fund (XLI): up 3.7%

- Financial Select SPDR ETF (XLF): up 0.5%

Arista stock surged 14.5% last week to 359.76. On Wednesday, shares cleared the 50-day line and broke through a trendline on Thursday, offering an early entry. By Friday, ANET stock surpassed a buy point of 358.68 from an awkward handle.

Related Stocks: Broadcom (AVGO) and Taiwan Semiconductor (TSM) are also showing early buy signals. Nvidia vaulted 15.8% last week, providing an aggressive entry point above its 50-day.

Meta stock rose 4.9% to 524.62 last week, rebounding from its 50-day on Wednesday and crossing the 21-day line. Meta is nearing a buy point of 542.81, with an alternative entry at 544.23.

Related Stocks: Trade Desk (TTD) rebounded from the 10-week line, reclaiming a buy point from its V-shaped consolidation.

Interactive Brokers stock gained 4.5% to 128.07 last week. Shares briefly crossed a buy point of 128.98 but pulled back. The stock found support at the 50-day moving average on Wednesday.

Related Stocks: Stifel Financial (SF), Piper Sandler (PIPR), and Robinhood Markets (HOOD) offer early entries, with Robinhood having broken out.

Shift4 stock leapt 9.5% to 82.92, rebounding from the 10-week line. Shares broke through the downtrend of a handle on Thursday, with FOUR stocks topping the buy point of 84.26 intraday on Friday.

Related Stocks: Toast (TOST) and Affirm Holdings (AFRM) are actionable, while Mastercard (MA) is in a traditional buy zone.

DoorDash stock rose 6.3% to 131.35, surpassing a buy point of 131.21 on Friday. Shares were already actionable after rebounding from the 21-day line and breaking a handle downtrend.

Related Stocks: Instacart parent Maplebear (CART) is near a buy point, while Uber (UBER) broke above its 50-day and 200-day lines on Friday.

Royal Caribbean stock climbed 7.3% to 167.96, nearing a buy point of 169.47. RCL stock became actionable after breaking trendlines and reclaiming its 21-day and 50-day lines.

Related Stocks: Booking Holdings (BKNG) is on the verge of a breakout, and United Airlines (UAL) is in a buy zone.

Sea stock rose 5.2% to 81.18. It held its buy point of 76.60 and bounced from its 21-day line, breaking a short downtrend.

Related Stocks: South Korean e-commerce giant Coupang (CPNG) is in a buy zone.

Microsoft stock climbed 7.2% to 430.59, rebounding above its 200-day and 50-day moving averages. While still below the buy point of 468.35, MSFT stock is actionable as a Long-Term Leader.

Related Stocks: ServiceNow (NOW) is in a buy zone, while Amazon.com (AMZN) is actionable after reclaiming its 50-day.