Cambodia's cryptocurrency market has seen remarkable growth in 2026, driven by increasing interest from crypto investors and advancements in digital finance. As the demand for cryptocurrency trading rises, selecting the best crypto brokers in Cambodia becomes crucial for ensuring a secure trading environment and optimizing returns.

This guide highlights the top crypto exchanges and crypto brokers catering to Cambodian users. From competitive trading fees to advanced trading features like margin trading, these platforms provide crypto assets and tools tailored to diverse investment objectives and trading experience. Whether you're trading in Cambodian riel or global digital currencies, you'll find brokers offering low costs, tight spreads, and user-friendly interfaces to enhance your journey in the cryptocurrency market.

What to Look for in a Crypto Broker

When selecting the best crypto brokers in Cambodia, investors should prioritize security, fees, and usability. A secure trading environment ensures your funds are safe, with features like cold storage and high security. Understanding trading fees and withdrawal fees is crucial, as low trading costs contribute to profitability. Look for brokers offering a user-friendly interface, mobile apps, and educational tools to enhance the trading experience, especially for crypto investors and active traders.

Additionally, consider brokers licensed by an exchange regulator, as they offer negative balance protection and ensure adherence to market standards. The availability of crypto assets, trading tools, and advanced trading features, such as margin trading and copy trading, can cater to both experienced traders and professional traders. Evaluate their payment options, including bank transfers, debit cards, and Cambodian riel, for convenience. A broker with tight spreads, low fees, and diverse tradable assets like crypto CFDs, digital currencies, and underlying assets is essential to navigate varying market conditions effectively.

The 5 Best Crypto Brokers in Cambodia

#1. Binance

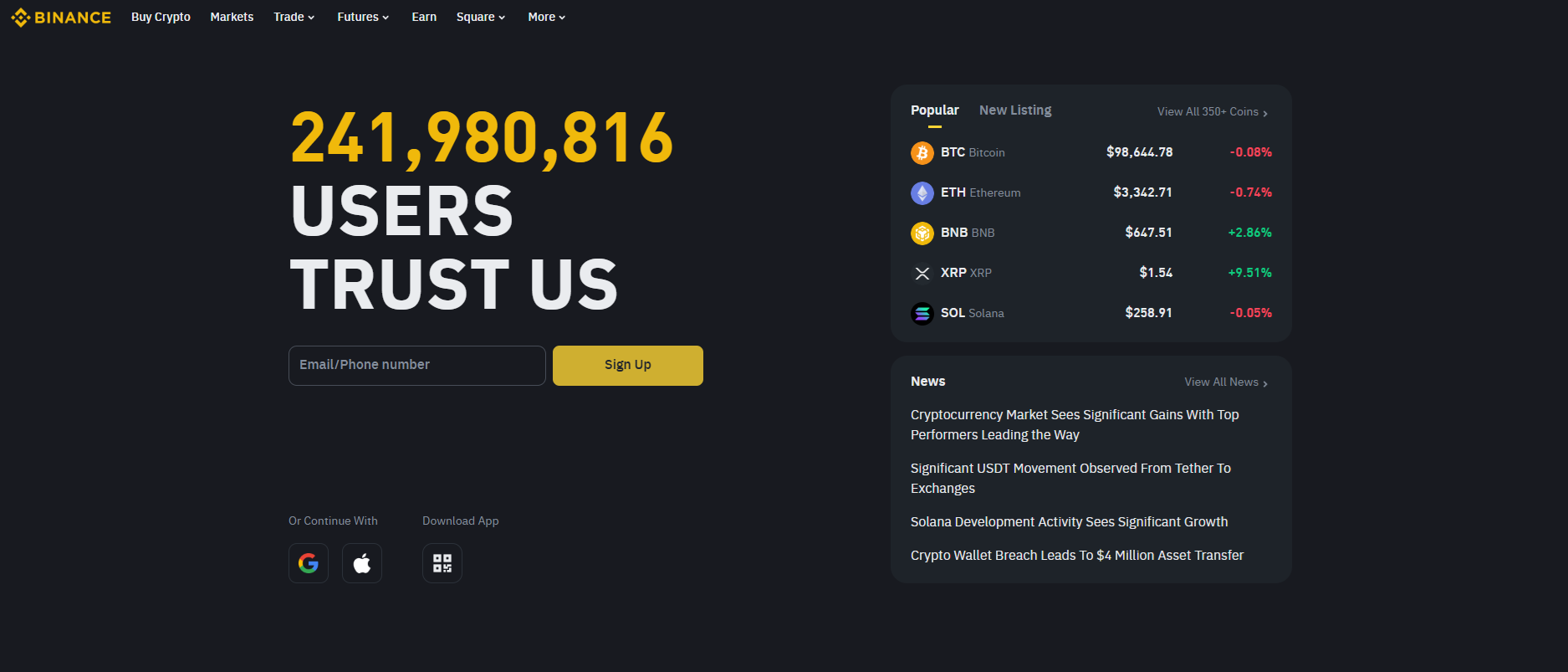

What is Binance?

Binance is a leading cryptocurrency exchange known for its extensive range of trading options and user-friendly platform. It offers access to hundreds of digital assets, including popular cryptocurrencies like Bitcoin and Ethereum. With its high liquidity and competitive features, Binance is a go-to platform for traders worldwide.

Advantages and Disadvantages of Binance

Binance Commissions and Fees

Binance charges low trading fees, typically 0.1% per transaction, which can be reduced further by using its native Binance Coin (BNB). Deposit fees vary depending on the payment method, while withdrawals are subject to network fees. The platform's transparent fee structure is appealing to both beginners and professional traders.

#2. eToro

What is eToro?

eToro is a social trading platform that enables users to invest in a variety of financial markets, including stocks, forex, and cryptocurrencies. Known for its innovative CopyTrading feature, eToro allows beginners to replicate the strategies of experienced traders. The platform is accessible via mobile and web, offering a user-friendly interface and tools for both new and advanced investors.

Advantages and Disadvantages of eToro

eToro Commissions and Fees

eToro offers commission-free trading for stocks, making it attractive for cost-conscious investors. However, it charges spreads on forex and cryptocurrency trades, which can vary depending on market conditions. Withdrawal fees and inactivity charges apply, and users should consider these before signing up. Overall, eToro balances affordability with its robust trading features.

#3. Crypto.com

What is Crypto.com?

Crypto.com is a popular cryptocurrency platform offering a wide range of services, including trading, staking, and a prepaid Crypto.com Visa Card. It provides access to over 250 cryptocurrencies and supports earning rewards through its flexible or fixed staking options. Known for its intuitive interface, Crypto.com is widely used for both novice and experienced crypto enthusiasts.

Advantages and Disadvantages of Crypto.com

Crypto.com Commissions and Fees

Crypto.com employs a tiered fee structure based on trading volume, with discounts for those staking CRO tokens. Spot trading fees start at 0.075%, while withdrawal fees vary by currency. While it offers competitive rates for high-volume traders, Crypto.com Visa Card holders can enjoy additional benefits, including reduced transaction costs. However, users should be cautious of fees for low activity or smaller transactions.

#4. KuCoin

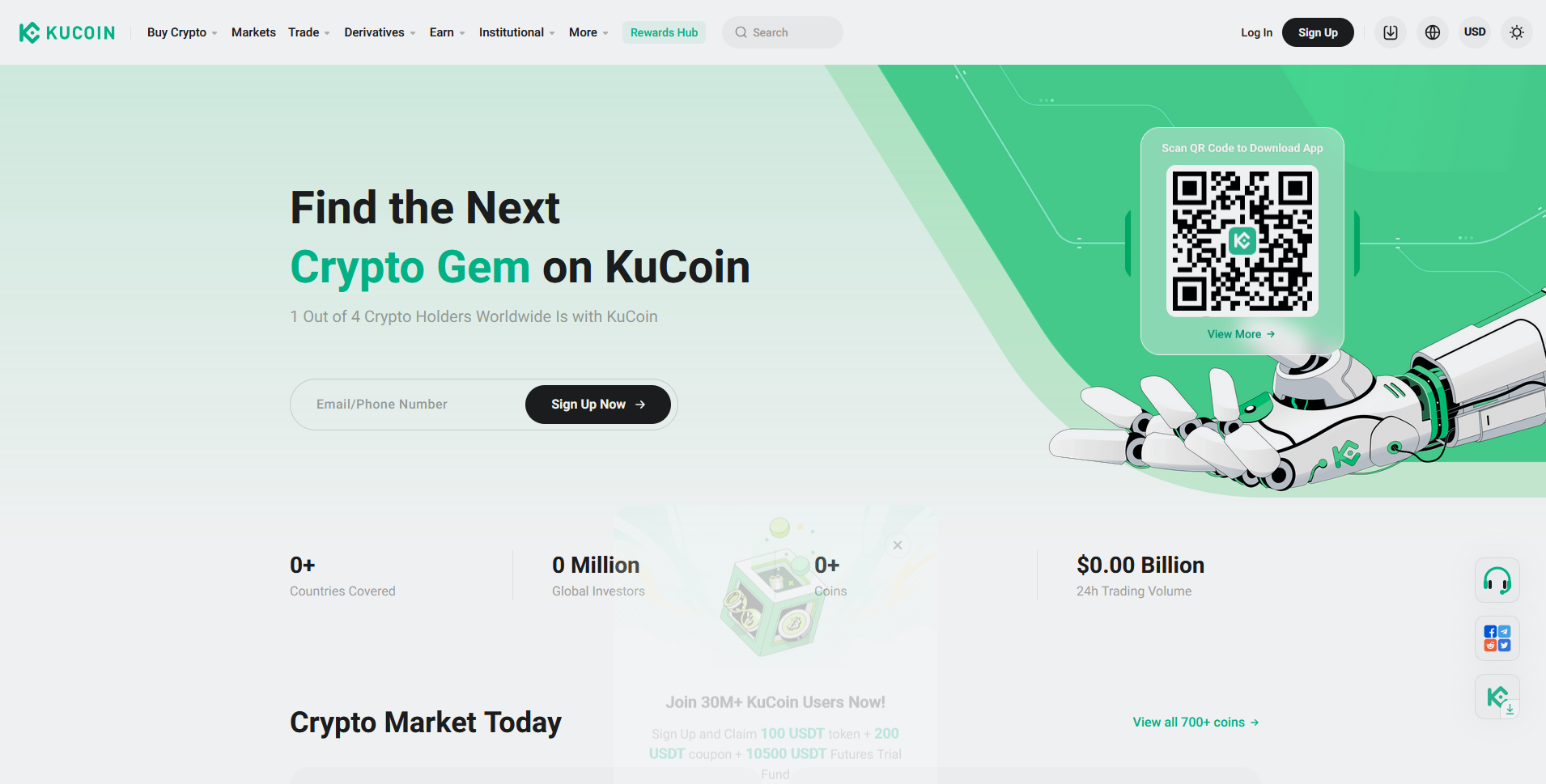

What is KuCoin?

KuCoin is a globally recognized cryptocurrency exchange offering a wide array of digital assets for trading. It provides services such as spot trading, futures, and staking, making it popular among beginners and experienced traders. Known for its user-friendly platform and advanced features, KuCoin supports over 700 cryptocurrencies, ensuring diverse investment opportunities.

Advantages and Disadvantages of KuCoin

KuCoin Commissions and Fees

KuCoin offers competitive trading fees starting as low as 0.1%, which can be further reduced using KuCoin Token (KCS). Deposit fees are generally free, while withdrawal fees vary depending on the asset. Additionally, its tiered fee structure rewards high-volume traders, ensuring cost efficiency.

#5. Paxful

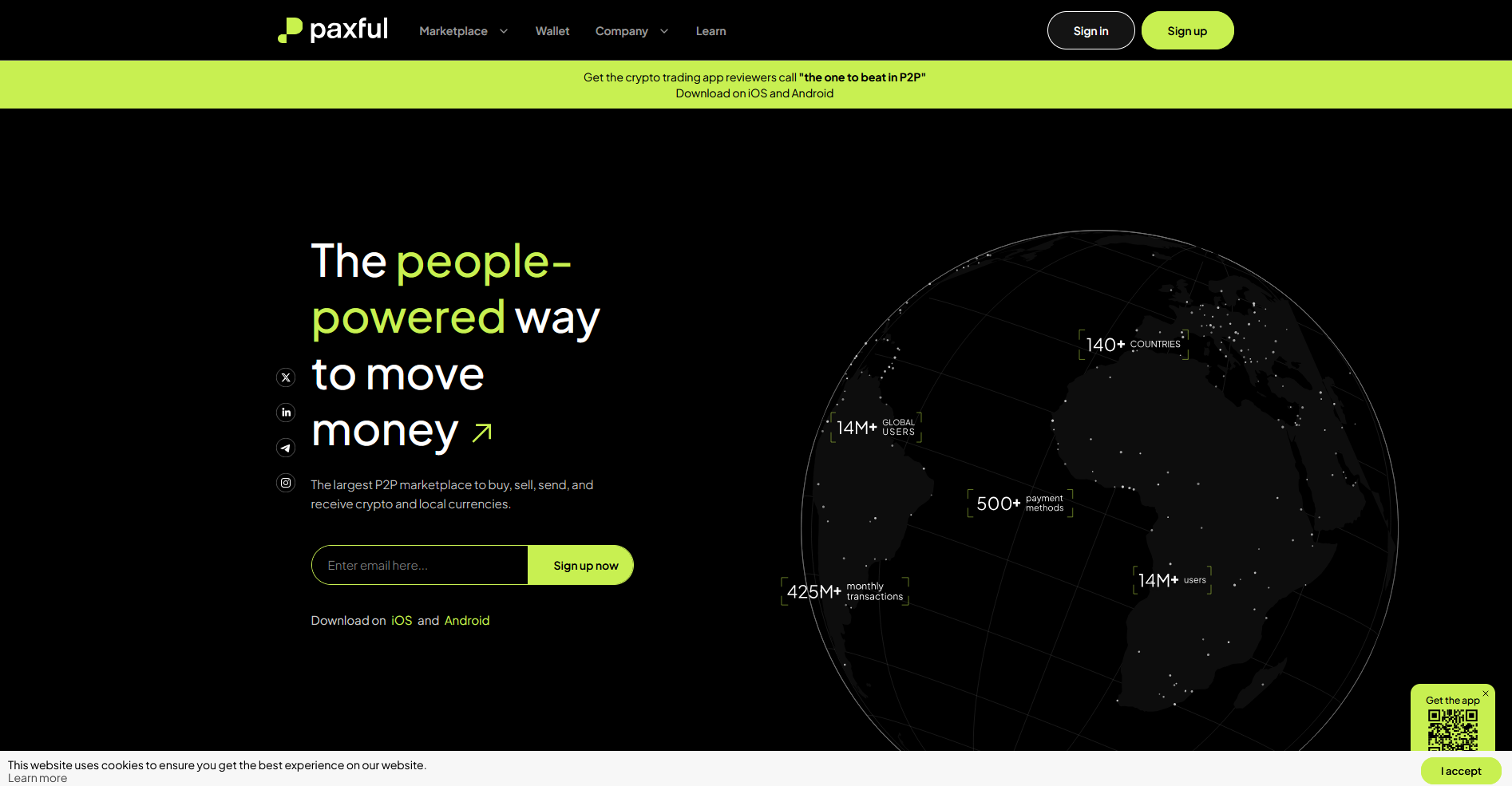

What is Paxful?

Paxful is a peer-to-peer cryptocurrency exchange platform that allows users to buy, sell, and trade digital currencies directly with others. It offers multiple payment methods, including bank transfers, gift cards, and e-wallets, making it accessible to a diverse user base. With secure escrow services, Paxful ensures safe transactions between buyers and sellers. It supports cryptocurrencies like Bitcoin, Tether, and Ethereum, appealing to both beginners and experienced traders.

Advantages and Disadvantages of Paxful

PaxfulCommissions and Fees

Paxful charges sellers a flat 1% fee on all transactions, while buyers generally incur no direct fees. However, payment method-specific charges may apply depending on the chosen option. The platform’s transparent fee structure ensures that users are aware of costs upfront. Paxful’s zero buyer fees policy attracts a wide range of crypto enthusiasts.

How to Choose the Right Broker for You

Choosing the right broker requires understanding your investment objectives and assessing your risk tolerance. For crypto investors, key considerations include access to crypto assets, cryptocurrency trading, and low trading fees. Look for brokers that support advanced trading features, such as margin trading, social trading, and copy trading, while ensuring they offer a secure trading environment with negative balance protection and cold storage for digital assets. Brokers specializing in cryptocurrency exchanges or crypto CFDs may also provide tight spreads, competitive trading fees, and educational tools for beginners.

Consider the broker's payment methods, such as bank transfers, debit cards, or Cambodian riel, and assess the minimum deposit, withdrawal fees, and overall trading costs. Active and professional traders may prioritize brokers offering user-friendly interfaces, mobile apps, and trading tools tailored for experienced traders. To identify the best crypto brokers in Cambodia, focus on low fees, competitive fees, and regulated platforms to match your financial situation and maximize your trading experience.

Also Read: The 5 Best Binary Brokers in Cambodia in 2026: Simplify Your Trades

Conclusion

To find the best crypto brokers in Cambodia, investors must assess standout features like low trading fees, a secure trading environment, and advanced trading features. Leading crypto exchanges offer robust platforms, tight spreads, and intuitive interfaces, making cryptocurrency trading accessible for both experienced traders and crypto investors. Platforms with margin trading, crypto CFDs, and futures trading appeal to active traders, while those offering social trading and educational tools cater to beginners. Features like cold storage, negative balance protection, and high security ensure funds and data are protected. Payment methods like bank transfers, debit cards, and dedicated crypto wallets enhance convenience.

Selecting a broker involves matching your investment objectives, risk tolerance, and preferred tradable assets to the available platforms. Whether aiming to buy cryptocurrency, sell bitcoin, or explore digital assets, top brokers deliver low costs, competitive fees, and versatile options for professional traders. The right choice ensures a seamless trading experience, so evaluate platforms and take the next step in your cryptocurrency market journey today.

FAQs

What is the safest crypto broker in Cambodia?

Binance is considered one of the safest due to its advanced security protocols and global reputation.

Are crypto brokers in Cambodia regulated?

Regulation varies, but most top brokers like eToro and Crypto.com adhere to international compliance standards.

What fees should I expect when using a crypto broker?

Common fees include trading fees, deposit fees, and withdrawal charges, which vary by platform.