Why Coins Pump Hard, Then Crash Even Harder

If you've spent more than a minute scrolling through crypto Twitter or hopping around YouTube, you've probably heard the phrase crypto bubble thrown around. It sounds kind of dramatic, but it actually explains a big part of how cryptocurrency markets behave, especially when things get a little too exciting too fast.

So what is a crypto bubble, and how can you tell when you’re caught in one? Let’s keep it simple.

What Does a Crypto Bubble Mean?

A crypto bubble takes place when, all of a sudden, the price of a coin or token rises, often far above its utility, technology, or real value. As in most cases, this kind of movement will come more from speculation, market hype, and excitement in the short run than from anything fundamental.

This bubble typically follows a pattern that will be familiar:

1. Hype takes over

People start talking about a token. Maybe a celebrity tweets about it, or someone posts a viral video calling it the next big investment. Suddenly, demand surges and the buzz spreads fast.

2. FOMO kicks in

More investors jump in, chasing further price increases. It becomes less about the value of the asset and more about not being left out of a hot opportunity.

3. The crash happens

Eventually, early buyers begin to sell and lock in profits. Once that starts, doubts creep in. Prices drop fast, and the market crash begins. Those who bought in late often take the biggest hit.

This kind of cycle has happened plenty of times in a relatively short period.

Real Examples of Cryptocurrency Bubbles

These patterns aren’t just theories. There have been several major crypto bubbles that played out in front of everyone:

- Bitcoin’s price in 2017 surged from around $1,000 to nearly $20,000 before crashing below $4,000 within a year. It was one of the most significant bubbles in crypto history.

- Dogecoin in 2021 soared off memes, TikTok, and tweets. Its rise was wild — but it didn’t take long for the bubble to pop and the value to fall back to earth.

- NFTs in early 2021 were selling for millions. But shortly after, many of those assets fell sharply in value, some becoming almost unsellable.

All of these cases show how fast prices can climb when excitement outweighs fundamentals, and how fast they can fall when expectations fade.

How to Spot a Crypto Bubble Before It Pops

While there’s no perfect methodology for calling the top of a bubble, some signs tend to show up again and again:

- Price increases seem too fast and not backed by much progress or adoption

- A large number of new investors are piling in without doing research

- Influencers and celebrities are suddenly acting like investment experts

- The project has no product, or the model relies purely on hype

These are all red flags. Being aware of them can help you avoid risky positions or at least manage your exposure.

What Is CryptoBubbles.net?

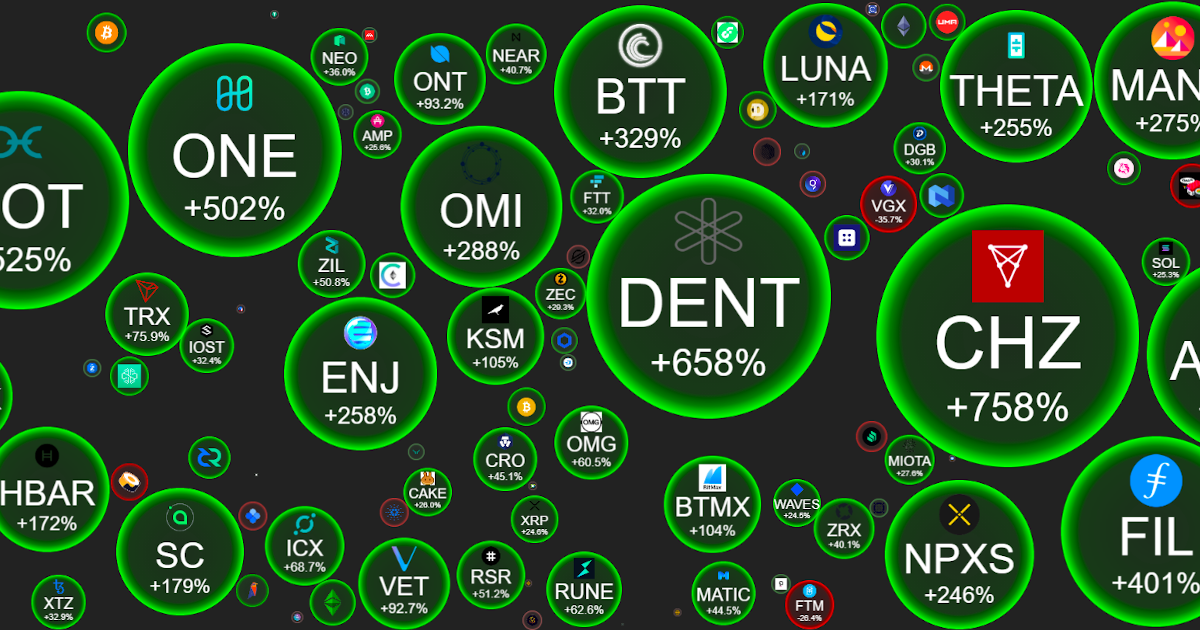

Besides being a term for overhyped coins, Crypto Bubbles is also the name of a popular crypto app and tool. CryptoBubbles.net gives investors a live visual snapshot of the cryptocurrency markets using floating price bubbles.

Here’s how it works:

- Green bubbles reflect coins that are up

- Red bubbles show coins that are down

- The size of each bubble reflects how big the price move is

- Filters let you sort by daily, weekly, or monthly data

This tool helps you track what’s rising or falling at a glance. It’s also a fun way to observe the behavior of the market without needing a full dashboard or portfolio tracker. Whether you're trading or just checking in for insights, it's worth bookmarking.

Why Do Crypto Bubbles Keep Happening?

In the crypto market, bubbles keep forming for a bunch of reasons:

- The rise of new tokens often happens before they prove any real-world value

- Volatility is high, making it easy for prices to spike and fall quickly

- Social media accelerates speculation and increases the number of people entering without doing research

- There’s no standard model for valuing coins or predicting what they’ll be worth in the future

This makes the market more sensitive to emotion, hype, and the emergence of new trends. Combine that with constant trading and a lack of regulation, and you get an environment where bubbles are pretty common.

Insights Into the Nature of Speculative Markets

Effectively, crypto bubbles reflect the gap between the perceived value of a project and how it ultimately pans out. Much of this is based on human nature, hype sets in, prices surge, and sellers ultimately surpass buyers.

It's useful to keep in mind that not all increases in price signal a bubble is being created. Growth sometimes is supported by good fundamentals or adoption. But when price action isn't keeping up with progress, and the investment seems to be based on nothing but hope, speculation is probably the primary driver.

Learning from previous bubbles can protect investors from making the same errors twice. Articles, charts, and sites such as Crypto Bubbles can show patterns that enable you to remain in front. And as more corporations, institutions, and developers arrive on the scene, some of these cycles can change, but the lessons endure.

Final Thoughts

Cryptocurrency bubbles are part of the story that kindles excitement and risks in digital assets. They emerge fast, move fast, and wipe up gains in just as fast a time as it takes to throw them up.

If you've just moved into this space or are already neck-deep in the actual market, one of the best things you can do is to keep your eye on hype vs. reality. They entail all the basic understanding of what a bubble is, identifying red flags, and utilizing tools like CryptoBubbles.net for making more educated decisions.

In short, ask whether you're buying something with real value or only speculating as you delve.